|

Rocket Internet

Rocket Internet SE is a German Internet company headquartered in Berlin. The company builds startups and owns shareholdings in various models of internet retail businesses. The company model is known as a startup studio or a venture builder. It provides office space to new companies at its headquarters in Berlin, with IT support, marketing services and access to investors. As of 2016, Rocket Internet has more than 28,000 employees across its worldwide network of companies, which consists of over 100 entities active in 110 countries. The company's market capitalization was €3.49 billion as of November 3, 2017. On July 12, 2021, the market capitalization was €3.7 billion. History The company was founded in Berlin in 2007 by three brothers: Marc, Oliver and Alexander Samwer and was once also connected to the European Founders Fund, an associated company. In 2008, Rocket Internet founded Zalando, emulating the business model of US online retailer Zappos.com. On July 1, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Company

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is offered, owned, traded, exchanged privately, or Over-the-counter (finance), over-the-counter. In the case of a closed corporation, there are a relatively small number of shareholders or company members. Related terms are closely-held corporation, unquoted company, and unlisted company. Though less visible than their public company, publicly traded counterparts, private companies have major importance in the world's economy. In 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for ($1.8 trillion) in revenues and employed 6.2 million people, according to ''Forbes''. In 2005, using a substantially smaller pool size (22.7%) for comparison, the 339 companies on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zalando

Zalando SE is a publicly traded German online retailer of shoes, fashion and beauty. The company was founded in 2008 by David Schneider and Robert Gentz and has more than 50 million active users in 25 European markets. Zalando is active in a variety of business fields - from multi-brand online shopping (including their own brands), the shopping club Zalando Lounge, outlets in 11 German cities, the consultation service Zalon, as well as logistics and marketing offers for retailers. With the program Connected Retail, Zalando connects more than 7,000 brick and mortar businesses to the online fashion platform. In 2021, Zalando generated revenue of 10.35 billion Euro, with roughly 17,000 employees. History Zalando was founded in 2008 by Robert Gentz and David Schneider in Berlin with investment capital from the three Samwer brothers. Gentz, Schneider and Oliver Samwer met each other through their studies at WHU - Otto Beisheim School of Management. Inspired by US online retailer Zap ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Delisting (stock)

In corporate finance, a listing refers to the company's shares being on the list (or board) of stock that are officially traded on a stock exchange. Some stock exchanges allow shares of a foreign company to be listed and may allow dual listing, subject to conditions. Normally the issuing company is the one that applies for a listing but in some countries an exchange can list a company, for instance because its stock is already being traded via informal channels. Stocks whose market value and/or turnover fall below critical levels may be delisted by the exchange. Delisting often arises from a merger or takeover, or the company going private. Requirements Each stock exchange has its own listing requirements or rules. Initial listing requirements usually include supplying a history of a few years of financial statements (not required for "alternative" markets targeting young firms); a sufficient size of the amount being placed among the general public (the free float), both in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Free Float

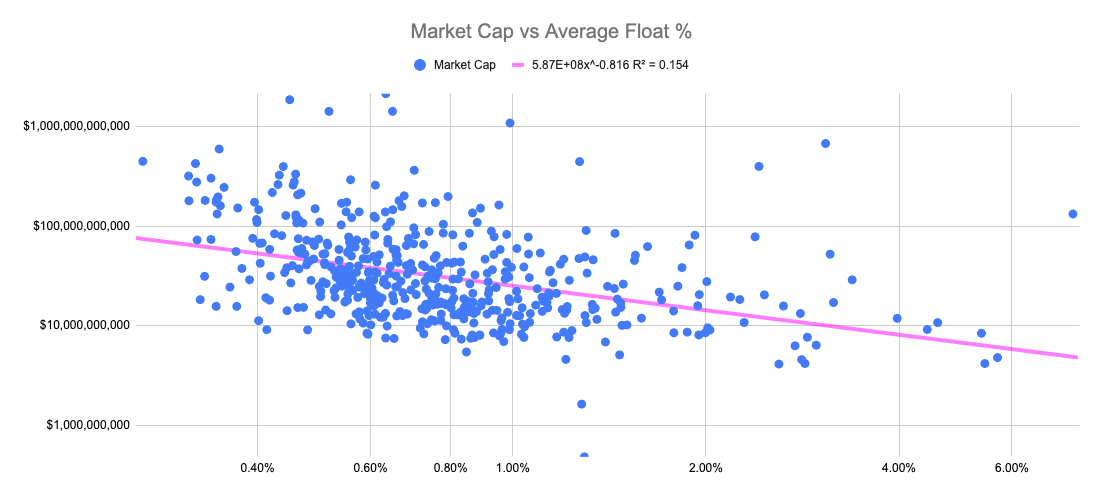

In the context of stock markets, the public float or free float represents the portion of shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments. This number is sometimes seen as a better way of calculating market capitalization, because it provides a more accurate reflection (than entire market capitalization) of what public investors consider the company to be worth. In this context, the ''float'' may refer to all the shares outstanding that can be publicly traded. Calculating public float The float is calculated by subtracting the locked-in shares from outstanding shares. For example, a company may have 10 million outstanding shares, with 3 million of them in a locked-in position; this company's float would be 7 million (multiplied by the share price). Stocks with smaller floats tend to be more volatile than those with larger floats. In general, the la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Access Industries

Access Industries, Inc. is an American privately held multinational industrial group. It was founded in 1986 by businessman Leonard "Len" Blavatnik, who is also its chairman. Access's industrial focus is in four areas: natural resources and chemicals, media and telecommunications, venture capital and real estate. The group invests in the United States, Europe, Israel, and Latin America. It is headquartered in New York, with additional offices in London and Moscow. History Len Blavatnik founded Access Industries in 1986 as an investment company. He attended Harvard Business School while running the company on the side, graduating with an MBA in 1989. Among its early investments, Access Industries helped form the large aluminum producer SUAL in 1996, which later became part of UC RUSAL. In 1997, Access acquired a 40% stake in the Russian oil company TNK. Half of TNK was sold to British Petroleum (BP) to form TNK-BP in 2003, in what was the largest-ever foreign investment in a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Philippine Long Distance Telephone Company

The Philippines (; fil, Pilipinas, links=no), officially the Republic of the Philippines ( fil, Republika ng Pilipinas, links=no), * bik, Republika kan Filipinas * ceb, Republika sa Pilipinas * cbk, República de Filipinas * hil, Republika sang Filipinas * ibg, Republika nat Filipinas * ilo, Republika ti Filipinas * ivv, Republika nu Filipinas * pam, Republika ning Filipinas * krj, Republika kang Pilipinas * mdh, Republika nu Pilipinas * mrw, Republika a Pilipinas * pag, Republika na Filipinas * xsb, Republika nin Pilipinas * sgd, Republika nan Pilipinas * tgl, Republika ng Pilipinas * tsg, Republika sin Pilipinas * war, Republika han Pilipinas * yka, Republika si Pilipinas In the recognized optional languages of the Philippines: * es, República de las Filipinas * ar, جمهورية الفلبين, Jumhūriyyat al-Filibbīn is an archipelagic country in Southeast Asia. It is situated in the western Pacific Ocean and consists of around 7,641 islands t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Baillie Gifford

Baillie Gifford is an investment management firm which is wholly owned by partners, all of whom work within the firm. It was founded in Edinburgh, Scotland, in 1908 and still has its headquarters in the city. It has corporate offices in New York and London. History Baillie & Gifford WS was formed in 1907 as a partnership between Colonel Augustus Baillie and Carlyle Gifford. Initially, it was a law firm but the financial climate of the time led to the business switching its emphasis to investment in 1908. In 1909, Baillie & Gifford created the Straits Mortgage and Trust Company Limited to lend money to rubber planters in Malaya and Ceylon. The Straits Mortgage and Trust Company Limited was renamed The Scottish Mortgage and Trust Limited in 1913, and this was followed by the introduction of several other investment trusts. Baillie Gifford’s clients and staff emerged relatively unscathed from the First World War, and the ‘Roaring Twenties’ gave Gifford many opportunities ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Internet

United Internet AG is a global Internet services company headquartered in Montabaur, Rhineland-Palatinate, Germany. The company is structured in two business areas, ''Access'' and ''Applications,'' and has a total of 16 brands and numerous subsidiaries. The well-known brands under the umbrella of United Internet AG include 1&1, IONOS, GMX, WEB.DE and 1&1 Versatel. United Internet AG is listed in MDAX, TecDAX - going public in 1998 (under the name 1&1 Internet AG &Co. KGaA). United Internet comprises over 27 million customer accounts and runs business in over 30 locations across the world. History The history of the Group goes back to 1&1 EDV-Marketing GmbH, which was founded in 1988 by Ralph Dommermuth and Wendelin Abresch as a service provider for marketing and advertising. In the 1990s, the company grew into a large corporation that offered web hosting packages as well as its own online service that allowed users to dial up to the Internet. In March 1998, the company went ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment AB Kinnevik

Kinnevik AB () is a Swedish investment company that was founded in 1936 by the Stenbeck, Klingspor and von Horn families. Kinnevik is an active and long-term owner investing primarily in digital consumer businesses. Current CEO, Georgi Ganev, was appointed in 2018. Kinnevik holds significant stakes in about 30 companies and invest in Europe, with a focus on the Nordics, the US, and selectively in other markets. Kinnevik currently operates in four sectors; Consumer Services, Financial Services, Healthcare Services and TMT (Technology, Media and Telecommunications). The largest holdings are Zalando, Tele2, Millicom, Global Fashion Group, Babylon Health and Livongo. History Kinnevik was founded as an investment company in 1936 by Robert von Horn, Wilhelm Klingspor and Hugo Stenbeck. The most important holdings when the company started were Mellersta Sveriges Lantbruks AB, Lidköpings Konfektyr Industri AB and Korsnäs Sågverks AB. The company grew quickly through share purchas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Frankfurt Stock Exchange

The Frankfurt Stock Exchange (german: link=no, Börse Frankfurt, former German name – FWB) is the world's 12th largest stock exchange by market capitalization. It has operations from 8:00 am to 10:00 pm ( German time). Organisation Located in Frankfurt, Germany, the Frankfurt Stock Exchange is owned and operated by Deutsche Börse AG and Börse Frankfurt Zertifikate AG. It is located in the district of Innenstadt and within the central business district known as Bankenviertel. With 90 percent of its turnover generated in Germany, namely at the two trading venues Xetra and Börse Frankfurt, the Frankfurt Stock Exchange is the largest of the seven regional securities exchanges in Germany. The trading indices are DAX, DAXplus, CDAX, DivDAX, LDAX, MDAX, SDAX, TecDAX, VDAX and EuroStoxx 50. Trading venues Xetra and Börse Frankfurt Through its Deutsche Börse Cash Market business section, Deutsche Börse AG now operates two trading venues at the Frankfurt Stock Exchan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |