|

RIGIBOR

RIGIBOR stands for the Riga Interbank Offered Rate and is a daily reference rate based on the interest rates at which banks offer to lend ''unsecured'' funds to other banks in the Latvia wholesale money market (or interbank market). RIGIBOR is published daily by the National Bank of Latvia The Bank of Latvia ( lv, Latvijas Banka,) is the central bank of Latvia. It is among the nation's key public institutions and carries out economic functions as prescribed by law. It was established in 1922. The principal objective of the Bank of ... together with RIGIBID (Riga Interbank Bid Rate). See also * Euribor * TALIBOR References External linksRIGIBOR and RIGIBID quotations by Bank of Latvia Reference rates Economy of Latvia {{finance-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

TALIBOR

Bank of Estonia ( et, Eesti Pank) is the central bank of Estonia as well as a member of the Eurosystem organisation of euro area central banks. The Bank of Estonia also belongs to the European System of Central Banks. Until 2010, the bank issued the former Estonian currency, the kroon. The Governor of the Bank of Estonia, currently Madis Müller, is a member of the Governing Council of the European Central Bank. TALIBOR Prior to the introduction of the euro, TALIBOR or the Tallinn Interbank Offered Rate was a daily reference rate based on the interest rates at which banks offer to lend ''unsecured'' funds to other banks in the Estonian wholesale money market (or interbank market in Estonian kroons). TALIBOR was published daily by the Bank of Estonia, together with TALIBID (Tallinn Interbank Bid Rate). TALIBOR was calculated based on the quotes for different maturities provided by reference banks at about 11.00 am each business day by disregarding highest and lowe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Riga

Riga (; lv, Rīga , liv, Rīgõ) is the capital and largest city of Latvia and is home to 605,802 inhabitants which is a third of Latvia's population. The city lies on the Gulf of Riga at the mouth of the Daugava river where it meets the Baltic Sea. Riga's territory covers and lies above sea level, on a flat and sandy plain. Riga was founded in 1201 and is a former Hanseatic League member. Riga's historical centre is a UNESCO World Heritage Site, noted for its Art Nouveau/Jugendstil architecture and 19th century wooden architecture. Riga was the European Capital of Culture in 2014, along with Umeå in Sweden. Riga hosted the 2006 NATO Summit, the Eurovision Song Contest 2003, the 2006 IIHF Men's World Ice Hockey Championships, 2013 World Women's Curling Championship and the 2021 IIHF World Championship. It is home to the European Union's office of European Regulators for Electronic Communications (BEREC). In 2017, it was named the European Region of Gastronomy. I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reference Rate

A reference rate is a rate that determines pay-offs in a financial contract and that is outside the control of the parties to the contract. It is often some form of LIBOR rate, but it can take many forms, such as a consumer price index, a house price index or an unemployment rate. Parties to the contract choose a reference rate that neither party has power to manipulate. Examples of use The most common use of reference rates is that of short-term interest rates such as LIBOR in floating rate notes, loans, swaps, short-term interest rate futures contracts, etc. The rates are calculated by an independent organisation, such as the British Bankers Association (BBA) as the average of the rates quoted by a large panel of banks, to ensure independence. Another example is that of swap reference rates for constant maturity swaps. The ISDAfix rates used are calculated daily for an independent organisation, the International Swaps and Derivatives Association, from quotes from a large pane ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income." The borrower wants, or needs, to have money sooner rather than later, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Latvia

Latvia ( or ; lv, Latvija ; ltg, Latveja; liv, Leţmō), officially the Republic of Latvia ( lv, Latvijas Republika, links=no, ltg, Latvejas Republika, links=no, liv, Leţmō Vabāmō, links=no), is a country in the Baltic region of Northern Europe. It is one of the Baltic states; and is bordered by Estonia to the north, Lithuania to the south, Russia to the east, Belarus to the southeast, and shares a maritime border with Sweden to the west. Latvia covers an area of , with a population of 1.9 million. The country has a temperate seasonal climate. Its capital and largest city is Riga. Latvians belong to the ethno-linguistic group of the Balts; and speak Latvian, one of the only two surviving Baltic languages. Russians are the most prominent minority in the country, at almost a quarter of the population. After centuries of Teutonic, Swedish, Polish-Lithuanian and Russian rule, which was mainly executed by the local Baltic German aristocracy, the independent R ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Market

The money market is a component of the economy that provides short-term funds. The money market deals in short-term loans, generally for a period of a year or less. As short-term securities became a commodity, the money market became a component of the financial market for assets involved in short-term borrowing, lending, buying and selling with original maturities of one year or less. Trading in money markets is done over the counter and is wholesale. There are several money market instruments in most Western countries, including treasury bills, commercial paper, banker's acceptances, deposits, certificates of deposit, bills of exchange, repurchase agreements, federal funds, and short-lived mortgage- and asset-backed securities. The instruments bear differing maturities, currencies, credit risks, and structures. A market can be described as a money market if it is composed of highly liquid, short-term assets. Money market funds typically invest in government securities, ce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interbank Market

The interbank market is the top-level foreign exchange market where banks exchange different currencies. The banks can either deal with one another directly, or through electronic brokering platforms. The Electronic Broking Services (EBS) and Thomson Reuters Dealing are the two competitors in the electronic brokering platform business and together connect over 1000 banks. The currencies of most developed countries have floating exchange rates. These currencies do not have fixed values but, rather, values that fluctuate relative to other currencies. The interbank market is an important segment of the foreign exchange market. It is a wholesale market through which most currency transactions are channeled. It is mainly used for trading among bankers. The three main constituents of the interbank market are: * the spot market * the forward market * SWIFT (Society for World-Wide Interbank Financial Telecommunications) The interbank market is unregulated and decentralized. There is no sp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Bank Of Latvia

The Bank of Latvia ( lv, Latvijas Banka,) is the central bank of Latvia. It is among the nation's key public institutions and carries out economic functions as prescribed by law. It was established in 1922. The principal objective of the Bank of Latvia is to regulate currency in circulation by implementing monetary policy to maintain price stability in Latvia. Until 31 December 2013, the bank was responsible for issuing the former Latvian currency, the lats. The Bank of Latvia administration is located in Riga. The fiscal year for the bank begins on 1 January and ends on 31 December. History On 7 September 1922, the Constitutional Assembly adopted the Law on the Establishment of the Bank of Latvia. The Bank of Latvia was granted emission rights. The Bank's interim statutes were approved on 19 September 1922, with the decision of the Cabinet of Ministers, and its initial capital was 10 million lats. On 24 April 1923, Saeima approved the Statute of the Bank of Latvia, signed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Euribor

The Euro Interbank Offered Rate (Euribor) is a daily reference rate, published by the European Money Markets Institute, based on the averaged interest rates at which Eurozone banks offer to lend unsecured funds to other banks in the euro wholesale money market (or interbank market). Prior to 2015, the rate was published by the European Banking Federation. Scope Euribors are used as a reference rate for euro-denominated forward rate agreements, short-term interest rate futures contracts and interest rate swaps, in very much the same way as LIBORs are commonly used for Sterling and US dollar-denominated instruments. They thus provide the basis for some of the world's most liquid and active interest rate markets. Domestic reference rates, like Paris' PIBOR, Frankfurt's FIBOR, and Helsinki's Helibor merged into Euribor on EMU day on 1 January 1999. Euribor should be distinguished from the less commonly used "Euro LIBOR" rates set in London by 16 major banks. Technical feature ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

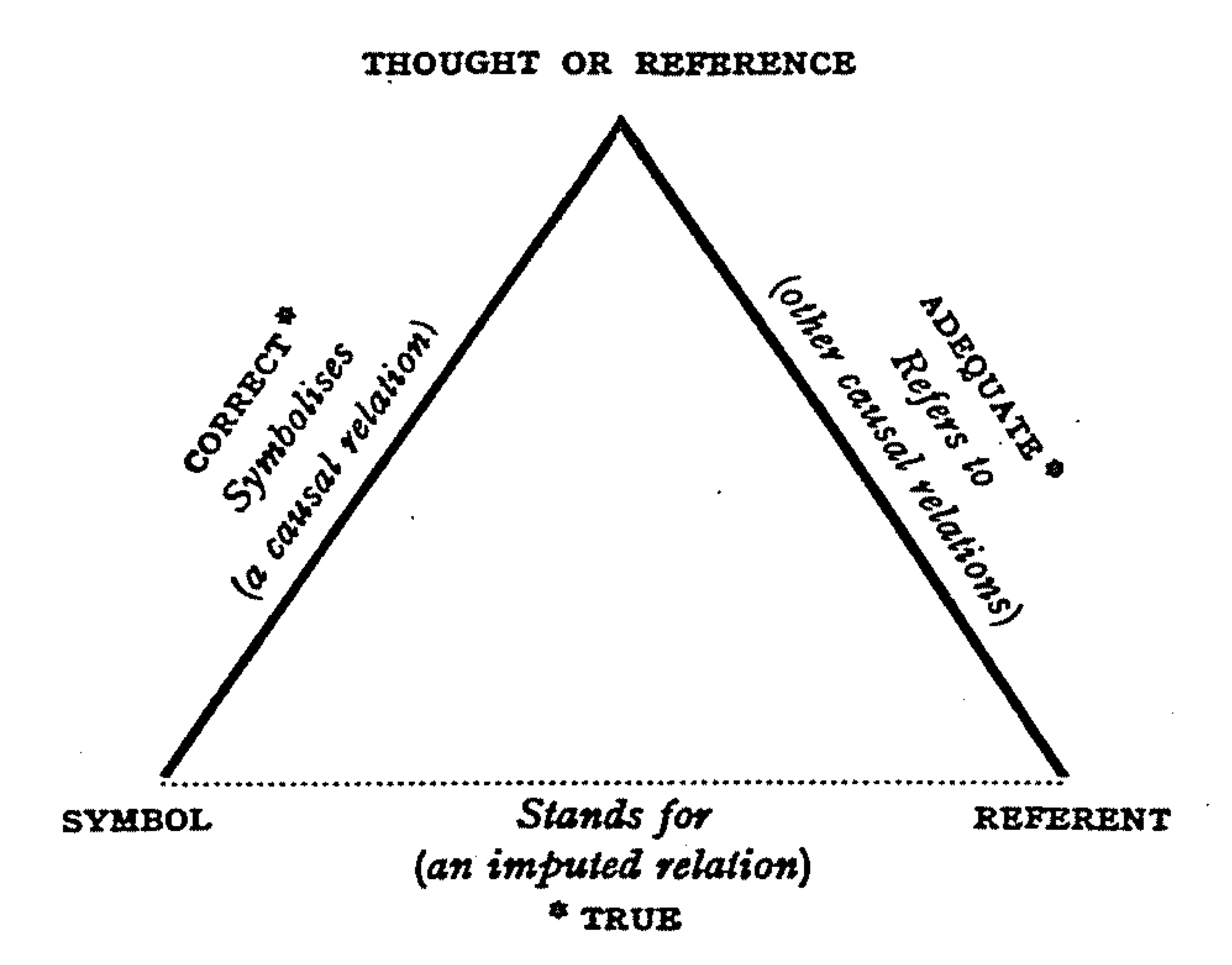

Reference Rates

Reference is a relationship between objects in which one object designates, or acts as a means by which to connect to or link to, another object. The first object in this relation is said to ''refer to'' the second object. It is called a '' name'' for the second object. The second object, the one to which the first object refers, is called the '' referent'' of the first object. A name is usually a phrase or expression, or some other symbolic representation. Its referent may be anything – a material object, a person, an event, an activity, or an abstract concept. References can take on many forms, including: a thought, a sensory perception that is audible (onomatopoeia), visual (text), olfactory, or tactile, emotional state, relationship with other, spacetime coordinate, symbolic or alpha-numeric, a physical object or an energy projection. In some cases, methods are used that intentionally hide the reference from some observers, as in cryptography. References feature in many ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |