|

Schedular System Of Taxation

The schedular system of taxation is the system of how the charge to United Kingdom corporation tax is applied. It also applied to United Kingdom income tax before legislation was rewritten by the Tax Law Rewrite Project. Similar systems apply in other jurisdictions that are or were closely related to the United Kingdom, such as Ireland and Jersey. The levies to tax on income were originally set out in Schedules to the Income Tax Act. In the case of United Kingdom corporation tax, they remain for companies charged to that tax, and in the case of United Kingdom income tax, many, but not all remain. In the United Kingdom the ''source rule'' applies. This means that something is taxed only if there is a specific provision bringing it within the charge to tax. Accordingly, profits are only charged to corporation tax if they fall within one of the following, and are not otherwise exempted by an explicit provision of the Taxes Acts: The Schedules Notes: #The heads of charge listed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

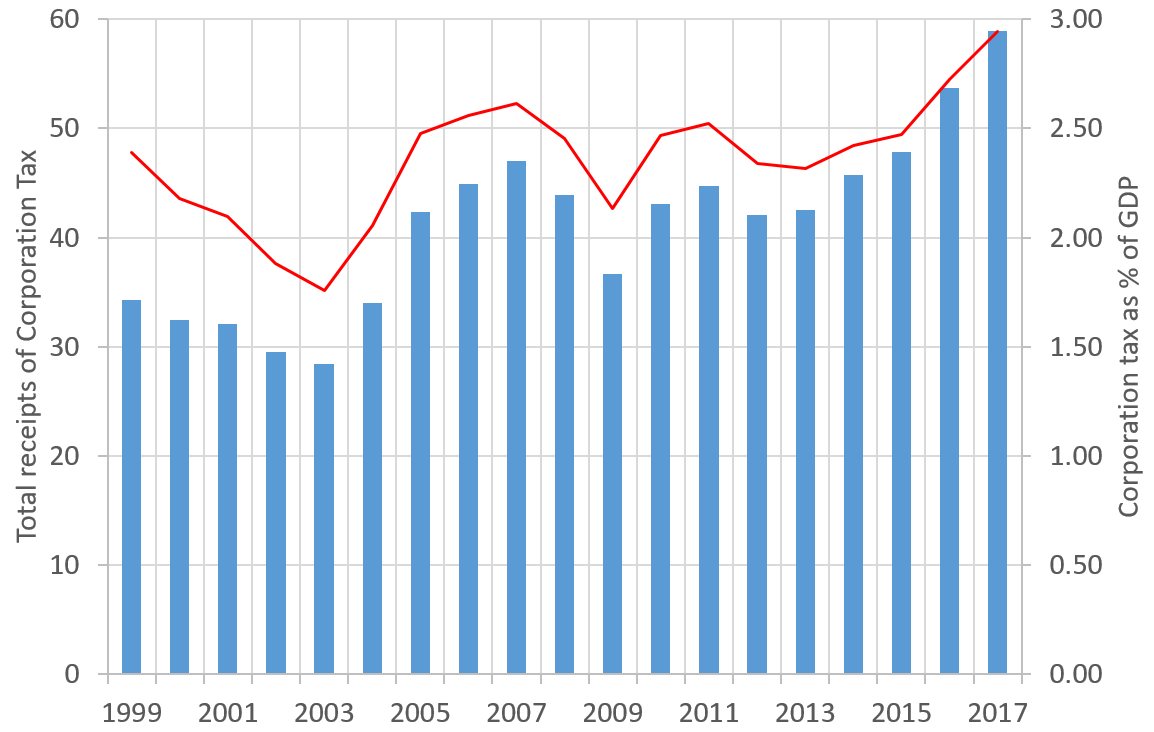

United Kingdom Corporation Tax

: ''Throughout this article, the term "pound" and the £ symbol refer to the Pound sterling.'' Corporation tax in the United Kingdom is a corporate tax levied in on the profits made by UK-resident companies and on the profits of entities registered overseas with permanent establishments in the UK. Until 1 April 1965, companies were taxed at the same income tax rates as individual taxpayers, with an additional profits tax levied on companies. Finance Act 1965 replaced this structure for companies and associations with a single corporate tax, which took its basic structure and rules from the income tax system. Since 1997, the UK's Tax Law Rewrite ProjectTax Law Rewrite , |

I Minus E Basis

In business and accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and amortization, interest, and taxes for an accounting period. It is computed as the residual of all revenues and gains less all expenses and losses for the period,Stickney, et al. (2009) Financial Accounting: An Introduction to Concepts, Methods, and Uses. Cengage Learning and has also been defined as the net increase in shareholders' equity that results from a company's operations.Needles, et al. (2010) Financial Accounting. Cengage Learning. It is different from gross income, which only deducts the cost of goods sold from revenue. For households and individuals, net income refers to the (gross) income minus taxes and other deductions (e.g. mandatory pension contributions). Definition Net income can be distributed among holders of common stock as a dividend or h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retail Prices Index (United Kingdom)

In the United Kingdom, the Retail Prices Index or Retail Price Index (RPI) is a measure of inflation published monthly by the Office for National Statistics. It measures the change in the cost of a representative sample of retail goods and services. As the RPI was held not to meet international statistical standards, since 2013 the Office for National Statistics no longer classifies it as a "national statistic", emphasising the Consumer Price Index instead. However, as of 2018 the UK Treasury still uses the RPI measure of inflation for various index-linked tax rises. History RPI was first introduced in 1956, replacing the previous Interim Index of Retail Prices that had been in use since June 1947. It was once the principal official measure of inflation. It has been superseded in that regard by the Consumer Price Index (CPI). The RPI is still used by the government as a base for various purposes, such as the amounts payable on index-linked securities including index-linked gilt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tonnage Tax

Tonnage is a measure of the cargo-carrying capacity of a ship, and is commonly used to assess fees on commercial shipping. The term derives from the taxation paid on ''tuns'' or casks of wine. In modern maritime usage, "tonnage" specifically refers to a calculation of the volume or cargo volume of a ship. Although tonnage (volume) should not be confused with displacement (the actual weight of the vessel), the long ton (or imperial ton) of 2,240 lb is derived from the fact that a "tun" of wine typically weighed that much. Tonnage measurements Tonnage measurements are governed by an IMO Convention (International Convention on Tonnage Measurement of Ships, 1969 (London-Rules)), which initially applied to all ships built after July 1982, and to older ships from July 1994. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Case Law

Case law, also used interchangeably with common law, is law that is based on precedents, that is the judicial decisions from previous cases, rather than law based on constitutions, statutes, or regulations. Case law uses the detailed facts of a legal case that have been resolved by courts or similar tribunals. These past decisions are called "case law", or precedent. ''Stare decisis''—a Latin phrase meaning "let the decision stand"—is the principle by which judges are bound to such past decisions, drawing on established judicial authority to formulate their positions. These judicial interpretations are distinguished from statutory law, which are codes enacted by legislative bodies, and regulatory law, which are established by executive agencies based on statutes. In some jurisdictions, case law can be applied to ongoing adjudication; for example, criminal proceedings or family law. In common law countries (including the United Kingdom, United States, Canada, Australia and Ne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statute Law

Statutory law or statute law is written law passed by a body of legislature. This is opposed to Oral law, oral or customary law; or regulatory law promulgated by the Executive (government), executive or common law of the judiciary. Statutes may originate with national, state legislatures or local Municipality, municipalities. Constitution, Codified law The term codified law refers to statutes that have been organized ("codified") by subject matter; in this narrower sense, some but not all statutes are considered "codified." The entire body of codified statute is referred to as a "code," such as the United States Code, the Ohio Revised Code or the 1983 Code of Canon Law, Code of Canon Law. The substantive provisions of the Act could be codified (arranged by subject matter) in one or more titles of the United States Code while the provisions of the law that have not reached their "effective date" (remaining uncodified) would be available by reference to the United States Statutes a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Financial Reporting Standards

International Financial Reporting Standards, commonly called IFRS, are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board (IASB). They constitute a standardised way of describing the company's financial performance and position so that company financial statements are understandable and comparable across international boundaries. They are particularly relevant for companies with shares or securities listed on a public stock exchange. IFRS have replaced many different national accounting standards around the world but have not replaced the separate accounting standards in the United States where U.S. GAAP is applied. History The International Accounting Standards Committee (IASC) was established in June 1973 by accountancy bodies representing ten countries. It devised and published International Accounting Standards (IAS), interpretations and a conceptual framework. These were looked to by many national accounting standard-set ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK Generally Accepted Accounting Principles

Generally Accepted Accounting Practice in the UK, or UK GAAP, is the overall body of regulation establishing how company accounts must be prepared in the United Kingdom. Company accounts must also be prepared in accordance with applicable company law (for UK companies, the Companies Act 2006; for companies in the Channel Islands and the Isle of Man, companies law applicable to those jurisdictions). Generally accepted accounting practice is a statutory term in the UK Taxes Acts. The abbreviation "GAAP" is also accepted as an abbreviation for the term used in other jurisdictions, Generally Accepted Accounting Principles, or Generally Accepted Accounting Policies. History Accounting standards derive from a number of sources. The chief standard-setter is the Accounting Standards Board (ASB), which issues standards called ''Financial Reporting Standards'' (FRS). The ASB is part of the Financial Reporting Council, an independent regulator funded by a levy on listed companies, and it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Life Assurance

Life insurance (or life assurance, especially in the Commonwealth of Nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policyholder). Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses. Life policies are legal contracts and the terms of each contract describe the limitations of the insured events. Often, specific exclusions written into the contract limit the liability of the insurer; common examples include claims relating to suicide, fraud, war, riot, and civil commotion. Difficulties may arise where an event is not clearly defined, for example, the insured knowingly incurred a risk by consenting to an experimental me ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HM Revenue And Customs

HM Revenue and Customs (His Majesty's Revenue and Customs, or HMRC) is a non-ministerial government department, non-ministerial Departments of the United Kingdom Government, department of the His Majesty's Government, UK Government responsible for the tax collection, collection of Taxation in the United Kingdom, taxes, the payment of some forms of Welfare state in the United Kingdom, state support, the administration of other regulatory Regime#Politics, regimes including the national minimum wage and the issuance of national insurance numbers. HMRC was formed by the merger of the Inland Revenue and HM Customs and Excise, which took effect on 18 April 2005. The department's logo is the St Edward's Crown enclosed within a circle. Prior to the Elizabeth II, Queen's death on 8 September 2022, the department was known as ''Her'' Majesty's Revenue and Customs and has since been amended to reflect the change of monarch. Departmental responsibilities The department is responsible for the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company is divided, or these shares considered together" "When a company issues shares or stocks ''especially AmE'', it makes them available for people to buy for the first time." (Especially in American English, the word "stocks" is also used to refer to shares.) A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |