|

Payback Period

Payback period in capital budgeting Capital budgeting in corporate finance is the planning process used to determine whether an organization's long term capital investments such as new machinery, replacement of machinery, new plants, new products, and research development project ... refers to the time required to Recoupment, recoup the funds expended in an investment, or to reach the Break-even (economics), break-even point. Farris, Paul W.; Neil T. Bendle; Phillip E. Pfeifer; David J. Reibstein (2010). ''Marketing Metrics: The Definitive Guide to Measuring Marketing Performance.'' Upper Saddle River, New Jersey: Pearson Education, Inc. . The Marketing Accountability Standards Board (MASB) endorses the definitions, purposes, and constructs of classes of measures that appear in ''Marketing Metrics'' as part of its ongoinCommon Language: Marketing Activities and Metrics Project For example, a $1000 investment made at the start of year 1 which Profit (economics), returned $500 a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Budgeting

Capital budgeting in corporate finance is the planning process used to determine whether an organization's long term capital investments such as new machinery, replacement of machinery, new plants, new products, and research development projects are worth the funding of cash through the firm's capitalization structures (debt, equity or retained earnings). It is the process of allocating resources for major capital, or investment, expenditures. An underlying goal, consistent with the overall approach in corporate finance, is to increase the value of the firm to the shareholders. Capital budgeting is typically considered a non-core business activity as it is not part of the revenue model or models of most types of firms, or even a part of daily operations. It holds a strategic financial function within a business. One example of a firm type where capital budgeting is plausibly a part of the core business activities is with investment banks, as their revenue model or models re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Energy Conservation

Energy conservation is the effort to reduce wasteful energy consumption by using fewer energy services. This can be done by using energy more effectively (using less energy for continuous service) or changing one's behavior to use less service (for example, by driving less). Energy conservation can be achieved through energy efficiency, which has a number of advantages, including a reduction in greenhouse gas emissions, a smaller carbon footprint, and cost, water, and energy savings. Energy conservation is an essential factor in building design and construction. It has increased in importance since the 1970s, as 40% of energy use in the U.S. is in buildings. Recently, concern over the effects of climate change and global warming has emphasized the importance of energy conservation. Energy can only be transformed from one form to another, such as when heat energy is converted into vehicle motive power or when water flow's kinetic energy is converted into electricity in hydroelectr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Finance

Corporate finance is the area of finance that deals with the sources of funding, the capital structure of corporations, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to Shareholder value, maximize or increase valuation (finance), shareholder value. Correspondingly, corporate finance comprises two main sub-disciplines. Capital budgeting is concerned with the setting of criteria about which value-adding projects should receive investment funding, and whether to finance that investment with ownership equity, equity or debt capital. Working capital management is the management of the company's monetary funds that deal with the short-term business operations, operating balance of current assets and Current liability, current liabilities; the focus here is on managing cash, inventory, inventories, and short-term borrowing an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Expenditure

Capital expenditure or capital expense (capex or CAPEX) is the money an organization or corporate entity spends to buy, maintain, or improve its fixed assets, such as buildings, vehicles, equipment, or land. It is considered a capital expenditure when the asset is newly purchased or when money is used towards extending the useful life of an existing asset, such as repairing the roof. Capital expenditures contrast with operating expenses (opex), which are ongoing expenses that are inherent to the operation of the asset. Opex includes items like electricity or cleaning. The difference between opex and capex may not be immediately obvious for some expenses; for instance, repaving the parking lot may be thought of inherent to the operation of a shopping mall. The dividing line for items like these is that the expense is considered capex if the financial benefit of the expenditure extends beyond the current fiscal year. Usage Capital expenditures are the funds used to acquire or upgra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Discounted Payback Period

The discounted payback period (DPB) is the amount of time that it takes (in years) for the initial cost of a project to equal to discounted value of expected cash flows, or the time it takes to break even from an investment. It is the period in which the cumulative net present value of a project equals zero. Calculation Cumulative discounted cash flows will start with a negative value due to the original cost of investment, but as cash is generated each year after the original investment the discounted cash flows for those years will be positive, and the cumulative discounted cash flows will progress in a positive direction towards zero. When the negative cumulative discounted cash flows become positive, or recover, DPB occurs. Discounted payback period is calculated by the formula: :DPB = Year before DPB occurs + Cumulative Discounted Cash flow in year before recovery ÷ Discounted cash flow in year after recovery Advantages Discounted payback period helps businesses rej ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

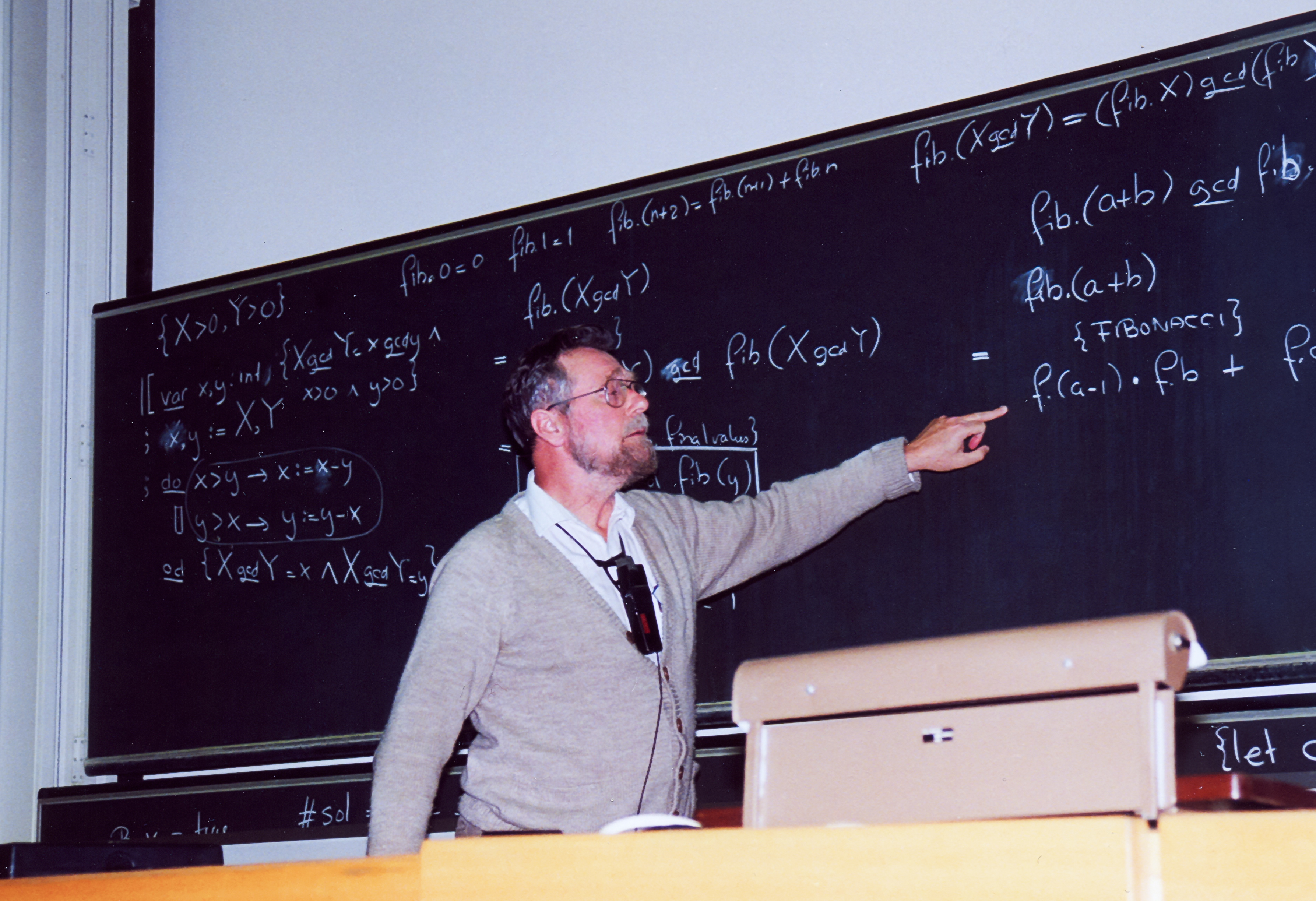

Algorithm

In mathematics and computer science, an algorithm () is a finite sequence of rigorous instructions, typically used to solve a class of specific Computational problem, problems or to perform a computation. Algorithms are used as specifications for performing calculations and data processing. More advanced algorithms can perform automated deductions (referred to as automated reasoning) and use mathematical and logical tests to divert the code execution through various routes (referred to as automated decision-making). Using human characteristics as descriptors of machines in metaphorical ways was already practiced by Alan Turing with terms such as "memory", "search" and "stimulus". In contrast, a Heuristic (computer science), heuristic is an approach to problem solving that may not be fully specified or may not guarantee correct or optimal results, especially in problem domains where there is no well-defined correct or optimal result. As an effective method, an algorithm ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Flow

A cash flow is a real or virtual movement of money: *a cash flow in its narrow sense is a payment (in a currency), especially from one central bank account to another; the term 'cash flow' is mostly used to describe payments that are expected to happen in the future, are thus uncertain and therefore need to be forecast with cash flows; *a cash flow is determined by its time ''t'', nominal amount ''N'', currency ''CCY'' and account ''A''; symbolically ''CF'' = ''CF''(''t,N,CCY,A''). * it is however popular to use ''cash flow'' in a less specified sense describing (symbolic) payments into or out of a business, project, or financial product. Cash flows are narrowly interconnected with the concepts of value, ''interest rate'' and liquidity. A cash flow that shall happen on a future day ''t''N can be transformed into a cash flow of the same value in ''t''0. Cash flow analysis Cash flows are often transformed into measures that give information e.g. on a company's value and situat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Formula

In science, a formula is a concise way of expressing information symbolically, as in a mathematical formula or a ''chemical formula''. The informal use of the term ''formula'' in science refers to the general construct of a relationship between given quantities. The plural of ''formula'' can be either ''formulas'' (from the most common English plural noun form) or, under the influence of scientific Latin, ''formulae'' (from the original Latin). In mathematics In mathematics, a formula generally refers to an identity which equates one mathematical expression to another, with the most important ones being mathematical theorems. Syntactically, a formula (often referred to as a ''well-formed formula'') is an entity which is constructed using the symbols and formation rules of a given logical language. For example, determining the volume of a sphere requires a significant amount of integral calculus or its geometrical analogue, the method of exhaustion. However, having done t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Rate Of Return

Internal rate of return (IRR) is a method of calculating an investment’s rate of return. The term ''internal'' refers to the fact that the calculation excludes external factors, such as the risk-free rate, inflation, the cost of capital, or financial risk. The method may be applied either ex-post or ex-ante. Applied ex-ante, the IRR is an estimate of a future annual rate of return. Applied ex-post, it measures the actual achieved investment return of a historical investment. It is also called the discounted cash flow rate of return (DCFROR)Project Economics and Decision Analysis, Volume I: Deterministic Models, M.A.Main, Page 269 or yield rate. Definition (IRR) The internal rate of return on an investment or project is the "annualized effective compounded return rate" or rate of return that sets the net present value of all cash flows (both positive and negative) from the investment equal to zero. Equivalently, it is the interest rate at which the net present value of the f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Net Present Value

The net present value (NPV) or net present worth (NPW) applies to a series of cash flows occurring at different times. The present value of a cash flow depends on the interval of time between now and the cash flow. It also depends on the discount rate. NPV accounts for the time value of money. It provides a method for evaluating and comparing capital projects or financial products with cash flows spread over time, as in loans, investments, payouts from insurance contracts plus many other applications. Time value of money dictates that time affects the value of cash flows. For example, a lender may offer 99 cents for the promise of receiving $1.00 a month from now, but the promise to receive that same dollar 20 years in the future would be worth much less today to that same person (lender), even if the payback in both cases was equally certain. This decrease in the current value of future cash flows is based on a chosen rate of return (or discount rate). If for example there exists ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Weighted Average

The weighted arithmetic mean is similar to an ordinary arithmetic mean (the most common type of average), except that instead of each of the data points contributing equally to the final average, some data points contribute more than others. The notion of weighted mean plays a role in descriptive statistics and also occurs in a more general form in several other areas of mathematics. If all the weights are equal, then the weighted mean is the same as the arithmetic mean. While weighted means generally behave in a similar fashion to arithmetic means, they do have a few counterintuitive properties, as captured for instance in Simpson's paradox. Examples Basic example Given two school with 20 students, one with 30 test grades in each class as follows: :Morning class = :Afternoon class = The mean for the morning class is 80 and the mean of the afternoon class is 90. The unweighted mean of the two means is 85. However, this does not account for the difference in number of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Opportunity Cost

In microeconomic theory, the opportunity cost of a particular activity is the value or benefit given up by engaging in that activity, relative to engaging in an alternative activity. More effective it means if you chose one activity (for example, an investment) you are giving up the opportunity to do a different option. The optimal activity is the one that, net of its opportunity cost, provides the greater return compared to any other activities, net of their opportunity costs. For example, if you buy a car and use it exclusively to transport yourself, you cannot rent it out, whereas if you rent it out you cannot use it to transport yourself. If your cost of transporting yourself without the car is more than what you get for renting out the car, the optimal choice is to use the car yourself. In basic equation form, opportunity cost can be defined as: "Opportunity Cost = (returns on best Forgone Option) - (returns on Chosen Option)." The opportunity cost of mowing one’s own la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |