|

Pension Regulation In Canada

Within Canadian law, Pension regulation in Canada falls mostly within provincial jurisdiction by virtue of the property and civil rights power under the ''Constitution Act, 1867''. For workers whose employers are subject to federal jurisdiction, such jurisdiction extends to regulating pension plans available to them. Pension Benefits Act (Ontario) The ''Pension Benefits Act'' is administered by the Superintendent of Financial Services appointed by the Financial Services Commission of Ontario. Ontario regulates approximately 8,350 employment pension plans, which comprise more than 40 per cent of all registered pension plans in Canada It was originally enacted as the ''Pension Benefits Act, 1965'' (S.O. 1965, c. 96), and it was the first statute in any Canadian jurisdiction to regulate pension plans. Overview * all pension plans in the province must be registered with the Superintendent * a plan must have an administrator * the administrator has a statutory duty to exercise care, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Law Of Canada

The legal system of Canada is pluralist: its foundations lie in the English common law system (inherited from its period as a colony of the British Empire), the French civil law system (inherited from its French Empire past), and Indigenous law systems developed by the various Indigenous Nations. The Constitution of Canada is the supreme law of the country, and consists of written text and unwritten conventions. The ''Constitution Act, 1867'' (known as the British North America Act prior to 1982), affirmed governance based on parliamentary precedent and divided powers between the federal and provincial governments. The Statute of Westminster 1931 granted full autonomy, and the ''Constitution Act, 1982'' ended all legislative ties to Britain, as well as adding a constitutional amending formula and the ''Canadian Charter of Rights and Freedoms''. The ''Charter'' guarantees basic rights and freedoms that usually cannot be over-ridden by any government—though a notwithstanding ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Provincial Jurisdiction

Canadian federalism () involves the current nature and historical development of the federal system in Canada. Canada is a federation with eleven components: the national Government of Canada and ten provincial governments. All eleven governments derive their authority from the Constitution of Canada. There are also three territorial governments in the far north, which exercise powers delegated by the federal parliament, and municipal governments which exercise powers delegated by the province or territory. Each jurisdiction is generally independent from the others in its realm of legislative authority. The division of powers between the federal government and the provincial governments is based on the principle of exhaustive distribution: all legal issues are assigned to either the federal Parliament or the provincial Legislatures. The division of powers is set out in the ''Constitution Act, 1867'' (originally called the ''British North America Act, 1867''), a key docum ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property And Civil Rights

Section 92(13) of the ''Constitution Act, 1867'', also known as the property and civil rights power, grants the provincial legislatures of Canada the authority to legislate on: It is one of three key residuary powers in the ''Constitution Act, 1867'', together with the federal power of peace, order and good government and the provincial power over matters of a local or private nature in the province. Extent Provincial jurisdiction over property and civil rights embraces all private law transactions, which includes virtually all commercial transactions. Note that "civil rights" in this context does not refer to civil rights in the more modern sense of political liberties. Rather, it refers to private rights enforceable through civil courts. This power is generally balanced against the federal trade and commerce power and criminal law power. With respect to the former, In the '' Insurance Reference'', Viscount Haldane noted that: It is the most powerful and expansive of the pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

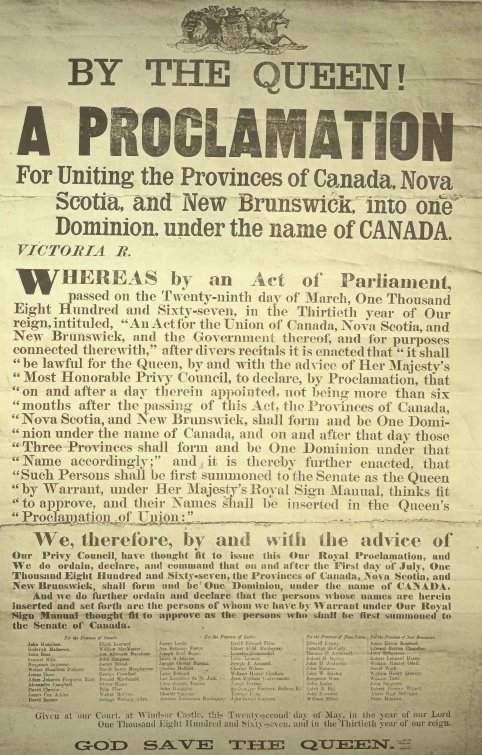

Constitution Act, 1867

The ''Constitution Act, 1867'' (french: Loi constitutionnelle de 1867),''The Constitution Act, 1867'', 30 & 31 Victoria (U.K.), c. 3, http://canlii.ca/t/ldsw retrieved on 2019-03-14. originally enacted as the ''British North America Act, 1867'' (BNA Act), is a major part of the Constitution of Canada. The act created a federation, federal dominion and defines much of the operation of the Government of Canada, including its Canadian federalism, federal structure, the House of Commons of Canada, House of Commons, the Senate of Canada, Senate, the justice system, and the taxation system. In 1982, with the patriation of the Constitution, the British North America Acts which were originally enacted by the Parliament of the United Kingdom, British Parliament, including this Act, were renamed. Although, the acts are still known by their original names in records of the United Kingdom. Amendments were also made at this time: section 92A was added, giving provinces greater control ove ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Section 91 Of The Constitution Act, 1867

Section 91 of the ''Constitution Act, 1867'' (french: article 91 de la Loi constitutionnelle de 1867) is a provision in the Constitution of Canada that sets out the legislative powers of the federal Parliament. The federal powers in section 91 are balanced by the list of provincial legislative powers set out in section 92 of the ''Constitution Act, 1867''. The dynamic tension between these two sets of legislative authority is generally known as the "division of powers". The interplay between the two lists of powers have been the source of much constitutional litigation since the Confederation of Canada in 1867. The ''Constitution Act, 1867'' is the constitutional statute which established Canada. Originally named the ''British North America Act, 1867'', the Act continues to be the foundational statute for the Constitution of Canada, although it has been amended many times since 1867. It is now recognised as part of the supreme law of Canada. ''Constitution Act, 1867'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Commission Of Ontario

The Financial Services Regulatory Authority of Ontario (FSRA; french: Autorité ontarienne de réglementation des services financiers) is a self-funding Crown agency which acts as the financial regulator for the province of Ontario, Canada. Established in 2016, FSRA officially succeeded its predecessor agencies – the Financial Services Commission of Ontario and the Deposit Insurance Corporation of Ontario – on June 8, 2019. The Financial Services Regulatory Authority of Ontario operates at arms-length from the Government of Ontario, and reports to the Legislative Assembly of Ontario through the Minister of Finance. Regulated sectors FSRA regulates the insurance, credit union, ''caisse populaire'', mortgage brokerage, loan, trust, and pension administration sectors in Ontario. Additionally it provides deposit insurance for members of provincially-incorporated credit unions and ''caisses populaires''. See also * Ontario Securities Commission * Pension regulation in Canada With ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Office Of The Superintendent Of Financial Institutions

The Office of the Superintendent of Financial Institutions (OSFI; french: Bureau du surintendant des institutions financières, BSIF) is an independent agency of the Government of Canada reporting to the Minister of Finance created "to contribute to public confidence in the Canadian financial system". It is the sole regulator of banks, and the primary regulator of insurance companies, trust companies, loan companies and pension plans in Canada. The current Superintendent is Peter Routledge, who was appointed in June 2021. He replaced Jeremy Rudin, who retired. The term of the appointment is seven years. Mandate The Office of the Superintendent of Financial Institutions (OSFI) was created to contribute to public confidence in the Canadian financial system. OSFI's mandate is to protect depositors, policyholders, financial institution creditors and pension plan members, while allowing financial institutions to compete and take reasonable risks. Specifically OSFI achieves this th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statutory Duty

Statutory law or statute law is written law passed by a body of legislature. This is opposed to oral or customary law; or regulatory law promulgated by the executive or common law of the judiciary. Statutes may originate with national, state legislatures or local municipalities. Codified law The term codified law refers to statutes that have been organized ("codified") by subject matter; in this narrower sense, some but not all statutes are considered "codified." The entire body of codified statute is referred to as a "code," such as the United States Code, the Ohio Revised Code or the 1983 Code of Canon Law, Code of Canon Law. The substantive provisions of the Act could be codified (arranged by subject matter) in one or more titles of the United States Code while the provisions of the law that have not reached their "effective date" (remaining uncodified) would be available by reference to the United States Statutes at Large. Another meaning of "codified law" is a statute that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Defined Benefit

Defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum, or combination thereof on retirement that depends on an employee's earnings history, tenure of service and age, rather than depending directly on individual investment returns. Traditionally, many governmental and public entities, as well as a large number of corporations, provide defined benefit plans, sometimes as a means of compensating workers in lieu of increased pay.Lemke and Lins, ''ERISA for Money Managers'', §1:1 (Thomson West, 2013). A defined benefit plan is 'defined' in the sense that the benefit formula is defined and known in advance. Conversely, for a "defined contribution retirement saving plan," the formula for computing the employer's and employee's contributions is defined and known in advance, but the benefit to be paid out is not known in advance. In the United States, specifies a defined benefit plan to be any pension plan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Defined Contribution

A defined contribution (DC) plan is a type of retirement plan in which the employer, employee or both make contributions on a regular basis. Individual accounts are set up for participants and benefits are based on the amounts credited to these accounts (through employee contributions and, if applicable, employer contributions) plus any investment earnings on the money in the account. In defined contribution plans, future benefits fluctuate on the basis of investment earnings. The most common type of defined contribution plan is a savings and thrift plan. Under this type of plan, the employee contributes a predetermined portion of his or her earnings (usually pretax) to an individual account, all or part of which is matched by the employer. In the United States, specifies a defined contribution plan as a "plan which provides for an individual account for each participant and for benefits based solely on the amount contributed to the participant's account, and any income, expense ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Winding Up

Liquidation is the process in accounting by which a company is brought to an end in Canada, United Kingdom, United States, Ireland, Australia, New Zealand, Italy, and many other countries. The assets and property of the company are redistributed. Liquidation is also sometimes referred to as winding-up or dissolution, although dissolution technically refers to the last stage of liquidation. The process of liquidation also arises when customs, an authority or agency in a country responsible for collecting and safeguarding customs duties, determines the final computation or ascertainment of the duties or drawback accruing on an entry. Liquidation may either be compulsory (sometimes referred to as a ''creditors' liquidation'' or ''receivership'' following bankruptcy, which may result in the court creating a "liquidation trust") or voluntary (sometimes referred to as a ''shareholders' liquidation'', although some voluntary liquidations are controlled by the creditors). The term " ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insolvency

In accounting, insolvency is the state of being unable to pay the debts, by a person or company ( debtor), at maturity; those in a state of insolvency are said to be ''insolvent''. There are two forms: cash-flow insolvency and balance-sheet insolvency. Cash-flow insolvency is when a person or company has enough assets to pay what is owed, but does not have the appropriate form of payment. For example, a person may own a large house and a valuable car, but not have enough liquid assets to pay a debt when it falls due. Cash-flow insolvency can usually be resolved by negotiation. For example, the bill collector may wait until the car is sold and the debtor agrees to pay a penalty. Balance-sheet insolvency is when a person or company does not have enough assets to pay all of their debts. The person or company might enter bankruptcy, but not necessarily. Once a loss is accepted by all parties, negotiation is often able to resolve the situation without bankruptcy. A company t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)