|

Reinsurance Companies

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself (at least in part) from the risk of a major claims event. With reinsurance, the company passes on ("cedes") some part of its own insurance liabilities to the other insurance company. The company that purchases the reinsurance policy is called a "ceding company" or "cedent" or "cedant" under most arrangements. The company issuing the reinsurance policy is referred to as the "reinsurer". In the classic case, reinsurance allows insurance companies to remain solvent after major claims events, such as major disasters like hurricanes and wildfires. In addition to its basic role in risk management, reinsurance is sometimes used to reduce the ceding company's capital requirements, or for tax mitigation or other purposes. The reinsurer may be either a specialist reinsurance company, which only undertakes reinsurance business, or another insurance company. Insurance companies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Game Theory

Game theory is the study of mathematical models of strategic interactions among rational agents. Myerson, Roger B. (1991). ''Game Theory: Analysis of Conflict,'' Harvard University Press, p.&nbs1 Chapter-preview links, ppvii–xi It has applications in all fields of social science, as well as in logic, systems science and computer science. Originally, it addressed two-person zero-sum games, in which each participant's gains or losses are exactly balanced by those of other participants. In the 21st century, game theory applies to a wide range of behavioral relations; it is now an umbrella term for the science of logical decision making in humans, animals, as well as computers. Modern game theory began with the idea of mixed-strategy equilibria in two-person zero-sum game and its proof by John von Neumann. Von Neumann's original proof used the Brouwer fixed-point theorem on continuous mappings into compact convex sets, which became a standard method in game theory and m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stop-loss Insurance

Stop-loss insurance is insurance that protects insurers against large claims. Stop-loss policies take effect after a certain threshold has been exceeded in claims. Overview Insurance companies themselves, as well as self-insuring employers, purchase stop-loss coverage for a premium to protect themselves. In the case of a participant reaching more than the specific (or "individual") stop-loss deductible ($300,000, for example), the insurer will reimburse the insured (the company, not the participant) for the remainder of the claim to be paid over that deductible amount. There is also typically an aggregate-claims deductible, which is applied to all paid claims combined. For all claims at or below their specific stop-loss level, if the sum of these are more than the aggregate stop loss level, then the insurer will reimburse the insured for the difference. Insurance companies and health and benefits consultants typically use mathematical models analyzing historical claims data to pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reinsurance Sidecar

Reinsurance sidecars, conventionally referred to as "sidecars", are financial structures that are created to allow investors to take on the risk and return of a group of insurance policies (a "book of business") written by an insurer or reinsurer (henceforth re/insurer) and earn the risk and return that arises from that business. A re/insurer will only pay ("cede") the premiums associated with a book of business to such an entity if the investors place sufficient funds in the vehicle to ensure that it can meet claims if they arise. Typically, the liability of investors is limited to these funds. These structures have become quite prominent in the aftermath of Hurricane Katrina as a vehicle for re/insurers to add risk-bearing capacity, and for investors to participate in the potential profits resulting from sharp price increases in re/insurance over the four quarters following Katrina. An earlier and smaller generation of sidecars were created after 9/11 for the same purpose. P ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securitization

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations (or other non-debt assets which generate receivables) and selling their related cash flows to third party investors as securities, which may be described as bonds, pass-through securities, or collateralized debt obligations (CDOs). Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS). The granularity of pools of securitized assets can mitigate the credit risk of individual borrowers. Unlike general corporate debt, the credit quality of securitized debt is non-stationary due to changes in volatility that are time- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Industry Loss Warranties

Industry loss warranties (ILWs), are a type of reinsurance contract used in the insurance industry through which one party will purchase protection based on the total loss arising from an event to the entire insurance industry above a certain trigger level rather than their own losses. For example, the buyer of a "$100million limit US Wind ILW attaching at $20bn" will pay a premium to a protection writer (generally a reinsurer but sometimes a hedge fund) and in return will receive $100million if total losses to the insurance industry from a single US hurricane exceed $20bn. The industry loss ($20bn in this case) is often referred to as the "trigger". The amount of protection offered by the contract ($100million in this case) is referred to as the "limit". ILWs could also be constructed based on an index not linked to insurance industry losses. For example, Professor Lawrence A. Cunningham of George Washington University suggests adapting similar mechanisms to the risks that l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Reinsurance

Financial Reinsurance (or fin re), is a form of reinsurance which is focused more on capital management than on risk transfer. In the non-life segment of the insurance industry this class of transactions is often referred to as finite reinsurance. One of the particular difficulties of running an insurance company is that its financial results - and hence its profitability - tend to be uneven from one year to the next. Since insurance companies generally want to produce consistent results, they may be attracted to ways of hoarding this year's profit to pay for next year's possible losses (within the constraints of the applicable standards for financial reporting). Financial reinsurance is one means by which insurance companies can "smooth" their results. A pure 'fin re' contract for a non-life insurer tends to cover a multi-year period, during which the premium is held and invested by the reinsurer. It is returned to the ceding company - minus a pre-determined profit margin for the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Catastrophe Modeling

:''This article refers to the use of computers to estimate losses caused by disasters. For other meanings of the word catastrophe, including catastrophe theory in mathematics, see catastrophe (other).'' Catastrophe modeling (also known as cat modeling) is the process of using computer-assisted calculations to estimate the losses that could be sustained due to a catastrophic event such as a hurricane or earthquake. Cat modeling is especially applicable to analyzing risks in the insurance industry and is at the confluence of actuarial science, engineering, meteorology, and seismology. Catastrophes/ Perils Natural catastrophes (sometimes referred to as "nat cat") that are modeled include: * Hurricane (main peril is wind damage; some models can also include storm surge and rainfall) * Earthquake (main peril is ground shaking; some models can also include tsunami, fire following earthquakes, liquefaction, landslide, and sprinkler leakage damage) * severe thunderstorm or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Catastrophe Bond

Catastrophe bonds (also known as cat bonds) are risk-linked securities that transfer a specified set of risks from a sponsor to investors. They were created and first used in the mid-1990s in the aftermath of Hurricane Andrew and the Northridge earthquake. Catastrophe bonds emerged from a need by insurance companies to alleviate some of the risks they would face if a major catastrophe occurred, which would incur damages that they could not cover by the invested premiums. An insurance company issues bonds through an investment bank, which are then sold to investors. These bonds are inherently risky, generally BB, and usually have maturities less than 3 years. If no catastrophe occurred, the insurance company would pay a coupon to the investors. But if a catastrophe did occur, then the principal would be forgiven and the insurance company would use this money to pay their claim-holders. Investors include hedge funds, catastrophe-oriented funds, and asset managers. They are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Governance

Governance is the process of interactions through the laws, norms, power or language of an organized society over a social system ( family, tribe, formal or informal organization, a territory or across territories). It is done by the government of a state, by a market, or by a network. It is the decision-making among the actors involved in a collective problem that leads to the creation, reinforcement, or reproduction of social norms and institutions". In lay terms, it could be described as the political processes that exist in and between formal institutions. A variety of entities (known generically as governing bodies) can govern. The most formal is a government, a body whose sole responsibility and authority is to make binding decisions in a given geopolitical system (such as a state) by establishing laws. Other types of governing include an organization (such as a corporation recognized as a legal entity by a government), a socio-political group ( chiefdom, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Econometrics

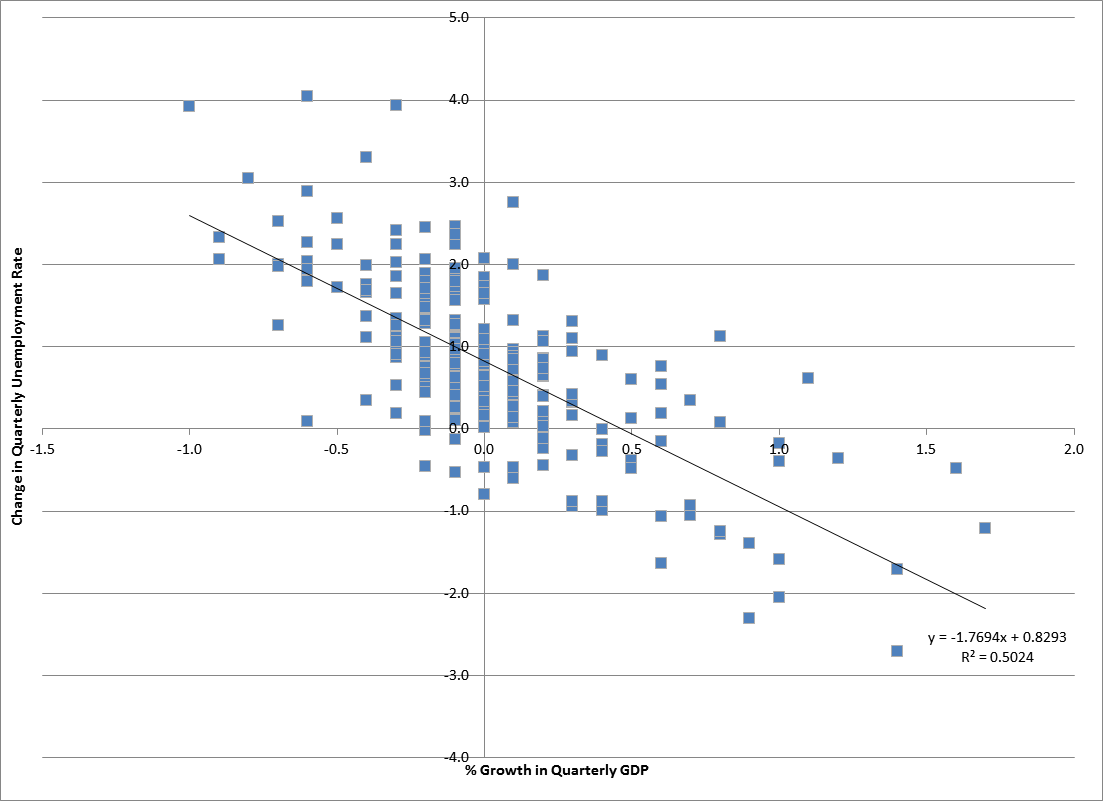

Econometrics is the application of statistical methods to economic data in order to give empirical content to economic relationships.M. Hashem Pesaran (1987). "Econometrics," '' The New Palgrave: A Dictionary of Economics'', v. 2, p. 8 p. 8–22 Reprinted in J. Eatwell ''et al.'', eds. (1990). ''Econometrics: The New Palgrave''p. 1p. 1–34Abstract (2008 revision by J. Geweke, J. Horowitz, and H. P. Pesaran). More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference". An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships". Jan Tinbergen is one of the two founding fathers of econometrics. The other, Ragnar Frisch, also coined the term in the sense in which it is used today. A basic tool for econometrics is the multiple linear regression model. ''Econometric the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yale University

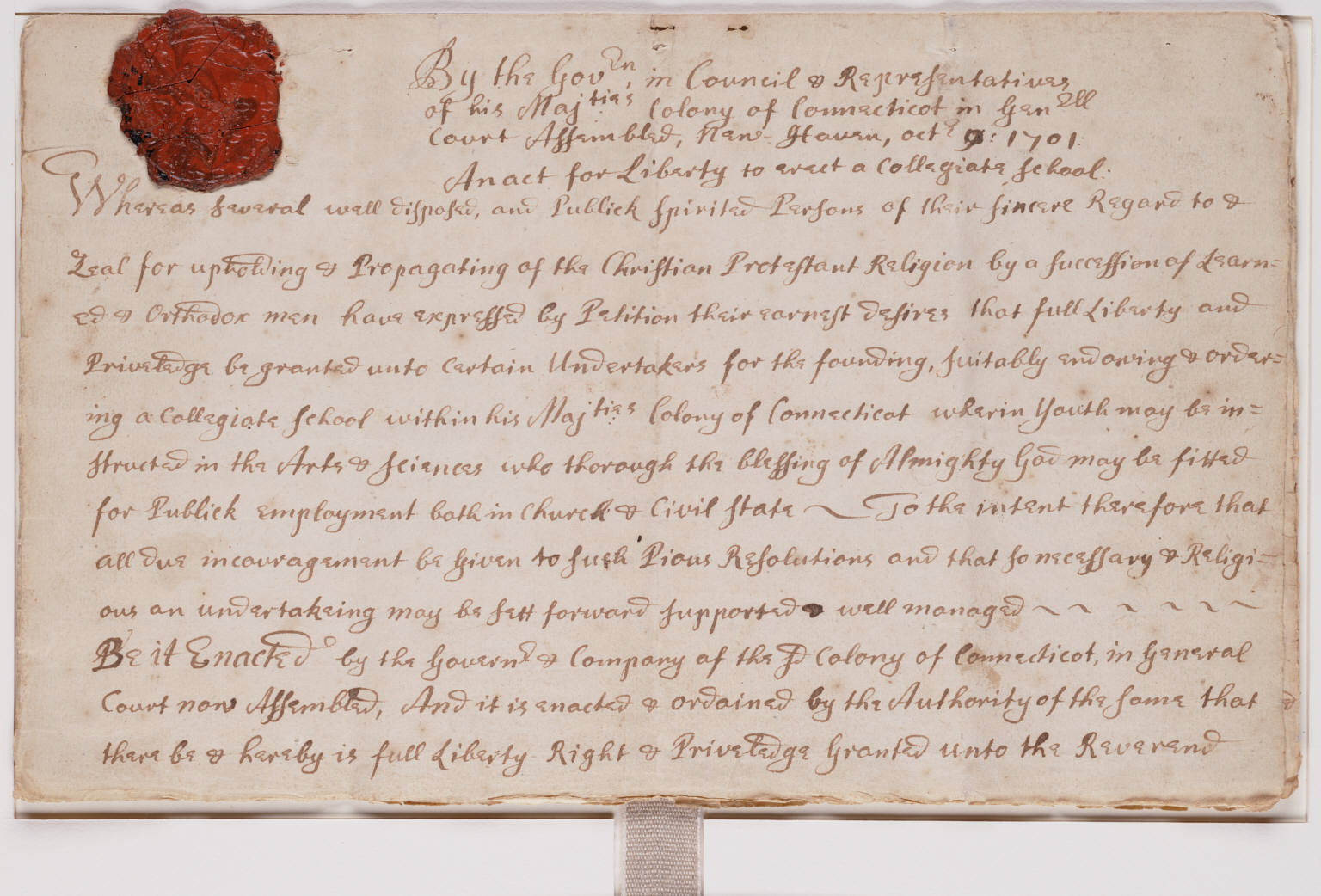

Yale University is a Private university, private research university in New Haven, Connecticut. Established in 1701 as the Collegiate School, it is the List of Colonial Colleges, third-oldest institution of higher education in the United States and among the most prestigious in the world. It is a member of the Ivy League. Chartered by the Connecticut Colony, the Collegiate School was established in 1701 by clergy to educate Congregationalism in the United States, Congregational ministers before moving to New Haven in 1716. Originally restricted to theology and sacred languages, the curriculum began to incorporate humanities and sciences by the time of the American Revolution. In the 19th century, the college expanded into graduate and professional instruction, awarding the first Doctor of Philosophy, PhD in the United States in 1861 and organizing as a university in 1887. Yale's faculty and student populations grew after 1890 with rapid expansion of the physical campus and sc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |