|

SSE Composite Index

The SSE Composite Index also known as SSE Index is a stock market index of all stocks ( A shares and B shares) that are traded at the Shanghai Stock Exchange. There are also SSE 180, SSE 50 and SSE Mega-Cap Indexes for top 170, 50 and 20 companies respectively, and the CSI 300 Index, which includes shares traded at the Shanghai Stock Exchange and the Shenzhen Stock Exchange. Weighting and calculation SSE Indices are all calculated using a Paasche weighted composite price index formula. This means that the index is based on a base period on a specific base day for its calculation. The base day for SSE Composite Index is December 19, 1990, and the base period is the total market capitalization of all stocks of that day. The Base Value is 100. The index was launched on July 15, 1991. * The formula is: Current index = Current total market cap of constituents × Base Value / Base Period Total market capitalization = Σ (price × shares issued) * The B share stocks are generally ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shanghai Stock Exchange

The Shanghai Stock Exchange (SSE) is a stock exchange based in the city of Shanghai, China. It is one of the three stock exchanges operating independently in mainland China, the others being the Beijing Stock Exchange and the Shenzhen Stock Exchange. The Shanghai Stock Exchange is the world's 3rd largest stock market by market capitalization at US$7.62 trillion . It is also Asia's biggest stock exchange. Unlike the Hong Kong Stock Exchange, the Shanghai Stock Exchange is still not entirely open to foreign investors and often affected by the decisions of the central government, due to capital account controls exercised by the Chinese mainland authorities. In 1891, Shanghai founded China's first exchange system. The current stock exchange was re-established on November 26, 1990, and was in operation on December 19 of the same year. It is a non-profit organization directly administered by the China Securities Regulatory Commission (CSRC). History The formation of the Interna ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1,000,000,000,000

This list contains selected positive numbers in increasing order, including counts of things, dimensionless quantities and probabilities. Each number is given a name in the short scale, which is used in English-speaking countries, as well as a name in the long scale, which is used in some of the countries that do not have English as their national language. Smaller than (one googolth) * ''Mathematics – random selections:'' Approximately is a rough first estimate of the probability that a typing "monkey", or an English-illiterate typing robot, when placed in front of a typewriter, will type out William Shakespeare's play ''Hamlet'' as its first set of inputs, on the precondition it typed the needed number of characters. However, demanding correct punctuation, capitalization, and spacing, the probability falls to around 10−360,783. * ''Computing:'' 2.2 is approximately equal to the smallest positive non-zero value that can be represented by an octuple-precision I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SSE 50 Index

SSE 50 Index is the stock index of Shanghai Stock Exchange The Shanghai Stock Exchange (SSE) is a stock exchange based in the city of Shanghai, China. It is one of the three stock exchanges operating independently in mainland China, the others being the Beijing Stock Exchange and the Shenzhen Stock Exc ..., representing the top 50 companies by "float-adjusted" capitalization and other criteria. In order to qualify as a constituent of SSE 50 Index, it must be a constituent of SSE 180 Index, thus SSE 50 is a subindex of SSE 180 Index. SSE 50 Index is also a subset of SSE Composite Index, which included all stock. SSE 50 was regarded as a blue-chip index of the exchange. Constituents References {{Asian Stock market indices Shanghai Stock Exchange Chinese stock market indices Lists of companies of China ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SSE 180 Index

SSE 180 Index is the stock index of Shanghai Stock Exchange, representing the top 180 companies by "float-adjusted" capitalization and other criteria. SSE 180 is a sub-index of SSE Composite Index, the latter included all shares of the exchange. Constituents Related indexes Both SSE 50 Index and SSE MidCap Index () were the subindex of SSE 180 Index. They did not intersect each other. By a different selection criteria than SSE 50, is also the sub-index of SSE 180. It consists of the top 20 companies with a cap of 6 from each kind of industries. The subindex may intersect with SSE 50 Index. SSE Mega-Cap started to publish in 2009. References See also * SSE Composite Index The SSE Composite Index also known as SSE Index is a stock market index of all stocks ( A shares and B shares) that are traded at the Shanghai Stock Exchange. There are also SSE 180, SSE 50 and SSE Mega-Cap Indexes for top 170, 50 and 20 compa ... {{Asian Stock market indices Shanghai Stock Exchan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market Index

In finance, a stock index, or stock market index, is an index that measures a stock market, or a subset of the stock market, that helps investors compare current stock price levels with past prices to calculate market performance. Two of the primary criteria of an index are that it is ''investable'' and ''transparent'': The methods of its construction are specified. Investors can invest in a stock market index by buying an index fund, which are structured as either a mutual fund or an exchange-traded fund, and "track" an index. The difference between an index fund's performance and the index, if any, is called ''tracking error''. For a list of major stock market indices, see List of stock market indices. Types of indices by weighting method Stock market indices could be segmented by their index weight methodology, or the rules on how stocks are allocated in the index, independent of its stock coverage. For example, the S&P 500 and the S&P 500 Equal Weight both covers the sam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

A-share (mainland China)

A shares (), also known as domestic shares () are shares that are denominated in Renminbi and traded in the Shanghai and Shenzhen stock exchanges, as well as the National Equities Exchange and Quotations. These are in contrast to B shares that are denominated in foreign currency and traded in Shanghai and Shenzhen, as well as H shares, that are denominated in Hong Kong dollars and traded in the Stock Exchange of Hong Kong. See also *Chip * Red chip * P chip * S chip * N share * L share * G share G, or g, is the seventh letter in the Latin alphabet, used in the modern English alphabet, the alphabets of other western European languages and others worldwide. Its name in English is ''gee'' (pronounced ), plural ''gees''. History Th ... * China Concepts Stock References Finance in China Stock market terminology {{Stockexchange-stub de:Aktienart (China)#A-Aktie .28A-Share.29 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

B-share (mainland China)

B shares (, officially Domestically Listed Foreign Investment Shares) on the Shanghai and Shenzhen stock exchanges refers to those that are traded in foreign currencies. Shares that are traded on the two mainland Chinese stock exchanges in Renminbi, the currency in mainland China, are called A shares. History B shares were limited to foreign investment until 19 February 2001, when the China Securities Regulatory Commission began permitting the exchange of B shares via the secondary market to domestic citizens. This was widely seen as a landmark event to the integration of Chinese stock markets. Currency The face values of B shares are set in Renminbi. In Shanghai, B shares are traded in US dollars, whereas in Shenzhen they are traded in Hong Kong dollars. See also *Chip * A share * H share * Red chip * P chip * S chip * N share * L share * G share G, or g, is the seventh letter in the Latin alphabet, used in the modern English alphabet, the alphabets of other wester ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CSI 300 Index

The CSI 300 () is a capitalization-weighted stock market index designed to replicate the performance of the top 300 stocks traded on the Shanghai Stock Exchange and the Shenzhen Stock Exchange. It has two sub-indexes: the CSI 100 Index and the CSI 200 Index. Over the years, it has been deemed the Chinese counterpart of the S&P 500 index and a better gauge of the Chinese stock market than the more traditional SSE Composite Index. The index is compiled by the China Securities Index Company, Ltd. It has been calculated since April 8, 2005. Its value is normalized relative to a base of 1000 on December 31, 2004. It is considered to be a blue chip index for Mainland China stock exchanges. Annual Returns The following table shows the annual development of the CSI 300 Index since 2005. Constituents Sub-Indices Moreover, there are the following ten sub-indices, which reflect specific sectors: * CSI 300 Energy Index * CSI 300 Materials Index * CSI 300 Industrials Index ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shenzhen Stock Exchange

The Shenzhen Stock Exchange (SZSE; ) is a stock exchange based in the city of Shenzhen, in the People's Republic of China. It is one of three stock exchanges operating independently in Mainland China, the others being the Beijing Stock Exchange and the Shanghai Stock Exchange. It is situated in the Futian district of Shenzhen. With a market capitalization of its listed companies around US$2.504 trillion in 2019, it is the 7th largest stock exchange in the world, and 4th largest in East Asia and Asia. History On December 1, 1990, Shenzhen Stock Exchange was founded. In January 1992, Deng Xiaoping's Southern Tour saved China's capital market and the two stock exchanges (the other is Shanghai Stock Exchange). In July 1997, the State Council of China decided that the Shenzhen Stock Exchange would be directly managed by the China Securities Regulatory Commission. In May 2004, the SME Board was launched. In October 2009, the ChiNext market () was inaugurated. State-owned c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capitalization-weighted Index

A capitalization-weighted (or cap-weighted) index, also called a market-value-weighted index is a stock market index whose components are weighted according to the total market value of their outstanding shares. Every day an individual stock's price changes and thereby changes a stock index's value. The impact that individual stock's price change has on the index is proportional to the company's overall market value (the share price multiplied by the number of outstanding shares), in a capitalization-weighted index. In other types of indices, different ratios are used. For example, the AMEX Composite Index (XAX) had more than 800 component stocks. The weighting of each stock constantly shifted with changes in the stock's price and the number of shares outstanding. The index fluctuates in line with the price move of the stocks. Stock market indices are a type of economic index. Free-float weighting A common version of capitalization weighting is the ''free-float'' weighting. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SZSE Component Index

The SZSE Component Index is an index of 500 stocks that are traded at the Shenzhen Stock Exchange (SZSE). It is the main stock market index of SZSE. Constituents The full list of all constituent stocks can be found aSZSE Related indices * SZSE 300 Index - top 300 companies ** SZSE 100 Index - top 100 companies ** SZSE 200 Index 101st to 300th companies * SZSE 1000 Index - top 1000 companies ** SZSE 700 Index 301st to 1000th companies * SZSE Composite Index - index for all shares from all companies of the exchange See also * CSI 300 Index major index of mainland Chinese stock markets * SSE Composite Index major index of Shanghai Stock Exchange * Hang Seng Index major index of Hong Kong Stock Exchange of Hong Kong S.A.R., China * Taiwan Capitalization Weighted Stock Index The Taiwan Capitalization Weighted Stock Index (TAIEX; ) or TWSE Capitalization Weighted Stock Index is a stock market index for companies traded on the Taiwan Stock Exchange (TWSE). TAIEX covers all ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

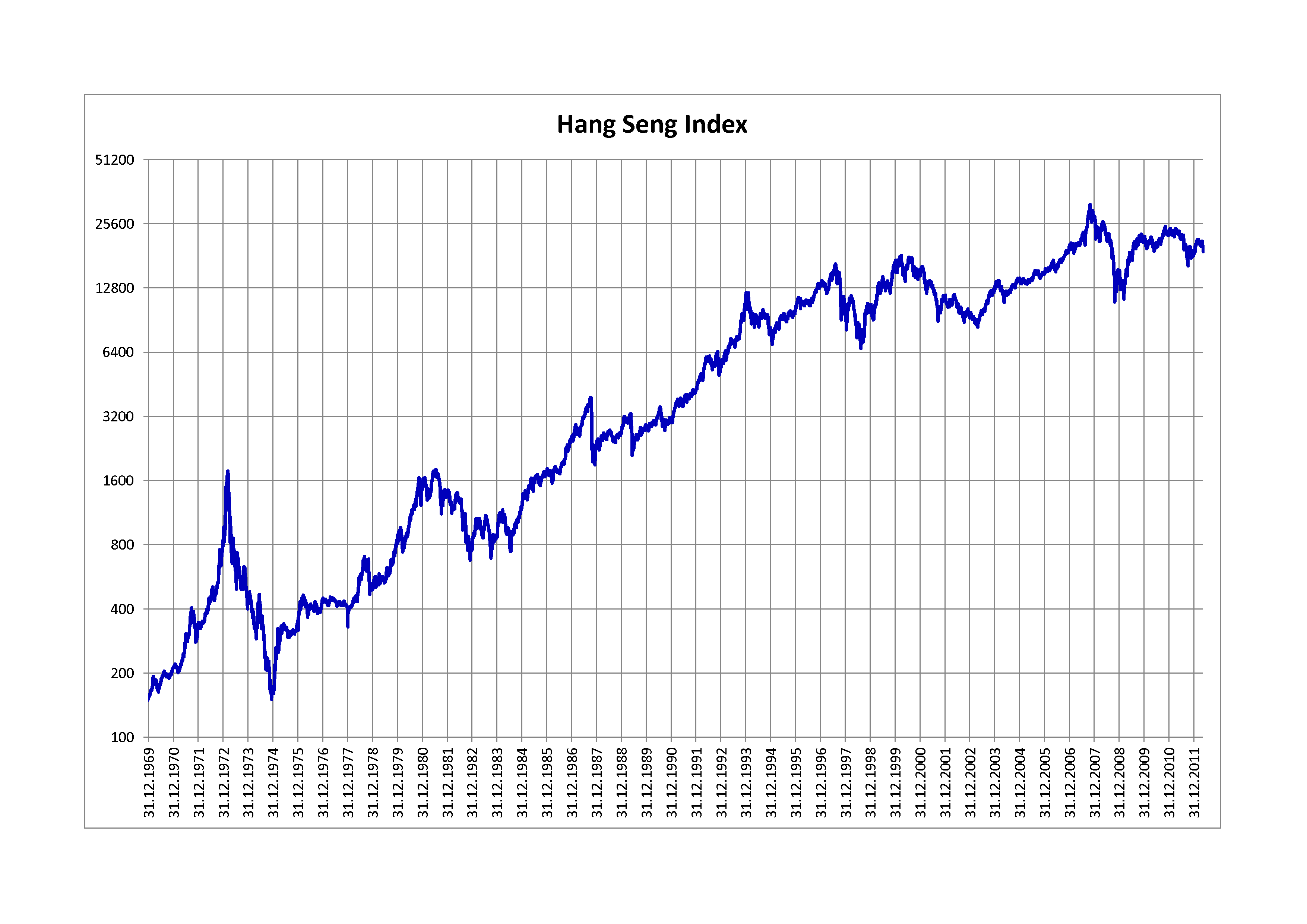

Hang Seng Index

The Hang Seng Index (HSI) is a freefloat-adjusted market- capitalization-weighted stock-market index in Hong Kong. It is used to record and monitor daily changes of the largest companies of the Hong Kong stock market and is the main indicator of the overall market performance in Hong Kong. These 66 constituent companies represent about 58% of the capitalisation of the Hong Kong Stock Exchange. HSI was started on November 24, 1969, and is currently compiled and maintained by Hang Seng Indexes Company Limited, which is a wholly owned subsidiary of Hang Seng Bank, one of the largest banks registered and listed in Hong Kong in terms of market capitalisation. It is responsible for compiling, publishing and managing the Hang Seng Index and a range of other stock indexes, such as ''Hang Seng China Enterprises Index'', ''Hang Seng China AH Index Series'', '' Hang Seng China H-Financials Index'', ''Hang Seng Composite Index Series'', ''Hang Seng China A Industry Top Index'', ''Hang Sen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |