|

State Budget

A government budget is a document prepared by the government and/or other political entity presenting its anticipated tax revenues (Inheritance tax, income tax, corporation tax, import taxes) and proposed spending/expenditure (Healthcare, Education, Defence, Roads, State Benefit) for the coming financial year. In most parliamentary systems, the budget is presented to the legislature and often requires approval of the legislature. Through this budget, the government implements economic policy and realizes its program priorities. Once the budget is approved, the use of funds from individual chapters is in the hands of government ministries and other institutions. Revenues of the state budget consist mainly of taxes, customs duties, fees and other revenues. State budget expenditures cover the activities of the state, which are either given by law or the constitution. The budget in itself does not appropriate funds for government programs, hence need for additional legislative measure ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government

A government is the system or group of people governing an organized community, generally a state. In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government is a means by which organizational policies are enforced, as well as a mechanism for determining policy. In many countries, the government has a kind of constitution, a statement of its governing principles and philosophy. While all types of organizations have governance, the term ''government'' is often used more specifically to refer to the approximately 200 independent national governments and subsidiary organizations. The major types of political systems in the modern era are democracies, monarchies, and authoritarian and totalitarian regimes. Historically prevalent forms of government include monarchy, aristocracy, timocracy, oligarchy, democracy, theocracy, and tyranny. These forms are not always mutually exclusive, and mixed govern ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stamp Act 1765

The Stamp Act 1765, also known as the Duties in American Colonies Act 1765 (5 Geo. III c. 12), was an Act of the Parliament of Great Britain which imposed a direct tax on the British colonies in America and required that many printed materials in the colonies be produced on stamped paper from London which included an embossed revenue stamp. Printed materials included legal documents, magazines, playing cards, newspapers, and many other types of paper used throughout the colonies, and it had to be paid in British currency, not in colonial paper money. The purpose of the tax was to pay for British military troops stationed in the American colonies after the French and Indian War, but the colonists had never feared a French invasion to begin with, and they contended that they had already paid their share of the war expenses. Colonists suggested that it was actually a matter of British patronage to surplus British officers and career soldiers who should be paid by London. The Stam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Library Of Economics And Liberty

Liberty Fund, Inc. is an American private educational foundation headquartered in Carmel, founded by Pierre F. Goodrich. Through publishing, conferences, and educational resources, the operating mandate of the Liberty Fund was set forth in an unpublished memo written by Goodrich "to encourage the study of the ideal of a society of free and responsible individuals".Morgan N. KnullGoodrich, Pierre, ''First Principles'', 09/23/11Robert T. Grimm (ed.), ''Notable American Philanthropists: Biographies of Giving and Volunteering'', Greenwood Publishing Group, 2002, pp. 125–128 History Liberty Fund was founded by Pierre F. Goodrich in 1960. In 1997 it received an $80 million donation from Goodrich's wife, Enid, increasing its assets to over $300 million. In November 2015, it was announced that the Liberty Fund was building a $22 million headquarters in Carmel, Indiana. Liberty Fund has been cited by historian Donald T. Critchlow as one of the endowed conservative foundations which ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Concise Encyclopedia Of Economics

Liberty Fund, Inc. is an American private educational foundation headquartered in Carmel, founded by Pierre F. Goodrich. Through publishing, conferences, and educational resources, the operating mandate of the Liberty Fund was set forth in an unpublished memo written by Goodrich "to encourage the study of the ideal of a society of free and responsible individuals".Morgan N. KnullGoodrich, Pierre, ''First Principles'', 09/23/11Robert T. Grimm (ed.), ''Notable American Philanthropists: Biographies of Giving and Volunteering'', Greenwood Publishing Group, 2002, pp. 125–128 History Liberty Fund was founded by Pierre F. Goodrich in 1960. In 1997 it received an $80 million donation from Goodrich's wife, Enid, increasing its assets to over $300 million. In November 2015, it was announced that the Liberty Fund was building a $22 million headquarters in Carmel, Indiana. Liberty Fund has been cited by historian Donald T. Critchlow as one of the endowed conservative foundations which ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Countries By Government Budget

The list is mainly based on CIA World Factbook for the year 2016 and 2019. The Chinese, Brazilian, Indian, and United States government budgets are the figures reported by the International Monetary Fund. The table includes information from government's budgets; namely revenues, expenditures and the resulting deficits or surpluses. The countries are ranked by their budget revenues in fiscal year 2016. Both sovereign states and dependent territories are included. List ''These figures are given as millions USD, unless otherwise specified.'' See also * List of countries by government budget per capita * List of countries by tax revenue to GDP ratio * List of countries by government spending as percentage of GDP Europe: * List of sovereign states in Europe by budget revenues * List of sovereign states in Europe by budget revenues per capita United States: * List of U.S. state budgets This is a list of U.S. state government budgets as enacted by each state's legislature. Note ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Scarcity

In economics, scarcity "refers to the basic fact of life that there exists only a finite amount of human and nonhuman resources which the best technical knowledge is capable of using to produce only limited maximum amounts of each economic good."Samuelson, P. Anthony., Samuelson, W. (1980). Economics. 11th ed. / New York: McGraw-Hill. If the conditions of scarcity didn't exist and an "infinite amount of every good could be produced or human wants fully satisfied ... there would be no economic goods, i.e. goods that are relatively scarce..." Scarcity is the limited availability of a commodity, which may be in demand in the market or by the commons. Scarcity also includes an individual's lack of resources to buy commodities. The opposite of scarcity is abundance. Scarcity plays a key role in economic theory, and it is essential for a "proper definition of economics itself."Montani G. (1987) Scarcity. In: Palgrave Macmillan (eds) ''The New Palgrave Dictionary of Economics''. Palgrav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

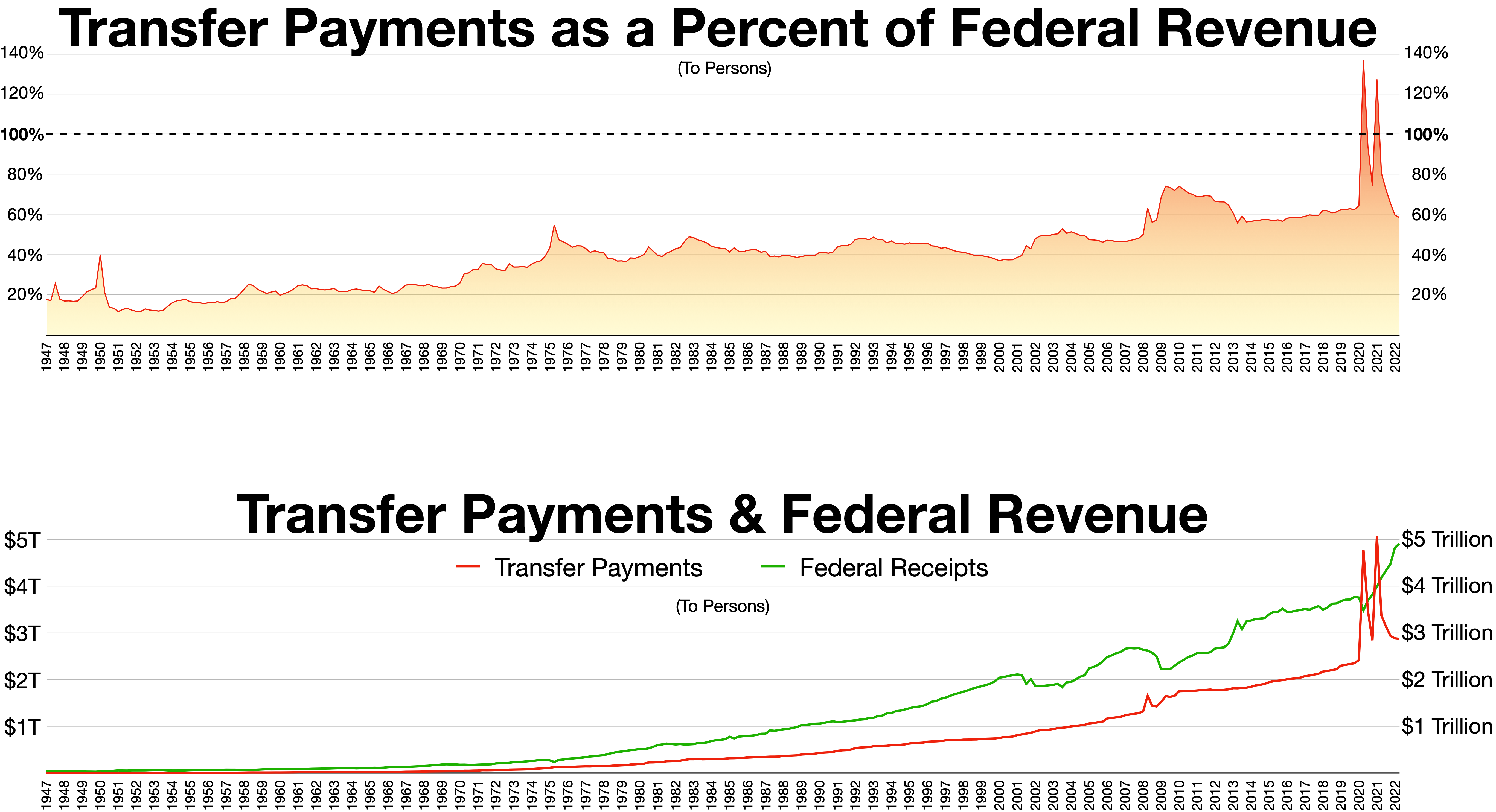

Transfer Payment

In macroeconomics and finance, a transfer payment (also called a government transfer or simply transfer) is a redistribution of income and wealth by means of the government making a payment, without goods or services being received in return. These payments are considered to be non-exhaustive because they do not directly absorb resources or create output. Examples of transfer payments include welfare, financial aid, social security, and government subsidies for certain businesses. Unlike the exchange transaction which mutually benefits all the parties involved in it, the transfer payment consists of a donor and a recipient, with the donor giving up something of value without receiving anything in return. Transfers can be made both between individuals and entities, such as private companies or governmental bodies. These transactions can be both voluntary or involuntary and are generally motivated either by the altruism of the donor or the malevolence of the recipient. For the p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Right Side Of The Report

''The'' () is a grammatical article in English, denoting persons or things already mentioned, under discussion, implied or otherwise presumed familiar to listeners, readers, or speakers. It is the definite article in English. ''The'' is the most frequently used word in the English language; studies and analyses of texts have found it to account for seven percent of all printed English-language words. It is derived from gendered articles in Old English which combined in Middle English and now has a single form used with pronouns of any gender. The word can be used with both singular and plural nouns, and with a noun that starts with any letter. This is different from many other languages, which have different forms of the definite article for different genders or numbers. Pronunciation In most dialects, "the" is pronounced as (with the voiced dental fricative followed by a schwa) when followed by a consonant sound, and as (homophone of pronoun ''thee'') when followed by a v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Expense

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment (government gross capital formation). These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product. Government spending can be financed by government borrowing, taxes, custom duties, the sale or lease of natural resources, and various fees like national park entry fees or licensing fees. When Governments choose to borrow money, they have to pay interest on the money borro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expenses

An expense is an item requiring an outflow of money, or any form of fortune in general, to another person or group as payment for an item, service, or other category of costs. For a tenant, rent is an expense. For students or parents, tuition is an expense. Buying food, clothing, furniture, or an automobile is often referred to as an expense. An expense is a cost that is "paid" or " remitted", usually in exchange for something of value. Something that seems to cost a great deal is "expensive". Something that seems to cost little is "inexpensive". "Expenses of the table" are expenses for dining, refreshments, a feast, etc. In accounting, ''expense'' is any specific outflow of cash or other valuable assets from a person or company to another person or company. This outflow is generally one side of a trade for products or services that have equal or better current or future value to the buyer than to the seller. Technically, an expense is an event in which a proprietary stake is dimi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenues

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business. Commercial revenue may also be referred to as sales or as turnover. Some companies receive revenue from interest, royalties, or other fees. This definition is based on IAS 18. "Revenue" may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in "Last year, Company X had revenue of $42 million". Profits or net income generally imply total revenue minus total expenses in a given period. In accounting, in the balance statement, revenue is a subsection of the Equity section and revenue increases equity, it is often referred to as the "top line" due to its position on the income statement at the very top. This is to be contrasted with the "bottom line" which denotes net income (gross revenues minus total expenses). In general usage, revenue is the total amount of income by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpeg)

.png)