|

Salomon Brothers

Salomon Brothers, Inc., was an American multinational bulge bracket investment bank headquartered in New York City. It was one of the five largest investment banking enterprises in the United States and the most profitable firm on Wall Street during the 1980s and 1990s. Its CEO and chairman at that time, John Gutfreund, was nicknamed "the King of Wall Street". Salomon Brothers served many of the largest corporations in America. At one time, it was the leading underwriter of corporate bonds and the largest dealer of Treasury Securities in the United States. It was also one of the top firms in futures and options (known as "derivatives") and in securitization in a range of asset classes including commercial real estate securities. The bank was famed for its "cutthroat corporate culture that rewarded risk-taking with massive bonuses, punishing poor results with a swift boot." In Michael Lewis' 1989 book '' Liar's Poker'', the insider descriptions of life at Salomon gave way t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1 New York Plaza

1 New York Plaza is an office building in the Financial District of Manhattan in New York City, at the intersection of South and Whitehall Streets near South Ferry. The building, measuring tall with 50 floors, is the southernmost skyscraper in Lower Manhattan. It was designed by William Lescaze & Assocs. and Kahn & Jacobs, and developed by Sol Atlas and John P. McGrath. The facade was designed by Nevio Maggiora, consisting of a boxlike "beehive" pattern with the windows recessed within, made of aluminum-clad wall elements resembling a type of thermally activated elevator button popular at the time of construction. There is a retail concourse on the lower level. History Construction and early years In 1959, the City of New York attempted to acquire the land under this development through eminent domain as part of the Battery Park Urban Renewal Area. The plan involved consolidating several blocks into a " superblock" for public housing. When that plan fell through, the city ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Treasury Securities

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. government debt has been managed by the Bureau of the Fiscal Service, succeeding the Bureau of the Public Debt. There are four types of marketable Treasury securities: Treasury bills, Treasury notes, Treasury bonds, and Treasury Inflation Protected Securities (TIPS). The government sells these securities in auctions conducted by the Federal Reserve Bank of New York, after which they can be traded in secondary markets. Non-marketable securities include savings bonds, issued to the public and transferable only as gifts; the State and Local Government Series (SLGS), purchaseable only with the proceeds of state and municipal bond sales; and the Government Account Series, purchased by units of the federal government. Treasury securities are bac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage-backed Security

A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment bank) that securitizes, or packages, the loans together into a security that investors can buy. Bonds securitizing mortgages are usually treated as a separate class, termed residential; another class is commercial, depending on whether the underlying asset is mortgages owned by borrowers or assets for commercial purposes ranging from office space to multi-dwelling buildings. The structure of the MBS may be known as "pass-through", where the interest and principal payments from the borrower or homebuyer pass through it to the MBS holder, or it may be more complex, made up of a pool of other MBSs. Other types of MBS include collateralized mortgage obligations (CMOs, often structured as real estate mortgage investment conduits) and collatera ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of security under which the issuer ( debtor) owes the holder ( creditor) a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in a company (i.e. they are owners), whereas bondholders have a creditor stake in a company (i.e. they are lenders). As creditors, bondholders have priority over stockholders. This means they will be repaid in advance of stockholders, but will rank behind s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chief Executive Officer

A chief executive officer (CEO), also known as a central executive officer (CEO), chief administrator officer (CAO) or just chief executive (CE), is one of a number of corporate executives charged with the management of an organization especially an independent legal entity such as a company or nonprofit institution. CEOs find roles in a range of organizations, including public and private corporations, non-profit organizations and even some government organizations (notably state-owned enterprises). The CEO of a corporation or company typically reports to the board of directors and is charged with maximizing the value of the business, which may include maximizing the share price, market share, revenues or another element. In the non-profit and government sector, CEOs typically aim at achieving outcomes related to the organization's mission, usually provided by legislation. CEOs are also frequently assigned the role of main manager of the organization and the highest-ranking offic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reverse Merger

A reverse takeover (RTO), reverse merger, or reverse IPO is the acquisition of a public company by a private company so that the private company can bypass the lengthy and complex process of going public. Sometimes, conversely, the public company is bought by the private company through an asset swap and share issue. The transaction typically requires reorganization of capitalization of the acquiring company. Process In a reverse takeover, shareholders of the private company purchase control of the public shell company/ SPAC and then merge it with the private company. The publicly traded corporation is called a "shell" since all that exists of the original company is its organizational structure. The private company shareholders receive a substantial majority of the shares of the public company and control of its board of directors. The transaction can be accomplished within weeks. The transaction involves the private and shell company exchanging information on each other, negot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Phibro Corporation

Phibro is a global low-carbon commodity company, focused on renewable asstets' development, acquisitions, optimizations and related contract structuring. Phibro's strategy is based on a proven track record of combining market insight, disciplined risk management, and create risk-reward opportunities in low carbon emission and green commodities markets. Phibro’s team has deep expertise across all commodities including ''oil and'' ''oil products, natural gas, natural gas liquids (NGL), electricity, renewable fuels, fertilizer, coal and emissions.'' Founded in 1901, Philipp Brothers (or PhibroTM as it became known) has a long heritage of innovation in the commodities markets. Phibro was a pioneer in the development of liquidity and price transparency in the global commodity markets, and it has operated in the US since 1915. Phibro’s headquarters are located in Stamford, Connecticut. History The origin of the company traces to 1901 when Julius Philipp, an Orthodox Jew, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Trading

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management. A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with central counterparty clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market. Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rising Through The Wreckage On Wall Street

Rising may refer to: * Rising, a stage in baking - see Proofing (baking technique) * Elevation * Short for Uprising, a rebellion Film and TV * "Rising" (''Stargate Atlantis''), the series premiere of the science fiction television program ''Stargate Atlantis'' * "Rising" (''Dark Angel''), an episode of the television series ''Dark Angel'' * ''Rising'' (news show), a news show hosted by Ryan Grim and Robby Soave of ''The Hill'' Books * ''Rising'' (novel), the last novel of R. C. Hutchinson Places * Rising, Illinois, United States, an unincorporated community * Rising City, Nebraska, United States, a village * Rising River, a river in California * Rising, the flow of water to the surface from underground - see spring (hydrosphere) Surname * Melbourne Rising, an Australian rugby union team * John Rising (1756–1815), English portrait and subject painter * Linda Rising, American author, lecturer and consultant * Nelson Rising, American businessman * Pop Rising (1877-1938) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

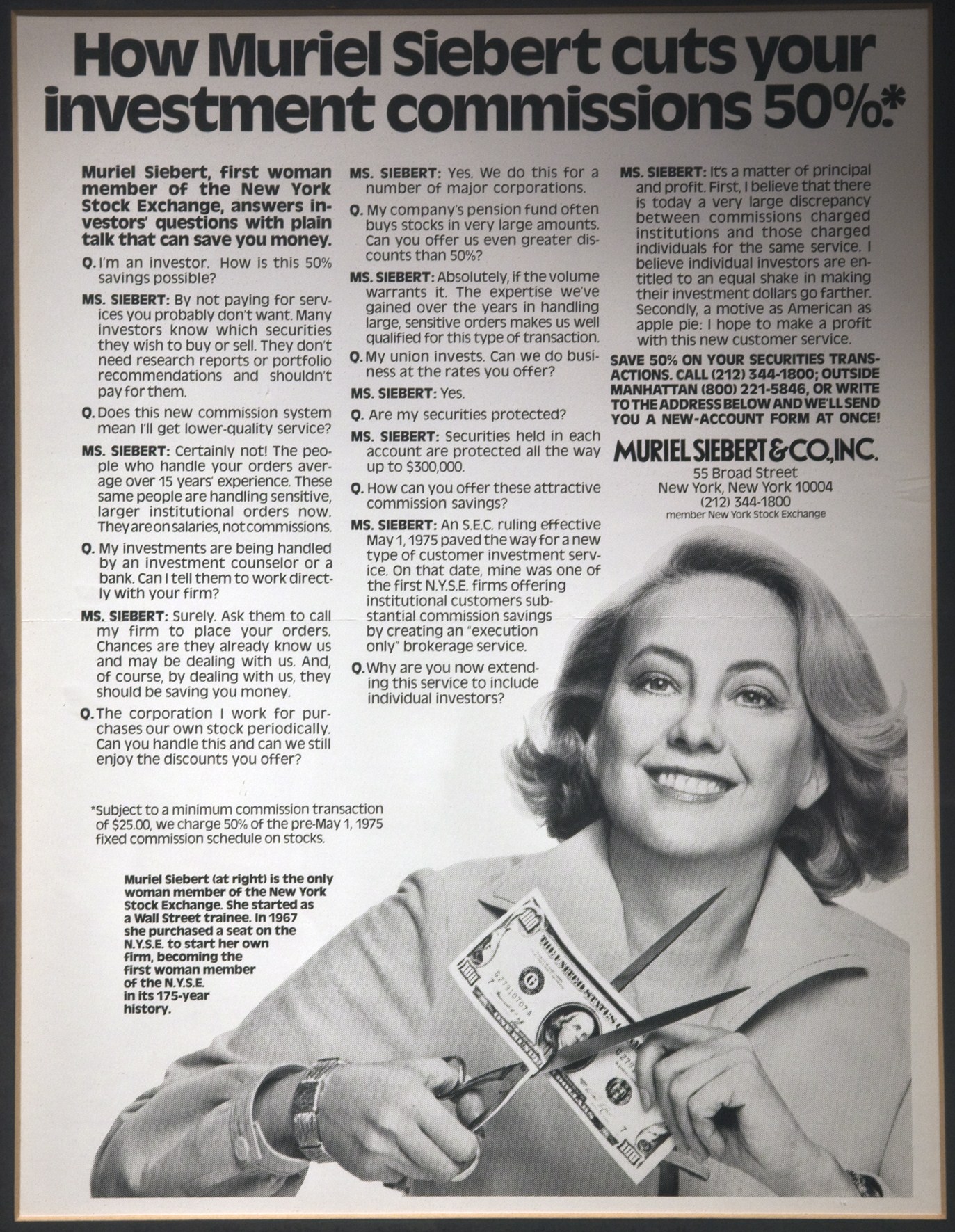

Muriel Siebert

Muriel Faye Siebert (September 12, 1928 – August 24, 2013) was an American businesswoman who was the first woman to own a seat on the New York Stock Exchange, and the first woman to head one of the NYSE's member firms. She joined the 1,365 male members of the exchange on December 28, 1967. Siebert is sometimes known as the “first woman of finance,” despite being preceded in owning a brokerage by Victoria Woodhull. Biography Siebert was born to a Jewish familyTablet Magazine: "Wall Street Pioneer Muriel Siebert Dies at 84 – Siebert was the first woman to own a seat on the New York Stock Exchange" By Stephanie Butnick August 27, 2013, in |

William Salomon

William Salomon (1914-2014) was an American businessman who served as managing partner of Salomon Brothers. Biography Salomon was born to a Jewish family in New York City, the son of Percy Salomon who co-founded Salomon Brothers with his brothers, Arthur and Herbert. William joined the firm aged 19 in 1933, soon after the Wall Street crash. He became a managing partner in 1963 and turned the firm into one of the "fearsome foursome that took on the elite white shoe banks such as Morgan Stanley and First Boston". He retired in 1978, passing the leadership to John Gutfreund, but regretted it when the latter led the partners into selling the firm for $554 million in 1981 to Phibro Phibro is a global low-carbon commodity company, focused on renewable asstets' development, acquisitions, optimizations and related contract structuring. Phibro's strategy is based on a proven track record of combining market insight, disciplin ..., a commodities trading house. He had prized the disci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Partnership

A partnership is an arrangement where parties, known as business partners, agree to cooperate to advance their mutual interests. The partners in a partnership may be individuals, businesses, interest-based organizations, schools, governments or combinations. Organizations may partner to increase the likelihood of each achieving their mission and to amplify their reach. A partnership may result in issuing and holding equity or may be only governed by a contract. History Partnerships have a long history; they were already in use in medieval times in Europe and in the Middle East. According to a 2006 article, the first partnership was implemented in 1383 by Francesco di Marco Datini, a merchant of Prato and Florence. The Covoni company (1336-40) and the Del Buono-Bencivenni company (1336-40) have also been referred to as early partnerships, but they were not formal partnerships. In Europe, the partnerships contributed to the Commercial Revolution which started in the 13th centur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)