|

Petroleum Revenue Tax Act 1980

The Petroleum Revenue Tax Act 1980 (1980 c. 1) is a UK Act of Parliament associated with UK enterprise law that made new provisions for petroleum revenue tax (introduced by the Oil Taxation Act 1975). The Act required that payments on account of tax should be made in advance of an assessment, and that interest payable on tax was brought forward. Background In introducing the Petroleum Revenue Tax Bill to Parliament in December 1979, the Treasury Minister of State, Peter Rees, admitted that the Bill was partly a response to the Government’s critical cash flow problem, caused by industrial action. The Bill was designed to advance the payments of petroleum revenue tax (PRT). It was estimated that the provisions would bring £700 million forward from 1980–81 into the financial year 1979–80. In addition, £300 million would be brought forward into 1980–81. It would also bring the regime for payment of PRT into line with that for the payment of royalties on North Sea oil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK Act Of Parliament

In the United Kingdom an act of Parliament is primary legislation passed by the Parliament of the United Kingdom. An act of Parliament can be enforced in all four of the constituent countries of the United Kingdom, UK constituent countries (England, Scotland, Wales and Northern Ireland); however as a result of Devolution in the United Kingdom, devolution the majority of acts that are now passed by Parliament apply either to England and Wales only, or England only; whilst generally acts only relating to Reserved and excepted matters, constitutional and reserved matters now apply to the whole of the United Kingdom. A draft piece of legislation is called a Bill (law), bill; when this is passed by Parliament and given Royal Assent, it becomes an act and part of statute law. Classification of legislation Acts of Parliament are classified as either "public general acts" or "local and personal acts" (also known as "private acts"). Bills are also classified as "public", "priva ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK Enterprise Law

United Kingdom enterprise law concerns the ownership and regulation of organisations producing goods and services in the UK, European and international economy. Private enterprises are usually incorporated under the Companies Act 2006, regulated by company law, competition law, and insolvency law, while almost one third of the workforce and half of the UK economy is in enterprises subject to special regulation. Enterprise law mediates the rights and duties of investors, workers, consumers and the public to ensure efficient production, and deliver services that UK and international law sees as universal human rights. Labour, company, competition and insolvency law create general rights for stakeholders, and set a basic framework for enterprise governance, but rules of governance, competition and insolvency are altered in specific enterprises to uphold the public interest, as well as civil and social rights. Universities and schools have traditionally been publicly established, an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oil Taxation Act 1975

The Oil Taxation Act 1975 (c 22) is a UK Act of Parliament relevant for UK enterprise law that was intended to ensure that oil and gas extraction companies operating in British territories and waters paid their fair share of tax. Over many years of amendments it was largely eliminated over 2015 and 2016, as the Petroleum Revenue Tax was cut to zero. Contents s 1, previously 50% now 0% Petroleum Revenue Tax. s 13, ring fence corporation tax, if ‘any oil extraction activities’ are undertaken or any ‘acquisition, enjoyment or exploitation of oil rights’ done, they are to be treated as a ‘separate trade, distinct from other activities’ carried out by the company. s 19, downstream activities (e.g. refining) or those outside the UK are not in the scope of the ring fence. Oil Taxation Act 1975 The Oil Taxation Act 1975 (1975 c. 22) received Royal Assent on 8 May 1975. Its long title is ‘An Act to impose a new tax in respect of profits from substances won or capable o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peter Rees, Baron Rees

Peter Wynford Innes Rees, Baron Rees, (9 December 1926 – 30 November 2008) was a British Conservative politician and barrister. He was Member of Parliament (MP) for Dover and Deal from 1974 to 1983 and MP for Dover from 1970 to 1974 and 1983 to 1987. He was Chief Secretary to the Treasury from 1983 until 1985. He was created a life peer as Baron Rees, of Goytre, in 1987. Early life and education Rees was born in Camberley, Surrey, the only son of Major-General Thomas Wynford Rees of the India Army, and Agatha Rosalie (''née'' Innes). His maternal grandfather was Sir Charles Alexander Innes, Governor of British Burma from 1927 to 1932. He was educated at Stowe School. He joined the Scots Guards in 1945 and three years later continued his education at Christ Church, Oxford. In 1953, he was called to the bar by the Inner Temple. He became a QC in 1969. Political career At the 1964 general election Rees stood as the Conservative candidate in the safe Labour seat of Abertille ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Royal Assent

Royal assent is the method by which a monarch formally approves an act of the legislature, either directly or through an official acting on the monarch's behalf. In some jurisdictions, royal assent is equivalent to promulgation, while in others that is a separate step. Under a modern constitutional monarchy, royal assent is considered little more than a formality. Even in nations such as the United Kingdom, Norway, the Netherlands, Liechtenstein and Monaco which still, in theory, permit their monarch to withhold assent to laws, the monarch almost never does so, except in a dire political emergency or on advice of government. While the power to veto by withholding royal assent was once exercised often by European monarchs, such an occurrence has been very rare since the eighteenth century. Royal assent is typically associated with elaborate ceremony. In the United Kingdom the Sovereign may appear personally in the House of Lords or may appoint Lords Commissioners, who announce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation Tax Act 2010

The Corporation Tax Act 2010 (c.4) is an Act of the Parliament of the United Kingdom that received Royal Assent on 3 March 2010. It was first presented (first reading) in the House of Commons on 19 November 2009 and received its third reading on 4 February 2010. It was first read in the House of Lords on 4 February 2010 and received its second and third readings on 2 March 2010. Overview Section 1 of the Act gives a summary of the contents of the 2010 Act, and the changes it made, primarily to the Income and Corporation Taxes Act 1988 Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. For .... References External linksCorporation Tax Act 2010 on legislation.gov.uk United Kingdom Acts of Parliament 2010 Tax legislation in the United Kingdom {{UK-statute-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Petroleum Act

Petroleum Act (with its variations) is a stock short title used internationally for legislation relating to petroleum. List Bahamas * The Petroleum Act 1971 Bangladesh * The Petroleum Act 1934 India * The Petroleum Act 1934 Iran * The Petroleum Act 1987 Ireland * The Petroleum and Other Minerals Development Act 1960 Jamaica * The Petroleum Act 1979 Kenya * The Petroleum Act 2019 Malawi * The Petroleum (Exploration and Production) Act 1984 Malaysia *The Petroleum Development Act 1974 *The Petroleum and Electricity (Control of Supplies) Act 1974 *The Petroleum (Income Tax) Act 1967 *The Petroleum Mining Act 1966 *The Petroleum (Safety Measures) Act 1984 New Zealand * The Petroleum Act 1937 Nigeria * The Petroleum Act 1969 Norway * The Petroleum Act 1996 Thailand * The Petroleum Act 1971 Trinidad and Tobago * The Petroleum Act 1969 United Kingdom *The Petroleum Act 1998 (c 17) *The Petroleum Royalties (Relief) and Continental S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oil And Gas Industry In The United Kingdom

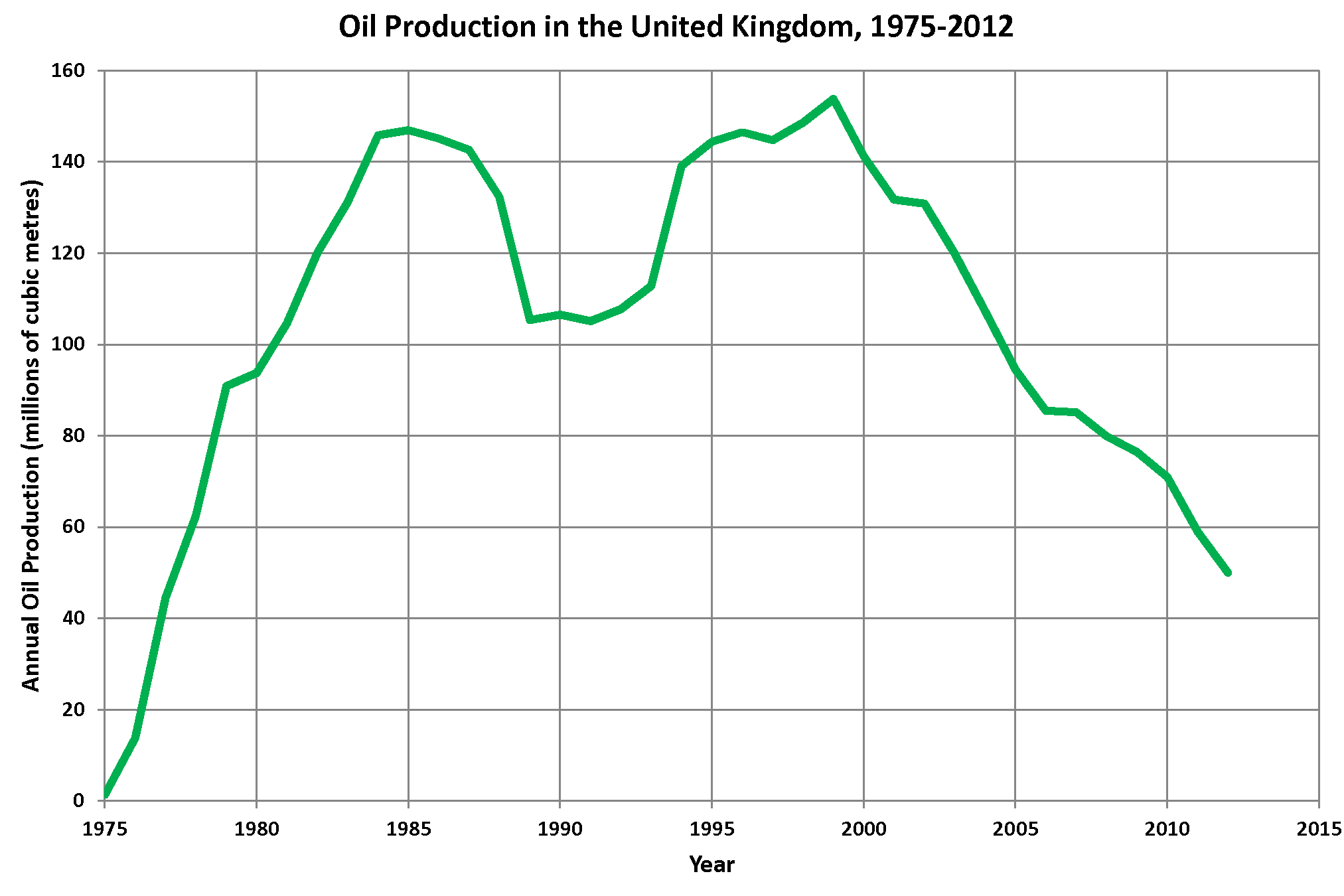

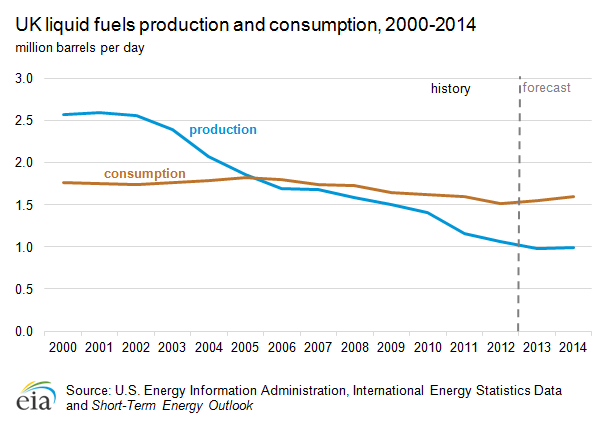

The oil and gas industry plays a central role in the economy of the United Kingdom. Oil and gas account for more than three-quarters of the UK's total primary energy needs. Oil provides 97 per cent of the fuel for transport, and gas is a key fuel for heating and electricity generation. Transport, heating and electricity each account for about one-third of the UK's primary energy needs. Oil and gas are also major feedstocks for the petrochemicals industries producing pharmaceuticals, plastics, cosmetics and domestic appliances. Although UK Continental Shelf production peaked in 1999, in 2016 the sector produced 62,906,000 cubic metres of oil and gas, meeting more than half of the UK's oil and gas needs. There could be up to 3.18 billion cubic metres of oil and gas still to recover from the UK's offshore fields. In 2017, capital investment in the UK offshore oil and gas industry was £5.6 billion. Since 1970 the industry has paid almost £330 billion in production tax. About 280,000 j ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Petroleum Industry In The United Kingdom

The oil and gas industry plays a central role in the economy of the United Kingdom. Oil and gas account for more than three-quarters of the UK's total primary energy needs. Oil provides 97 per cent of the fuel for transport, and gas is a key fuel for heating and electricity generation. Transport, heating and electricity each account for about one-third of the UK's primary energy needs. Oil and gas are also major feedstocks for the petrochemicals industries producing pharmaceuticals, plastics, cosmetics and domestic appliances. Although UK Continental Shelf production peaked in 1999, in 2016 the sector produced 62,906,000 cubic metres of oil and gas, meeting more than half of the UK's oil and gas needs. There could be up to 3.18 billion cubic metres of oil and gas still to recover from the UK's offshore fields. In 2017, capital investment in the UK offshore oil and gas industry was £5.6 billion. Since 1970 the industry has paid almost £330 billion in production tax. About 280,000 j ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

History Of The Petroleum Industry In The United Kingdom

History (derived ) is the systematic study and the documentation of the human activity. The time period of event before the invention of writing systems is considered prehistory. "History" is an umbrella term comprising past events as well as the memory, discovery, collection, organization, presentation, and interpretation of these events. Historians seek knowledge of the past using historical sources such as written documents, oral accounts, art and material artifacts, and ecological markers. History is not complete and still has debatable mysteries. History is also an academic discipline which uses narrative to describe, examine, question, and analyze past events, and investigate their patterns of cause and effect. Historians often debate which narrative best explains an event, as well as the significance of different causes and effects. Historians also debate the nature of history as an end in itself, as well as its usefulness to give perspective on the problems of the p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom Enterprise Law

United Kingdom enterprise law concerns the ownership and regulation of organisations producing goods and services in the UK, European and international economy. Private enterprises are usually incorporated under the Companies Act 2006, regulated by company law, competition law, and insolvency law, while almost one third of the workforce and half of the UK economy is in enterprises subject to special regulation. Enterprise law mediates the rights and duties of investors, workers, consumers and the public to ensure efficient production, and deliver services that UK and international law sees as universal human rights. Labour, company, competition and insolvency law create general rights for stakeholders, and set a basic framework for enterprise governance, but rules of governance, competition and insolvency are altered in specific enterprises to uphold the public interest, as well as civil and social rights. Universities and schools have traditionally been publicly established, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)