|

Stada Arzneimittel

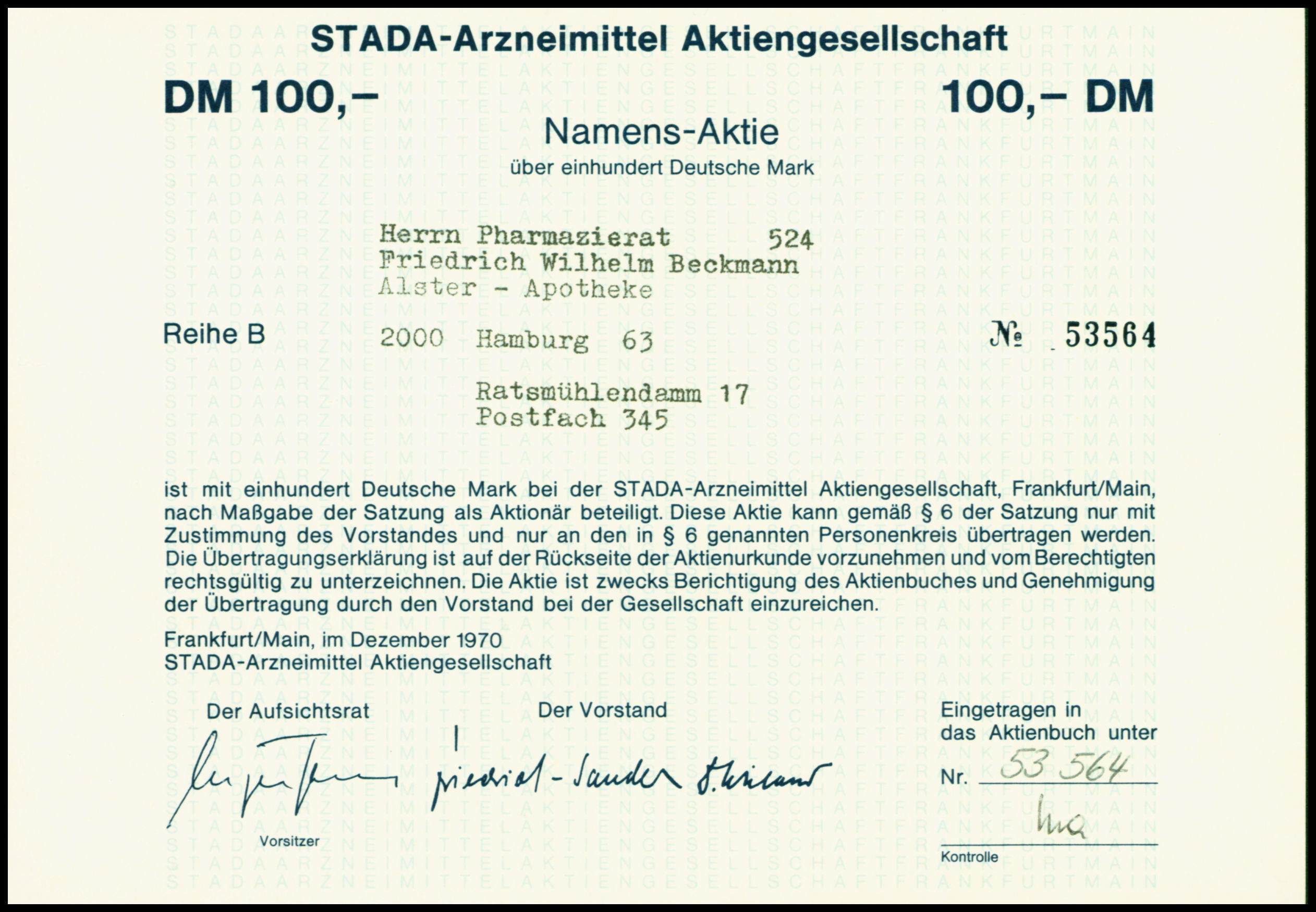

Stada Arzneimittel AG is a pharmaceutical company based in Bad Vilbel, Germany which specializes in the production of generic and over-the-counter drugs. In 2018, revenue totaled €2.33 billion. Commonly known products produced by Stada are Stada-brand acetaminophen and lactulose, Grippostad-C cold medicine and Ladival sun protection products. Stada is involved in various charity projects and sponsoring activities which include the support for dolphin aid e.V since 2007 and the support of a Romanian children's village in Timișoara. History Foundation & early history Stada was founded in Dresden in 1895 as a cooperative pharmacy. Stada was originally an acronym for ''Standardarzneimittel Deutscher Apotheker'' (Standard Drugs (of) German Pharmacists). After World War II, the company was relocated to Essen and Tübingen. In 1956 it was moved again to Bad Vilbel and in 1970, Stada began trading on the stock exchange as a public company. At that time the shares were restricted to p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aktiengesellschaft

(; abbreviated AG, ) is a German word for a corporation limited by Share (finance), share ownership (i.e. one which is owned by its shareholders) whose shares may be traded on a stock market. The term is used in Germany, Austria, Switzerland (where it is equivalent to a ''S.A. (corporation), société anonyme'' or a ''società per azioni''), and South Tyrol for companies incorporated there. It is also used in Luxembourg (as lb, Aktiëgesellschaft, label=none, ), although the equivalent French language term ''S.A. (corporation), société anonyme'' is more common. In the United Kingdom, the equivalent term is public limited company, "PLC" and in the United States while the terms Incorporation (business), "incorporated" or "corporation" are typically used, technically the more precise equivalent term is "joint-stock company" (though note for the British term only a minority of public limited companies have their shares listed on stock exchanges). Meaning of the word The German w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deutsche Mark

The Deutsche Mark (; English: ''German mark''), abbreviated "DM" or "D-Mark" (), was the official currency of West Germany from 1948 until 1990 and later the unified Germany from 1990 until the adoption of the euro in 2002. In English, it was typically called the "Deutschmark" (). One Deutsche Mark was divided into 100 pfennigs. It was first issued under Allied occupation in 1948 to replace the Reichsmark and served as the Federal Republic of Germany's official currency from its founding the following year. On 31 December 1998, the Council of the European Union fixed the irrevocable exchange rate, effective 1 January 1999, for German mark to euros as DM 1.95583 = €1. In 1999, the Deutsche Mark was replaced by the euro; its coins and banknotes remained in circulation, defined in terms of euros, until the introduction of euro notes and coins on 1 January 2002. The Deutsche Mark ceased to be legal tender immediately upon the introduction of the euro—in contrast to the o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merck & Co

Merck & Co., Inc. is an American multinational pharmaceutical company headquartered in Rahway, New Jersey, and is named for Merck Group, founded in Germany in 1668, of whom it was once the American arm. The company does business as Merck Sharp & Dohme or MSD outside the United States and Canada. Merck & Co. was originally established as the American affiliate of Merck Group in 1891. Merck develops and produces medicines, vaccines, biologic therapies and animal health products. It has multiple blockbuster drugs or products each with 2020 revenues including cancer immunotherapy, anti-diabetic medication and vaccines against HPV and chickenpox. The company is ranked 71st on the 2022 ''Fortune'' 500 and 87th on the 2022 ''Forbes'' Global 2000, both based on 2021 revenues. Products The company develops medicines, vaccines, biologic therapies and animal health products. In 2020, the company had 6 blockbuster drugs or products, each with over $1 billion in revenue: ''Keytruda'' ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mylan

Mylan N.V. was a global generic and specialty pharmaceuticals company. In November 2020, Mylan merged with Upjohn, Pfizer's off-patent medicine division, to form Viatris. Previously, the company was domiciled in the Netherlands, with principal executive offices in Hatfield, Hertfordshire, UKMylan N10-K for the Fiscal Year Ended December 31, 2015/ref> and a "Global Center" in Canonsburg, Pennsylvania, US. In 2007, the company acquired a controlling interest in India-based Matrix Laboratories Limited, a top producer of active pharmaceutical ingredients (APIs) for generic drugs, and the generics business of Germany-based Merck KGaA. Through these acquisitions, the company grew from the third-largest generic and pharmaceuticals company in the United States to the second-largest generic and specialty pharmaceuticals company in the world. Mylan went public on the OTC market in February 1973. It was listed on the NASDAQ, and its shares were a component of the NASDAQ Biotechnology and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shanghai Pharmaceuticals Holding

Shanghai (; , , Standard Mandarin pronunciation: ) is one of the four direct-administered municipalities of the People's Republic of China (PRC). The city is located on the southern estuary of the Yangtze River, with the Huangpu River flowing through it. With a population of 24.89 million as of 2021, Shanghai is the most populous urban area in China with 39,300,000 inhabitants living in the Shanghai metropolitan area, the second most populous city proper in the world (after Chongqing) and the only city in East Asia with a GDP greater than its corresponding capital. Shanghai ranks second among the administrative divisions of Mainland China in human development index (after Beijing). As of 2018, the Greater Shanghai metropolitan area was estimated to produce a gross metropolitan product (nominal) of nearly 9.1 trillion RMB ($1.33 trillion), exceeding that of Mexico with GDP of $1.22 trillion, the 15th largest in the world. Shanghai is one of the world's major centers for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fosun Pharmaceutical

Shanghai Fosun Pharmaceutical (Group) Co., Ltd. (trade name: Fosun Pharma) is a Chinese pharmaceutical company. It is mostly owned by Fosun International. As of 2018, the A shares of the company is a constituent of SSE 180 Index as well as its sub-index SSE MidCap Index. The company was ranked 1,840th in 2020 edition of the '' Forbes Global 2000'', a list of top listed companies of the world. Key people * Wu Yifang is the president and CEO of Fosun Pharma. * Chen Qiyu is co-CEO of Fosun International and Chairman of Fosun Pharma. History Fosun Pharmaceutical is a listed company which started A share initial public offering in 1998 and H share in 2012. The English name of the company was initially known as Shanghai Fortune Industrial Joint-Stock Co., Ltd. (SFIC; ), but the transliteration of was later changed from Fortune to Fosun (as Fosun Industrial), as well as changing the name from Industrial () to Pharmaceutical (). The company also shorten the transliteration of th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CVC Capital Partners

CVC Capital Partners is a Luxembourg-based French private equity and investment advisory firm with approximately US$133 billion of assets under management and approximately €157 billion in secured commitments since inception across American, European and Asian private equity, secondaries and credit funds. As of 31 December 2021, the funds managed or advised by CVC are invested in more than 100 companies worldwide, employing over 450,000 people in numerous countries. CVC was founded in 1981 and, as of 31 March 2022, has over 650 employees working across its network of 25 offices throughout EMEA, Asia and the Americas. History Spinout from Citicorp and the 1990s By the early 1990s, Michael Smith, who joined Citicorp in 1982, was leading Citicorp Venture Capital in Europe along with other managing directors Steven Koltes, Hardy McLain, Donald Mackenzie, Iain Parham, and Rolly Van Rappard. In 1993, Smith and the senior investment professionals of Citicorp Venture Capital negotiat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Advent International

Advent International is a global private equity firm focused on buyouts of companies in Western and Central Europe, North America, Latin America and Asia. The firm focuses on international buyouts, growth and strategic restructuring in five core sectors. Since its inception in 1984, Advent has invested $56 billion in private equity capital and, through its buyout programs, has completed more than 375 transactions in 42 countries. Advent operates from 14 offices in 11 countries, with affiliates in additional countries, and employs over 240 investment professionals. History Advent is a Boston, Massachusetts spin-out from TA Associates by Peter Brooke. Brooke had founded TA Associates in 1968 after having expanded the venture capital operations of TA's parent Tucker Anthony & R.L. Day. In 1985, Advent raised its first fund – a $14 million corporate venture capital program for Nabisco. In 1987, the firm raised the $225 million International Network Fund, its first institutio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Watson Pharmaceuticals

Actavis Generics (formerly known as Watson Pharmaceuticals and Actavis plc, prior to the acquisition of Irish-based Allergan Inc) is a global pharmaceutical company focused on acquiring, developing, manufacturing and marketing branded pharmaceuticals, generic and over-the-counter medicines, and biologic products. Actavis has a commercial presence across approximately 100 countries. The company has global headquarters in Dublin, Ireland and administrative headquarters in Parsippany-Troy Hills, New Jersey, United States. Actavis PLC markets brand products through six franchises in key therapeutic categories including: Aesthetics/Dermatology/Plastic Surgery; Neurosciences/CNS; Eye Care; Women's Health and Urology; GI and Cystic Fibrosis; and Cardiovascular Disease and Infectious Disease. The company's products include Botox, Namenda, Restasis, Linzess, Bystolic, Juvederm, Latisse, Lo Loestrin Fe, Estrace, Teflaro, Dalvance, Ozurdex, Optive, Natrelle, Viibryd, Liletta, Sap ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Grünenthal GmbH

Grünenthal is a pharmaceutical company headquartered in Aachen in Germany. It was founded in 1946 as Chemie Grünenthal and has been continuously family-owned. The company was the first to introduce penicillin into the German market in the postwar period, after the Allied Control Council lifted its ban. Grünenthal became infamous in the 1950s and 1960s for the development and sale of the teratogenic drug thalidomide, marketed as the sleeping pill Contergan and promoted as a morning sickness preventive. Thalidomide caused severe birth defects, miscarriages, and other severe health problems. Though these side effects were proven conclusively in 1959, and 1962, Grünenthal continued marketing the drug well into the 1970s and 1980s. The company generates more than 50 percent of its income with pain medications such as Tramadol. The company has two offices in Germany as well as subsidiaries in Europe, Latin America, the US, and China. In November 2016, the company acquired Thar P ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joint Venture

A joint venture (JV) is a business entity created by two or more parties, generally characterized by shared ownership, shared returns and risks, and shared governance. Companies typically pursue joint ventures for one of four reasons: to access a new market, particularly Emerging market; to gain scale efficiencies by combining assets and operations; to share risk for major investments or projects; or to access skills and capabilities. According to Gerard Baynham of Water Street Partners, there has been much negative press about joint ventures, but objective data indicate that they may actually outperform wholly owned and controlled affiliates. He writes, "A different narrative emerged from our recent analysis of U.S. Department of Commerce (DOC) data, collected from more than 20,000 entities. According to the DOC data, foreign joint ventures of U.S. companies realized a 5.5 percent average return on assets (ROA), while those companies’ wholly owned and controlled affiliates ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |