|

Ramsey Pricing

The Ramsey problem, or Ramsey pricing, or Ramsey–Boiteux pricing, is a second-best policy problem concerning what prices a public monopoly should charge for the various products it sells in order to maximize social welfare (the sum of producer and consumer surplus) while earning enough revenue to cover its fixed costs. Under Ramsey pricing, the price markup over marginal cost is inverse to the price elasticity of demand: the more elastic the product's demand, the smaller the markup. Frank P. Ramsey found this 1927 in the context of Optimal taxation: the more elastic the demand, the smaller the optimal tax. The rule was later applied by Marcel Boiteux (1956) to natural monopolies (industries with decreasing average cost). A natural monopoly earns negative profits if it sets price equals to marginal cost, so it must set prices for some or all of the products it sells to above marginal cost if it is to be viable without government subsidies. Ramsey pricing says to mark up most the g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Theory Of The Second Best

In welfare economics, the theory of the second best (also known as the general theory of second best or the second best theorem) concerns the situation when one or more optimality conditions cannot be satisfied. The economists Richard Lipsey and Kelvin Lancaster showed in 1956, that if one optimality condition in an economic model cannot be satisfied, it is possible that the next-best solution involves changing other variables away from the values that would otherwise be optimal. Politically, the theory implies that if it is infeasible to remove a particular market distortion, introducing one or more ''additional'' market distortions in an interdependent market may partially counteract the first, and lead to a more efficient outcome. Implications In an economy with some uncorrectable market failure in one sector, actions to correct market failures in another related sector with the intent of increasing economic efficiency may actually decrease overall economic efficiency. In the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lagrange Multiplier

In mathematical optimization, the method of Lagrange multipliers is a strategy for finding the local maxima and minima of a function subject to equality constraints (i.e., subject to the condition that one or more equations have to be satisfied exactly by the chosen values of the variables). It is named after the mathematician Joseph-Louis Lagrange. The basic idea is to convert a constrained problem into a form such that the derivative test of an unconstrained problem can still be applied. The relationship between the gradient of the function and gradients of the constraints rather naturally leads to a reformulation of the original problem, known as the Lagrangian function. The method can be summarized as follows: in order to find the maximum or minimum of a function f(x) subjected to the equality constraint g(x) = 0, form the Lagrangian function :\mathcal(x, \lambda) = f(x) + \lambda g(x) and find the stationary points of \mathcal considered as a function of x and the Lagrange mu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopoly (economics)

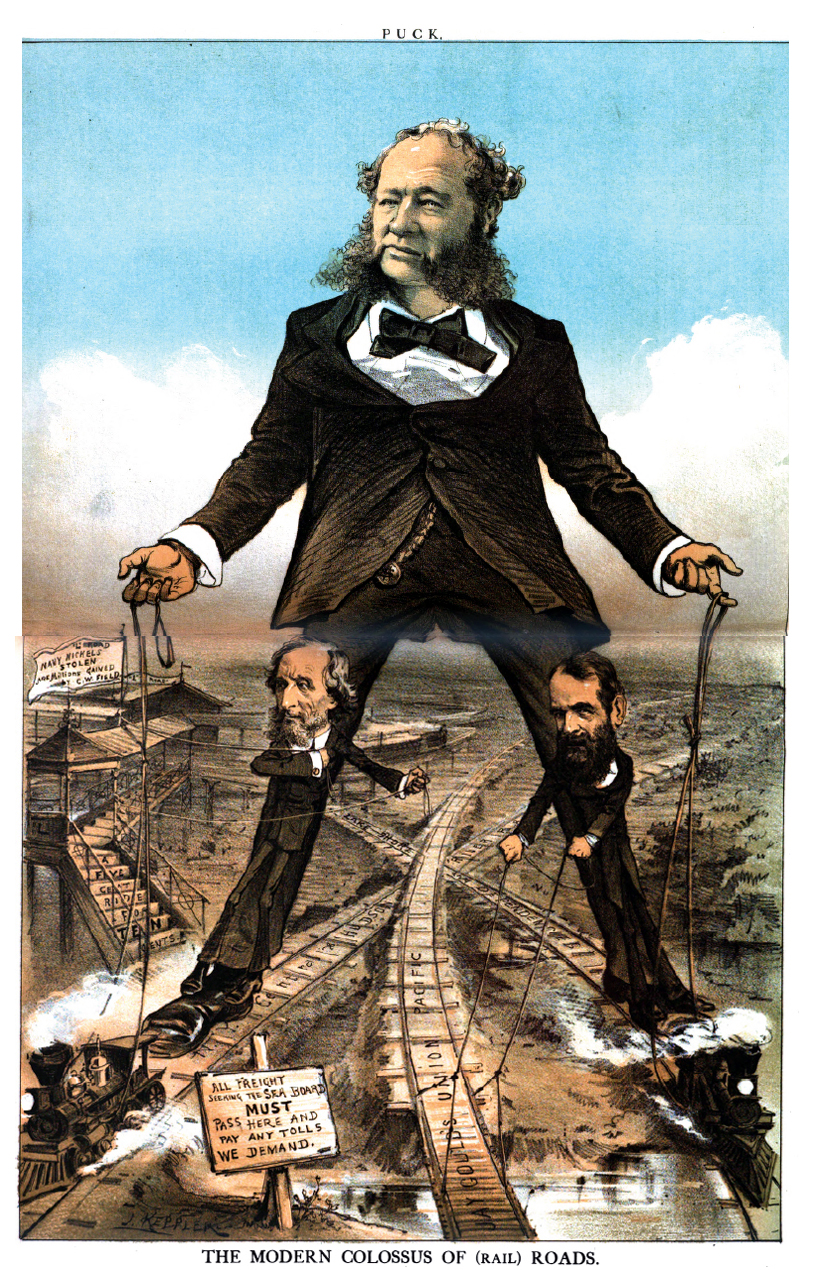

A monopoly (from Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a specific person or enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterized by a lack of economic competition to produce the good or service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb ''monopolise'' or ''monopolize'' refers to the ''process'' by which a company gains the ability to raise prices or exclude competitors. In economics, a monopoly is a single seller. In law, a monopoly is a business ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Policy

The economy of governments covers the systems for setting levels of taxation, government budgets, the money supply and interest rates as well as the labour market, national ownership, and many other areas of government interventions into the economy. Most factors of economic policy can be divided into either fiscal policy, which deals with government actions regarding taxation and spending, or monetary policy, which deals with central banking actions regarding the money supply and interest rates. Such policies are often influenced by international institutions like the International Monetary Fund or World Bank as well as political beliefs and the consequent policies of parties. Types of economic policy Almost every aspect of government has an important economic component. A few examples of the kinds of economic policies that exist include: *Macroeconomic stabilization policy, which attempts to keep the money supply growing at a rate that does not result in excessive inflatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lerner Index

The Lerner index, formalized in 1934 by British economist of Russian origin Abba Lerner, is a measure of a firm's market power. Definition The Lerner index is defined by: L=\frac where P is the market price set by the firm and MC is the firm's marginal cost. The index ranges from 0 to 1. A perfectly competitive firm charges P = MC, L = 0; such a firm has no market power. An oligopolist or monopolist charges P > MC, so its index is L > 0, but the extent of its markup depends on the elasticity (the price-sensitivity) of demand and strategic interaction with competing firms. The index rises to 1 if the firm has MC = 0. The following factors affect the value of the Lerner index: * the price elasticity of demand for goods produced by the company — the smaller the fluctuations in demand under the influence of prices, the smaller the elasticity and the greater the value of L; * the interaction with competitors — the more of them and the larger their size, the less the company's a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Amoroso–Robinson Relation

The Amoroso–Robinson relation, named after economists Luigi Amoroso and Joan Robinson, describes the relation between price, marginal revenue, and elasticity of demand. \frac=p\left( 1+\frac\right), where *\scriptstyle \frac is the marginal revenue, *x is the particular good, *p is the good's price, *\epsilon_<0 is the price elasticity of demand. Extension and generalization In 1967, Ernst Lykke Jensen published two extensions, one deterministic, the other probabilistic, of Amoroso–Robinson's formula.See also * * |

Theory Of The Second Best

In welfare economics, the theory of the second best (also known as the general theory of second best or the second best theorem) concerns the situation when one or more optimality conditions cannot be satisfied. The economists Richard Lipsey and Kelvin Lancaster showed in 1956, that if one optimality condition in an economic model cannot be satisfied, it is possible that the next-best solution involves changing other variables away from the values that would otherwise be optimal. Politically, the theory implies that if it is infeasible to remove a particular market distortion, introducing one or more ''additional'' market distortions in an interdependent market may partially counteract the first, and lead to a more efficient outcome. Implications In an economy with some uncorrectable market failure in one sector, actions to correct market failures in another related sector with the intent of increasing economic efficiency may actually decrease overall economic efficiency. In the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deadweight Loss

In economics, deadweight loss is the difference in production and consumption of any given product or service including government tax. The presence of deadweight loss is most commonly identified when the quantity produced ''relative'' to the amount consumed differs in regards to the optimal concentration of surplus. This difference in the amount reflects the quantity that is not being utilized or consumed and thus resulting in a ''loss''. This "deadweight loss" is therefore attributed to both, producers and consumers because neither one of them benefits from the surplus of the overall production. Deadweight loss can also be a measure of lost economic efficiency when the socially optimal quantity of a good or a service is not produced. Non-optimal production can be caused by monopoly pricing in the case of artificial scarcity, a positive or negative externality, a tax or subsidy, or a binding price ceiling or price floor such as a minimum wage. Examples Assume a market for na ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lerner Index

The Lerner index, formalized in 1934 by British economist of Russian origin Abba Lerner, is a measure of a firm's market power. Definition The Lerner index is defined by: L=\frac where P is the market price set by the firm and MC is the firm's marginal cost. The index ranges from 0 to 1. A perfectly competitive firm charges P = MC, L = 0; such a firm has no market power. An oligopolist or monopolist charges P > MC, so its index is L > 0, but the extent of its markup depends on the elasticity (the price-sensitivity) of demand and strategic interaction with competing firms. The index rises to 1 if the firm has MC = 0. The following factors affect the value of the Lerner index: * the price elasticity of demand for goods produced by the company — the smaller the fluctuations in demand under the influence of prices, the smaller the elasticity and the greater the value of L; * the interaction with competitors — the more of them and the larger their size, the less the company's a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Discrimination

Price discrimination is a microeconomic pricing strategy where identical or largely similar goods or services are sold at different prices by the same provider in different markets. Price discrimination is distinguished from product differentiation by the more substantial difference in production cost for the differently priced products involved in the latter strategy. Price differentiation essentially relies on the variation in the customers' willingness to payApollo, M. (2014). Dual Pricing–Two Points of View (Citizen and Non-citizen) Case of Entrance Fees in Tourist Facilities in Nepal. Procedia - Social and Behavioral Sciences, 120, 414-422. https://doi.org/10.1016/j.sbspro.2014.02.119 and in the elasticity of their demand. For price discrimination to succeed, a firm must have market power, such as a dominant market share, product uniqueness, sole pricing power, etc. All prices under price discrimination are higher than the equilibrium price in a perfectly-competitive ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopoly

A monopoly (from Greek language, Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a specific person or company, enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a Market (economics), market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterized by a lack of economic Competition (economics), competition to produce the good (economics), good or Service (economics), service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb ''monopolise'' or ''monopolize'' refers to the ''process'' by which a company gains the ability to raise ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Telecommunication

Telecommunication is the transmission of information by various types of technologies over wire, radio, optical, or other electromagnetic systems. It has its origin in the desire of humans for communication over a distance greater than that feasible with the human voice, but with a similar scale of expediency; thus, slow systems (such as postal mail) are excluded from the field. The transmission media in telecommunication have evolved through numerous stages of technology, from beacons and other visual signals (such as smoke signals, semaphore telegraphs, signal flags, and optical heliographs), to electrical cable and electromagnetic radiation, including light. Such transmission paths are often divided into communication channels, which afford the advantages of multiplexing multiple concurrent communication sessions. ''Telecommunication'' is often used in its plural form. Other examples of pre-modern long-distance communication included audio messages, such as coded drumb ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |