|

Panic Of 1826

The Panic of 1826 was a financial crisis built upon fraudulent financial practices from the management of various firms. The height of the panic occurred during July 1826 when six of the sixty-seven companies publicly traded on the New York Stock Exchange abruptly failed. Within the coming months, twelve more NYSE firms would also fail. The panic sparked New York State to bring in extensive legislation seeking to regulate financial companies and protect investor interests. These regulations, legislation, and precedents like the shareholder derivative precedent were some of the first ever enacted in America and provided the basis for today's financial regulations after the panic of 2008. Causes One of the primary causes of the Panic of 1826 was the rise in the number of incorporations in New York during the 1820s. From having only one bank and no insurance corporations in 1791, by 1830, there were over 150 financial companies and 1000 businesses. With this rise in number of incorpor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (e.g. the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is no consensus, however, and financial crises continue to occur from time to time. Types Banking crisis When a bank suffers a sudden rush of withdrawals by depositors, this is called a ''bank run''. Si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Speculation

In finance, speculation is the purchase of an asset (a commodity, good (economics), goods, or real estate) with the hope that it will become more valuable shortly. (It can also refer to short sales in which the speculator hopes for a decline in value.) Many speculators pay little attention to the fundamental value of a security and instead focus purely on price movements. In principle, speculation can involve any tradable good or financial instrument. Speculators are particularly common in the markets for stocks, bond (finance), bonds, commodity futures, currency, currencies, fine art, collectibles, real estate, and derivative (finance), derivatives. Speculators play one of four primary roles in financial markets, along with hedge (finance), hedgers, who engage in transactions to offset some other pre-existing risk, arbitrageus who seek to profit from situations where Fungibility, fungible instruments trade at different prices in different market segments, and investors who s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Crises In The United States

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated with the production, use, and management of scarce resources'. A given economy is a set of processes that involves its culture, values, education, technological evolution, history, social organization, political structure, legal systems, and natural resources as main factors. These factors give context, content, and set the conditions and parameters in which an economy functions. In other words, the economic domain is a social domain of interrelated human practices and transactions that does not stand alone. Economic agents can be individuals, businesses, organizations, or governments. Economic transactions occur when two groups or parties agree to the value or price of the transacted good or service, commonly expressed in a certain currency. Howev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1826 In The United States

Events from the year 1826 in the United States. Incumbents Federal government of the United States, Federal Government * President of the United States, President: John Quincy Adams (Democratic-Republican Party, DR/NR-Massachusetts) * Vice President of the United States, Vice President: John C. Calhoun (Democratic Party (United States), D-South Carolina) * Chief Justice of the United States, Chief Justice: John Marshall (Virginia) * Speaker of the United States House of Representatives, Speaker of the House of Representatives: John W. Taylor (politician), John W. Taylor (Democratic-Republican Party, DR-New York (state), New York) * United States Congress, Congress: 19th United States Congress, 19th Events * January 24 – Treaty of Washington (1826), Treaty of Washington between the United States government and the Creek (people), Creek National Council, in which they cede much of their land in the Georgia (U.S. state), State of Georgia. * February 6 – First pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1826 In Economics

Eighteen or 18 may refer to: * 18 (number), the natural number following 17 and preceding 19 * one of the years 18 BC, AD 18, 1918, 2018 Film, television and entertainment * ''18'' (film), a 1993 Taiwanese experimental film based on the short story ''God's Dice'' * ''Eighteen'' (film), a 2005 Canadian dramatic feature film * 18 (British Board of Film Classification), a film rating in the United Kingdom, also used in Ireland by the Irish Film Classification Office * 18 (''Dragon Ball''), a character in the ''Dragon Ball'' franchise * "Eighteen", a 2006 episode of the animated television series ''12 oz. Mouse'' Music Albums * ''18'' (Moby album), 2002 * ''18'' (Nana Kitade album), 2005 * '' 18...'', 2009 debut album by G.E.M. Songs * "18" (5 Seconds of Summer song), from their 2014 eponymous debut album * "18" (One Direction song), from their 2014 studio album ''Four'' * "18", by Anarbor from their 2013 studio album ''Burnout'' * "I'm Eighteen", by Alice Cooper commonly re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivative Suit

A shareholder derivative suit is a lawsuit brought by a shareholder on behalf of a corporation against a third party. Often, the third party is an insider of the corporation, such as an executive officer or director. Shareholder derivative suits are unique because under traditional corporate law, management is responsible for bringing and defending the corporation against suit. Shareholder derivative suits permit a shareholder to initiate a suit when management has failed to do so. To enable a diversity of management approaches to risks and reinforce the most common forms of corporate rules with a high degree of permissible management power, many jurisdictions have implemented minimum thresholds and grounds (procedural and substantive) to such suits. Purpose and difficulties Under traditional corporate business law, shareholders are the owners of a corporation. However, they are not empowered to control the day-to-day operations of the corporation. Instead, shareholders appoint dire ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

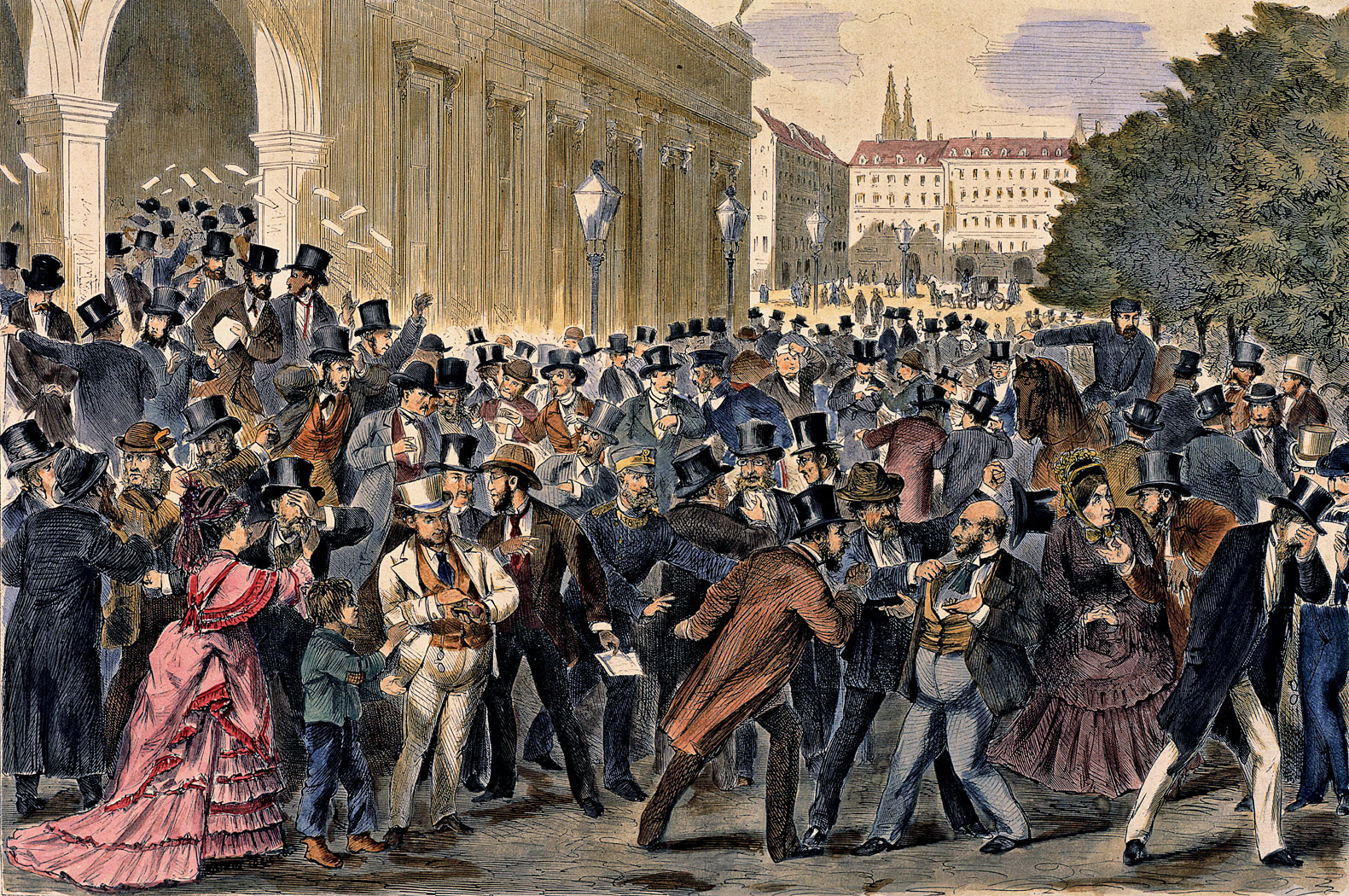

Panic Of 1825

The Panic of 1825 was a stock market crash that started in the Bank of England, arising in part out of speculative investments in Latin America, including an imaginary country: Poyais. The crisis was felt most acutely in Britain, where it led to the closure of twelve banks. It was also manifest in the markets of Europe, Latin America and the United States. Nation wide gold and silver confiscation ensued and an infusion of gold reserves from the Banque de France saved the Bank of England from collapse. The panic has been called the first modern economic crisis not attributable to an external event, such as a war, and so the start of modern economic cycles. The Napoleonic Wars had been highly profitable for all sectors of the British financial system, and the expansionist monetary actions taken during transition from war to peace brought a surge of prosperity and speculative ventures. The stock market boom became a bubble and banks caught in the euphoria made risky loans. Bank impr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

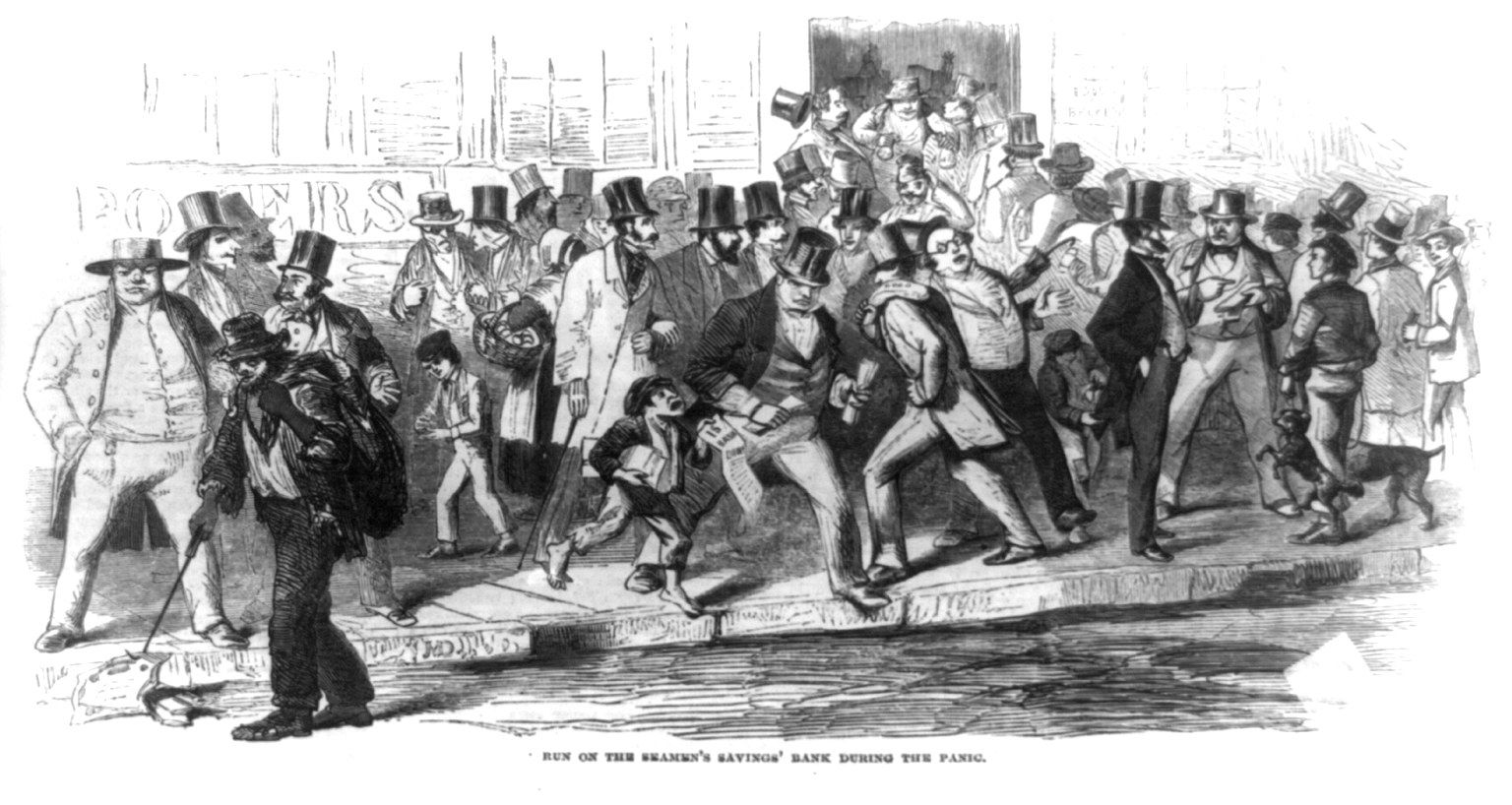

Panic Of 1857

The Panic of 1857 was a financial panic in the United States caused by the declining international economy and over-expansion of the domestic economy. Because of the invention of the telegraph by Samuel F. Morse in 1844, the Panic of 1857 was the first financial crisis to spread rapidly throughout the United States. The world economy was also more interconnected by the 1850s, which also made the Panic of 1857 the first worldwide economic crisis. In Britain, the Palmerston government circumvented the requirements of the Bank Charter Act 1844, which required gold and silver reserves to back up the amount of money in circulation. Surfacing news of this circumvention set off the Panic in Britain. Beginning in September 1857, the financial downturn did not last long, but a proper recovery was not seen until the onset of the American Civil War in 1861. The sinking of contributed to the panic of 1857, as New York banks were awaiting a much-needed shipment of gold. American banks ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panic Of 1819

The Panic of 1819 was the first widespread and durable financial crisis in the United States that slowed westward expansion in the Cotton Belt and was followed by a general collapse of the American economy that persisted through 1821. The Panic heralded the transition of the nation from its colonial commercial status with Europe toward an independent economy. Though the downturn was driven by global market adjustments in the aftermath of the Napoleonic Wars, its severity was compounded by excessive speculation in public lands, fueled by the unrestrained issue of paper money from banks and business concerns. The Second Bank of the United States (SBUS), itself deeply enmeshed in these inflationary practices, sought to compensate for its laxness in regulating the state bank credit market by initiating a sharp curtailment in loans by its western branches, beginning in 1818. Failing to provide gold specie from their reserves when presented with their own banknotes for redemption by t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wall Street

Wall Street is an eight-block-long street in the Financial District of Lower Manhattan in New York City. It runs between Broadway in the west to South Street and the East River in the east. The term "Wall Street" has become a metonym for the financial markets of the United States as a whole, the American financial services industry, New York–based financial interests, or the Financial District itself. Anchored by Wall Street, New York has been described as the world's principal financial center. Wall Street was originally known in Dutch as "de Waalstraat" when it was part of New Amsterdam in the 17th century, though the origins of the name vary. An actual wall existed on the street from 1685 to 1699. During the 17th century, Wall Street was a slave trading marketplace and a securities trading site, and from the early eighteenth century (1703) the location of Federal Hall, New York's first city hall. In the early 19th century, both residences and businesses occupied the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivative Suit

A shareholder derivative suit is a lawsuit brought by a shareholder on behalf of a corporation against a third party. Often, the third party is an insider of the corporation, such as an executive officer or director. Shareholder derivative suits are unique because under traditional corporate law, management is responsible for bringing and defending the corporation against suit. Shareholder derivative suits permit a shareholder to initiate a suit when management has failed to do so. To enable a diversity of management approaches to risks and reinforce the most common forms of corporate rules with a high degree of permissible management power, many jurisdictions have implemented minimum thresholds and grounds (procedural and substantive) to such suits. Purpose and difficulties Under traditional corporate business law, shareholders are the owners of a corporation. However, they are not empowered to control the day-to-day operations of the corporation. Instead, shareholders appoint dire ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and Fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or "book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a secur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

_per_capita_in_2020.png)

.jpg)

.jpg)