|

Peace Tax Fund Bill

The Religious Freedom Peace Tax Fund Act is legislation proposed in the United States Congress that would legalize a form of conscientious objection to military taxation. Description This act would establish a "peace tax fund" that parallels the general fund which the government draws upon to pay its expenses. But the peace tax fund, unlike the general fund, could only be used for non-military spending: the term "military purpose" means any activity or program which any agency of the Government conducts, administers, or sponsors and which effects an augmentation of military forces or of defensive and offensive intelligence activities, or enhances the capability of any person or nation to wage war, including the appropriation of funds by the United States for 1) the Department of Defense; 2) the Central Intelligence Agency; 3) the National Security Council; 4) the Selective Service System; 5) activities of the Department of Energy that have a military purpose; 6) activities of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Congress

The United States Congress is the legislature of the federal government of the United States. It is bicameral, composed of a lower body, the House of Representatives, and an upper body, the Senate. It meets in the U.S. Capitol in Washington, D.C. Senators and representatives are chosen through direct election, though vacancies in the Senate may be filled by a governor's appointment. Congress has 535 voting members: 100 senators and 435 representatives. The U.S. vice president has a vote in the Senate only when senators are evenly divided. The House of Representatives has six non-voting members. The sitting of a Congress is for a two-year term, at present, beginning every other January. Elections are held every even-numbered year on Election Day. The members of the House of Representatives are elected for the two-year term of a Congress. The Reapportionment Act of 1929 establishes that there be 435 representatives and the Uniform Congressional Redistricting Act requires ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congress Of The United States

The United States Congress is the legislature of the federal government of the United States. It is Bicameralism, bicameral, composed of a lower body, the United States House of Representatives, House of Representatives, and an upper body, the United States Senate, Senate. It meets in the U.S. Capitol in Washington, D.C. Senators and representatives are chosen through direct election, though vacancies in the Senate may be filled by a Governor (United States), governor's appointment. Congress has 535 voting members: 100 senators and 435 representatives. The U.S. vice president has a vote in the Senate only when senators are evenly divided. The House of Representatives has six Non-voting members of the United States House of Representatives, non-voting members. The sitting of a Congress is for a two-year term, at present, beginning every other January. Elections in the United States, Elections are held every even-numbered year on Election Day (United States), Election Day. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

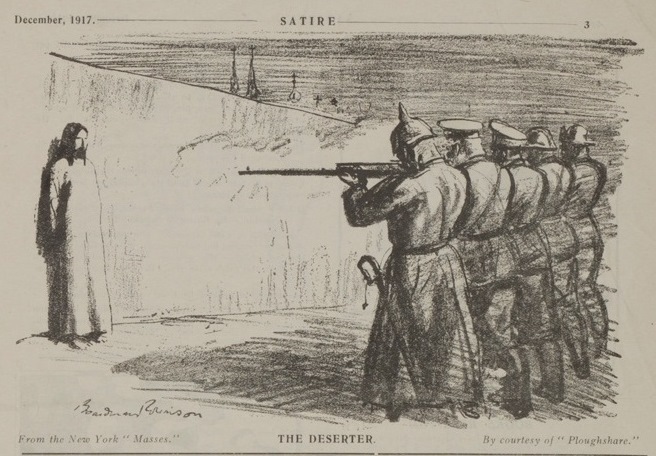

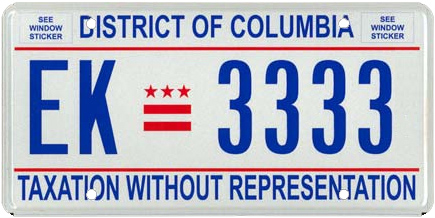

Tax Resistance In The United States

Tax resistance in the United States has been practiced at least since colonial times, and has played important parts in American history. Tax resistance is the refusal to pay a tax, usually by means that bypass established legal norms, as a means of protest, nonviolent resistance, or conscientious objection. It was a core tactic of the American Revolution and has played a role in many struggles in America from colonial times to the present day. In addition, the philosophy of tax resistance, from the "no taxation without representation" axiom that served as a foundation of the Revolution to the assertion of individual conscience in Henry David Thoreau's '' Civil Disobedience'', has been an important plank of American political philosophy. Theory The theory that there should be "no taxation without representation", while it did not originate in America, is often associated with the American Revolution, in which that slogan did strong duty. It continues to be a rallying cry for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Resistance

Tax resistance is the refusal to pay tax because of opposition to the government that is imposing the tax, or to government policy, or as opposition to taxation in itself. Tax resistance is a form of direct action and, if in violation of the tax regulations, also a form of civil disobedience. Examples of tax resistance campaigns include those advocating home rule, such as the Salt March led by Mahatma Gandhi, and those promoting women's suffrage, such as the Women's Tax Resistance League. War tax resistance is the refusal to pay some or all taxes that pay for war, and may be practiced by conscientious objectors, pacifists, or those protesting against a particular war. Tax resisters are distinct from "tax protesters", who deny that the legal obligation to pay taxes exists or applies to them. Tax resisters may accept that some law commands them to pay taxes but they still choose to resist taxation. History The earliest and most widespread forms of taxation were the corvée and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Choice

In public choice theory, tax choice (sometimes called taxpayer sovereignty, earmarking, or fiscal subsidiarity) is the belief that individual taxpayers should have direct control over how their taxes are spent. Its proponents apply the theory of consumer choice to public finance. They claim taxpayers react positively when they are allowed to allocate portions of their taxes to specific spending. Tax relationship between the state and taxpayers The term tax sovereignty emphasizes the perceived equal status of state and taxpayer, instead of the traditional view of the dominant position of the state in taxation. Tracing back to the legitimacy of the state, Viktoria Raritska points out that “the legitimacy of the state as a formal institution is substantiated by the people’s refusal of their freedoms and an agreement to submit to government in exchange for the protection of their guaranteed rights”. Proponents of tax sovereignty believe that in a traditional system of taxatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Render Unto Caesar

"Render unto Caesar" is the beginning of a phrase attributed to Jesus in the synoptic gospels, which reads in full, "Render unto Caesar the things that are Caesar's, and unto God the things that are God's" (). This phrase has become a widely quoted summary of the relationship between Christianity, secular government, and society. The original message, coming in response to a question of whether it was lawful for Jews to pay taxes to Caesar, gives rise to multiple possible interpretations about the circumstances under which it is desirable for Christians to submit to earthly authority. Narrative All three synoptic gospels state that hostile questioners tried to trap Jesus into taking an explicit and dangerous stand on whether Jews should or should not pay taxes to the Roman authorities. The accounts in and say that the questioners were Pharisees and Herodians, while says only that they were "spies" sent by "teachers of the law and the chief priests". They anticipated that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peace Churches

Peace churches are Christian churches, groups or communities advocating Christian pacifism or Biblical nonresistance. The term historic peace churches refers specifically only to three church groups among pacifist churches: * Church of the Brethren, including all daughter churches such as the Old German Baptist Brethren, Old Brethren and Dunkard Brethren; * Religious Society of Friends (Quakers); and * Mennonites, including the Amish, Beachy Amish, Old Order Mennonites, and Conservative Mennonites In addition to the Schwarzenau Brethren and Mennonites, other Anabaptist Christian fellowships, such as the Hutterian Brethren, River Brethren, Apostolic Christian Church and Bruderhof teach pacifism as well. This phrase has been used since the first conference of the peace churches in Kansas in 1935.Concise Encyclopedia of Amish, Brethren, Hutterites, and Mennonites p6 Donald B. Kraybill – 2010 "In 1935, BRETHREN, Mennonites, and Quakers met in North Newton, Kansas, for a confer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Campaign For A Peace Tax Fund

The National Campaign for a Peace Tax Fund (NCPTF) is a non-profit organization located in Washington, D.C. It was founded in 1971 to address conscientious objection to military taxation. History and purpose The campaign exists solely to pass Peace Tax legislation in the United States. Such legislation would provide a way for some conscientious objectors to participate in the tax system without violating their beliefs. The proposed legislation, ''Religious Freedom Peace Tax Fund Act'', would amend the Internal Revenue Code to allow a conscientious objector to have his or her income, estate, and gift tax payments spent for non-military purposes only. The campaign advocates and educates on behalf of citizens who are petitioning the government for the right to pay 100% of their taxes without violating their religious or ethical teachings. Voluntary contributions from some 2,000 individuals and from organizations support the campaign. The annual budget is $140,000. Forty seven natio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

War Bonds

War bonds (sometimes referred to as Victory bonds, particularly in propaganda) are debt securities issued by a government to finance military operations and other expenditure in times of war without raising taxes to an unpopular level. They are also a means to control inflation by removing money from circulation in a stimulated wartime economy. War bonds are either retail bonds marketed directly to the public or wholesale bonds traded on a stock market. Exhortations to buy war bonds have often been accompanied by appeals to patriotism and conscience. Retail war bonds, like other retail bonds, tend to have a yield which is below that offered by the market and are often made available in a wide range of denominations to make them affordable for all citizens. Before World War I Governments throughout history have needed to borrow money to fight wars. Traditionally they dealt with a small group of rich financiers such as Jakob Fugger and Nathan Rothschild, but no particular distinc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Court Of Appeals For The Third Circuit

The United States Court of Appeals for the Third Circuit (in case citations, 3d Cir.) is a federal court with appellate jurisdiction over the district courts for the following districts: * District of Delaware * District of New Jersey * Eastern District of Pennsylvania * Middle District of Pennsylvania * Western District of Pennsylvania This circuit also hears appeals from the District Court of the Virgin Islands, which is an Article VI territorial court and not a district court under Article III of the Constitution. The court is composed of 14 active judges and is based at the James A. Byrne United States Courthouse in Philadelphia Philadelphia, often called Philly, is the largest city in the Commonwealth of Pennsylvania, the sixth-largest city in the U.S., the second-largest city in both the Northeast megalopolis and Mid-Atlantic regions after New York City. Sinc ..., Pennsylvania. The court also conducts sittings in other venues, including the United St ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Court Of Appeals For The Second Circuit

The United States Court of Appeals for the Second Circuit (in case citations, 2d Cir.) is one of the thirteen United States Courts of Appeals. Its territory comprises the states of Connecticut, New York and Vermont. The court has appellate jurisdiction over the district courts in the following districts: * District of Connecticut * Eastern District of New York * Northern District of New York * Southern District of New York * Western District of New York * District of Vermont The Second Circuit has its clerk's office and hears oral arguments at the Thurgood Marshall United States Courthouse at 40 Foley Square in Lower Manhattan. Due to renovations at that building, from 2006 until early 2013, the court temporarily relocated to the Daniel Patrick Moynihan United States Courthouse across Pearl Street from Foley Square; certain court offices temporarily relocated to the Woolworth Building at 233 Broadway. Because the Second Circuit includes New York City, it has long been one ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Religious Freedom Restoration Act

The Religious Freedom Restoration Act of 1993, Pub. L. No. 103-141, 107 Stat. 1488 (November 16, 1993), codified at through (also known as RFRA, pronounced "rifra"), is a 1993 United States federal law that "ensures that interests in religious freedom are protected." The bill was introduced by Congressman Chuck Schumer ( D- NY) on March 11, 1993. A companion bill was introduced in the Senate by Ted Kennedy ( D- MA) the same day. A unanimous U.S. House and a nearly unanimous U.S. Senate—three senators voted against passage—passed the bill, and President Bill Clinton signed it into law. RFRA, as applied to the states, was held unconstitutional by the United States Supreme Court in the ''City of Boerne v. Flores'' decision in 1997, which ruled that the RFRA is not a proper exercise of Congress's enforcement power. However, it continues to be applied to the federal government—for instance, in '' Gonzales v. O Centro Espírita Beneficente União do Vegetal'' (2006) and '' Bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)