|

Revenue Act Of 1861

The Revenue Act of 1861, formally cited as Act of August 5, 1861, Chap. XLV, 12 Stat. 292', included the first U.S. Federal income tax statute (seSec.49. The Act, motivated by the need to fund the Civil War, imposed an income tax to be "levied, collected, and paid, upon the annual income of every person residing in the United States, whether such income is derived from any kind of property, or from any profession, trade, employment, or vocation carried on in the United States or elsewhere, or from any other source whatever . . . . The tax imposed was a flat tax, with a rate of 3% on incomes above $800. The Revenue Act of 1861 was signed into law by Abraham Lincoln. The income tax provisionSections 49, 50 and 51 was repealed by the Revenue Act of 1862. (SeSec.89 which replaced the flat rate with a progressive scale of 3% on annual incomes beyond $600 (which was 3.4 times the 1862 nominal gross domestic product per capita of $177.69; the corresponding income in 2021 is $234K) an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William Pitt Fessenden

William Pitt Fessenden (October 16, 1806September 8, 1869) was an American politician from the U.S. state of Maine. Fessenden was a Whig (later a Republican) and member of the Fessenden political family. He served in the United States House of Representatives and Senate before becoming Secretary of the Treasury under President Abraham Lincoln during the American Civil War. Fessenden then re-entered the Senate, where he died in office in 1869. A lawyer, he was a leading antislavery Whig in Maine; in Congress, he fought the Slave Power, plantation owners who controlled Southern states. He built an antislavery coalition in the state legislature that elected him to the U.S. Senate; it became Maine's Republican organization. In the Senate, Fessenden played a central role in the debates on Kansas, denouncing the expansion of slavery. He led Radical Republicans in attacking Democrats Stephen Douglas, Franklin Pierce, and James Buchanan. Fessenden's speeches were read widely, influe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Federal Taxation Legislation

United may refer to: Places * United, Pennsylvania, an unincorporated community * United, West Virginia, an unincorporated community Arts and entertainment Films * ''United'' (2003 film), a Norwegian film * ''United'' (2011 film), a BBC Two film Literature * ''United!'' (novel), a 1973 children's novel by Michael Hardcastle Music * United (band), Japanese thrash metal band formed in 1981 Albums * ''United'' (Commodores album), 1986 * ''United'' (Dream Evil album), 2006 * ''United'' (Marvin Gaye and Tammi Terrell album), 1967 * ''United'' (Marian Gold album), 1996 * ''United'' (Phoenix album), 2000 * ''United'' (Woody Shaw album), 1981 Songs * "United" (Judas Priest song), 1980 * "United" (Prince Ital Joe and Marky Mark song), 1994 * "United" (Robbie Williams song), 2000 * "United", a song by Danish duo Nik & Jay featuring Lisa Rowe Television * ''United'' (TV series), a 1990 BBC Two documentary series * ''United!'', a soap opera that aired on BBC One from 1965-19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

37th United States Congress

The 37th United States Congress was a meeting of the legislative branch of the United States federal government, consisting of the United States Senate and the United States House of Representatives. It met in Washington, D.C. from March 4, 1861, to March 4, 1863, during the first two years of Abraham Lincoln's presidency. * May 20, 1861: North Carolina Secession Convention enacted an Ordinance of Secession. * May 23, 1861: Virginia popular referendum ratified Ordinance of Secession. 5 of 12 U.S. Representatives remained. Two senators from the "Restored Government of Virginia" replaced the two who withdrew. * June 8, 1861: Tennessee popular referendum ratified Ordinance of Secession. 3 of 10 U.S. Representatives remain. One Senator, Andrew Johnson, remained. * July 21, 1861: First Battle of Bull Run Union approach to Richmond is repulsed. * September 17, 1862: Battle of Antietam rebel invasion into Maryland is repulsed. * September 22, 1862: Emancipation Proclamation ordered, to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure provided over a fifth of the Union's war expenses before being allowed to expire a decade later. In 1913, the Sixteenth Amendment to the U.S. Constitutio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cape Of Good Hope

The Cape of Good Hope ( af, Kaap die Goeie Hoop ) ;''Kaap'' in isolation: pt, Cabo da Boa Esperança is a rocky headland on the Atlantic coast of the Cape Peninsula in South Africa. A common misconception is that the Cape of Good Hope is the southern tip of Africa, based on the misbelief that the Cape was the dividing point between the Atlantic and Indian oceans, and have nothing to do with north or south. In fact, by looking at a map, the southernmost point of Africa is Cape Agulhas about to the east-southeast. The currents of the two oceans meet at the point where the warm-water Agulhas current meets the cold-water Benguela current and turns back on itself. That oceanic meeting point fluctuates between Cape Agulhas and Cape Point (about east of the Cape of Good Hope). When following the western side of the African coastline from the equator, however, the Cape of Good Hope marks the point where a ship begins to travel more eastward than southward. Thus, the first mode ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ad Valorem

An ''ad valorem'' tax (Latin for "according to value") is a tax whose amount is based on the value of a transaction or of property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ''ad valorem'' tax may also be imposed annually, as in the case of a real or personal property tax, or in connection with another significant event (e.g. inheritance tax, expatriation tax, or tariff). In some countries, a stamp duty is imposed as an ''ad valorem'' tax. Operation All ad valorem taxes are collected according to the determined value of the taxed item. In the most common application of ad valorem taxes, namely municipal property taxes, public tax assessors regularly assess the property owner's real estate in order to determine its current value. The determined value of the property is used to calculate the annual tax collected by the municipality or any other government entity upon the property owner. Ad valorem taxes are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sulfur

Sulfur (or sulphur in British English) is a chemical element with the symbol S and atomic number 16. It is abundant, multivalent and nonmetallic. Under normal conditions, sulfur atoms form cyclic octatomic molecules with a chemical formula S8. Elemental sulfur is a bright yellow, crystalline solid at room temperature. Sulfur is the tenth most abundant element by mass in the universe and the fifth most on Earth. Though sometimes found in pure, native form, sulfur on Earth usually occurs as sulfide and sulfate minerals. Being abundant in native form, sulfur was known in ancient times, being mentioned for its uses in ancient India, ancient Greece, China, and ancient Egypt. Historically and in literature sulfur is also called brimstone, which means "burning stone". Today, almost all elemental sulfur is produced as a byproduct of removing sulfur-containing contaminants from natural gas and petroleum.. Downloahere The greatest commercial use of the element is the production o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States House Committee On Ways And Means

The Committee on Ways and Means is the chief tax-writing committee of the United States House of Representatives. The committee has jurisdiction over all taxation, tariffs, and other revenue-raising measures, as well as a number of other programs including Social Security, unemployment benefits, Medicare, the enforcement of child support laws, Temporary Assistance for Needy Families, foster care, and adoption programs. Members of the Ways and Means Committee are not allowed to serve on any other House Committee unless they are granted a waiver from their party's congressional leadership. It has long been regarded as the most prestigious committee of the House of Representatives. The United States Constitution requires that all bills regarding taxation must originate in the U.S. House of Representatives, and House rules dictate that all bills regarding taxation must pass through Ways and Means. This system imparts upon the committee and its members a significant degree of influe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thaddeus Stevens

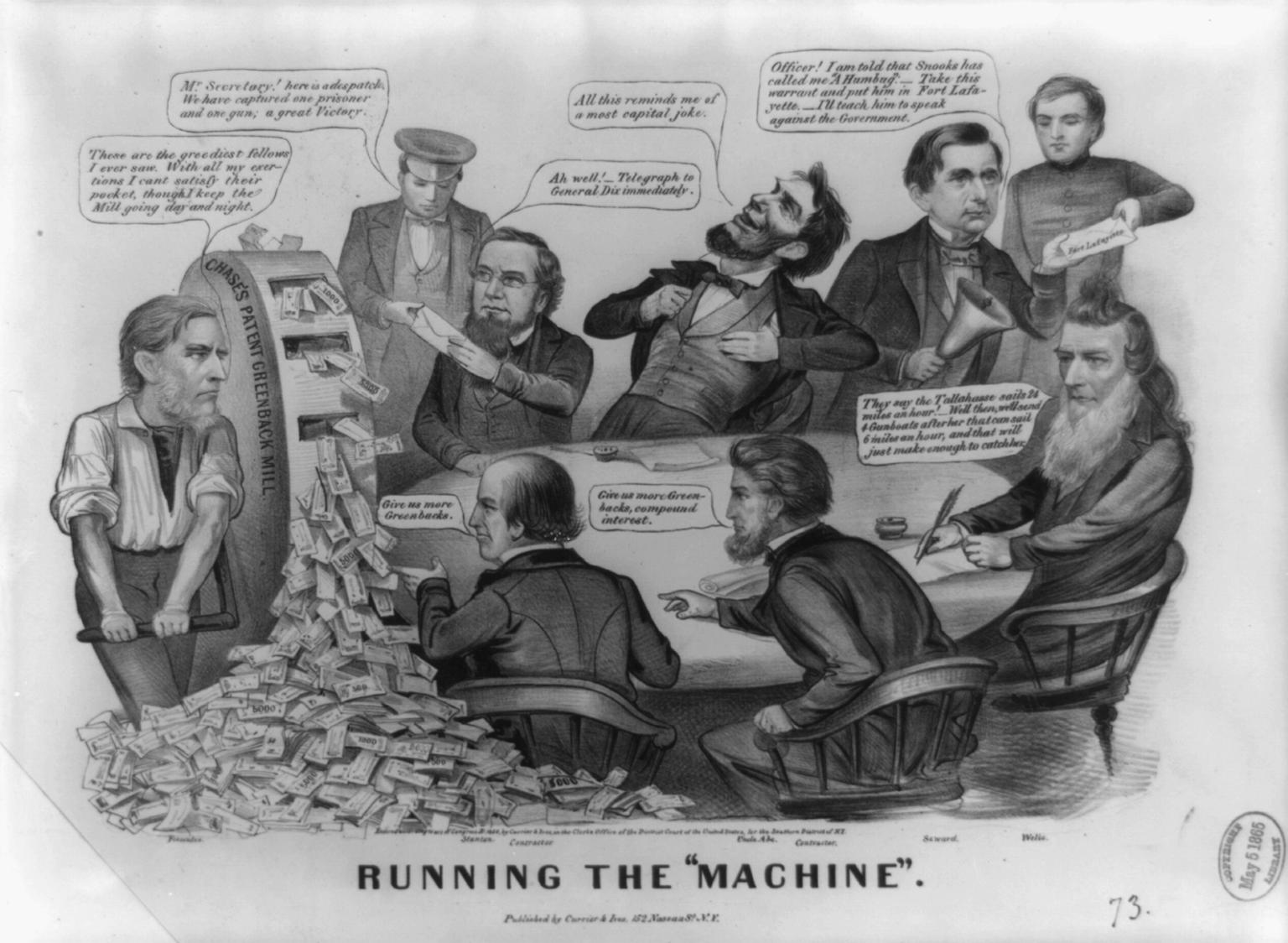

Thaddeus Stevens (April 4, 1792August 11, 1868) was a member of the United States House of Representatives from Pennsylvania, one of the leaders of the Radical Republican faction of the Republican Party during the 1860s. A fierce opponent of slavery and discrimination against black Americans, Stevens sought to secure their rights during Reconstruction, leading the opposition to U.S. President Andrew Johnson. As chairman of the House Ways and Means Committee during the American Civil War, he played a leading role, focusing his attention on defeating the Confederacy, financing the war with new taxes and borrowing, crushing the power of slave owners, ending slavery, and securing equal rights for the freedmen. Stevens was born in rural Vermont, in poverty, and with a club foot, which left him with a permanent limp. He moved to Pennsylvania as a young man and quickly became a successful lawyer in Gettysburg. He interested himself in municipal affairs and then in politics. He was elec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Senate Finance Committee

The United States Senate Committee on Finance (or, less formally, Senate Finance Committee) is a standing committee of the United States Senate. The Committee concerns itself with matters relating to taxation and other revenue measures generally, and those relating to the insular possessions; bonded debt of the United States; customs, collection districts, and ports of entry and delivery; deposit of public moneys; general revenue sharing; health programs under the Social Security Act (notably Medicare and Medicaid) and health programs financed by a specific tax or trust fund; national social security; reciprocal trade agreements; tariff and import quotas, and related matters thereto; and the transportation of dutiable goods. It is considered to be one of the most powerful committees in Congress. History The Committee on Finance is one of the original committees established in the Senate. First created on December 11, 1815, as a select committee and known as the Committee o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |