|

SZSE Component Index

The SZSE Component Index is an index of 500 stocks that are traded at the Shenzhen Stock Exchange (SZSE). It is the main stock market index of SZSE. Constituents The full list of all constituent stocks can be found aSZSE Related indices * SZSE 300 Index - top 300 companies ** SZSE 100 Index - top 100 companies ** SZSE 200 Index 101st to 300th companies * SZSE 1000 Index - top 1000 companies ** SZSE 700 Index 301st to 1000th companies * SZSE Composite Index - index for all shares from all companies of the exchange See also * CSI 300 Index major index of mainland Chinese stock markets * SSE Composite Index major index of Shanghai Stock Exchange * Hang Seng Index major index of Hong Kong Stock Exchange of Hong Kong S.A.R., China * Taiwan Capitalization Weighted Stock Index The Taiwan Capitalization Weighted Stock Index (TAIEX; ) or TWSE Capitalization Weighted Stock Index is a stock market index for companies traded on the Taiwan Stock Exchange (TWSE). TAIEX covers all ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shenzhen Stock Exchange

The Shenzhen Stock Exchange (SZSE; ) is a stock exchange based in the city of Shenzhen, in the People's Republic of China. It is one of three stock exchanges operating independently in Mainland China, the others being the Beijing Stock Exchange and the Shanghai Stock Exchange. It is situated in the Futian district of Shenzhen. With a market capitalization of its listed companies around US$2.504 trillion in 2019, it is the 7th largest stock exchange in the world, and 4th largest in East Asia and Asia. History On December 1, 1990, Shenzhen Stock Exchange was founded. In January 1992, Deng Xiaoping's Southern Tour saved China's capital market and the two stock exchanges (the other is Shanghai Stock Exchange). In July 1997, the State Council of China decided that the Shenzhen Stock Exchange would be directly managed by the China Securities Regulatory Commission. In May 2004, the SME Board was launched. In October 2009, the ChiNext market () was inaugurated. State-owned c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SZSE 300 Index

SZSE 300 Price Index () and its sub-indexes SZSE 100 Price Index and SZSE 200 Price Index were the stock market indices of Shenzhen Stock Exchange, representing top 300 companies by free float adjusted market capitalization. The sub-indices represented top 100 companies and next 200 (the 101st to 300th) companies, respectively. SZSE 300 Index itself is a sub-index of SZSE Component Index, SZSE 1000 Index The Shenzhen Stock Exchange (SZSE; ) is a stock exchange based in the city of Shenzhen, in the People's Republic of China. It is one of three stock exchanges operating independently in Mainland China, the others being the Beijing Stock Excha ... and SZSE Composite Index. The index series also had a counterpart which calculated in different methodology, as SZSE 300 Return Index (), SZSE 100 Return Index and SZSE 200 Return Index. Constituents SZSE 100 Sub-Index SZSE 200 Sub-Index Change history References ;general * ;specific Chinese stock market indices She ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SZSE 100 Index

SZSE 100 Index are indice of Shenzhen Stock Exchange. It consists of SZSE 100 Price Index () and SZSE 100 Return Index (), using the same constituents but different methodology. Despite it was intended as the blue-chip index of Shenzhen Stock Exchange, comparing to counterpart SSE 50 Index, it had a smaller total free-float adjusted market capitalization of the constituents as well as smaller average free-float adjusted market capitalization per constituent. They have difference composition in constituents. , 23.54% of the constituents of SZSE 100 Index were financial services companies (including bank and insurance), 21.49% were from consumer discretionary industry and 20.54% were from information technology industry. Constituents Weighting updated to 31 December 2021 Footnotes References ;general * ;specific Chinese stock market indices Shenzhen Stock Exchange Lists of companies of China {{business-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SZSE 200 Index

SZSE 200 Index are indice of Shenzhen Stock Exchange. It consists of SZSE 200 Price Index () and SZSE 200 Return Index (), using the same constituents but different methodology. It was a sub-index of SZSE 300 Index, which consists of all constituents of SZSE 300 that was not included in SZSE 100 Index SZSE 100 Index are indice of Shenzhen Stock Exchange. It consists of SZSE 100 Price Index () and SZSE 100 Return Index (), using the same constituents but different methodology. Despite it was intended as the blue-chip index of Shenzhen Stock Exc .... Constituents Change history References ;general * ;specific Chinese stock market indices Shenzhen Stock Exchange {{business-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SZSE 1000 Index

The Shenzhen Stock Exchange (SZSE; ) is a stock exchange based in the city of Shenzhen, in the People's Republic of China. It is one of three stock exchanges operating independently in Mainland China, the others being the Beijing Stock Exchange and the Shanghai Stock Exchange. It is situated in the Futian district of Shenzhen. With a market capitalization of its listed companies around US$2.504 trillion in 2019, it is the 7th largest stock exchange in the world, and 4th largest in East Asia and Asia. History On December 1, 1990, Shenzhen Stock Exchange was founded. In January 1992, Deng Xiaoping's Southern Tour saved China's capital market and the two stock exchanges (the other is Shanghai Stock Exchange). In July 1997, the State Council of China decided that the Shenzhen Stock Exchange would be directly managed by the China Securities Regulatory Commission. In May 2004, the SME Board was launched. In October 2009, the ChiNext market () was inaugurated. State-owned com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SZSE 700 Index

The Shenzhen Stock Exchange (SZSE; ) is a stock exchange based in the city of Shenzhen, in the People's Republic of China. It is one of three stock exchanges operating independently in Mainland China, the others being the Beijing Stock Exchange and the Shanghai Stock Exchange. It is situated in the Futian district of Shenzhen. With a market capitalization of its listed companies around US$2.504 trillion in 2019, it is the 7th largest stock exchange in the world, and 4th largest in East Asia and Asia. History On December 1, 1990, Shenzhen Stock Exchange was founded. In January 1992, Deng Xiaoping's Southern Tour saved China's capital market and the two stock exchanges (the other is Shanghai Stock Exchange). In July 1997, the State Council of China decided that the Shenzhen Stock Exchange would be directly managed by the China Securities Regulatory Commission. In May 2004, the SME Board was launched. In October 2009, the ChiNext market () was inaugurated. State-owned com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SZSE Composite Index

SZSE Composite Index ({{zh, s=深证综合指数) is a stock market index of Shenzhen Stock Exchange. It included all companies listed on the exchange. See also * SSE Composite Index * Hang Seng Composite Index The Hang Seng Composite Index is a stock market index of the Stock Exchange of Hong Kong and was launched in 2001. It offers an equivalent of Hong Kong market benchmark that covers around the top 95th percentile of the total market capitalisation o ... External links Official Page Chinese stock market indices Shenzhen Stock Exchange ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CSI 300 Index

The CSI 300 () is a capitalization-weighted stock market index designed to replicate the performance of the top 300 stocks traded on the Shanghai Stock Exchange and the Shenzhen Stock Exchange. It has two sub-indexes: the CSI 100 Index and the CSI 200 Index. Over the years, it has been deemed the Chinese counterpart of the S&P 500 index and a better gauge of the Chinese stock market than the more traditional SSE Composite Index. The index is compiled by the China Securities Index Company, Ltd. It has been calculated since April 8, 2005. Its value is normalized relative to a base of 1000 on December 31, 2004. It is considered to be a blue chip index for Mainland China stock exchanges. Annual Returns The following table shows the annual development of the CSI 300 Index since 2005. Constituents Sub-Indices Moreover, there are the following ten sub-indices, which reflect specific sectors: * CSI 300 Energy Index * CSI 300 Materials Index * CSI 300 Industrials Index ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SSE Composite Index

The SSE Composite Index also known as SSE Index is a stock market index of all stocks ( A shares and B shares) that are traded at the Shanghai Stock Exchange. There are also SSE 180, SSE 50 and SSE Mega-Cap Indexes for top 170, 50 and 20 companies respectively, and the CSI 300 Index, which includes shares traded at the Shanghai Stock Exchange and the Shenzhen Stock Exchange. Weighting and calculation SSE Indices are all calculated using a Paasche weighted composite price index formula. This means that the index is based on a base period on a specific base day for its calculation. The base day for SSE Composite Index is December 19, 1990, and the base period is the total market capitalization of all stocks of that day. The Base Value is 100. The index was launched on July 15, 1991. * The formula is: Current index = Current total market cap of constituents × Base Value / Base Period Total market capitalization = Σ (price × shares issued) * The B share stocks are generally ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

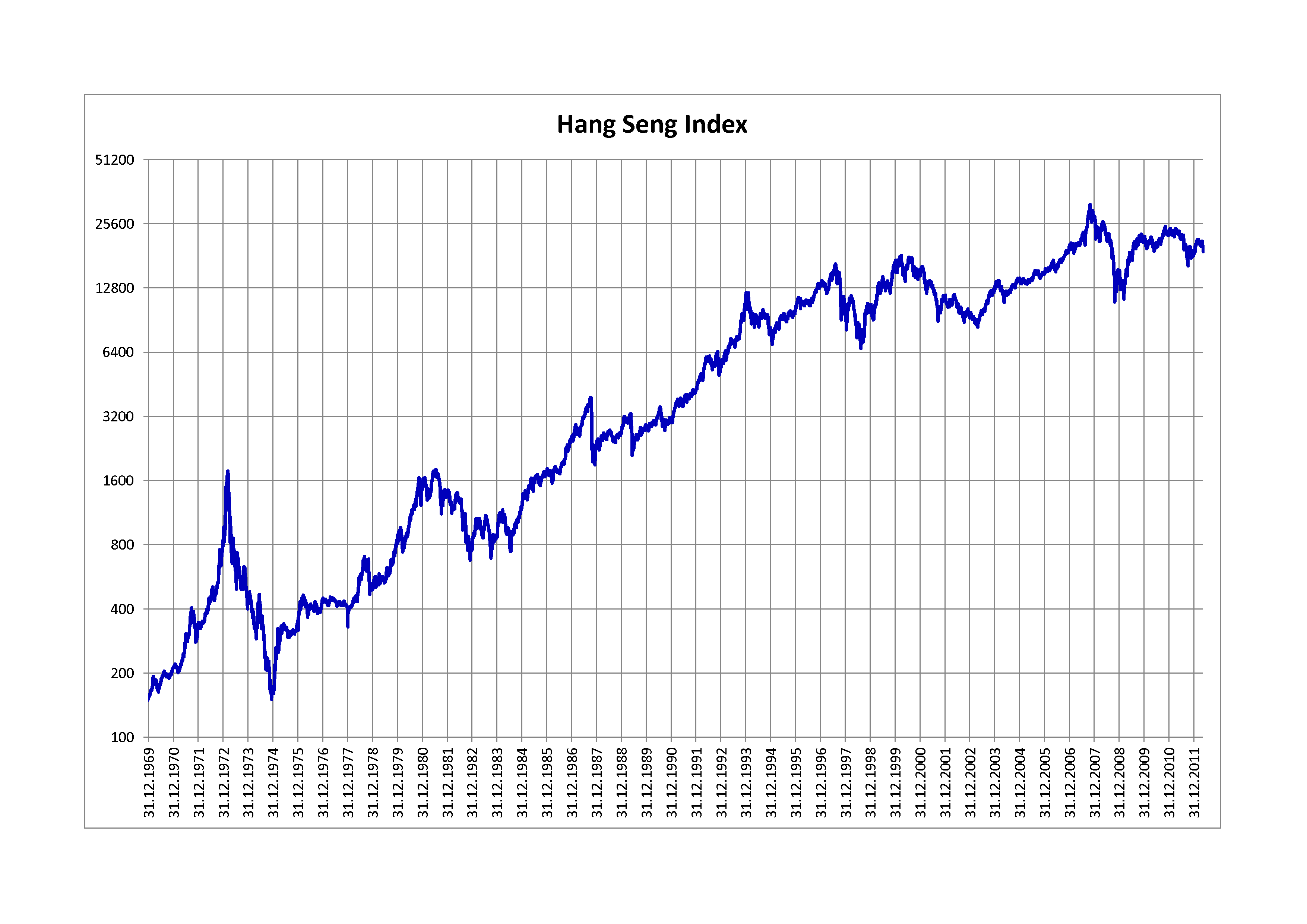

Hang Seng Index

The Hang Seng Index (HSI) is a freefloat-adjusted market- capitalization-weighted stock-market index in Hong Kong. It is used to record and monitor daily changes of the largest companies of the Hong Kong stock market and is the main indicator of the overall market performance in Hong Kong. These 66 constituent companies represent about 58% of the capitalisation of the Hong Kong Stock Exchange. HSI was started on November 24, 1969, and is currently compiled and maintained by Hang Seng Indexes Company Limited, which is a wholly owned subsidiary of Hang Seng Bank, one of the largest banks registered and listed in Hong Kong in terms of market capitalisation. It is responsible for compiling, publishing and managing the Hang Seng Index and a range of other stock indexes, such as ''Hang Seng China Enterprises Index'', ''Hang Seng China AH Index Series'', '' Hang Seng China H-Financials Index'', ''Hang Seng Composite Index Series'', ''Hang Seng China A Industry Top Index'', ''Hang Sen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taiwan Capitalization Weighted Stock Index

The Taiwan Capitalization Weighted Stock Index (TAIEX; ) or TWSE Capitalization Weighted Stock Index is a stock market index for companies traded on the Taiwan Stock Exchange (TWSE). TAIEX covers all of the listed stocks excluding preferred stock Preferred stock (also called preferred shares, preference shares, or simply preferreds) is a component of share capital that may have any combination of features not possessed by common stock, including properties of both an equity and a debt inst ...s, full-delivery stocks and newly listed stocks, which are listed for less than one calendar month. It was first published in 1967 by TWSE with 1966 being the base year with a value of 100. Annual Returns The following table shows the annual development of the TAIEX since 1966. References External linksBloomberg page for TWSE:INDTAIEX page on the Taiwan stock exchange Historical chart [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chinese Stock Market Indices

Chinese can refer to: * Something related to China * Chinese people, people of Chinese nationality, citizenship, and/or ethnicity **'' Zhonghua minzu'', the supra-ethnic concept of the Chinese nation ** List of ethnic groups in China, people of various ethnicities in contemporary China ** Han Chinese, the largest ethnic group in the world and the majority ethnic group in Mainland China, Hong Kong, Macau, Taiwan, and Singapore ** Ethnic minorities in China, people of non-Han Chinese ethnicities in modern China ** Ethnic groups in Chinese history, people of various ethnicities in historical China ** Nationals of the People's Republic of China ** Nationals of the Republic of China ** Overseas Chinese, Chinese people residing outside the territories of Mainland China, Hong Kong, Macau, and Taiwan * Sinitic languages, the major branch of the Sino-Tibetan language family ** Chinese language, a group of related languages spoken predominantly in China, sharing a written script (Chinese ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |