|

Revenue Act Of 1926

The United States Revenue Act of 1926, , reduced inheritance and personal income taxes, cancelled many excise imposts, eliminated the gift tax and ended public access to federal income tax returns. Passed by the 69th Congress, it was signed into law by President Calvin Coolidge Calvin Coolidge (born John Calvin Coolidge Jr.; ; July 4, 1872January 5, 1933) was the 30th president of the United States from 1923 to 1929. Born in Vermont, Coolidge was a History of the Republican Party (United States), Republican lawyer .... The act was applicable to incomes for 1925 and thereafter. Tax on Corporations A rate of 13.5 percent was levied on the net income of corporations. Tax on individuals A normal tax and a surtax were levied against the net income of individuals as shown in the following table. *Exemption of $1,500 for single filers and $3,500 for married couples and heads of family. A $400 exemption for each dependent under 18. References {{US_tax_acts United ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance Tax

An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died. International tax law distinguishes between an estate tax and an inheritance tax—an estate tax is assessed on the assets of the deceased, while an inheritance tax is assessed on the legacies received by the estate's beneficiaries. However, this distinction is not always observed; for example, the UK's "inheritance tax" is a tax on the assets of the deceased, and strictly speaking is therefore an estate tax. For historical reasons, the term death duty is still used colloquially (though not legally) in the UK and some Commonwealth countries. For political, statutory and other reasons, the term death tax is sometimes used to refer to estate tax in the United States. Varieties of inheritance and estate taxes * Belgium, droits de succession or erfbelasting (Inheritance tax). Collected at t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when the barrel was tapped it would destroy the stamp. An excise, or excise tax, is any duty (economics), duty on manufactured goods (economics), goods that is levied at the moment of manufacture rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the ''border'', while excise is levied on goods that came into existence ''inland''. An excise is considered an indirect tax, meaning that the producer or seller who pays the levy to the government is expected to try to recover their loss by raising the price paid by the eventual buyer of the goods. Excises are typically impos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Government Of The United States

The federal government of the United States (U.S. federal government or U.S. government) is the national government of the United States, a federal republic located primarily in North America, composed of 50 states, a city within a federal district (the city of Washington in the District of Columbia, where most of the federal government is based), five major self-governing territories and several island possessions. The federal government, sometimes simply referred to as Washington, is composed of three distinct branches: legislative, executive, and judicial, whose powers are vested by the U.S. Constitution in the Congress, the president and the federal courts, respectively. The powers and duties of these branches are further defined by acts of Congress, including the creation of executive departments and courts inferior to the Supreme Court. Naming The full name of the republic is "United States of America". No other name appears in the Constitution, and this i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

69th United States Congress

The 69th United States Congress was a meeting of the legislative branch of the United States federal government, consisting of the United States Senate and the United States House of Representatives. It met in Washington, D.C. from March 4, 1925, to March 4, 1927, during the third and fourth years of Calvin Coolidge's presidency. The apportionment of seats in the House of Representatives was based on the thirteenth decennial census of the United States in 1910. The Republicans made modest gains in maintaining their majority in both chambers, and with the election of President Calvin Coolidge to his own term in office, the Republicans maintained an overall federal government trifecta. Major events A special session of the Senate was called by President Coolidge on February 14, 1925. * Impeachment of Judge George W. English — On April 1, 1926, the House of Representatives impeached Judge George W. English of the United States District Court for the Eastern District of Ill ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

President Of The United States

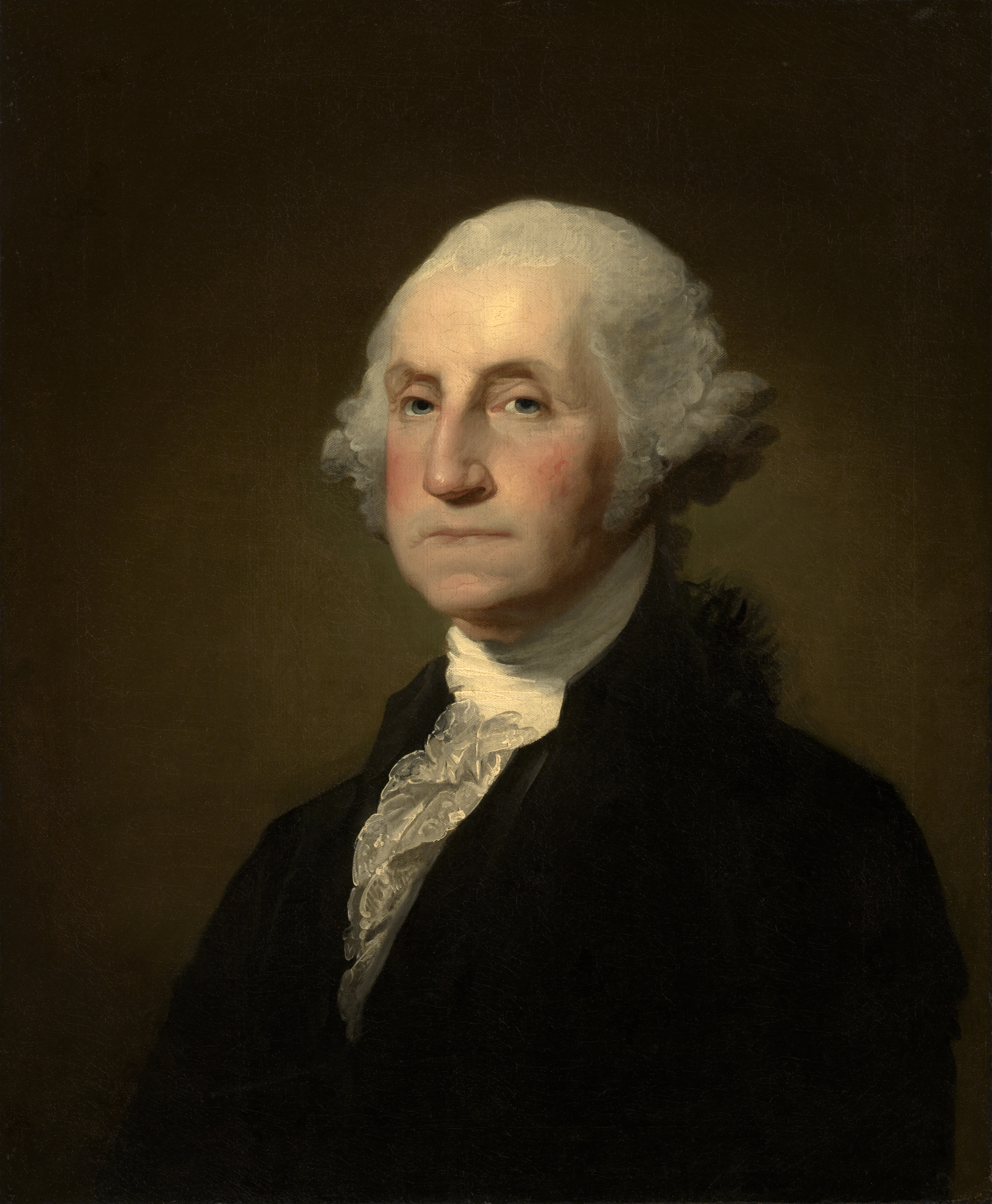

The president of the United States (POTUS) is the head of state and head of government of the United States of America. The president directs the executive branch of the federal government and is the commander-in-chief of the United States Armed Forces. The power of the presidency has grown substantially since the first president, George Washington, took office in 1789. While presidential power has ebbed and flowed over time, the presidency has played an increasingly strong role in American political life since the beginning of the 20th century, with a notable expansion during the presidency of Franklin D. Roosevelt. In contemporary times, the president is also looked upon as one of the world's most powerful political figures as the leader of the only remaining global superpower. As the leader of the nation with the largest economy by nominal GDP, the president possesses significant domestic and international hard and soft power. Article II of the Constitution establ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Calvin Coolidge

Calvin Coolidge (born John Calvin Coolidge Jr.; ; July 4, 1872January 5, 1933) was the 30th president of the United States from 1923 to 1929. Born in Vermont, Coolidge was a History of the Republican Party (United States), Republican lawyer from New England who climbed up the ladder of Massachusetts state politics, becoming the state's Governor of Massachusetts, 48th governor. His response to the Boston Police Strike of 1919 thrust him into the national spotlight as a man of decisive action. Coolidge was elected the country's 29th vice president of the United States, vice president the next year, succeeding the presidency upon the sudden death of President Warren G. Harding in 1923. Elected in his own right in 1924 United States presidential election, 1924, Coolidge gained a reputation as a small-government Conservatism in the United States, conservative distinguished by a taciturn personality and dry sense of humor, receiving the nickname "Silent Cal". Though his widespread p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Federal Taxation Legislation

United may refer to: Places * United, Pennsylvania, an unincorporated community * United, West Virginia, an unincorporated community Arts and entertainment Films * ''United'' (2003 film), a Norwegian film * ''United'' (2011 film), a BBC Two film Literature * ''United!'' (novel), a 1973 children's novel by Michael Hardcastle Music * United (band), Japanese thrash metal band formed in 1981 Albums * ''United'' (Commodores album), 1986 * ''United'' (Dream Evil album), 2006 * ''United'' (Marvin Gaye and Tammi Terrell album), 1967 * ''United'' (Marian Gold album), 1996 * ''United'' (Phoenix album), 2000 * ''United'' (Woody Shaw album), 1981 Songs * "United" (Judas Priest song), 1980 * "United" (Prince Ital Joe and Marky Mark song), 1994 * "United" (Robbie Williams song), 2000 * "United", a song by Danish duo Nik & Jay featuring Lisa Rowe Television * ''United'' (TV series), a 1990 BBC Two documentary series * ''United!'', a soap opera that aired on BBC One from 1965-19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1926 In American Law

Nineteen or 19 may refer to: * 19 (number), the natural number following 18 and preceding 20 * one of the years 19 BC, AD 19, 1919, 2019 Films * ''19'' (film), a 2001 Japanese film * ''Nineteen'' (film), a 1987 science fiction film Music * 19 (band), a Japanese pop music duo Albums * ''19'' (Adele album), 2008 * ''19'', a 2003 album by Alsou * ''19'', a 2006 album by Evan Yo * ''19'', a 2018 album by MHD * ''19'', one half of the double album ''63/19'' by Kool A.D. * ''Number Nineteen'', a 1971 album by American jazz pianist Mal Waldron * ''XIX'' (EP), a 2019 EP by 1the9 Songs * "19" (song), a 1985 song by British musician Paul Hardcastle. * "Nineteen", a song by Bad4Good from the 1992 album ''Refugee'' * "Nineteen", a song by Karma to Burn from the 2001 album ''Almost Heathen''. * "Nineteen" (song), a 2007 song by American singer Billy Ray Cyrus. * "Nineteen", a song by Tegan and Sara from the 2007 album '' The Con''. * "XIX" (song), a 2014 song by Slipknot. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |