|

Ricardian Equivalence

The Ricardian equivalence proposition (also known as the Ricardo–de Viti–Barro equivalence theorem) is an economic hypothesis holding that consumers are forward-looking and so internalize the government's budget constraint when making their consumption decisions. This leads to the result that, for a given pattern of government spending, the method of financing such spending does not affect agents' consumption decisions, and thus, it does not change aggregate demand. Introduction Governments can finance their expenditures by creating new money, by levying taxes, or by issuing bonds. Since bonds are loans, they must eventually be repaid—presumably by raising taxes in the future. The choice is therefore "tax now or tax later." Suppose that the government finances some extra spending through deficits; i.e. it chooses to tax later. According to the hypothesis, taxpayers will anticipate that they will have to pay higher taxes in future. As a result, they will save, rather than sp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated with the production, use, and management of scarce resources'. A given economy is a set of processes that involves its culture, values, education, technological evolution, history, social organization, political structure, legal systems, and natural resources as main factors. These factors give context, content, and set the conditions and parameters in which an economy functions. In other words, the economic domain is a social domain of interrelated human practices and transactions that does not stand alone. Economic agents can be individuals, businesses, organizations, or governments. Economic transactions occur when two groups or parties agree to the value or price of the transacted good or service, commonly expressed in a certain curre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Finance

Public finance is the study of the role of the government in the economy. It is the branch of economics that assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones. The purview of public finance is considered to be threefold, consisting of governmental effects on: # The efficient allocation of available resources; # The distribution of income among citizens; and # The stability of the economy. Economist Jonathan Gruber has put forth a framework to assess the broad field of public finance. Gruber suggests public finance should be thought of in terms of four central questions: # When should the government intervene in the economy? To which there are two central motivations for government intervention, Market failure and redistribution of income and wealth. # How might the government intervene? Once the decision is made to intervene the government must ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Policy

In economics and political science, fiscal policy is the use of government revenue collection ( taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorised that government changes in the levels of taxation and government spending influence aggregate demand and the level of economic activity. Fiscal and monetary policy are the key strategies used by a country's government and central bank to advance its economic objectives. The combination of these policies enables these authorities to target inflation (which is considered "healthy" at the level in the range 2%–3%) and to increase employment. Additionally, it is designed to t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Say's Law

In classical economics, Say's law, or the law of markets, is the claim that the production of a product creates demand for another product by providing something of value which can be exchanged for that other product. So, production is the source of demand. In his principal work, ''A Treatise on Political Economy'' (''Traité d'économie politique'', 1803), Jean-Baptiste Say wrote: "A product is no sooner created, than it, from that instant, affords a market for other products to the full extent of its own value." And also, "As each of us can only purchase the productions of others with his own productions – as the value we can buy is equal to the value we can produce, the more men can produce, the more they will purchase." Some maintain that Say further argued that this law of markets implies that a general glut (a widespread excess of supply over demand) cannot occur. If there is a surplus of one good, there must be unmet demand for another: "If certain goods remain unsold, i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Policy-ineffectiveness Proposition

The policy-ineffectiveness proposition (PIP) is a new classical theory proposed in 1975 by Thomas J. Sargent and Neil Wallace based upon the theory of rational expectations, which posits that monetary policy cannot systematically manage the levels of output and employment in the economy. Theory Prior to the work of Sargent and Wallace, macroeconomic models were largely based on the adaptive expectations assumption. Many economists found this unsatisfactory since it assumes that agents may repeatedly make systematic errors and can only revise their expectations in a backward-looking way. Under adaptive expectations, agents do not revise their expectations even if the government announces a policy that involves increasing money supply beyond its expected growth level. Revisions would only be made after the increase in the money supply has occurred, and even then agents would react only gradually. In each period that agents found their expectations of inflation to be wrong, a certain ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt. In 2020, the value of government debt worldwide was $87.4 US trillion, or 99% measured as a share of gross domestic product (GDP). Government debt accounted for almost 40% of all debt (which includes corporate and household debt), the highest share since the 1960s. The rise in government debt since 2007 is largely attributable to the global financial crisis of 2007–2008, and the COVID-19 pandemic. The ability of government to issue debt has been central to state formation and to state building. Public de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Finance

Public finance is the study of the role of the government in the economy. It is the branch of economics that assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones. The purview of public finance is considered to be threefold, consisting of governmental effects on: # The efficient allocation of available resources; # The distribution of income among citizens; and # The stability of the economy. Economist Jonathan Gruber has put forth a framework to assess the broad field of public finance. Gruber suggests public finance should be thought of in terms of four central questions: # When should the government intervene in the economy? To which there are two central motivations for government intervention, Market failure and redistribution of income and wealth. # How might the government intervene? Once the decision is made to intervene the government must ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in mathematics, he built on and greatly refined earlier work on the causes of business cycles. One of the most influential economists of the 20th century, he produced writings that are the basis for the school of thought known as Keynesian economics, and its various offshoots. His ideas, reformulated as New Keynesianism, are fundamental to mainstream macroeconomics. Keynes's intellect was evident early in life; in 1902, he gained admittance to the competitive mathematics program at King's College at the University of Cambridge. During the Great Depression of the 1930s, Keynes spearheaded a revolution in economic thinking, challenging the ideas of neoclassical economics that held that free markets would, in the short to medium term, auto ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

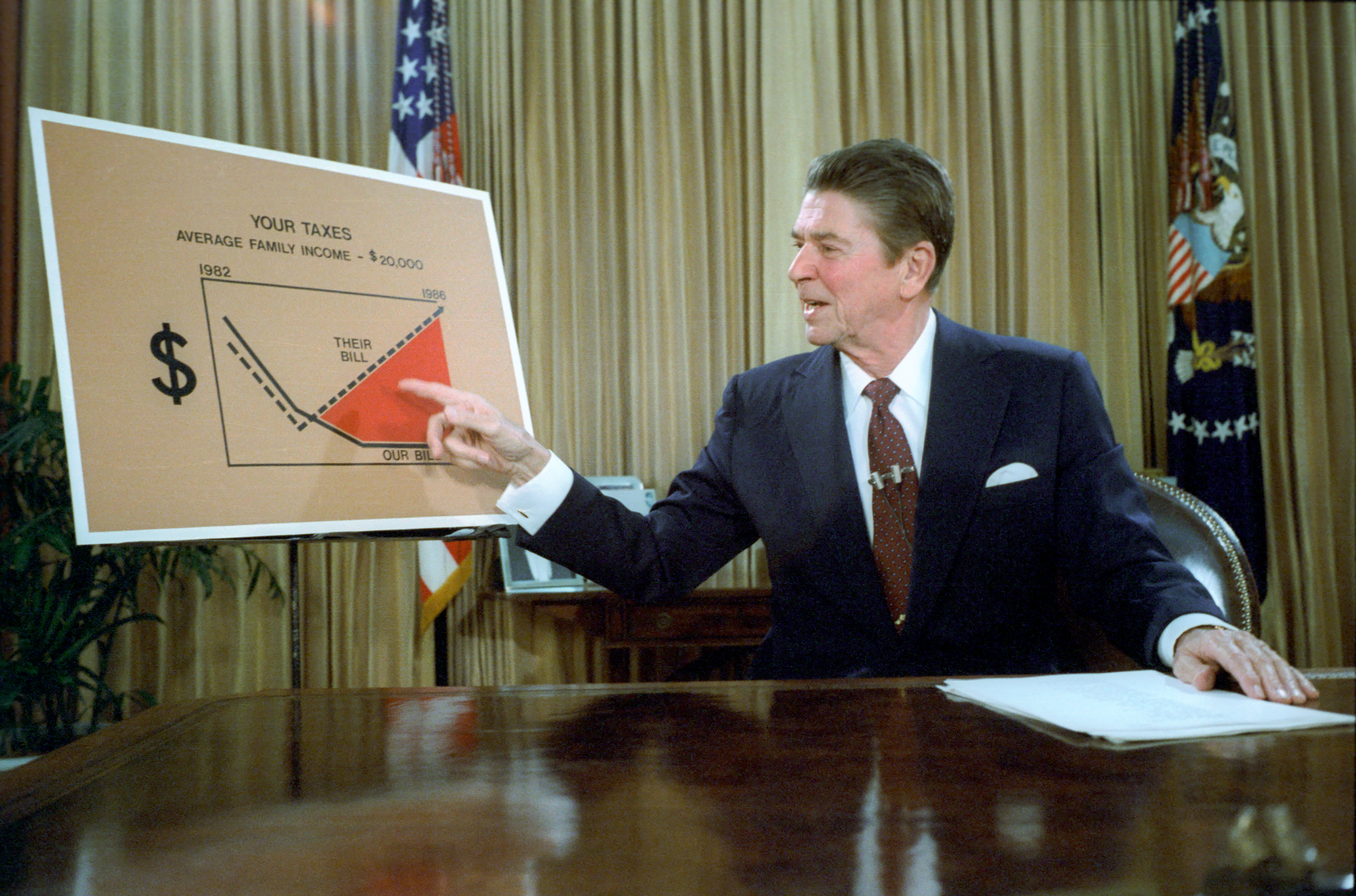

Reaganomics

Reaganomics (; a portmanteau of ''Reagan'' and ''economics'' attributed to Paul Harvey), or Reaganism, refers to the neoliberal economic policies promoted by U.S. President Ronald Reagan during the 1980s. These policies are commonly associated with and characterized as supply-side economics, trickle-down economics, or "voodoo economics" by opponents, while Reagan and his advocates preferred to call it free-market economics. The pillars of Reagan's economic policy included increasing defense spending, balancing the federal budget and slowing the growth of government spending, reducing the federal income tax and capital gains tax, reducing government regulation, and tightening the money supply in order to reduce inflation. The results of Reaganomics are still debated. Supporters point to the end of stagflation, stronger GDP growth, and an entrepreneurial revolution in the decades that followed. Critics point to the widening income gap, what they described as an atmosphere of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the World War II by country, vast majority of the world's countries—including all of the great powers—forming two opposing military alliances: the Allies of World War II, Allies and the Axis powers. World War II was a total war that directly involved more than 100 million Military personnel, personnel from more than 30 countries. The major participants in the war threw their entire economic, industrial, and scientific capabilities behind the war effort, blurring the distinction between civilian and military resources. Air warfare of World War II, Aircraft played a major role in the conflict, enabling the strategic bombing of population centres and deploying the Atomic bombings of Hiroshima and Nagasaki, only two nuclear weapons ever used in war. World War II was by far the List of wars by death toll, deadliest conflict in hu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ronald Reagan

Ronald Wilson Reagan ( ; February 6, 1911June 5, 2004) was an American politician, actor, and union leader who served as the 40th president of the United States from 1981 to 1989. He also served as the 33rd governor of California from 1967 to 1975, after having a career in entertainment. Reagan was born in Tampico, Illinois. He graduated from Eureka College in 1932 and began to work as a sports announcer in Iowa. In 1937, Reagan moved to California, where he found work as a film actor. From 1947 to 1952, Reagan served as the president of the Screen Actors Guild, working to root out alleged communist influence within it. In the 1950s, he moved to a career in television and became a spokesman for General Electric. From 1959 to 1960, he again served as the guild's president. In 1964, his speech "A Time for Choosing" earned him national attention as a new conservative figure. Building a network of supporters, Reagan was elected governor of California in 1966. During his go ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lawrence Summers

Lawrence Henry Summers (born November 30, 1954) is an American economist who served as the 71st United States secretary of the treasury from 1999 to 2001 and as director of the National Economic Council from 2009 to 2010. He also served as president of Harvard University from 2001 to 2006,"Historical Facts" Harvard University, retrieved March 31, 2017 where he is the Charles W. Eliot university professor and director of the Mossavar-Rahmani Center for Business and Government at . [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_per_capita_in_2020.png)

.jpg)