|

RiverSource

RiverSource (RiverSource Life Insurance Company) is a US-based Investment management and life insurance firm which is a subsidiary of Ameriprise Financial, Inc. RiverSource is made up of RiverSource Investments, RiverSource Annuities, and RiverSource Insurance and is based in Minneapolis. RiverSource Funds include more than 60 retail mutual funds and more than 20 variable portfolio mutual funds sold in variable annuity and variable insurance products offered by RiverSource Annuities and RiverSource Insurance. RiverSource Funds are currently available to individual and institutional U.S. investors. The more than 60 retail mutual funds had approximately $60 billion in assets under management as of June 30, 2005. History The forerunner to RiverSource was established in 1894 as Investors Syndicate in Minneapolis, Minnesota. The syndicate changed its name to Investors Diversified Services, Inc. (IDS) in 1950. In 1984 American Express bought IDS and integrated it into its own fin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ameriprise Financial

Ameriprise Financial, Inc. is a diversified financial services company and bank holding company incorporated in Delaware and headquartered in Minneapolis, Minnesota. It provides financial planning products and services, including wealth management, asset management, insurance, annuities, and estate planning. As of April 2022, more than 80% of the company's revenue came from wealth management. The company's primary subsidiaries include Ameriprise Financial Services, RiverSource Life Insurance Company, and Columbia Threadneedle Investments, its global asset management brand, and a provider of investments to institutional and retail clients. Ameriprise was formerly a division of American Express, which completed the corporate spin-off of the company in September 2005. The company is ranked 245th on the Fortune 500. It is on the list of largest banks in the United States. It is also the 9th largest independent broker-dealer based on assets under management. It is one of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ameriprise Financial, Inc

Ameriprise Financial, Inc. is a diversified financial services company and bank holding company incorporated in Delaware and headquartered in Minneapolis, Minnesota. It provides financial planning products and services, including wealth management, asset management, insurance, annuities, and estate planning. As of April 2022, more than 80% of the company's revenue came from wealth management. The company's primary subsidiaries include Ameriprise Financial Services, RiverSource Life Insurance Company, and Columbia Threadneedle Investments, its global asset management brand, and a provider of investments to institutional and retail clients. Ameriprise was formerly a division of American Express, which completed the corporate spin-off of the company in September 2005. The company is ranked 245th on the Fortune 500. It is on the list of largest banks in the United States. It is also the 9th largest independent broker-dealer based on assets under management. It is one of the large ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Management

Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contracts or, more commonly, via collective investment schemes like mutual funds, exchange-traded funds, or REITs. The term asset management is often used to refer to the management of investment funds, while the more generic term fund management may refer to all forms of institutional investment, as well as investment management for private investors. Investment managers who specialize in ''advisory'' or ''discretionary'' management on behalf of (normally wealthy) private investors may often refer to their services as money management or portfolio management within the context of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Life Insurance

Life insurance (or life assurance, especially in the Commonwealth of Nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policyholder). Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses. Life policies are legal contracts and the terms of each contract describe the limitations of the insured events. Often, specific exclusions written into the contract limit the liability of the insurer; common examples include claims relating to suicide, fraud, war, riot, and civil commotion. Difficulties may arise where an event is not clearly defined, for example, the insured knowingly incurred a risk by consenting to an experimental m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidiary

A subsidiary, subsidiary company or daughter company is a company owned or controlled by another company, which is called the parent company or holding company. Two or more subsidiaries that either belong to the same parent company or having a same management being substantially controlled by same entity/group are called sister companies. The subsidiary can be a company (usually with limited liability) and may be a government- or state-owned enterprise. They are a common feature of modern business life, and most multinational corporations organize their operations in this way. Examples of holding companies are Berkshire Hathaway, Jefferies Financial Group, The Walt Disney Company, Warner Bros. Discovery, or Citigroup; as well as more focused companies such as IBM, Xerox, and Microsoft. These, and others, organize their businesses into national and functional subsidiaries, often with multiple levels of subsidiaries. Details Subsidiaries are separate, distinct legal entities f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Minneapolis

Minneapolis () is the largest city in Minnesota, United States, and the county seat of Hennepin County. The city is abundant in water, with thirteen lakes, wetlands, the Mississippi River, creeks and waterfalls. Minneapolis has its origins in timber and as the flour milling capital of the world. It occupies both banks of the Mississippi River and adjoins Saint Paul, the state capital of Minnesota. Prior to European settlement, the site of Minneapolis was inhabited by Dakota people. The settlement was founded along Saint Anthony Falls on a section of land north of Fort Snelling; its growth is attributed to its proximity to the fort and the falls providing power for industrial activity. , the city has an estimated 425,336 inhabitants. It is the most populous city in the state and the 46th-most-populous city in the United States. Minneapolis, Saint Paul and the surrounding area are collectively known as the Twin Cities. Minneapolis has one of the most extensive public par ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

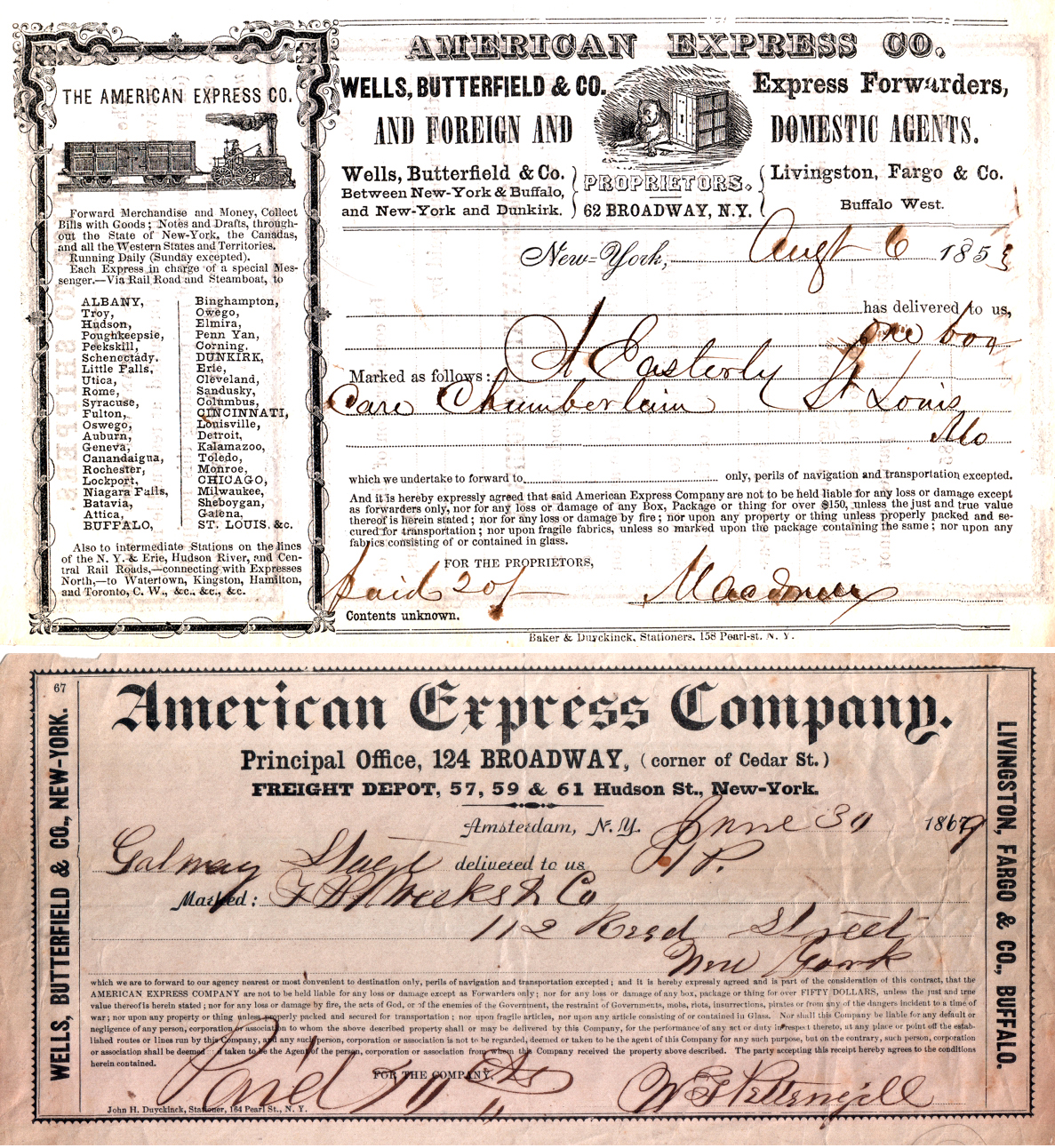

American Express

American Express Company (Amex) is an American multinational corporation specialized in payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Manhattan in New York City. The company was founded in 1850 and is one of the 30 components of the Dow Jones Industrial Average. The company's logo, adopted in 1958, is a gladiator or centurion whose image appears on the company's well-known traveler's cheques, charge cards, and credit cards. During the 1980s, Amex invested in the brokerage industry, acquiring what became, in increments, Shearson Lehman Hutton and then divesting these into what became Smith Barney Shearson (owned by Primerica) and a revived Lehman Brothers. By 2008 neither the Shearson nor the Lehman name existed. In 2016, credit cards using the American Express network accounted for 22.9% of the total dollar volume of credit card transactions in the United States. , the company had 121.7million cards in force, includ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Funds

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe ('investment company with variable capital') and open-ended investment company (OEIC) in the UK. Mutual funds are often classified by their principal investments: money market funds, bond or fixed income funds, stock or equity funds, or hybrid funds. Funds may also be categorized as index funds, which are passively managed funds that track the performance of an index, such as a stock market index or bond market index, or actively managed funds, which seek to outperform stock market indices but generally charge higher fees. Primary structures of mutual funds are open-end funds, closed-end funds, unit investment trusts. Open-end funds are purchased from or sold to the issuer at the net asset value of each share as of the close of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investor

An investor is a person who allocates financial capital with the expectation of a future Return on capital, return (profit) or to gain an advantage (interest). Through this allocated capital most of the time the investor purchases some species of property. Types of investments include Stock, equity, Bond (finance), debt, Security (finance), securities, real estate, infrastructure, currency, commodity, Exonumia, token, derivatives such as put and call Option (finance), options, Futures contract, futures, Forward contract, forwards, etc. This definition makes no distinction between the investors in the primary and secondary markets. That is, someone who provides a business with capital and someone who buys a stock are both investors. An investor who owns stock is a shareholder. Types of investors There are two types of investors: retail investors and institutional investors. Retail investor * Individual investors (including Trust law, trusts on behalf of individuals, and umbr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical effec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |