|

Scottish Taxation System

Taxation in Scotland today involves payments that are required to be made to three different levels of government: to the UK government, to the Scottish Government and to local government. Currently 32.4% of taxation collected in Scotland is in the form of taxes under the control of the Scottish parliament and 67.6% of all taxation collected in Scotland goes directly to the UK government in taxation that is a reserved matter of the UK parliament. History Until the 17th century, taxation was regarded as 'an extraordinary source of revenue that was levied for a specific purpose such as the defence of the realm'. However, during the 17th century, Parliament permitted a Land Tax to be collected from 1667, a Hearth tax from 1691-1695 and a Poll tax from 1693-1699. The 1707 Union of the Kingdom of Scotland with the Kingdom of England formed a new Kingdom of Great Britain, so that responsibility for taxation in Scotland became a matter for the Westminster Parliament, now the legislatur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Of The United Kingdom

ga, Rialtas a Shoilse gd, Riaghaltas a Mhòrachd , image = HM Government logo.svg , image_size = 220px , image2 = Royal Coat of Arms of the United Kingdom (HM Government).svg , image_size2 = 180px , caption = Royal coat of arms of the United Kingdom, Royal Arms , date_established = , state = United Kingdom , address = 10 Downing Street, London , leader_title = Prime Minister of the United Kingdom, Prime Minister (Rishi Sunak) , appointed = Monarchy of the United Kingdom, Monarch of the United Kingdom (Charles III) , budget = 882 billion , main_organ = Cabinet of the United Kingdom , ministries = 23 Departments of the Government of the United Kingdom#Ministerial departments, ministerial departments, 20 Departments of the Government of the United Kingdom#Non-ministerial departments, non-ministerial departments , responsible = Parliament of the United Kingdom , url = The Government of the United Kingdom (commonly referred to as British Governmen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stamp Duty

Stamp duty is a tax that is levied on single property purchases or documents (including, historically, the majority of legal documents such as cheques, receipts, military commissions, marriage licences and land transactions). A physical revenue stamp had to be attached to or impressed upon the document to show that stamp duty had been paid before the document was legally effective. More modern versions of the tax no longer require an actual stamp. The duty is thought to have originated in Venice in 1604, being introduced (or re-invented) in Spain in the 1610s, the Spanish Netherlands in the 1620s, France in 1651, Denmark in 1657, Prussia in 1682 and England in 1694. Usage by country Australia The Australian Federal Government does not levy stamp duty. However, stamp duties are levied by the Australian states on various instruments (written documents) and transactions. Stamp duty laws can differ significantly between all eight jurisdictions. The rates of stamp duty also diffe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance Tax (United Kingdom)

In the United Kingdom, Inheritance Tax is a transfer tax. It was introduced with effect from 18 March 1986, replacing Capital Transfer Tax. History Prior to the introduction of Estate Duty by the Finance Act 1894, there was a complex system of different taxes relating to the inheritance of property, that applied to either realty (land) or personalty (other personal property): # From 1694, Probate Duty, introduced as a stamp duty on wills entered in probate in 1694, applying to personalty. # From 1780, Legacy Duty, an inheritance duty paid by the receiver of personalty, graduated according to consanguinity # From 1853, Succession Duty, a duty introduced by the Succession Duty Act 1853 applying to realty settlements, taking effect on the death of the settlor # From 1881, Account Duty applied as an anti-avoidance duty on lifetime gifts made to avoid paying Legacy Duty # From 1885, Corporation Duty applied to the annual value of certain property vested in corporate and unincorp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Gains Tax In The United Kingdom

Capital gains tax in the United Kingdom is a tax levied on capital gains, the profit realised on the sale of a non-inventory asset by an individual or trust in the United Kingdom. The most common capital gains are realised from the sale of shares, bonds, precious metals, real estate, and property, so the tax principally targets business owners, investors and employee share scheme participants. In the UK, gains made by companies fall under the scope of corporation tax rather than capital gains tax. In 2017–18, total capital gains tax receipts were £8.3 billion from 265,000 individuals and £0.6 billion from trusts, on total gains of £58.9 billion. The current operation of the capital gains tax system is a recognised issue. The Conservative government consulted on the issue in 2020. Beginnings The capital gains tax (CGT) system was introduced by Labour Chancellor James Callaghan in 1965. Prior to this, capital gains were not taxed. Channon observed t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value-added Tax (United Kingdom)

In the United Kingdom, the value added tax (VAT) was introduced in 1973, replacing Purchase Tax, and is the third-largest source of government revenue, after income tax and National Insurance. It is administered and collected by HM Revenue and Customs, primarily through the Value Added Tax Act 1994. VAT is levied on most goods and services provided by registered businesses in the UK and some goods and services imported from outside the UK. The default VAT rate is the standard rate, 20% since 4 January 2011. Some goods and services are subject to VAT at a reduced rate of 5% (such as domestic fuel) or 0% (such as most food and children's clothing). Others are exempt from VAT or outside the system altogether. VAT is an indirect tax because the tax is paid to the government by the seller (the business) rather than the person who ultimately bears the economic burden of the tax (the consumer). Opponents of VAT claim it is a regressive tax because the poorest people spend a higher pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Insurance

National Insurance (NI) is a fundamental component of the welfare state in the United Kingdom. It acts as a form of social security, since payment of NI contributions establishes entitlement to certain state benefits for workers and their families. Introduced by the National Insurance Act 1911 and expanded by the Labour government in 1948, the system has been subjected to numerous amendments in succeeding years. Initially, it was a contributory form of insurance against illness and unemployment, and eventually provided retirement pensions and other benefits. Currently, workers pay contributions from the age of 16 years, until the age they become eligible for the State pension. Contributions are due from employed people earning at or above a threshold called the Lower Earnings Limit, the value of which is reviewed each year. Self-employed people contribute partly through a fixed weekly or monthly payment and partly on a percentage of net profits above a threshold, which is revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom Corporation Tax

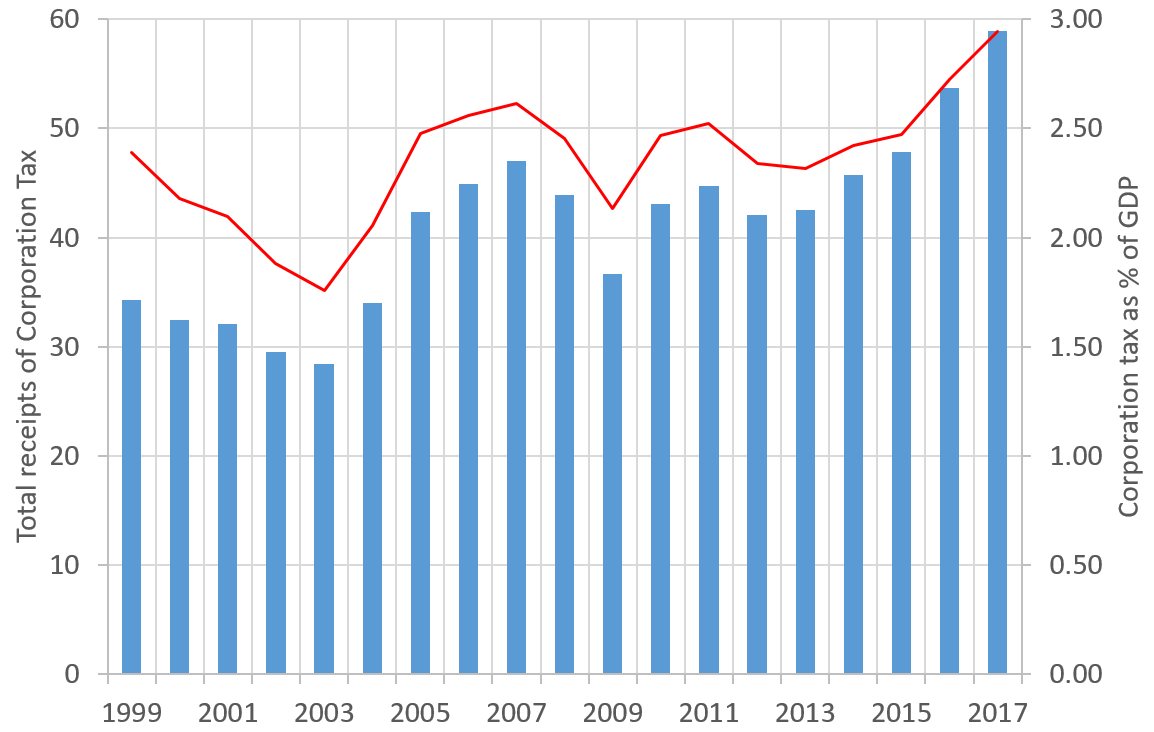

: ''Throughout this article, the term "pound" and the £ symbol refer to the Pound sterling.'' Corporation tax in the United Kingdom is a corporate tax levied in on the profits made by UK-resident companies and on the profits of entities registered overseas with permanent establishments in the UK. Until 1 April 1965, companies were taxed at the same income tax rates as individual taxpayers, with an additional profits tax levied on companies. Finance Act 1965 replaced this structure for companies and associations with a single corporate tax, which took its basic structure and rules from the income tax system. Since 1997, the UK's Tax Law Rewrite ProjectTax Law Rewrite , |

Air Passenger Duty

Air Passenger Duty (APD) is an excise Duty (tax), duty which is charged on the carriage of passengers flying from a United Kingdom or Isle of Man airport on an aircraft that has an authorised take-off weight of more than 5.7 tonnes or more than twenty seats for passengers. The duty is not payable by inbound international passengers who are bookedNotice 550 Section 4.1 HMRC to continue their journey (to an international destination) within 24 hours of their scheduled time of arrival in the UK. (The same exemption applies to booked onward domestic flights, but the time limits are shorter and more complex.) If a passenger "stops-over" for more than 24 hours (or the domestic limit, if applicable), duty is p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Scotland Act 2016

The Scotland Act 2016 (c. 11) is an act of the Parliament of the United Kingdom. It sets out amendments to the Scotland Act 1998 and devolves further powers to Scotland. The legislation is based on recommendations given by the report of the Smith Commission, which was established on 19 September 2014 in the wake of the Scottish independence referendum. The Act The act gives extra powers to the Scottish Parliament and the Scottish Government, This article contains quotations from this source, which is available under th Open Government Licence v3.0 © Crown copyright. most notably: * The ability to amend sections of the Scotland Act 1998 which relate to the operation of the Scottish Parliament and the Scottish Government within the United Kingdom including control of its electoral system (subject to a two-thirds majority within the parliament for any proposed change). * The ability to use such amendment to devolve powers to the Scottish Parliament and Scottish Ministers over a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Smith Commission

The Smith Commission was announced by Prime Minister David Cameron on 19 September 2014 in the wake of the 'No' vote in the 2014 Scottish independence referendum. The establishment of the commission was part of the process of fulfilling The Vow made by the leaders of the three main unionist parties during the last days of the referendum campaign. The Vow promised the devolution of more powers from the Parliament of the United Kingdom to the Scottish Parliament in the event of a No vote. Following the No vote, Lord Smith of Kelvin was given the task to "convene cross-party talks and facilitate an inclusive engagement process across Scotland to produce, by 30 November 2014, Heads of Agreement with recommendations for further devolution of powers to the Scottish Parliament". Ten representatives were nominated by the political parties with elected members in the Scottish Parliament; the Commission started its discussions on 22 October. Agreement was reached and the report published ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2014 Scottish Independence Referendum

A referendum on Scottish independence from the United Kingdom was held in Scotland on 18 September 2014. The referendum question was, "Should Scotland be an independent country?", which voters answered with "Yes" or "No". The "No" side won with 2,001,926 (55.3%) voting against independence and 1,617,989 (44.7%) voting in favour. The turnout of 84.6% was the highest recorded for an election or referendum in the United Kingdom since the January 1910 general election, which was held before the introduction of universal suffrage. The Scottish Independence Referendum Act 2013 set out the arrangements for the referendum and was passed by the Scottish Parliament in November 2013, following an agreement between the devolved Scottish government and the Government of the United Kingdom. The independence proposal required a simple majority to pass. All European Union (EU) or Commonwealth citizens residing in Scotland age 16 or over could vote, with some exceptions, which produced ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Barnett Formula

The Barnett formula is a mechanism used by the Treasury in the United Kingdom to automatically adjust the amounts of public expenditure allocated to Northern Ireland, Scotland and Wales to reflect changes in spending levels allocated to public services in England, Scotland and Wales, as appropriate. The formula applies to a large proportion, but not the whole, of the devolved governments' budgets − in 2013–14 it applied to about 85% of the Scottish Parliament's total budget.Barnett Formula definition in Scottish Draft Budget 2013–14 ''www.scotland.gov.uk'' The formula is named after Joel Barnett, who devised it in 1978 while |