|

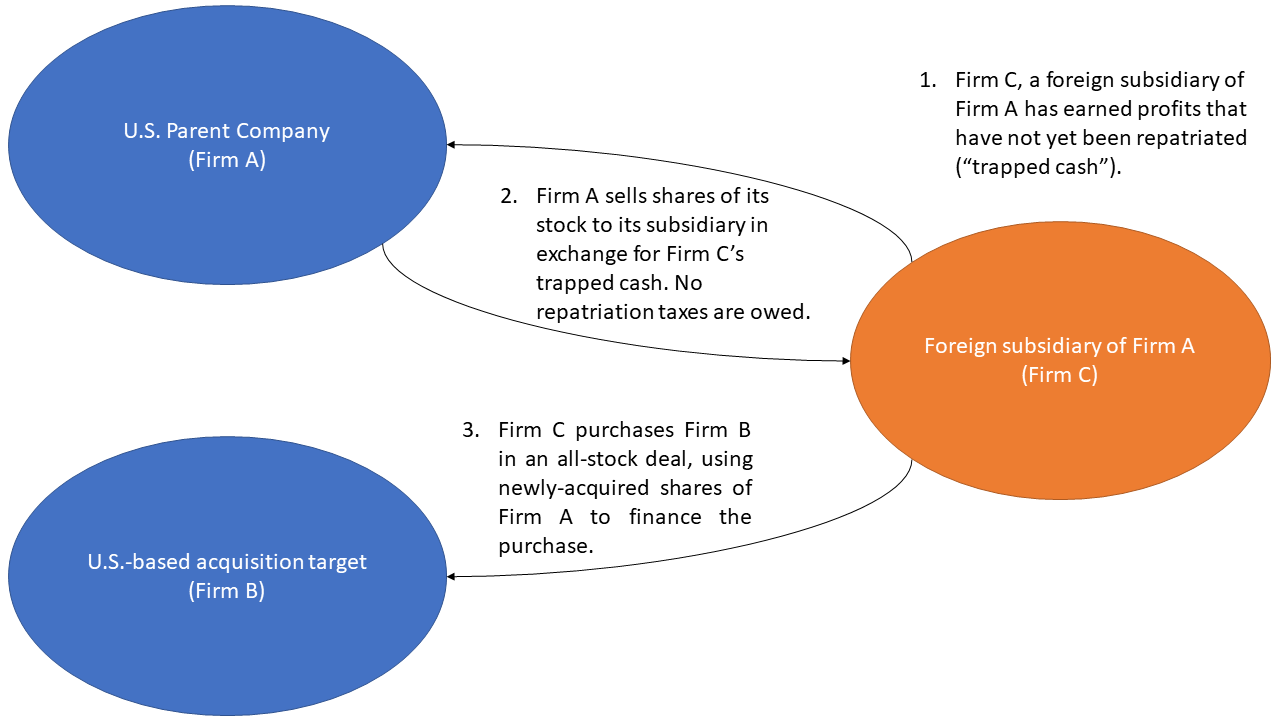

Repatriation Tax Avoidance

Repatriation tax avoidance is the legal use of a tax regime within a country in order to repatriate income earned by foreign subsidiaries to a parent corporation while avoiding taxes ordinarily owed to the parent's country on the repatriation of foreign income. Prior to the passage of the Tax Cuts and Jobs Act of 2017, multinational firms based in the United States owed the U.S. government taxes on worldwide income. Companies avoided taxes on the repatriation of income earned abroad through a variety of strategies involving the use of mergers and acquisitions. Three main types of strategies emerged and were given names—the "Killer B", "Deadly D", and "Outbound F"—each of which took advantage of a different area of the Internal Revenue Code to conduct tax-exempt corporate reorganizations. The application of repatriation tax avoidance strategies has drawn public scrutiny. Several large corporate acquisitions have involved significant repatriation tax avoidance strategies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidiary

A subsidiary, subsidiary company or daughter company is a company owned or controlled by another company, which is called the parent company or holding company. Two or more subsidiaries that either belong to the same parent company or having a same management being substantially controlled by same entity/group are called sister companies. The subsidiary can be a company (usually with limited liability) and may be a government- or state-owned enterprise. They are a common feature of modern business life, and most multinational corporations organize their operations in this way. Examples of holding companies are Berkshire Hathaway, Jefferies Financial Group, The Walt Disney Company, Warner Bros. Discovery, or Citigroup; as well as more focused companies such as IBM, Xerox, and Microsoft. These, and others, organize their businesses into national and functional subsidiaries, often with multiple levels of subsidiaries. Details Subsidiaries are separate, distinct legal entit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Killer B Pseudo-reorganization Acquisition Diagram

A killer is someone or something that kills, such as a murderer or a serial killer. Killer may also refer to: Arts, entertainment, and media Fictional characters * Killer (''Home and Away''), a character from ''Home and Away'' * Killer Kane, the villain of the 1939 Buck Rogers film serial Films * ''Killer!'' (1969 film), an alternative title for ''This Man Must Die'' * ''Killer'' (1991 film), a Telugu film starring Akkineni Nagarjuna * ''Killer'' (1994 film) (a.k.a. ''Bulletproof Heart''), a film starring Anthony LaPaglia and Mimi Rogers, and featuring Peter Boyle * ''Killer: A Journal of Murder'' (film), a 1996 film about serial killer Carl Panzram * ''Killer'' (1998 film), a French/Kazakhstani crime drama Games * Killer (game), a parlor game played with cards and candles * Killer (pool), a multi-player pocket billiards (pool) game * Killer, a climbing card game related to tiến lên * Killer, a variant of the game of darts * Assassin (game), or Killer, a live-actio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dutch Sandwich

Dutch Sandwich is a base erosion and profit shifting (BEPS) corporate tax tool, used mostly by U.S. multinationals to avoid incurring EU withholding taxes on untaxed profits as they were being moved to non-EU tax havens (such as the Bermuda black hole). These untaxed profits could have originated from within the EU, or from outside the EU, but in most cases were routed to major EU corporate-focused tax havens, such as Ireland and Luxembourg, by the use of other BEPS tools. The Dutch Sandwich was often used with Irish BEPS tools such as the Double Irish, the Single Malt and the Capital Allowances for Intangible Assets ("CAIA") tools. In 2010, Ireland changed its tax-code to enable Irish BEPS tools to avoid such withholding taxes without needing a Dutch Sandwich. Explanation The structure relies on the tax loophole that most EU countries will allow royalty payments be made to other EU countries without incurring withholding taxes. However, the Dutch tax code allows roy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Janssen Pharmaceuticals

Janssen Pharmaceuticals is a pharmaceutical company headquartered in Beerse, Belgium, and wholly-owned by Johnson & Johnson. It was founded in 1953 by Paul Janssen. In 1961, Janssen Pharmaceuticals was purchased by New Jersey-based American corporation Johnson & Johnson, and became part of Johnson & Johnson Pharmaceutical Research and Development (J&J PRD), now renamed to Janssen Research and Development (JRD), which conducts research and development activities related to a wide range of human medical disorders, including mental illness, neurological disorders, anesthesia and analgesia, gastrointestinal disorders, fungal infection, HIV/AIDS, allergies and cancer. Janssen and Ortho-McNeil Pharmaceutical have been placed in the Ortho-McNeil-Janssen group within Johnson & Johnson Company. Subsidiaries * Actelion * Cilag AG * Janssen Biotech (formerly ''Centocor'') * Janssen Vaccines (formerly ''Crucell'') * Tibotec * Beijing Dabao Cosmetics Co., Ltd. History The early root ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published six days a week by Dow Jones & Company, a division of News Corp. The newspaper is published in the broadsheet format and online. The ''Journal'' has been printed continuously since its inception on July 8, 1889, by Charles Dow, Edward Jones, and Charles Bergstresser. The ''Journal'' is regarded as a newspaper of record, particularly in terms of business and financial news. The newspaper has won 38 Pulitzer Prizes, the most recent in 2019. ''The Wall Street Journal'' is one of the largest newspapers in the United States by circulation, with a circulation of about 2.834million copies (including nearly 1,829,000 digital sales) compared with '' USA Today''s 1.7million. The ''Journal'' publishes the luxury news and lifestyle magazine ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Big Four Accounting Firms

The Big Four are the four largest professional services networks in the world, the global accounting networks Deloitte, Ernst & Young (EY), KPMG, and PricewaterhouseCoopers (PwC). The four are often grouped because they are comparable in size relative to the rest of the market, both in terms of revenue and workforce; they are considered equal in their ability to provide a wide scope of professional services to their clients; and, among those looking to start a career in professional services, particularly accounting, they are considered equally attractive networks to work in, because of the frequency with which these firms engage with ''Fortune'' 500 companies. The Big Four each offer audit, assurance, taxation, management consulting, actuarial, corporate finance, and legal services to their clients. A significant majority of the audits of public companies, as well as many audits of private companies, are conducted by these four networks. Until the late 20th century, the mark ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of security under which the issuer ( debtor) owes the holder ( creditor) a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in a company (i.e. they are owners), whereas bondholders have a creditor stake in a company (i.e. they are lenders). As creditors, bondholders have priority over stockholders. This means they will be repaid in advance of stockholders, but will rank b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deloitte

Deloitte Touche Tohmatsu Limited (), commonly referred to as Deloitte, is an international professional services network headquartered in London, England. Deloitte is the largest professional services network by revenue and number of professionals in the world and is considered one of the Big Four accounting firms along with EY (Ernst & Young), KPMG and PricewaterhouseCoopers (PWC). The firm was founded by William Welch Deloitte in London in 1845 and expanded into the United States in 1890. It merged with Haskins & Sells to form Deloitte Haskins & Sells in 1972 and with Touche Ross in the US to form Deloitte & Touche in 1989. In 1993, the international firm was renamed Deloitte Touche Tohmatsu, later abbreviated to Deloitte. In 2002, Arthur Andersen's practice in the UK as well as several of that firm's practices in Europe and North and South America agreed to merge with Deloitte. Subsequent acquisitions have included Monitor Group, a large strategy consulting business, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Outbound F Pseudo-reorganization Acquisition Diagram

{{disambiguation ...

Outbound refers to a direction of trains, other transport, or roads that travel away from the city center. It may also refer to: __NOTOC__ Arts, entertainment, and media Music * ''Outbound'' (Béla Fleck and the Flecktones album), 2000 * ''Outbound'' (Christian Bautista album) * ''Outbound'' (Keldian album), an album by symphonic power metal band Keldian * ''Outbound'' (Stuart Hamm album) Other arts, entertainment, and media * ''Outbound'' (film), a Romanian film Brands and enterprises *Outbound Systems, manufacturer of the Outbound Laptop, an early Apple Macintosh compatible laptop computer *Rans S-21 Outbound, an American kit aircraft design See also *Outward Bound (other) Outward Bound is an international network of non-profit organizations which runs adventure and wilderness education programs. Outward Bound may also refer to: Outward Bound-affiliated organizations * Outward Bound Australia * Outward Bound Costa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deadly D Pseudo-reorganization Acquisition Diagram

Deadly may refer to: * Deadliness, the ability to cause death Arts and entertainment * ''Deadly'', a 2011 novel by Julie Chibbaro * ''Deadly'', a children's book series by Morris Gleitzman and Paul Jennings * ''Deadly'' (Australian TV series), an Australian children's television cartoon series * ''Deadly'' (film), a 1991 Australian film * ''Deadly'' (franchise), a British wildlife TV documentary series * Deadly Awards, also known as The Deadlys, awards for excellence given to Indigenous Australians for achievement in music, sport, entertainment and community * ''Karla'' (film), a 2006 American movie originally titled ''Deadly'' Other uses * Alan Dedicoat (born 1954), BBC announcer nicknamed "Deadly" * Deadly, a word in Aboriginal Australian English meaning excellent, similar to "wicked" or "awesome" in English slang See also * Lethal (other) *Deadly Nannas, Australian singing group *Uncle Deadly (Muppet), a Muppets character * "Too Deadly", an episode of ''Wapos Ba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Slate (magazine)

''Slate'' is an online magazine that covers current affairs, politics, and culture in the United States. It was created in 1996 by former ''The New Republic, New Republic'' editor Michael Kinsley, initially under the ownership of Microsoft as part of MSN. In 2004, it was purchased by Graham Holdings, The Washington Post Company (later renamed the Graham Holdings Company), and since 2008 has been managed by The Slate Group, an online publishing entity created by Graham Holdings. ''Slate'' is based in New York City, with an additional office in Washington, D.C. ''Slate'', which is updated throughout the day, covers politics, arts and culture, sports, and news. According to its former editor-in-chief Julia Turner (journalist), Julia Turner, the magazine is "not fundamentally a breaking news source", but rather aimed at helping readers to "analyze and understand and interpret the world" with witty and entertaining writing. As of mid-2015, it publishes about 1,500 stories per month. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure provided over a fifth of the Union's war expenses before being allowed to expire a decade later. In 1913, the Sixteenth Amendment to the U.S. Consti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)