|

Robert Smith, Baron Smith Of Kelvin

Robert Haldane Smith, Baron Smith of Kelvin, (born 8 August 1944) is a British businessman and former Governor of the British Broadcasting Corporation. Smith was knighted in 1999, appointed to the House of Lords as an independent crossbench peer in 2008, and appointed Knight of the Thistle in the 2014 New Year Honours. He was also appointed to the Order of the Companions of Honour in 2016. Lord Smith of Kelvin serves as Chancellor of the University of Strathclyde and Chair of the British Business Bank. He is Chairman of IMI plc, Scottish Enterprise and Forth Ports Limited. On 19 September 2014, he was appointed as Chair of the newly formed Scotland Devolution Commission by Prime Minister David Cameron, following the "No" result in the Scottish independence referendum; his role being to oversee devolution commitments spelt out by the Westminster parliamentary leaders, with initial proposals drawn up by November 2014. Early life Smith grew up in the Maryhill district of Glas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Member Of The House Of Lords

This is a list of members of the House of Lords, the upper house of the Parliament of the United Kingdom. Current sitting members Lords Spiritual 26 bishops of the Church of England sit in the House of Lords: the Archbishops of Canterbury and of York, the Bishops of London, of Durham and of Winchester, and the next 21 most senior diocesan bishops (with the exception of the Bishop in Europe and the Bishop of Sodor and Man). Under the Lords Spiritual (Women) Act 2015, female bishops take precedence over men until May 2025 to become new Lords Spiritual for the 21 seats allocated by seniority. Lords Temporal Lords Temporal include life peers, excepted hereditary peers elected under the House of Lords Act 1999 and remaining law life peers. ;Note: Current non-sitting members There are also peers who remain members of the House, but are currently ineligible to sit and vote. Peers on leave of absence Under section 23 of the Standing Orders of the House of Lords, peers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Allan Glen's School

Allan Glen's School was, for most of its existence, a local authority, selective secondary school for boys in Glasgow, Scotland, charging nominal fees for tuition. It was founded by the Allan Glen's Endowment Scholarship Trust on the death, in 1850, of Allan Glen, a successful Glasgow tradesman and businessman, "to give a good practical education and preparation for trades or businesses, to between forty to fifty boys, the sons of tradesmen or persons in the industrial classes of society". The School was formally established in 1853 and located in the Townhead district of the city, on land that Glen had owned on the corner of North Hanover Street and Cathedral Street. School's evolution Although notionally fee-paying, the school offered a large number of bursaries and enrolled pupils from all social classes, selected on the basis of academic ability. The school's emphasis on science and engineering led to it becoming, in effect, Glasgow's High School of Science. As such, in 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Reporting Council

The Financial Reporting Council (FRC) is an independent regulator in the UK and Ireland based in London Wall in the City of London, responsible for regulating auditors, accountants and actuaries, and setting the UK's Corporate Governance and Stewardship Codes. The FRC seeks to promote transparency and integrity in business by aiming its work at investors and others who rely on company reports, audits and high-quality risk management. In December 2018, an independent review of the FRC, led by Sir John Kingman, recommended its replacement by a new Audit, Reporting and Governance Authority, a recommendation followed by the government in March 2019. Ireland adopted the FRC's auditing framework in 2017. Structure The FRC is a company limited by guarantee, and is funded by the audit profession, who are required to contribute under the provisions of the Companies Act 2006 and by other groups subject to, or benefitting from FRC regulation. Its board of directors is appointed by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Judicial Appointments Board For Scotland

The Judicial Appointments Board for Scotland is an advisory non-departmental public body of the Scottish Government responsible for making recommendations on appointments to certain offices of the judiciary of Scotland. It was established in June 2002 on a non-statutory, ad hoc, basis by the Scottish Government, and was given statutory authority by the Judiciary and Courts (Scotland) Act 2008. All recommendations are made to the First Minister, who must consult the Lord President of the Court of Session before making a recommendation to the monarch in relation to full-time, permanent, judiciary, or before any appointments are made by Scottish Ministers to temporary or part-time judicial office. The board does not make recommendations for, or have any in role in the appointment of, justices of the peace, whose appointments are made by Scottish Ministers on the recommendation of Justice of the Peace Advisory Committees for each sheriffdom. History The Judicial Appointments Bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Authority

The Financial Services Authority (FSA) was a quasi-judicial body accountable for the financial regulation, regulation of the financial services industry in the United Kingdom between 2001 and 2013. It was founded as the Securities and Investments Board (SIB) in 1985. Its board was appointed by the HM Treasury, Treasury, although it operated independently of government. It was structured as a company limited by guarantee and was funded entirely by fees charged to the financial services industry. Due to perceived regulatory failure of the banks during the financial crisis of 2007–2008, the Cameron–Clegg coalition, UK government decided to restructure financial regulation and abolish the FSA. On 19 December 2012, the ''Financial Services Act 2012'' received royal assent, abolishing the FSA with effect from 1 April 2013. Its responsibilities were then split between two new agencies: the Financial Conduct Authority and the Prudential Regulation Authority (United Kingdom), Prudent ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

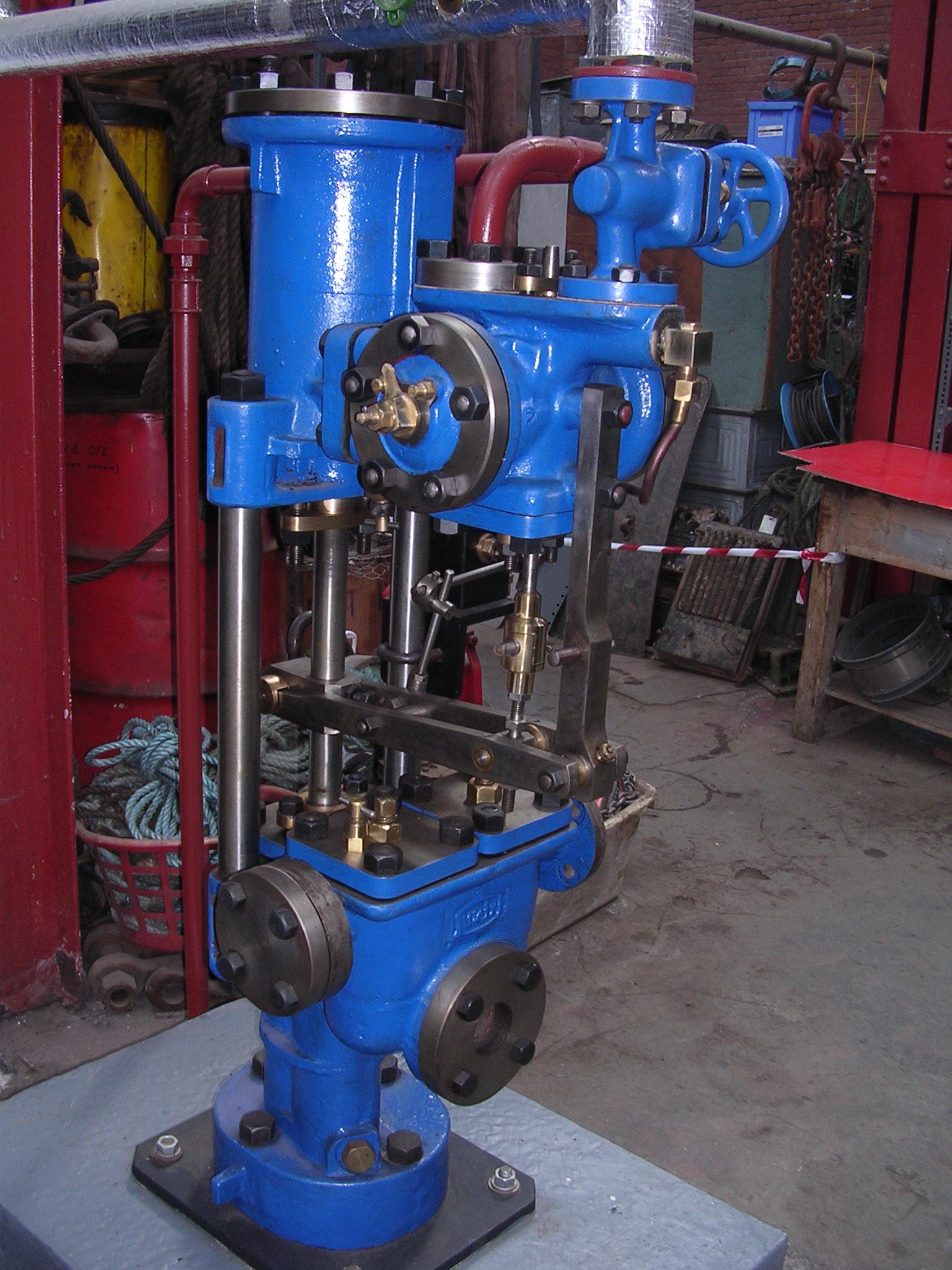

Weir Group

The Weir Group plc is a Scottish multinational engineering company headquartered in Glasgow, Scotland. It is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index. History The company was established in 1871 as an engineering firm by two brothers, George and James Weir, founding G. & J. Weir Ltd. The Weir brothers produced numerous groundbreaking inventions in pumping equipment, primarily for the Clyde shipyards and the steam ships built there. These pumps became extremely well known for their use as boiler feedwater pumps, and for ship's auxiliary equipment such as evaporators. Under W D Weir, the company turned to producing munitions and war materiel in the First World War. As well as shells, they manufactured aircraft including the Royal Aircraft Factory F.E.2 fighter and bomber. James George Weir (aviator, son of James Galloway Weir) a director of the company formed the Cierva Autogiro Company. G & J Weir would be a financial supporter of th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Network Rail

Network Rail Limited is the owner (via its subsidiary Network Rail Infrastructure Limited, which was known as Railtrack plc before 2002) and infrastructure manager of most of the railway network in Great Britain. Network Rail is an "arm's length" public body of the Department for Transport with no shareholders, which reinvests its income in the railways. Network Rail's main customers are the private train operating companies (TOCs), responsible for passenger transport, and freight operating companies (FOCs), who provide train services on the infrastructure that the company owns and maintains. Since 1 September 2014, Network Rail has been classified as a "public sector body". To cope with fast-increasing passenger numbers, () Network Rail has been undertaking a £38 billion programme of upgrades to the network, including Crossrail, electrification of lines and upgrading Thameslink. In May 2021, the Government announced its intent to replace Network Rail in 2023 with a ne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of Scotland

The Bank of Scotland plc (Scottish Gaelic: ''Banca na h-Alba'') is a commercial and clearing bank based in Scotland and is part of the Lloyds Banking Group, following the Bank of Scotland's implosion in 2008. The bank was established by the Parliament of Scotland in 1695 to develop Scotland's trade with other countries, and aimed to create a stable banking system in the Kingdom of Scotland. With a history dating to the end of the 17th century, it is the fifth-oldest extant bank in the United Kingdom (the Bank of England having been established one year earlier), and is the only commercial institution created by the Parliament of Scotland to remain in existence. It was one of the first banks in Europe to print its own banknotes, and it continues to print its own sterling banknotes under legal arrangements that allow Scottish banks to issue currency. In June 2006, the HBOS Group Reorganisation Act 2006 was passed by the Parliament of the United Kingdom, allowing the bank' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MFI Furniture Group Plc

MFI Group Limited was a British furniture retailer, operating under the MFI brand. The company was one of the largest suppliers of kitchens and bedroom furniture in the United Kingdom, and operated mainly in retail parks in out of town locations. Anecdotally, it was said at one stage that one in three Sunday lunches in the United Kingdom were cooked in a kitchen from MFI, and 60% of British children were conceived in a bedroom from MFI. After success in its early decades, it experienced recurring financial problems accompanied by several changes of ownership, and on 26 November 2008, it was announced that the business had been placed into administration. Merchant Equity Partners, headed by Henry Jackson, was the last company to own it, before it was sold to the management in September 2008 for a "small profit". The business ceased trading by 19 December 2008, after the administrators failed to find a buyer. It struggled to make profits during the 2000s, as chains such as B& ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deutsche Asset Management

The DWS Group (Formerly: Deutsche Asset Management) commonly referred to as SDWS, is a German asset management company. It previously operated as part of Deutsche Bank until 2018 where it became a separate entity through an initial public offering on the Frankfurt Stock Exchange. It is currently headquartered in Frankfurt, Germany and is a constituent member of the SDAX index. History DWS was founded in Hamburg in 1956 as "Deutsche Gesellschaft für Wertpapiersparen mbH" (German Enterprise for Securities Savings), the name was later shortened to DWS, "Die Wertpapier Spezialisten" (The Fund Specialists). Originally, the activities involved products and investment services that were initially offered to investors in Germany and throughout Europe. Activities under the DWS Investments brand were later expanded to include separate line-ups of products and investments services for investors in the USA, Asia and other regions. Originally Deutsche Bank held 30% of DWS while the rest was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Morgan Grenfell

Morgan, Grenfell & Co. was a leading London-based investment bank regarded as one of the oldest and once most influential British merchant banks. It had its origins in a merchant banking business commenced by George Peabody. Junius Spencer Morgan became a partner in 1854. After Peabody retired the business was styled J. S. Morgan & Co. In 1910, it was reconstituted as Morgan Grenfell & Co. in recognition of the senior London-based partner, Edward Grenfell, although J. P. Morgan & Co. still held a controlling interest. In the 1930s, it became a commercial bank and the Morgan family relinquished their controlling interest in the business. After a period of retrenchment, it expanded under the management of second Viscount Harcourt in the 1960s. The link with J. P. Morgan & Co. ended completely in the 1980s. The business also became embroiled in the Guinness share-trading fraud at that time. In 1990, Morgan Grenfell was acquired in an agreed deal by its minority shareholder, Deutsche ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Royal Bank Of Scotland

The Royal Bank of Scotland plc (RBS; gd, Banca Rìoghail na h-Alba) is a major retail and commercial bank in Scotland. It is one of the retail banking subsidiaries of NatWest Group, together with NatWest (in England and Wales) and Ulster Bank. The Royal Bank of Scotland has around 700 branches, mainly in Scotland, though there are branches in many larger towns and cities throughout England and Wales. The bank is completely separate from the fellow Edinburgh-based bank, the Bank of Scotland, which pre-dates the Royal Bank by 32 years. The Royal Bank of Scotland was established in 1724 to provide a bank with strong Hanoverian and Whig ties. Following ring-fencing of the Group's core domestic business, the bank became a direct subsidiary of NatWest Holdings in 2019. NatWest Markets comprises the Group's investment banking arm. To give it legal form, the former RBS entity was renamed NatWest Markets in 2018; at the same time Adam and Company (which held a separate PRA banking ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |