|

Probability Of Default

Probability of default (PD) is a financial term describing the likelihood of a default over a particular time horizon. It provides an estimate of the likelihood that a borrower will be unable to meet its debt obligations. PD is used in a variety of credit analyses and risk management frameworks. Under Basel II, it is a key parameter used in the calculation of economic capital or regulatory capital for a banking institution. PD is closely linked to the expected loss, which is defined as the product of the PD, the loss given default (LGD) and the exposure at default (EAD). Overview The probability of default is an estimate of the likelihood that the default event will occur. It applies to a particular assessment horizon, usually one year. Credit scores, such as FICO for consumers or bond ratings from S&P, Fitch or Moodys for corporations or governments, typically imply a certain probability of default. For group of obligors sharing similar credit risk characteristics such as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Default (finance)

In finance, default is failure to meet the legal obligations (or conditions) of a loan, for example when a home buyer fails to make a mortgage payment, or when a corporation or government fails to pay a bond which has reached maturity. A national or sovereign default is the failure or refusal of a government to repay its national debt. The biggest private default in history is Lehman Brothers, with over $600 billion when it filed for bankruptcy in 2008. The biggest sovereign default is Greece, with $138 billion in March 2012. Distinction from insolvency, illiquidity and bankruptcy The term "default" should be distinguished from the terms " insolvency", illiquidity and "bankruptcy": * Default: Debtors have been passed behind the payment deadline on a debt whose payment was due. * Illiquidity: Debtors have insufficient cash (or other "liquefiable" assets) to pay debts. * Insolvency: A legal term meaning debtors are unable to pay their debts. * Bankruptcy: A legal finding ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or financial instrument, instrument at a specified strike price on or before a specified expiration (options), date, depending on the Option style, style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a Valuation of options, valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in ''Over-the-counter (finance), over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that all ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Classification Tree

Classification chart or classification tree is a synopsis of the classification scheme, designed to illustrate the structure of any particular field. Overview Classification is the process in which ideas and objects are recognized, differentiated, and understood, and classification charts are intended to help create and eventually visualize the outcome. According to Brinton "in a classification chart the facts, data etc. are arranged so that the place of each in relation to all others is readily seen. Quantities need not be given, although a quantitative analysis adds to the value of a classification chart." Willard Cope Brinton, ''Graphic presentation.'' 1939. p. 43 Karsten (1923) explained, that "in all chart-making, the material to be shown must be accurately compiled before it can be charted. For an understanding of the classification chart, we must delve somewhat into the mysteries of the classification and indexing. The art of classification calls into play the power of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Artificial Neural Network

Artificial neural networks (ANNs), usually simply called neural networks (NNs) or neural nets, are computing systems inspired by the biological neural networks that constitute animal brains. An ANN is based on a collection of connected units or nodes called artificial neurons, which loosely model the neurons in a biological brain. Each connection, like the synapses in a biological brain, can transmit a signal to other neurons. An artificial neuron receives signals then processes them and can signal neurons connected to it. The "signal" at a connection is a real number, and the output of each neuron is computed by some non-linear function of the sum of its inputs. The connections are called ''edges''. Neurons and edges typically have a ''weight'' that adjusts as learning proceeds. The weight increases or decreases the strength of the signal at a connection. Neurons may have a threshold such that a signal is sent only if the aggregate signal crosses that threshold. Typically, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cox Proportional Hazards Model

Proportional hazards models are a class of survival models in statistics. Survival models relate the time that passes, before some event occurs, to one or more covariates that may be associated with that quantity of time. In a proportional hazards model, the unique effect of a unit increase in a covariate is multiplicative with respect to the hazard rate. For example, taking a drug may halve one's hazard rate for a stroke occurring, or, changing the material from which a manufactured component is constructed may double its hazard rate for failure. Other types of survival models such as accelerated failure time models do not exhibit proportional hazards. The accelerated failure time model describes a situation where the biological or mechanical life history of an event is accelerated (or decelerated). Background Survival models can be viewed as consisting of two parts: the underlying baseline hazard function, often denoted \lambda_0(t), describing how the risk of event per t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panel Analysis

Panel (data) analysis is a statistical method, widely used in social science, epidemiology, and econometrics to analyze two-dimensional (typically cross sectional and longitudinal) panel data. The data are usually collected over time and over the same individuals and then a regression is run over these two dimensions. Multidimensional analysis is an econometric method in which data are collected over more than two dimensions (typically, time, individuals, and some third dimension). A common panel data regression model looks like y_=a+bx_+\varepsilon_, where y is the dependent variable Dependent and independent variables are variables in mathematical modeling, statistical modeling and experimental sciences. Dependent variables receive this name because, in an experiment, their values are studied under the supposition or dema ..., x is the independent variable, a and b are coefficients, i and t are Indexed family, indices for individuals and time. The error \varepsilon_ is v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Probit

In probability theory and statistics, the probit function is the quantile function associated with the standard normal distribution. It has applications in data analysis and machine learning, in particular exploratory statistical graphics and specialized regression modeling of binary response variables. Mathematically, the probit is the inverse of the cumulative distribution function of the standard normal distribution, which is denoted as \Phi(z), so the probit is defined as :\operatorname(p) = \Phi^(p) \quad \text \quad p \in (0,1). Largely because of the central limit theorem, the standard normal distribution plays a fundamental role in probability theory and statistics. If we consider the familiar fact that the standard normal distribution places 95% of probability between −1.96 and 1.96, and is symmetric around zero, it follows that :\Phi(-1.96) = 0.025 = 1-\Phi(1.96).\,\! The probit function gives the 'inverse' computation, generating a value of a standard normal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Logit

In statistics, the logit ( ) function is the quantile function associated with the standard logistic distribution. It has many uses in data analysis and machine learning, especially in data transformations. Mathematically, the logit is the inverse of the standard logistic function \sigma(x) = 1/(1+e^), so the logit is defined as :\operatorname p = \sigma^(p) = \ln \frac \quad \text \quad p \in (0,1). Because of this, the logit is also called the log-odds since it is equal to the logarithm of the odds \frac where is a probability. Thus, the logit is a type of function that maps probability values from (0, 1) to real numbers in (-\infty, +\infty), akin to the probit function. Definition If is a probability, then is the corresponding odds; the of the probability is the logarithm of the odds, i.e.: :\operatorname(p)=\ln\left( \frac \right) =\ln(p)-\ln(1-p)=-\ln\left( \frac-1\right)=2\operatorname(2p-1) The base of the logarithm function used is of little importance in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

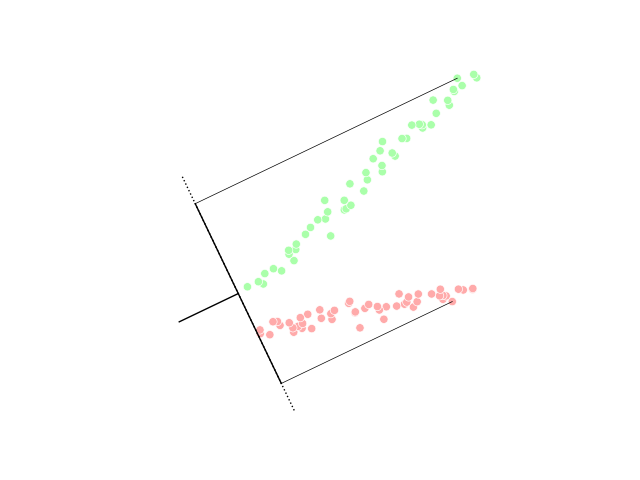

Discriminant Analysis

Linear discriminant analysis (LDA), normal discriminant analysis (NDA), or discriminant function analysis is a generalization of Fisher's linear discriminant, a method used in statistics and other fields, to find a linear combination of features that characterizes or separates two or more classes of objects or events. The resulting combination may be used as a linear classifier, or, more commonly, for dimensionality reduction before later classification. LDA is closely related to analysis of variance (ANOVA) and regression analysis, which also attempt to express one dependent variable as a linear combination of other features or measurements. However, ANOVA uses categorical independent variables and a continuous dependent variable, whereas discriminant analysis has continuous independent variables and a categorical dependent variable (''i.e.'' the class label). Logistic regression and probit regression are more similar to LDA than ANOVA is, as they also explain a categorical va ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Linear Regression

In statistics, linear regression is a linear approach for modelling the relationship between a scalar response and one or more explanatory variables (also known as dependent and independent variables). The case of one explanatory variable is called '' simple linear regression''; for more than one, the process is called multiple linear regression. This term is distinct from multivariate linear regression, where multiple correlated dependent variables are predicted, rather than a single scalar variable. In linear regression, the relationships are modeled using linear predictor functions whose unknown model parameters are estimated from the data. Such models are called linear models. Most commonly, the conditional mean of the response given the values of the explanatory variables (or predictors) is assumed to be an affine function of those values; less commonly, the conditional median or some other quantile is used. Like all forms of regression analysis, linear regressio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Euphemism

A euphemism () is an innocuous word or expression used in place of one that is deemed offensive or suggests something unpleasant. Some euphemisms are intended to amuse, while others use bland, inoffensive terms for concepts that the user wishes to downplay. Euphemisms may be used to mask profanity or refer to topics some consider taboo such as disability, sex, excretion, or death in a polite way. Etymology ''Euphemism'' comes from the Greek word () which refers to the use of 'words of good omen'; it is a compound of (), meaning 'good, well', and (), meaning 'prophetic speech; rumour, talk'. '' Eupheme'' is a reference to the female Greek spirit of words of praise and positivity, etc. The term ''euphemism'' itself was used as a euphemism by the ancient Greeks; with the meaning "to keep a holy silence" (speaking well by not speaking at all). Purpose Avoidance Reasons for using euphemisms vary by context and intent. Commonly, euphemisms are used to avoid directly addressing sub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Score

A credit score is a numerical expression based on a level analysis of a person's credit files, to represent the creditworthiness of an individual. A credit score is primarily based on a credit report, information typically sourced from credit bureaus. Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to consumers and to mitigate losses due to bad debt. Lenders use credit scores to determine who qualifies for a loan, at what interest rate, and what credit limits. Lenders also use credit scores to determine which customers are likely to bring in the most revenue. Credit scoring is not limited to banks. Other organizations, such as mobile phone companies, insurance companies, landlords, and government departments employ the same techniques. Digital finance companies such as online lenders also use alternative data sources to calculate the creditworthiness of borrowers. By country Australia In Australia, c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |