|

Planters Development Bank

Planters Development Bank, more commonly known as Plantersbank, was a major private development bank in the Philippines which mainly catered to small and medium enterprises (SMEs). At its peak, it was the largest private development bank in the country. It was a China Banking Corporation subsidiary from 2014 until it was merged to its parent company's savings bank in 2016. History Businessman Jesus Tambunting is credited to have founded Planters Development Bank. The bank traces its roots to two banking institutions in Bulacan; the Bulacan Development Bank (BDB) which was founded in 1961 in San Miguel and the Bulacan Savings and Loan Association (BSLA) of Malolos.At least one these banks in Bulacan catered to entrepreneurs from the countryside who runs small and medium enterprises (SMEs). The Tambunting Group acquired the BSLA in July 1971 took over the BDB in December 1972. The two banks merged in December 1975 with the BDB the surviving entity. The BDB was renamed the Planters ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

San Miguel, Bulacan

San Miguel, officially the Municipality of San Miguel ( tgl, Bayan ng San Miguel), is a 1st class municipality in the province of Bulacan, Philippines. According to the 2020 census, it has a population of 172,073 people. It is the third largest municipality by area in the province after Doña Remedios Trinidad and Norzagaray. Etymology There are two accounts on the origin of the town's name: * According to the 1953 journal ''History of Bulacan'', the town was originally named ''Mayumo'' from the Kapampangan term for "sweets". The name San Miguel was added by the Augustinian missionaries who selected Michael the Archangel as the patron saint of the town. * An account tells that the two leaders decided to form a town named Miguel De Mayumo after the name of Miguel Pineda and ''Mayumo'', from the Kapampangan term and for the goodwill and generosity of Mariano Puno. History The municipality of San Miguel de Mayumo was established in 1763 by Carlos Agustin Maniquiz, Maria Juana ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Malolos

Malolos, officially the City of Malolos ( fil, Lungsod ng Malolos), is a 1st class Cities of the Philippines#Legal classification, component city and capital of the Provinces of the Philippines, province of Bulacan, Philippines. According to the 2020 census, it has a population of 261,189 people. It is the capital city of the Provinces of the Philippines, province of Bulacan as the seat of the provincial government. The city is north of Manila, the capital city of the Philippines. It is one of the major suburbs conurbated to Metro Manila, situated in the southwestern part of Bulacan, in the Central Luzon Regions of the Philippines, Region (Region 3) in the island of Luzon and part of the Super regions of the Philippines, Metro Luzon Urban Beltway Super Region. Malolos was the site of the Constitutional convention (political meeting), constitutional convention of 1898, known as the Revolutionary Government of the Philippines, Malolos Convention, that led to the establishment o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Established In 1961

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the anc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies Based In Makati

A company, abbreviated as co., is a legal entity representing an association of people, whether natural, legal or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * business entities, whose aim is generating profit * financial entities and banks * programs or educational institutions A company can be created as a legal person so that the company itself has limited liability as members perform or fail to discharge their duty according to the publicly declared incorporation, or published policy. When a company closes, it may need to be liquidated to avoid further legal obligations. Companies may associate and collectively register themselves as new companies; the resulting entities are often known as corporate groups. Meanings and definitions A company can be defined as an "artificial per ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Of The Philippines

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the anc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Department Of Labor And Employment (Philippines)

The Department of Labor and Employment ( fil, Kagawaran ng Paggawa at Empleyo}, commonly abbreviated as DOLE) is one of the executive departments of the Philippine government mandated to formulate policies, implement programs and services, and serve as the policy-coordinating arm of the Executive Branch in the field of labor and employment. It is tasked with the enforcement of the provisions of the Labor Code. History The Department of Labor & Employment (DOLE) was founded on December 7, 1933, via the Act No. 4121 by the Philippine Legislature. It was renamed as Ministry of Labor and Employment in 1978. The agency was renamed as a department after the 1986 EDSA Revolution in 1986. List of the Secretaries of the Department of Labor and Employment Bureaus Bureau of Local Employment(BLE) Bureau of Labor Relations(BLR) Bureau of Working Conditions(BWC) Bureau of Workers with Special Concerns(BWSC) International Labor Affairs Bureau(ILAB) Attached Agencies Employees' Compen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Henry Sy

Henry Tan Chi Sieng Sy Sr. (; ; October 15, 1924 – January 19, 2019) was a Filipino businessman and investor. Born in Fujian, he moved with his family to the Philippines at age 12. While his family returned to China, he stayed behind and founded ShoeMart, a small Manila shoe store, in 1958. Over the decades he developed ShoeMart into SM Investments, one of the largest conglomerates in the Philippines, including 49 SM malls in the Philippines and China, 62 department stores, 56 supermarkets and over 200 grocery stores. SM also owns Banco de Oro, the second-largest bank in the Philippines, as well as real estate holdings. For eleven straight years until his death, Sy was named by ''Forbes'' as the richest person in the Philippines. When he died, his net worth was estimated at US$19 billion. Early life and education Henry Sy, also known as ''Sy Chi Sieng'' in Philippine Hokkien (''Shī Zhìchéng'' in Mandarin), was born in Jinjiang in Fujian, then still under the Republi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Baliuag

Baliwag or Baliuag, officially the City of Baliwag ( fil, Lungsod ng Baliwag), is a component city in the province of Bulacan, Philippines. According to the 2020 census, it has a population of 168,470 people. Baliuag was founded in 1732 by Augustinian friars and was incorporated by the Spanish Governor-General on May 26, 1733. The city was a part of Quingua (now Plaridel) before. Baliwag is from Malolos and from Manila. Through the years of Spanish domination, Baliuag was predominantly agricultural. People had to depend on rice farming for the main source of livelihood. Orchards and ''tumanas'' yielded fruits and vegetables, which were sold in the public market. Commerce and industry also played important contributions to the economy of the people. Buntal hat weaving in Baliwag together with silk weaving popularly known in the world as Thai silk; the manufacturer of cigar cases, piña fibers, petates (mats), and Sillas de Bejucos (cane chairs) all of the fine quality became k ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Small And Medium Enterprises

Small and medium-sized enterprises (SMEs) or small and medium-sized businesses (SMBs) are businesses whose personnel and revenue numbers fall below certain limits. The abbreviation "SME" is used by international organizations such as the World Bank, the European Union, the United Nations, and the World Trade Organization (WTO). In any given national economy, SMEs sometimes outnumber large companies by a wide margin and also employ many more people. For example, Australian SMEs makeup 98% of all Australian businesses, produce one-third of the total GDP (gross domestic product) and employ 4.7 million people. In Chile, in the commercial year 2014, 98.5% of the firms were classified as SMEs. In Tunisia, the self-employed workers alone account for about 28% of the total non-farm employment, and firms with fewer than 100 employees account for about 62% of total employment. The United States' SMEs generate half of all U.S. jobs, but only 40% of GDP. Developing countries tend to have a lar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bulacan

Bulacan, officially the Province of Bulacan ( tl, Lalawigan ng Bulacan), is a province in the Philippines located in the Central Luzon region. Its capital is the city of Malolos. Bulacan was established on August 15, 1578, and part of the Metro Luzon Urban Beltway Super Region. It has 569 barangays in 20 municipalities and four component cities (Baliuag, Malolos the provincial capital, Meycauayan, and San Jose del Monte). Bulacan is located immediately north of Metro Manila. Bordering Bulacan are the provinces of Pampanga to the west, Nueva Ecija to the north, Aurora and Quezon to the east, and Metro Manila and Rizal to the south. Bulacan also lies on the north-eastern shore of Manila Bay. In the 2020 census, Bulacan had a population of 3,708,890 people, the most populous in Central Luzon and the third most populous in the Philippines, after Cebu and Cavite. Bulacan's most populated city is San Jose del Monte, the most populated municipality is Santa Maria while the least po ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

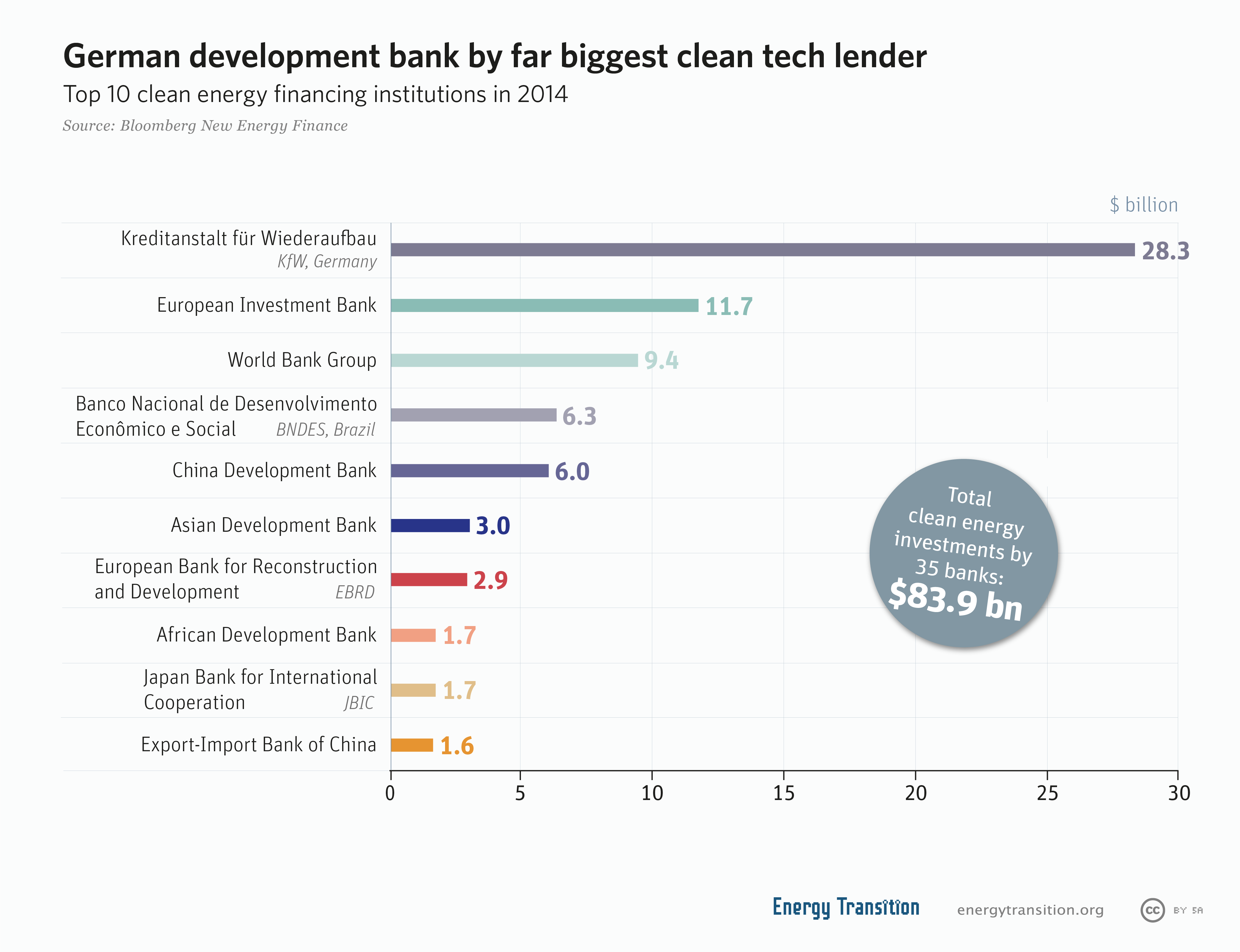

Development Bank

A development financial institution (DFI), also known as a development bank or development finance company (DFC), is a financial institution that provides risk capital for economic development projects on a non-commercial basis. , total commitments (as loans, equity, guarantees and debt securities) of the major regional, multilateral and bilateral DFIs totaled US$45 billion (US$21.3 billion of which went to support the private sector). Mandate DFIs can play a crucial role in financing private and public sector investments in developing countries, in the form of higher risk loans, equity positions, and guarantees.Dirk Willem te Velde and Michael Warner (2007Use of subsidies by Development Finance Institutions in the infrastructure sector Overseas Development Institute DFIs often provide finance to the private sector for investments that promote development and to help companies to invest, especially in countries with various restrictions on the market. Some development banks i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services

Financial services are the Service (economics), economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, accountancy companies, consumer finance, consumer-finance companies, brokerage firm, stock brokerages, investment management, investment funds, individual asset managers, and some government-sponsored enterprises. History The term "financial services" became more prevalent in the United States partly as a result of the Gramm-Leach-Bliley Act, GrammLeachBliley Act of the late 1990s, which enabled different types of companies operating in the U.S. financial services industry at that time to merge. Companies usually have two distinct approaches to this new type of business. One approach would be a bank that simply buys an insurance company or an investment bank, keeps the original brands of the acquired firm, and adds the Takeover, acquisit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_respondents_in_East_Africa.png)