|

Smuggling In Iran

Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of Iran. In 2008, about 55% of the government's budget came from oil and natural gas revenues, the rest from taxes and fees. An estimated 50% of Iran's GDP was exempt from taxes in FY 2004. There are virtually millions of people who do not pay taxes in Iran and hence operate outside the formal economy. The fiscal year begins on March 21 and ends on March 20 of the next year. As part of the Iranian Economic Reform Plan, the government has proposed income tax increases on traders in gold, steel, fabrics and other sectors, prompting several work stoppages by merchants. In 2011, the government announced that during the second phase of the economic reform plan, it aims to increase tax revenues, simplify tax calculation method, introduce double taxation, mechanize tax system, regulate tax exemptions and prevent tax evasion. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Iran

Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of Iran. In 2008, about 55% of the government's budget came from oil and natural gas revenues, the rest from taxes and fees. An estimated 50% of Iran's GDP was exempt from taxes in FY 2004. There are virtually millions of people who do not pay taxes in Iran and hence operate outside the formal economy. The fiscal year begins on March 21 and ends on March 20 of the next year. As part of the Iranian Economic Reform Plan, the government has proposed income tax increases on traders in gold, steel, fabrics and other sectors, prompting several work stoppages by merchants. In 2011, the government announced that during the second phase of the economic reform plan, it aims to increase tax revenues, simplify tax calculation method, introduce double taxation, mechanize tax system, regulate tax exemptions and prevent tax evasion. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Evasion

Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to reduce the taxpayer's tax liability, and it includes dishonest tax reporting, declaring less income, profits or gains than the amounts actually earned, overstating deductions, using bribes against authorities in countries with high corruption rates and hiding money in secret locations. Tax evasion is an activity commonly associated with the informal economy. One measure of the extent of tax evasion (the "tax gap") is the amount of unreported income, which is the difference between the amount of income that should be reported to the tax authorities and the actual amount reported. In contrast, tax avoidance is the legal use of tax laws to reduce one's tax burden. Both tax evasion and tax avoidance can be viewed as forms of tax noncompliance, as they desc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Iranian Rial

The rial ( fa, ریال ایران, riyâl-è Irân; sign: ﷼; abbreviation: Rl (singular) and Rls (plural) or IR in Latin; ISO code: IRR) is the official currency of Iran. There is no official symbol for the currency but the Iranian standard ISIRI 820 defined a symbol for use on typewriters (mentioning that it is an invention of the standards committee itself) and the two Iranian standards ISIRI 2900 and ISIRI 3342 define a character code to be used for it. The Unicode Standard has a compatibility character defined . A proposal has been agreed to by the Iranian parliament to drop four zeros, by replacing the rial with a new currency called the toman, the name of a previous Iranian currency, at the rate of 1 toman = 10,000 rials. History The rial was first introduced in 1798 as a coin worth 1,250 dinars or one-eighth of a '' toman''. In 1825, the rial ceased to be issued, with the qiran subdivided into 20 shahi or 1,000 dinars and was worth one-tenth of a toman, being is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Managing Director

A chief executive officer (CEO), also known as a central executive officer (CEO), chief administrator officer (CAO) or just chief executive (CE), is one of a number of corporate executives charged with the management of an organization especially an independent legal entity such as a company or nonprofit institution. CEOs find roles in a range of organizations, including public and private corporations, non-profit organizations and even some government organizations (notably state-owned enterprises). The CEO of a corporation or company typically reports to the board of directors and is charged with maximizing the value of the business, which may include maximizing the share price, market share, revenues or another element. In the non-profit and government sector, CEOs typically aim at achieving outcomes related to the organization's mission, usually provided by legislation. CEOs are also frequently assigned the role of main manager of the organization and the highest-ranking offic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exit Visa

A visa (from the Latin ''charta visa'', meaning "paper that has been seen") is a conditional authorization granted by a polity to a foreigner that allows them to enter, remain within, or leave its territory. Visas typically include limits on the duration of the foreigner's stay, areas within the country they may enter, the dates they may enter, the number of permitted visits, or if the individual has the ability to work in the country in question. Visas are associated with the request for permission to enter a territory and thus are, in most countries, distinct from actual formal permission for an alien to enter and remain in the country. In each instance, a visa is subject to entry permission by an immigration official at the time of actual entry and can be revoked at any time. Visa evidence most commonly takes the form of a sticker endorsed in the applicant's passport or other travel document but may also exist electronically. Some countries no longer issue physical visa evi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Iran

Iran, officially the Islamic Republic of Iran, and also called Persia, is a country located in Western Asia. It is bordered by Iraq and Turkey to the west, by Azerbaijan and Armenia to the northwest, by the Caspian Sea and Turkmenistan to the north, by Afghanistan and Pakistan to the east, and by the Gulf of Oman and the Persian Gulf to the south. It covers an area of , making it the 17th-largest country. Iran has a population of 86 million, making it the 17th-most populous country in the world, and the second-largest in the Middle East. Its largest cities, in descending order, are the capital Tehran, Mashhad, Isfahan, Karaj, Shiraz, and Tabriz. The country is home to one of the world's oldest civilizations, beginning with the formation of the Elamite kingdoms in the fourth millennium BC. It was first unified by the Medes, an ancient Iranian people, in the seventh century BC, and reached its territorial height in the sixth century BC, when Cyrus the Great fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Iranian Nationality Law

Iranian nationality law contains principles of both '' jus sanguinis'' and ''jus soli''. The full nationality law is defined in Book 2 of the Civil Code of Iran, Articles 976 through 991. Definition of Iranian nationals Article 976 of the Civil Code of Iran defines who is an Iranian national: # All residing in Iran except those whose foreign nationality is established; the foreign nationality of such persons is considered to be established if their documents of nationality have not been objected to by the Iranian Government. # Those born in Iran or outside whose father is Iranian. # Those born in Iran of unknown parentage. # People born in Iran of foreign parents, one of whom was also born in Iran. # People born in Iran of a father of foreign nationality who have resided at least one more year in Iran immediately after reaching the full age of 18; in other cases their naturalization as Iranian subjects will be subject to the stipulations for Iranian naturalization laid down by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bazaar Zanjan

A bazaar () or souk (; also transliterated as souq) is a marketplace consisting of multiple small stalls or shops, especially in the Middle East, the Balkans, North Africa and India. However, temporary open markets elsewhere, such as in the West, might also designate themselves as bazaars. The ones in the Middle East were traditionally located in vaulted or covered streets that had doors on each end and served as a city's central marketplace. Street markets are the European and North American equivalents. The term ''bazaar'' originates from Persian, where it referred to a town's public market district. The term bazaar is sometimes also used to refer to the "network of merchants, bankers and craftsmen" who work in that area. The term ''souk'' comes from Arabic and refers to marketplaces in the Middle East and North Africa. Evidence for the existence of bazaars or souks dates to around 3,000 BCE. Although the lack of archaeological evidence has limited detailed studies of the e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Offshore Banking

An offshore bank is a bank regulated under international banking license (often called offshore license), which usually prohibits the bank from establishing any business activities in the jurisdiction of establishment. Due to less regulation and transparency, accounts with offshore banks were often used to hide undeclared income. Since the 1980s, jurisdictions that provide financial services to nonresidents on a big scale can be referred to as offshore financial centres. OFCs often also levy little or no corporation tax and/or personal income and high direct taxes such as duty, making the cost of living high. With worldwide increasing measures on CTF ( combatting the financing of terrorism) and AML (anti-money laundering) compliance, the offshore banking sector in most jurisdictions was subject to changing regulations. Since 2002 the Financial Action Task Force issues the so-called FATF blacklist of "Non-Cooperative Countries or Territories" (NCCTs), which it perceived to be non-c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

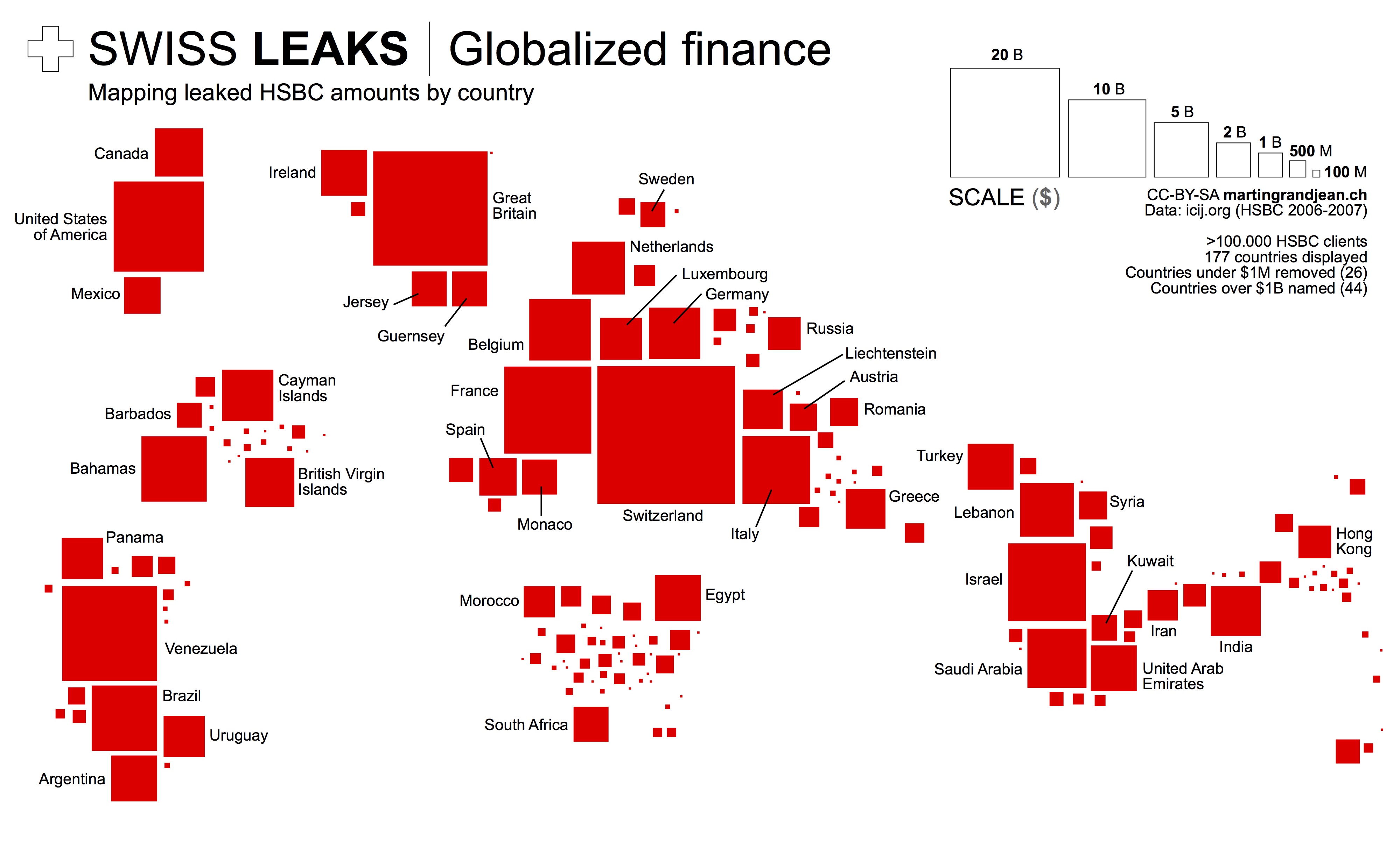

Swiss Leaks

Swiss Leaks (or SwissLeaks) is the name of a journalistic investigation, released in February 2015, of a giant tax evasion scheme allegedly operated with the knowledge and encouragement of the British multinational bank HSBC via its Swiss subsidiary, HSBC Private Bank (Suisse). Triggered by leaked information from French computer analyst Hervé Falciani on accounts held by over 100,000 clients and 20,000 offshore companies with HSBC in Geneva, the disclosed information was then called "the biggest leak in Swiss banking history". Investigation Investigators allege that 180.6 billion euros passed through HSBC accounts held in Geneva by over 100,000 clients and 20,000 offshore companies between November 2006 and March 2007. The data for this period comes from files removed from HSBC Private Bank by a former staffer, software engineer Hervé Falciani, who fled to Lebanon with the attempt to sell it. Later he handed it to French authorities in late 2008. Investigation in Fra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Smuggling In Iran

Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of Iran. In 2008, about 55% of the government's budget came from oil and natural gas revenues, the rest from taxes and fees. An estimated 50% of Iran's GDP was exempt from taxes in FY 2004. There are virtually millions of people who do not pay taxes in Iran and hence operate outside the formal economy. The fiscal year begins on March 21 and ends on March 20 of the next year. As part of the Iranian Economic Reform Plan, the government has proposed income tax increases on traders in gold, steel, fabrics and other sectors, prompting several work stoppages by merchants. In 2011, the government announced that during the second phase of the economic reform plan, it aims to increase tax revenues, simplify tax calculation method, introduce double taxation, mechanize tax system, regulate tax exemptions and prevent tax evasion. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Setad

The Execution of Imam Khomeini's Order (EIKO) ( fa, ستاد اجرایی فرمان امام, ''Setâd-e Ejrây-ye Farmân-e Emâm''), also known as the Executive Headquarters of Imam's Directive or simply Setad, is a parastatal organization in the Islamic Republic of Iran, under direct control of the Supreme Leader of Iran. It was created from thousands of properties confiscated in the aftermath of the 1979 Islamic Revolution. A Reuters investigation found that the organization built "its empire on the systematic seizure of thousands of properties belonging to ordinary Iranians", also seizing property from members of religious minorities, business people and Iranians living abroad; at times falsely claiming that the properties were abandoned. Supreme Leader Ruhollah Khomeini originally ordered three of his aides to take care of and distribute the confiscated property to charity. However, under Ayatollah Ali Khamenei, the organization has been acquiring property for itself. It h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpeg/1200px-Turkey_(68742801).jpeg)