|

Right Of First Refusal

Right of first refusal (ROFR or RFR) is a contractual right that gives its holder the option to enter a business transaction with the owner of something, according to specified terms, before the owner is entitled to enter into that transaction with a third party. A first refusal right must have at least three parties: the owner, the third party or buyer, and the option holder. In general, the owner must make the same offer to the option holder ''before'' making the offer to the buyer. The right of first refusal is similar in concept to a call option. An ROFR can cover almost any sort of asset, including real estate, personal property, a patent license, a screenplay, or an interest in a business. It might also cover business transactions that are not strictly assets, such as the right to enter a joint venture or distribution arrangement. In entertainment, a right of first refusal on a concept or a screenplay would give the holder the right to make that movie first while in rea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contractual Right

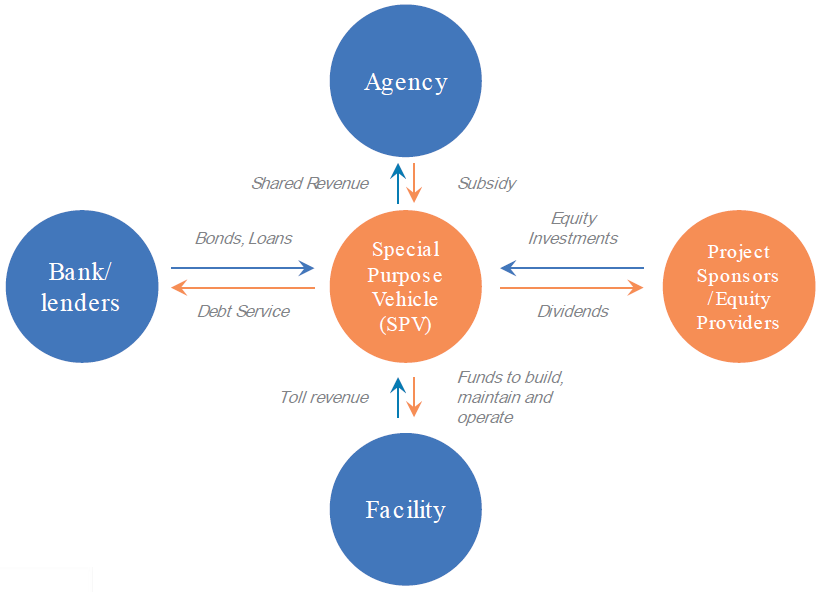

A concession or concession agreement is a grant of rights, land or property by a government, local authority, corporation, individual or other legal entity. Public services such as water supply may be operated as a concession. In the case of a public service concession, a private company enters into an agreement with the government to have the exclusive right to operate, maintain and carry out investment in a public utility (such as a water privatisation) for a given number of years. Other forms of contracts between public and private entities, namely lease contract and management contract (in the water sector often called by the French term ''affermage''), are closely related but differ from a concession in the rights of the operator and its remuneration. A lease gives a company the right to operate and maintain a public utility, but investment remains the responsibility of the public. Under a management contract the operator will collect the revenue only on behalf of the gov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Escrow

An escrow is a contractual arrangement in which a third party (the stakeholder or escrow agent) receives and disburses money or property for the primary transacting parties, with the disbursement dependent on conditions agreed to by the transacting parties. Examples include an account established by a broker for holding funds on behalf of the broker's principal or some other person until the consummation or termination of a transaction; or, a trust account held in the borrower's name to pay obligations such as property taxes and insurance premiums. The word derives from the Old French word , meaning a scrap of paper or a scroll of parchment; this indicated the deed that a third party held until a transaction was completed. Types Escrow generally refers to money held by a third party on behalf of transacting parties. It is mostly used regarding the purchase of shares of a company. It is best known in the United States in the context of the real estate industry (specifically in mor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tag-along Right

Tag along rights (TARs) comprise a group of clauses in a contract which together have the effect of allowing the minority shareholder(s) in a corporation to also take part in a sale of shares by the majority shareholder to a third party under the same terms and conditions. Consider an example: A and B are both shareholders in a company, with A being the majority shareholder and B the minority shareholder. C, a third party, offers to buy A's shares at an attractive price, and A accepts. In this situation, tag-along rights would allow B to also participate in the sale under the same terms and conditions as A. As with other contractual provisions, tag-along rights originated from the doctrine of freedom of contract and is governed by contract law (in common law countries) or the law of obligations (in civil law countries). As tag-along rights are contractual terms between private parties, they are often found in venture capital and private equity firms but not public companies. St ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pre-emption Right

A pre-emption right, right of pre-emption, or first option to buy is a contractual right to acquire certain property newly coming into existence before it can be offered to any other person or entity. It comes from the Latin verb ''emo, emere, emi, emptum'', to buy or purchase, plus the inseparable preposition ''pre'', before. A right to acquire existing property in preference to any other person is usually referred to as a '' right of first refusal''. Company shares In practice, the most common form of pre-emption right is the right of existing shareholders to acquire new shares issued by a company in a rights issue, usually a public offering. In this context, the pre-emptive right is also called subscription right or subscription privilege. It is the right but not the obligation of existing shareholders to buy the new shares before they are offered to the public. In that way, existing shareholders can maintain their proportional ownership of the company and thus prevent stock di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in ''over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified st ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

First-look Deal

A first-look deal is any contract containing a clause granting, usually for a fee or other consideration that covers a specified period of time, a pre-emption right, right of first refusal, or right of first offer (also called a right of first negotiation) to another party, who then is given the first opportunity to buy outright, co-own, invest in, license, etc., something that is newly coming into existence or on the market for the first time or after an absence, such as intellectual property (manuscript, musical composition, invention, artwork, business idea, etc.) or real property (real estate). Film industry In the film industry The film industry or motion picture industry comprises the technological and commercial institutions of filmmaking, i.e., film production companies, film studios, cinematography, animation, film production, screenwriting, pre-production, ..., it is an agreement between a writer and an independent production company or between an independent ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Drag-along Right

Drag-along right (DAR) is a legal concept in corporate law. Under the concept, if the majority shareholder(s) of an entity sells their stake, the prospective owner(s) have the right to force the remaining minority shareholders to join the deal. However, the owner must usually offer the same terms and conditions to the minority shareholders as to the majority shareholder(s). Drag-along rights are fairly standard terms in a stock purchase agreement. This right protects majority shareholders (allowing them to sell to an owner desiring total control of the entity, without being encumbered by holdout investors) but also protects minority shareholders (who can sell their investment on the same terms and conditions as the majority shareholder). This differs from a tag-along right, which also allows minority shareholders to sell on the same terms and conditions (and requires the new owner to offer them), but does not require them to sell. In most jurisdictions drag-along and tag-along r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Startup Company

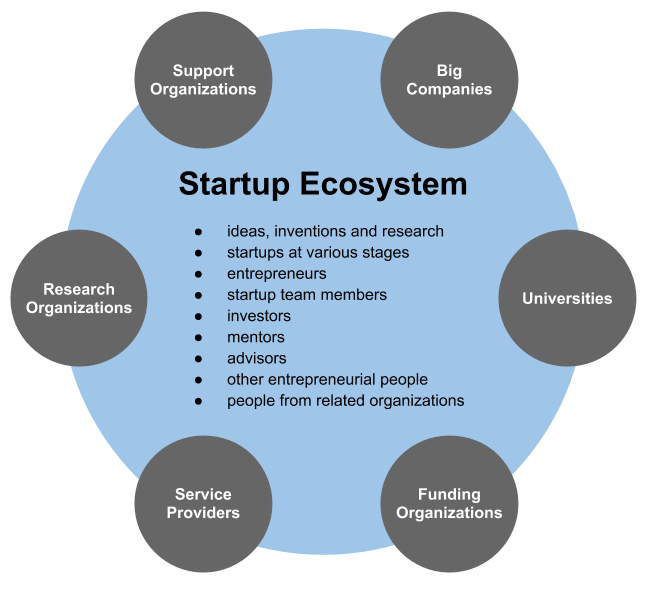

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship refers to all new businesses, including self-employment and businesses that never intend to become registered, startups refer to new businesses that intend to grow large beyond the solo founder. At the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to be successful and influential.Erin Griffith (2014)Why startups fail, according to their founders Fortune.com, 25 September 2014; accessed 27 October 2017 Actions Startups typically begin by a founder (solo-founder) or co-founders who have a way to solve a problem. The founder of a startup will begin market validation by problem interview, solution interview, and building a minimum viable product (MVP), i.e. a prototype, to develop and validate their business models. The startup process can take a long period of time (by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Dilution

Stock dilution, also known as equity dilution, is the decrease in existing shareholders' ownership percentage of a company as a result of the company issuing new equity. New equity increases the total shares outstanding which has a dilutive effect on the ownership percentage of existing shareholders. This increase in the number of shares outstanding can result from a primary market offering (including an initial public offering), employees exercising stock options, or by issuance or conversion of convertible bonds, preferred shares or warrants into stock. This dilution can shift fundamental positions of the stock such as ownership percentage, voting control, earnings per share, and the value of individual shares. Control dilution Control dilution describes the reduction in ownership percentage or loss of a controlling share of an investment's stock. Many venture capital contracts contain an anti-dilution provision in favor of the original investors, to protect their equity inve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Term Sheet

A term sheet is a bullet-point document outlining the material terms and conditions of a potential business agreement, establishing the basis for future negotiations between a seller and buyer. It is usually the first documented evidence of a possible acquisition. It may be either binding or non-binding. After a term sheet has been "executed", it guides legal counsel in the preparation of a proposed "definitive agreement". It then guides, but is not necessarily binding, as the signatories negotiate, usually with legal counsel, the final terms of their agreement. Term sheets are very similar to " letters of intent" (LOI) in that they are both preliminary, mostly non-binding documents meant to record two or more parties' intentions to enter into a future agreement based on specified (but incomplete or preliminary) terms. The difference between the two is slight and mostly a matter of style: an LOI is typically written in letter form and focuses on the parties' intentions; a te ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Time

Time is the continued sequence of existence and events that occurs in an apparently irreversible succession from the past, through the present, into the future. It is a component quantity of various measurements used to sequence events, to compare the duration of events or the intervals between them, and to quantify rates of change of quantities in material reality or in the conscious experience. Time is often referred to as a fourth dimension, along with three spatial dimensions. Time has long been an important subject of study in religion, philosophy, and science, but defining it in a manner applicable to all fields without circularity has consistently eluded scholars. Nevertheless, diverse fields such as business, industry, sports, the sciences, and the performing arts all incorporate some notion of time into their respective measuring systems. 108 pages. Time in physics is operationally defined as "what a clock reads". The physical nature of time is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Call Option

In finance, a call option, often simply labeled a "call", is a contract between the buyer and the seller of the call option to exchange a security at a set price. The buyer of the call option has the right, but not the obligation, to buy an agreed quantity of a particular commodity or financial instrument (the underlying) from the seller of the option at a certain time (the expiration date) for a certain price (the strike price). This effectively gives the owner a ''long'' position in the given asset. The seller (or "writer") is obliged to sell the commodity or financial instrument to the buyer if the buyer so decides. This effectively gives the seller a ''short'' position in the given asset. The buyer pays a fee (called a premium) for this right. The term "call" comes from the fact that the owner has the right to "call the stock away" from the seller. Price of options Option values vary with the value of the underlying instrument over time. The price of the call cont ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |