|

Risk Score

Risk score (or risk scoring) is the name given to a general practice in applied statistics, bio-statistics, econometrics and other related disciplines, of creating an easily calculated number (the score) that reflects the level of risk in the presence of some risk factors (e.g. risk of mortality or disease in the presence of symptoms or genetic profile, risk financial loss considering credit and financial history, etc.). Risk scores are designed to be: * Simple to calculate: In many cases all you need to calculate a score is a pen and a piece of paper (although some scores use rely on more sophisticated or less transparent calculations that require a computer program). * Easily interpreted: The result of the calculation is a single number, and higher score usually means higher risk. Furthermore, many scoring methods enforce some form of monotonicity along the measured risk factors to allow a straight forward interpretation of the score (e.g. risk of mortality only increases wit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statistics

Statistics (from German language, German: ''wikt:Statistik#German, Statistik'', "description of a State (polity), state, a country") is the discipline that concerns the collection, organization, analysis, interpretation, and presentation of data. In applying statistics to a scientific, industrial, or social problem, it is conventional to begin with a statistical population or a statistical model to be studied. Populations can be diverse groups of people or objects such as "all people living in a country" or "every atom composing a crystal". Statistics deals with every aspect of data, including the planning of data collection in terms of the design of statistical survey, surveys and experimental design, experiments.Dodge, Y. (2006) ''The Oxford Dictionary of Statistical Terms'', Oxford University Press. When census data cannot be collected, statisticians collect data by developing specific experiment designs and survey sample (statistics), samples. Representative sampling as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interaction (statistics)

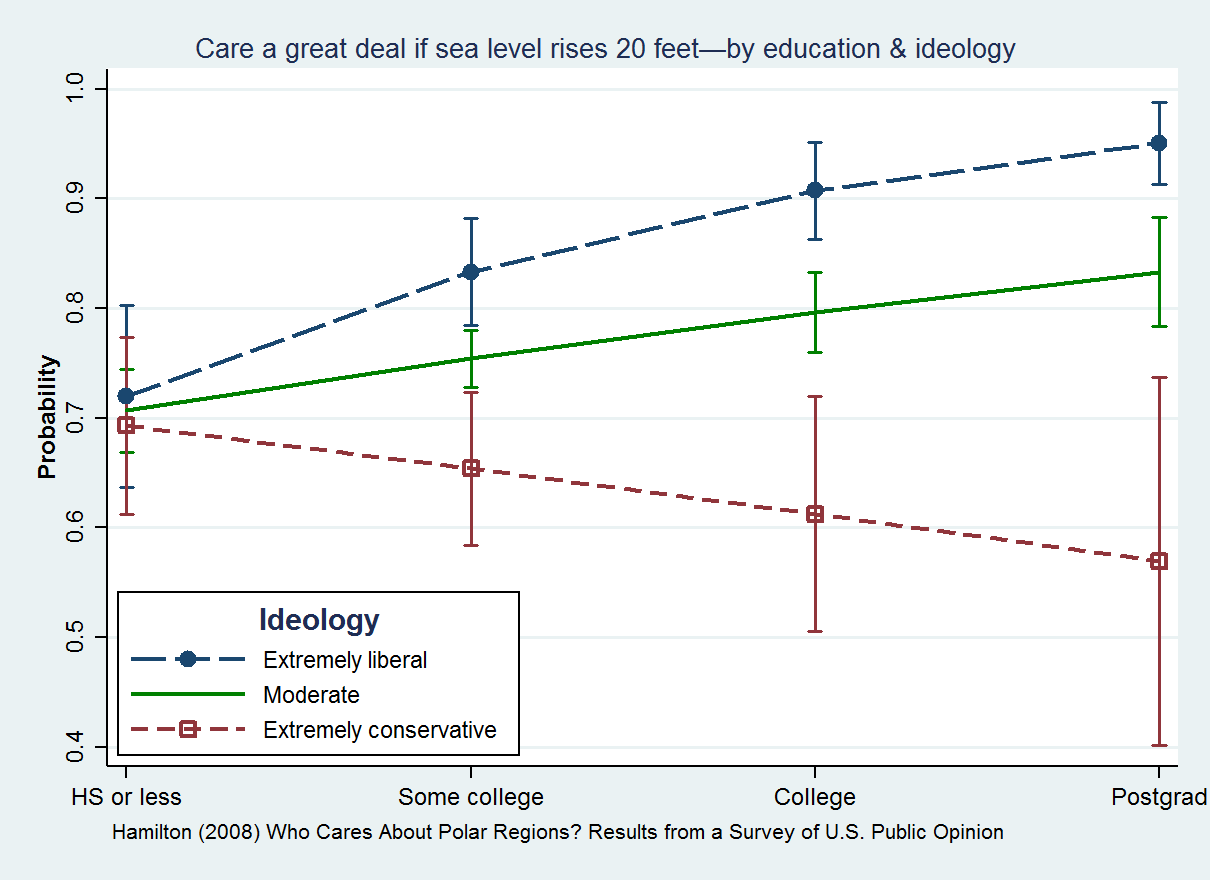

In statistics, an interaction may arise when considering the relationship among three or more variables, and describes a situation in which the effect of one causal variable on an outcome depends on the state of a second causal variable (that is, when effects of the two causes are not additive). Although commonly thought of in terms of causal relationships, the concept of an interaction can also describe non-causal associations (then also called moderation or effect modification). Interactions are often considered in the context of regression analyses or factorial experiments. The presence of interactions can have important implications for the interpretation of statistical models. If two variables of interest interact, the relationship between each of the interacting variables and a third "dependent variable" depends on the value of the other interacting variable. In practice, this makes it more difficult to predict the consequences of changing the value of a variable, particu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Probability Of Default

Probability of default (PD) is a financial term describing the likelihood of a default over a particular time horizon. It provides an estimate of the likelihood that a borrower will be unable to meet its debt obligations. PD is used in a variety of credit analyses and risk management frameworks. Under Basel II, it is a key parameter used in the calculation of economic capital or regulatory capital for a banking institution. PD is closely linked to the expected loss, which is defined as the product of the PD, the loss given default (LGD) and the exposure at default (EAD). Overview The probability of default is an estimate of the likelihood that the default event will occur. It applies to a particular assessment horizon, usually one year. Credit scores, such as FICO for consumers or bond ratings from S&P, Fitch or Moodys for corporations or governments, typically imply a certain probability of default. For group of obligors sharing similar credit risk characteristics such as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Logistic Regression

In statistics, the logistic model (or logit model) is a statistical model that models the probability of an event taking place by having the log-odds for the event be a linear function (calculus), linear combination of one or more independent variables. In regression analysis, logistic regression (or logit regression) is estimation theory, estimating the parameters of a logistic model (the coefficients in the linear combination). Formally, in binary logistic regression there is a single binary variable, binary dependent variable, coded by an indicator variable, where the two values are labeled "0" and "1", while the independent variables can each be a binary variable (two classes, coded by an indicator variable) or a continuous variable (any real value). The corresponding probability of the value labeled "1" can vary between 0 (certainly the value "0") and 1 (certainly the value "1"), hence the labeling; the function that converts log-odds to probability is the logistic function, h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Score

A credit score is a numerical expression based on a level analysis of a person's credit files, to represent the creditworthiness of an individual. A credit score is primarily based on a credit report, information typically sourced from credit bureaus. Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to consumers and to mitigate losses due to bad debt. Lenders use credit scores to determine who qualifies for a loan, at what interest rate, and what credit limits. Lenders also use credit scores to determine which customers are likely to bring in the most revenue. Credit scoring is not limited to banks. Other organizations, such as mobile phone companies, insurance companies, landlords, and government departments employ the same techniques. Digital finance companies such as online lenders also use alternative data sources to calculate the creditworthiness of borrowers. By country Australia In Australia, cre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankruptcy Risk Score

A bankruptcy risk score is a number that indicates the likelihood of an individual filing for bankruptcy. Although it has been used for over twenty years to assess risk in lending, few consumers know of it. It is related to the better-known credit score, but unlike credit scores, bankruptcy risk scores are not sold to consumers by any of the credit bureaus. Consequentially, individuals have little or no way of knowing what their bankruptcy risk scores are or how to improve upon them. Furthermore, since there is no standardized index of measurement, consumers often have trouble contextualizing their score on a standardized scale, instead only receiving general information from a single bureau. This is also referred to as debt analysis which allows lenders the ability to assess a customers' risk in taking out a loan. One can improve their score by paying bills on time, keeping balances low, and having few revolving accounts. Equifax, a US credit bureau, offers a bankruptcy Bankr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Score In The United States

A credit score is a number that provides a comparative estimate of an individual's creditworthiness based on an analysis of their credit report. It is an inexpensive and main alternative to other forms of consumer loan underwriting. Lenders, such as banks and credit card companies, use credit scores to evaluate the risk of lending money to consumers. Lenders contend that widespread use of credit scores has made credit more widely available and less expensive for many consumers. Under the Wall Street reform bill passed in 2010, a consumer is entitled to receive a free report of the specific credit score used if they are denied a loan, credit card or insurance due to their credit score. History Before credit scores, credit was evaluated using credit reports from credit bureaus. During the late 1950s, banks started using computerized credit scoring to redefine creditworthiness as abstract statistical risk. The Equal Credit Opportunity Act banned denying credit on gender or mari ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Score

A credit score is a numerical expression based on a level analysis of a person's credit files, to represent the creditworthiness of an individual. A credit score is primarily based on a credit report, information typically sourced from credit bureaus. Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to consumers and to mitigate losses due to bad debt. Lenders use credit scores to determine who qualifies for a loan, at what interest rate, and what credit limits. Lenders also use credit scores to determine which customers are likely to bring in the most revenue. Credit scoring is not limited to banks. Other organizations, such as mobile phone companies, insurance companies, landlords, and government departments employ the same techniques. Digital finance companies such as online lenders also use alternative data sources to calculate the creditworthiness of borrowers. By country Australia In Australia, cre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Scorecards

Credit analysis is the understanding and evaluation to check if an individual, organization, or business is worthy of credit. Credit Risk scorecards are mathematical models which use a formula that consists of data elements or variables that are used to determine a probabilistic threshold that can be used to determine risk tolerance. These scores display a defined behavior (e.g. loan default, bankruptcy, or a lower level of delinquency) with respect to their current or proposed credit position with a lender. Credit/Loan Officers are people who are employed by the bank and who are responsible for evaluating and authorizing the customer's loan application. Scorecards are built and optimized to evaluate the credit file of a homogeneous population (e.g. files with delinquencies, files that are very young, files that have very little information). Most empirically derived credit scoring systems have between 10 and 20 variables.Murray Bailey "Practical Credit Scoring: Issues and Techn ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CHA2DS2–VASc Score

The CHADS2 score and its updated version, the CHA2DS2-VASc score, are clinical prediction rules for estimating the risk of stroke in people with non-rheumatic atrial fibrillation (AF), a common and serious heart arrhythmia associated with thromboembolic stroke. Such a score is used to determine whether or not treatment is required with anticoagulation therapy or antiplatelet therapy, since AF can cause stasis of blood in the upper heart chambers, leading to the formation of a mural thrombus that can dislodge into the blood flow, reach the brain, cut off supply to the brain, and cause a stroke. A high score corresponds to a greater risk of stroke, while a low score corresponds to a lower risk of stroke. The CHADS2 score is simple and has been validated by many studies. In clinical use, the CHADS2 score (pronounced "chads two") has been superseded by the CHA2DS2-VASc score ("chads vasc"), which gives a better stratification of low-risk patients. Use The CHA2DS2-VASc score ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rockall Score

Rockall risk scoring system attempts to identify patients at risk of adverse outcome following acute upper gastrointestinal bleeding. Rockall ''et al.'' identified independent risk factors in 1996 which were later shown to predict mortality accurately. The scoring system uses clinical criteria (increasing age, co-morbidity, shock) as well as endoscopic finding (diagnosis, stigmata of acute bleeding). It is named for Professor Tim Rockall, who was the main investigator and first author of the studies that led to its formulation. A convenient mnemonic is ABCDE - i.e. Age, Blood pressure fall (shock), Co-morbidity, Diagnosis and Evidence of bleeding. Interpretation Total score is calculated by simple addition. A score less than 3 carries good prognosis but total score more than 8 carries high risk of mortality. See also * Forrest classification Forrest classification is a classification of upper gastrointestinal hemorrhage used for purposes of comparison and in selecting patients f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |