|

Standard Of Deferred Payment

In economics, standard of deferred payment is a function of money. It is the function of being a widely accepted way to value a debt, thereby allowing goods and services to be acquired now and paid for in the future. The 19th-century economist William Stanley Jevons, influential in the study of money, considered it to be one of four fundamental functions of money, the other three being medium of exchange, store of value, and unit of account. However, most modern textbooks now list only the other three functions, considering standard of deferred payment to be subsumed by the others. Most forms of money can act as standards of deferred payment including commodity money, representative money and most commonly fiat money. Representative and fiat money often exist in digital form as well as physical tokens such as coins and notes. Functions of money Money is held to serve multiple distinguished but related functions, of which a "standard of deferred payment" is one. The most comm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are as a medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment. Money was historically an emergent market phenomenon that possess intrinsic value as a commodity; nearly all contemporary money systems are based on unbacked fiat money without use value. Its value is consequently derived by social convention, having been declared by a government or regulatory entity to be legal tender; that is, it must be accepted as a form of payment within the boundaries of the country, for "all debts, public and private", in the case of the United States dollar. Contexts which erode public confidence, such as the circulation of counterfeit money or domestic hyperinflation, can cause good money to lose its value. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Legal Tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt. Some jurisdictions allow contract law to overrule the status of legal tender, allowing (for example) merchants to specify that they will not accept cash payments. Coins and banknotes are usually defined as legal tender in many countries, but personal cheques, credit cards, and similar non-cash methods of payment are usually not. Some jurisdictions may include a specific foreign currency as legal tender, at times as its exclusive legal tender or concurrently with its domestic currency. Some jurisdictions may forbid or restrict payment made by other than legal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Legal Tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt. Some jurisdictions allow contract law to overrule the status of legal tender, allowing (for example) merchants to specify that they will not accept cash payments. Coins and banknotes are usually defined as legal tender in many countries, but personal cheques, credit cards, and similar non-cash methods of payment are usually not. Some jurisdictions may include a specific foreign currency as legal tender, at times as its exclusive legal tender or concurrently with its domestic currency. Some jurisdictions may forbid or restrict payment made by other than legal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt), but promises either to repay or return those resources (or other materials of equal value) at a later date. In other words, credit is a method of making reciprocity formal, legally enforceable, and extensible to a large group of unrelated people. The resources provided may be financial (e.g. granting a loan), or they may consist of goods or services (e.g. consumer credit). Credit encompasses any form of deferred payment. Credit is extended by a creditor, also known as a lender, to a debtor, also known as a borrower. Etymology The term "credit" was first used in English in the 1520s. The term came "from Middle French crédit (15c.) "belief, trust," from Italian credito, from Latin creditum "a loan, thing entrusted to another," from past ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bretton Woods System

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the United States, Canada, Western European countries, Australia, and Japan after the 1944 Bretton Woods Agreement. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold (or 0.88867 gram fine gold per dollar). It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to nations with balance of payments deficits. Preparing to rebuild the interna ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ithaca Hours

The Ithaca HOUR is a local currency formerly used in Ithaca, New York and was one of the longest-running local currency systems, though it is now no longer in circulation. It has inspired other similar systems in Madison, Wisconsin; Santa Barbara, California; Corvallis, Oregon; and a proposed system in the Lehigh Valley, Pennsylvania. One Ithaca HOUR is valued at US$10 and is generally recommended to be used as payment for one hour's work, although the rate is negotiable. The currency Ithaca HOURS are not backed by national currency and cannot be freely converted to national currency, although some businesses may agree to buy them. HOURS are printed on high-quality paper and use faint graphics that would be difficult to reproduce, and each bill is stamped with a serial number, to discourage counterfeiting. In 2002, a one-tenth hour bill was introduced, partly due to the encouragement and funding from Alternatives Federal Credit Union and feedback from retailers who complained ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Time-based Currency

In economics, a time-based currency is an alternative currency or exchange system where the unit of account is the person-hour or some other time unit. Some time-based currencies value everyone's contributions equally: one hour equals one service credit. In these systems, one person volunteers to work for an hour for another person; thus, they are credited with one hour, which they can redeem for an hour of service from another volunteer. Others use time units that might be fractions of an hour (e.g. minutes, ten minutes – 6 units/hour, or 15 minutes – 4 units/hour). While most time-based exchange systems are service exchanges in that most exchange involves the provision of services that can be measured in a time unit, it is also possible to exchange goods by 'pricing' them in terms of the average national hourly wage rate (e.g. if the average hourly rate is $20/hour, then a commodity valued at $20 in the national currency would be equivalent to 1 hour). History 19th century ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hyper-inflation

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as they usually switch to more stable foreign currencies. When measured in stable foreign currencies, prices typically remain stable. Unlike low inflation, where the process of rising prices is protracted and not generally noticeable except by studying past market prices, hyperinflation sees a rapid and continuing increase in nominal prices, the nominal cost of goods, and in the supply of currency. Typically, however, the general price level rises even more rapidly than the money supply as people try ridding themselves of the devaluing currency as quickly as possible. As this happens, the real stock of money (i.e., the amount of circulating money divided by the price level) decreases considerably.Bernholz, Peter 2003, chapter 5.3 Almost all ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debtor

A debtor or debitor is a legal entity (legal person) that owes a debt to another entity. The entity may be an individual, a firm, a government, a company or other legal person. The counterparty is called a creditor. When the counterpart of this debt arrangement is a bank, the debtor is more often referred to as a borrower. If X borrowed money from their bank, X is the debtor and the bank is the creditor. If X puts money in the bank, X is the creditor and the bank is the debtor. It is not a crime to fail to pay a debt. Except in certain bankruptcy situations, debtors can choose to pay debts in any priority they choose. But if one fails to pay a debt, they have broken a contract or agreement between them and a creditor. Generally, most oral and written agreements for the repayment of consumer debt - debts for personal, family or household purposes secured primarily by a person's residence - are enforceable. For the most part, debts that are business-related must be made in writi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Creditor

A creditor or lender is a party (e.g., person, organization, company, or government) that has a claim on the services of a second party. It is a person or institution to whom money is owed. The first party, in general, has provided some property or service to the second party under the assumption (usually enforced by contract) that the second party will return an equivalent property and service. The second party is frequently called a debtor or borrower. The first party is called the creditor, which is the lender of property, service, or money. Creditors can be broadly divided into two categories: secured and unsecured. *A secured creditor has a security or charge over some or all of the debtor's assets, to provide reassurance (thus to ''secure'' him) of ultimate repayment of the debt owed to him. This could be by way of, for example, a mortgage, where the property represents the security. *An unsecured creditor does not have a charge over the debtor's assets. The term creditor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Counterfeit

To counterfeit means to imitate something authentic, with the intent to steal, destroy, or replace the original, for use in illegal transactions, or otherwise to deceive individuals into believing that the fake is of equal or greater value than the real thing. Counterfeit products are fakes or unauthorized replicas of the real product. Counterfeit products are often produced with the intent to take advantage of the superior value of the imitated product. The word ''counterfeit'' frequently describes both the forgeries of currency and documents as well as the imitations of items such as clothing, handbags, shoes, pharmaceuticals, automobile parts, unapproved aircraft parts (which have caused many accidents), watches, electronics and electronic parts, software, works of art, toys, and movies. Counterfeit products tend to have fake company logos and brands, which results in patent or trademark infringement in the case of goods. They also have a reputation for being lower quality, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

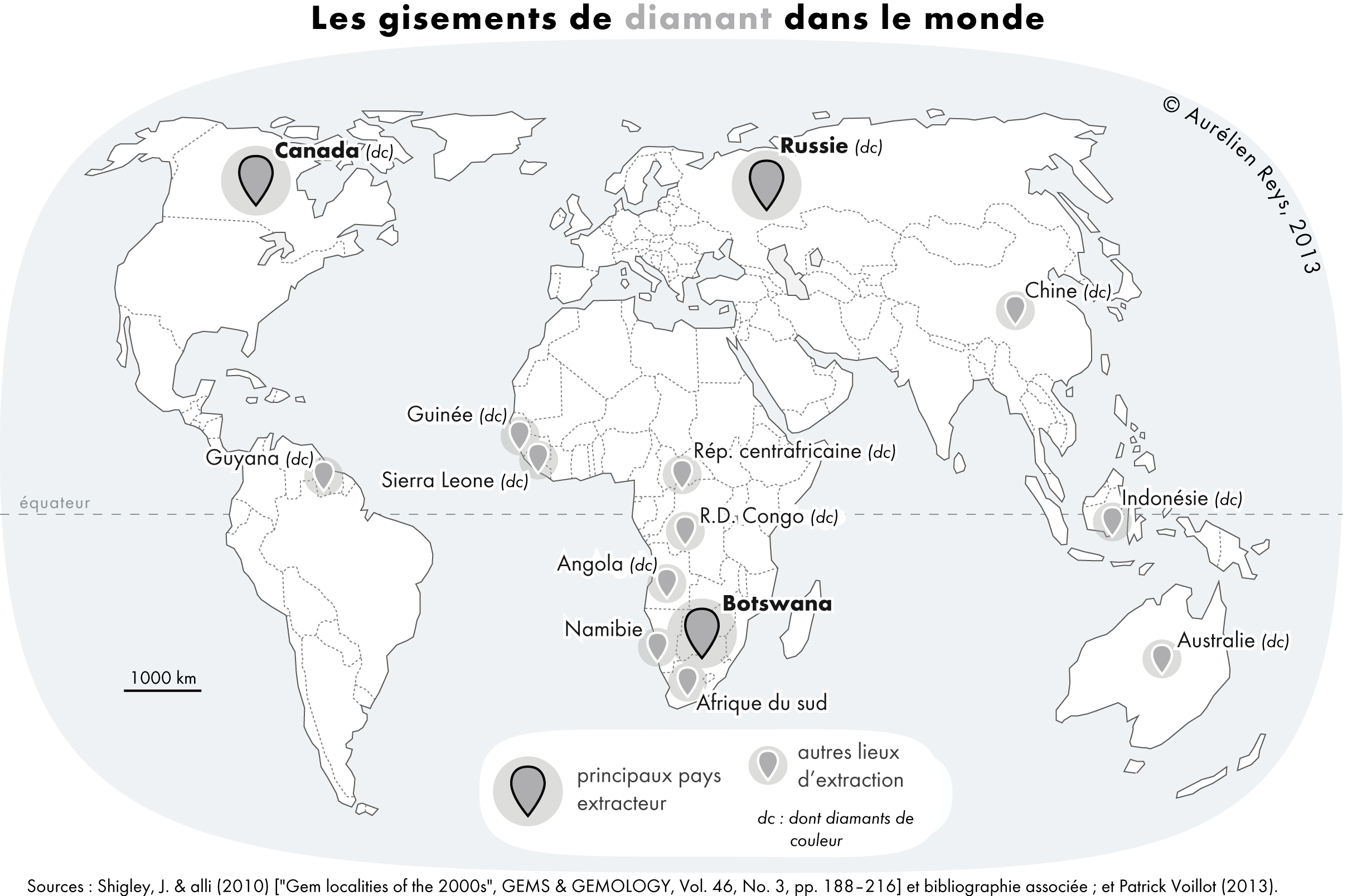

Diamond

Diamond is a Allotropes of carbon, solid form of the element carbon with its atoms arranged in a crystal structure called diamond cubic. Another solid form of carbon known as graphite is the Chemical stability, chemically stable form of carbon at Standard conditions for temperature and pressure, room temperature and pressure, but diamond is metastable and converts to it at a negligible rate under those conditions. Diamond has the highest Scratch hardness, hardness and thermal conductivity of any natural material, properties that are used in major industrial applications such as cutting and polishing tools. They are also the reason that diamond anvil cells can subject materials to pressures found deep in the Earth. Because the arrangement of atoms in diamond is extremely rigid, few types of impurity can contaminate it (two exceptions are boron and nitrogen). Small numbers of lattice defect, defects or impurities (about one per million of lattice atoms) color diamond blue (bor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)