|

RBL Bank

RBL Bank, formerly known as Ratnakar Bank, is an Private sector banks in India, Indian private sector bank headquartered in Mumbai and founded in 1943. It offers services across six verticals: corporate and institutional banking, commercial banking, branch and business banking, retail assets, development banking and financial inclusion, treasury and financial market operations.https://www.rblbank.com/about-us History On 6 August 1943, Ratnakar Bank was founded as a regional bank in Maharashtra with two branches in Kolhapur and Sangli founded by Babgonda Bhujgonda Patil from Sangli and Gangappa Siddappa Chougule from Kolhapur. It mainly served Small and medium-sized enterprises, small and medium enterprises (SMEs) and business merchants in the Kolhapur-Sangli belt. It was incorporated in Kolhapur district on 14 June 1943 as Ratnakar Bank Limited. In 1959, the bank was categorized as a Scheduled Banks (India), scheduled commercial bank as per the Reserve Bank of India Act, 1934 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Privately Held Company

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is offered, owned, traded, exchanged privately, or Over-the-counter (finance), over-the-counter. In the case of a closed corporation, there are a relatively small number of shareholders or company members. Related terms are closely-held corporation, unquoted company, and unlisted company. Though less visible than their public company, publicly traded counterparts, private companies have major importance in the world's economy. In 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for ($1.8 trillion) in revenues and employed 6.2 million people, according to ''Forbes''. In 2005, using a substantially smaller pool size (22.7%) for comparison, the 339 companies on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

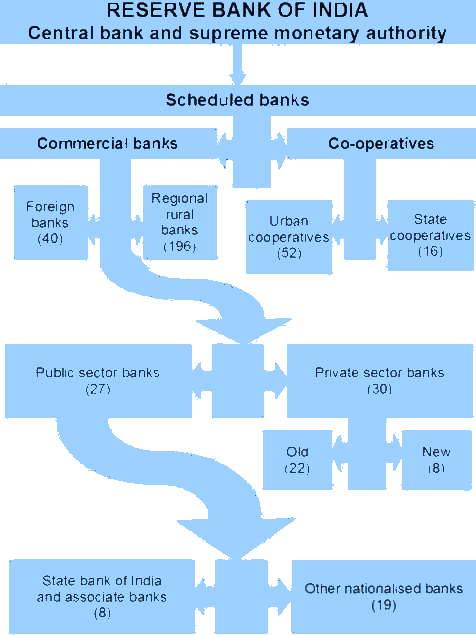

Scheduled Banks (India)

Scheduled Banks in India refer to those banks which have been included in the Second Schedule of Reserve Bank of India Act, 1934. Reserve Bank of India (RBI) in turn includes only those banks in this Schedule which satisfy the criteria laid down vide section 42(6)(a) of the said Act. Banks not under this Schedule are called Non-Scheduled Banks Facilities Every Scheduled bank enjoys two types of principal facilities: it becomes eligible for debts/loans at the bank rate from the RBI; and, it automatically acquires the membership of Clearing house (finance), clearing house. Types of banks There are two main categories of commercial banks in India namely - * Scheduled Commercial banks * Scheduled Cooperative banking, Co-operative banks Scheduled commercial Banks are further divided into 5 types as below - # Nationalised Banks # Development Banks # Regional urban Banks # Foreign Banks # Private sector Banks #Payment bank (currently five banks NSDL Payments Bank, Airtel Payments Bank ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking In India

Modern banking in India originated in the mid of 18th century. Among the first banks were the Bank of Hindustan, which was established in 1770 and liquidated in 1829–32; and the General Bank of India, established in 1786 but failed in 1791. The largest and the oldest bank which is still in existence is the State Bank of India (SBI). It originated and started working as the Bank of Calcutta in mid-June 1806. In 1809, it was renamed as the Bank of Bengal. This was one of the three banks founded by a presidency government, the other two were the Bank of Bombay in 1840 and the Bank of Madras in 1843. The three banks were merged in 1921 to form the Imperial Bank of India, which upon India's independence, became the State Bank of India in 1955. For many years, the presidency banks had acted as quasi-central banks, as did their successors, until the Reserve Bank of India was established in 1935, under the Reserve Bank of India Act, 1934. In 1960, the State Banks of India was g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Asian Banker

The Asian Banker is a company that provides information for the financial services industry in the form of publications, online materials such as e-newsletters, research, and conventions, and other industry gatherings. It is regarded as one of the Asian region's leading consultancies in financial services research, benchmarking and intelligence. History The Asian Banker was founded in Singapore in 1996 by Emmanuel Daniel, a former consultant. It was established first as a publisher of trade publication, such as The Asian Banker Journal, before moving into research, consulting, benchmarking, and events organisation, all catering to the financial services industry. Publications The company's original product was ''The Asian Banker Journal'', a quarterly publication of 40 pages that was launched in January 1997. Throughout 1997 and 1998, it provided on-the-ground coverage of the 1997 Asian financial crisis, anchored by Daniel's journalistic skills and award-winning articles—Dan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microfinance

Microfinance is a category of financial services targeting individuals and small businesses who lack access to conventional banking and related services. Microfinance includes microcredit, the provision of small loans to poor clients; savings and checking accounts; microinsurance; and payment systems, among other services. Microfinance services are designed to reach excluded customers, usually poorer population segments, possibly socially marginalized, or geographically more isolated, and to help them become self-sufficient.Christen, Robert Peck Christen; Rosenberg, Richard; Jayadeva, Veena. ''Financial institutions with a double-bottom line: Implications for the future of microfinance''. CGAP, Occasional Papers series, July 2004, pp. 2–3. ID Ghana is an example of a microfinance institution. Microfinance initially had a limited definition: the provision of microloans to poor entrepreneurs and small businesses lacking access to credit. The two main mechanisms for the delive ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Euromoney

''Euromoney'' is an English-language monthly magazine focused on business and finance. First published in 1969, it is the flagship production of Euromoney Institutional Investor plc. History and profile ''Euromoney'' was first published in 1969 by Sir Patrick Sergeant. It is part of Euromoney Institutional Investor, an international business-to-business media group focused primarily on the international finance industry. The group became a public company in 1986, and is listed on the London Stock Exchange as Euromoney Institutional Investor PLC. The headquarters of the magazine is in London. Sir Patrick Sergeant continued to manage the business until 1985 and remains as co-president of the company. Daily Mail and General Trust plc is the largest shareholder in the company. DMGT's principal shareholder, Jonathan Harmsworth, 4th Viscount Rothermere, is co-president of Euromoney Institutional Investor. ''Euromoney'' covers global banking, macroeconomics and capital markets, inc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

R Subramaniakumar

R Subramaniakumar is an Indian businessman. He is the managing director and chief executive officer of Ratnakar Bank Limited. He was the former executive director at Indian Bank and Indian Overseas Bank. Early life and education Subramaniakumar is a Physics graduate with PGDCA. Career Subramaniakumar started his career with Punjab National Bank and lead the Business Transformation. He was the executive director at Indian Bank. He was the executive director and also the MD and CEO of Indian Overseas Bank Indian Overseas Bank (IOB) is an Indian public sector bank based in Chennai. It has about 3,214 domestic branches, about 4 foreign branches and representative office. Founded in February 1937 by M. Ct. M. Chidambaram Chettyar with twin object .... He was an administrator at Dewan Housing Financial Corporation. He also was an Independent Director of the UC Pension Fund Limited. On 24 June 22, he joined Ratnakar Bank Limited as the managing director and chief executive offic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Baring Private Equity Asia

BPEA EQT (formerly known as Baring Private Equity Asia and BPEA) is an Asian private equity firm. Previously it was an affiliate of Barings Bank before becoming an independent firm. In 2022 it was acquired by EQT Partners to act as its Asian investment platform. It is one of the largest private equity firms in Asia. History Baring Private Equity Asia (BPEA) was founded in 1997 as a subsidiary of Baring Private Equity International (BPEP International) which was an affiliate of Barings Bank. In addition to BPEA, the affiliates of BPEP International include Baring Vostok Capital Partners, Baring Private Equity Partners India and GP Investments. In 2000, Jean Eric Salata led a management buyout of BPEA leading it to be established as an independent Firm. In 2016, Affiliated Managers Group acquired a 15% minority stake in BPEA. In 2017, BPEA launched it's Credit investment unit in India after acquiring the Credit unit of Religare Global Asset Management. In March 2022, EQT Partn ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CDC Group

British International Investment, (formerly CDC Group plc, Commonwealth Development Corporation, and Colonial Development Corporation) is the development finance institution of the UK government. The Foreign, Commonwealth and Development Office is responsible for the organisation, and is the sole shareholder. It has an investment portfolio valued around US$7.1 billion (year-end 2020) and since 2011 is focused on the emerging markets of South Asia and Africa. History Formation The original Colonial Development Corporation was established as a statutory corporation in 1948 by Clement Attlee's post-war Labour government, to assist British colonies in the development of agriculture. Following the independence of many colonies, it was renamed the Commonwealth Development Corporation in 1963 and was permitted to invest outside the Commonwealth in 1969. As part of the Commonwealth Development Corporation Act 1999, CDC was converted from a statutory corporation to a public lim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Livemint

''Mint'' is an Indian financial daily newspaper published by HT Media, a Delhi-based media group which is controlled by the K. K. Birla family that also publishes ''Hindustan Times''. It mostly targets readers who are business executives and policy makers. It has been in circulation since 2007. Of the five business dailies published in India, Mint rose to the number two position immediately after its launch and has remained there (behind The Economic Times ever since. It publishes a single national edition that is printed and distributed in New Delhi, Mumbai, Bangalore, Hyderabad, Chennai, Kolkata, Pune, Ahmedabad and Chandigarh. Unlike most mainstream newspapers from India, Mint is not published on Sunday. It instead offers its readers Mint Lounge every Saturday, a weekend magazine focused on intelligent lifestyle, fashion, food, books, science and culture. Mint's editorial coverage and its style of presentation is noted for its refreshing clarity and accessibility - facets ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Automatic Teller Machine

An automated teller machine (ATM) or cash machine (in British English) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, balance inquiries or account information inquiries, at any time and without the need for direct interaction with bank staff. ATMs are known by a variety of names, including automatic teller machine (ATM) in the United States (sometimes redundantly as "ATM machine"). In Canada, the term ''automated banking machine'' (ABM) is also used, although ATM is also very commonly used in Canada, with many Canadian organizations using ATM over ABM. In British English, the terms ''cashpoint'', ''cash machine'' and ''hole in the wall'' are most widely used. Other terms include ''any time money'', ''cashline'', ''tyme machine'', ''cash dispenser'', ''cash corner'', ''bankomat'', or ''bancomat''. ATMs that are not operated by a financial in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

RBL Bank

RBL Bank, formerly known as Ratnakar Bank, is an Private sector banks in India, Indian private sector bank headquartered in Mumbai and founded in 1943. It offers services across six verticals: corporate and institutional banking, commercial banking, branch and business banking, retail assets, development banking and financial inclusion, treasury and financial market operations.https://www.rblbank.com/about-us History On 6 August 1943, Ratnakar Bank was founded as a regional bank in Maharashtra with two branches in Kolhapur and Sangli founded by Babgonda Bhujgonda Patil from Sangli and Gangappa Siddappa Chougule from Kolhapur. It mainly served Small and medium-sized enterprises, small and medium enterprises (SMEs) and business merchants in the Kolhapur-Sangli belt. It was incorporated in Kolhapur district on 14 June 1943 as Ratnakar Bank Limited. In 1959, the bank was categorized as a Scheduled Banks (India), scheduled commercial bank as per the Reserve Bank of India Act, 1934 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)