|

Revenue Act Of 1978

The United States Revenue Act of 1978, , amended the Internal Revenue Code by reducing individual income taxes (widening tax brackets and reducing the number of tax rates), increasing the personal exemption from $750 to $1,000, reducing corporate tax rates (the top rate falling from 48 percent to 46 percent), increasing the standard deduction from $3,200 to $3,400 (joint returns), increasing the capital gains exclusion from 50 percent to 60 percent (effectively reducing the rate of taxation on realized capital gains to 28%), and repealing the non-business exemption for state and local gasoline taxes. Legislative history The Act was passed by the 95th Congress and was signed into law by President Jimmy Carter on November 6, 1978. Provisions Flexible spending accounts and the 401(k) section of the IRS code The Act also established Flexible spending accounts, which allow employees to receive reimbursement for medical expenses from untaxed income dollars. The Act added section 401(k) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code (USC). It is organized topically, into subtitles and sections, covering income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not separately organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, eff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Bracket

Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer). Essentially, tax brackets are the cutoff values for taxable income—income past a certain point is taxed at a higher rate. Example Imagine that there are three tax brackets: 10%, 20%, and 30%. The 10% rate applies to income from $1 to $10,000; the 20% rate applies to income from $10,001 to $20,000; and the 30% rate applies to all income above $20,000. Under this system, someone earning $10,000 is taxed at 10%, paying a total of $1,000. Someone earning $5,000 pays $500, and so on. Meanwhile, someone who earns $25,000 faces a more complicated calculation. The rate on the first $10,000 is 10%, from $10,001 to $20,000 is 20%, and above that is 30%. Thus, they pay $1,000 for the first $10,000 of income (10%), $2,000 for the second $10,000 of income (20%), and $1,500 for the last $5,000 of income (30%), In total, they pay $4,500, or an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax

A corporate tax, also called corporation tax or company tax, is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed at state or local levels. The taxes may also be referred to as income tax or capital tax. A country's corporate tax may apply to: * corporations incorporated in the country, * corporations doing business in the country on income from that country, * foreign corporations who have a permanent establishment in the country, or * corporations deemed to be resident for tax purposes in the country. Company income subject to tax is often determined much like taxable income for individual taxpayers. Generally, the tax is imposed on net profits. In some jurisdictions, rules for taxing companies may differ significantly from rules for taxing individuals. Certain corporate acts or types of entities may be exempt from tax. The incidence of corporate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gasoline

Gasoline (; ) or petrol (; ) (see ) is a transparent, petroleum-derived flammable liquid that is used primarily as a fuel in most spark-ignited internal combustion engines (also known as petrol engines). It consists mostly of organic compounds obtained by the fractional distillation of petroleum, enhanced with a variety of additives. On average, U.S. refineries produce, from a barrel of crude oil, about 19 to 20 gallons of gasoline; 11 to 13 gallons of distillate fuel (most of which is sold as diesel fuel); and 3 to 4 gallons of jet fuel. The product ratio depends on the processing in an oil refinery and the crude oil assay. A barrel of oil is defined as holding 42 US gallons, which is about 159 liters or 35 imperial gallons. The characteristic of a particular gasoline blend to resist igniting too early (which causes knocking and reduces efficiency in reciprocating engines) is measured by its octane rating, which is produced in several grades. Tetraethyl lead and o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

95th United States Congress

The 95th United States Congress was a meeting of the legislative branch of the United States federal government, composed of the United States Senate and the United States House of Representatives. It met in Washington, DC from January 3, 1977, to January 3, 1979, during the final weeks of the administration of U.S. President Gerald Ford and the first two years of the administration of U.S. President Jimmy Carter. The apportionment of seats in this House of Representatives was based on the Nineteenth Census of the United States in 1970. Both chambers maintained a Democratic supermajority, and with Jimmy Carter being sworn in as President on January 20, 1977, this gave the Democrats an overall federal government trifecta for the first time since the 90th Congress ending in 1969. , this was the most recent Congress to approve an amendment (the unratified District of Columbia Voting Rights Amendment) to the Constitution. This is the last time democrats or any party held a 2/3rd ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

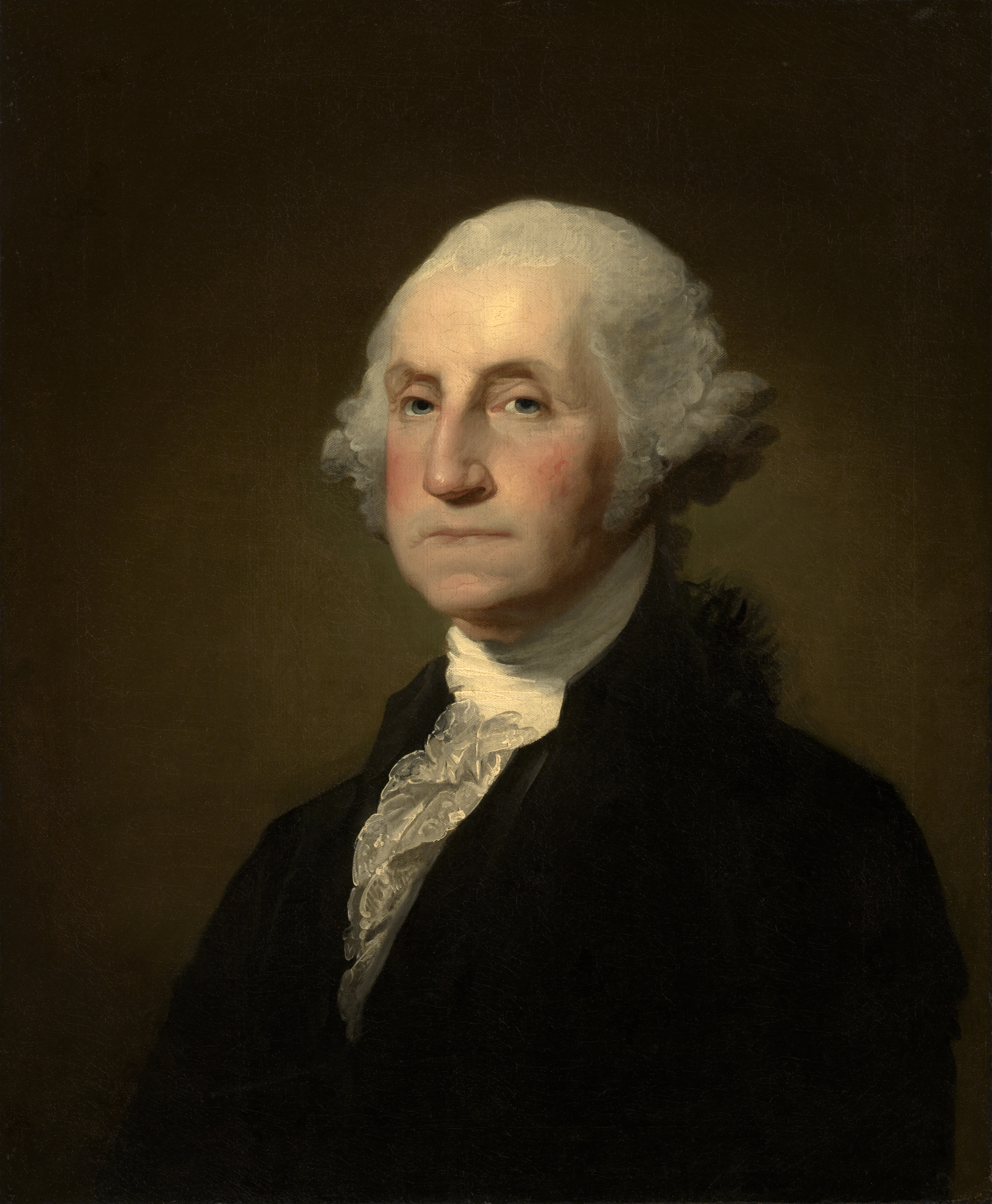

President Of The United States

The president of the United States (POTUS) is the head of state and head of government of the United States of America. The president directs the executive branch of the federal government and is the commander-in-chief of the United States Armed Forces. The power of the presidency has grown substantially since the first president, George Washington, took office in 1789. While presidential power has ebbed and flowed over time, the presidency has played an increasingly strong role in American political life since the beginning of the 20th century, with a notable expansion during the presidency of Franklin D. Roosevelt. In contemporary times, the president is also looked upon as one of the world's most powerful political figures as the leader of the only remaining global superpower. As the leader of the nation with the largest economy by nominal GDP, the president possesses significant domestic and international hard and soft power. Article II of the Constitution establ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jimmy Carter

James Earl Carter Jr. (born October 1, 1924) is an American politician who served as the 39th president of the United States from 1977 to 1981. A member of the Democratic Party (United States), Democratic Party, he previously served as the 76th governor of Georgia from 1971 to 1975 and as a Georgia state senator from 1963 to 1967. Since leaving office, Carter has remained engaged in political and social projects, receiving the Nobel Peace Prize in 2002 for his humanitarian work. Born and raised in Plains, Georgia, Carter graduated from the United States Naval Academy in 1946 with a Bachelor of Science degree and joined the United States Navy, serving on numerous submarines. After the death of his father in 1953, he left his naval career and returned home to Plains, where he assumed control of his family's peanut-growing business. He inherited little, due to his father's forgiveness of debts and the division of the estate amongst himself and his siblings. Nevertheless, his ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flexible Spending Account

In the United States, a flexible spending account (FSA), also known as a flexible spending arrangement, is one of a number of tax-advantaged financial accounts, resulting in payroll tax savings. One significant disadvantage to using an FSA is that funds not used by the end of the plan year are forfeited to the employer, known as the "use it or lose it" rule. Under the terms of the Affordable Care Act however a plan may permit an employee to carry over up to $550 into the following year without losing the funds but this does not apply to all plans and some plans may have lower limits. The most common type of flexible spending account, the medical expense FSA (also medical FSA or health FSA), is similar to a health savings account (HSA) or a health reimbursement account (HRA). However, while HSAs and HRAs are almost exclusively used as components of a consumer-driven health care plan, medical FSAs are commonly offered with more traditional health plans as well. In addition, funds ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

401(k)

In the United States, a 401(k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection 401(k) of the U.S. Internal Revenue Code. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. This legal option is what makes 401(k) plans attractive to employees, and many employers offer this option to their (full-time) workers. There are two types: traditional and Roth 401(k). For Roth accounts, contributions and withdrawals have no impact on income tax. For traditional accounts, contributions may be deducted from taxable income and withdrawals are added to taxable income. There are limits to contributions, rules governing withdrawals and possible penalties. The benefit of the Roth account is from tax-free capital gains. The net benefit of the traditional account is the sum of (1) a possible bonus (or penalty) from withdrawals at tax rates lower (or higher) than at contributio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Federal Taxation Legislation

United may refer to: Places * United, Pennsylvania, an unincorporated community * United, West Virginia, an unincorporated community Arts and entertainment Films * ''United'' (2003 film), a Norwegian film * ''United'' (2011 film), a BBC Two film Literature * ''United!'' (novel), a 1973 children's novel by Michael Hardcastle Music * United (band), Japanese thrash metal band formed in 1981 Albums * ''United'' (Commodores album), 1986 * ''United'' (Dream Evil album), 2006 * ''United'' (Marvin Gaye and Tammi Terrell album), 1967 * ''United'' (Marian Gold album), 1996 * ''United'' (Phoenix album), 2000 * ''United'' (Woody Shaw album), 1981 Songs * "United" (Judas Priest song), 1980 * "United" (Prince Ital Joe and Marky Mark song), 1994 * "United" (Robbie Williams song), 2000 * "United", a song by Danish duo Nik & Jay featuring Lisa Rowe Television * ''United'' (TV series), a 1990 BBC Two documentary series * ''United!'', a soap opera that aired on BBC One from 1965-19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_1950_-_2010.gif)