|

PSI 20

The PSI-20 (an acronym of Portuguese Stock Index) is a benchmark stock market index of companies that trade on Euronext Lisbon, the main stock exchange of Portugal. The index tracks the prices of the twenty listings with the largest market capitalisation and share turnover in the PSI Geral, the general stock market of the Lisbon exchange. It is one of the main national indices of the pan-European stock exchange group Euronext alongside Brussels' BEL20, Paris's CAC 40 and Amsterdam's AEX. History The PSI-20 was initiated on 31 December 1992 with a base value of 3,000 index points. The index experienced considerably more volatility than the world's main financial markets between 1998 and 2000, caused by uncertainty in the world's emerging markets: a sharp increase of over 50% in the PSI-20's value in the first four months of 1998 was followed by a decline of similar magnitude between July and October of that year. Another price surge sparked at the tail end of 1999 peaked wit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Euronext

Euronext N.V. (short for European New Exchange Technology) is a pan-European bourse that offers various trading and post-trade services. Traded assets include regulated equities, exchange-traded funds (ETF), warrants and certificates, bonds, derivatives, commodities, foreign exchange as well as indices. In December 2021, it had nearly 2,000 listed issuers worth €6.9 trillion in market capitalisation. Euronext is the largest center for debt and funds listings in the world, and provides technology and managed services to third parties. In addition to its main regulated market, it operates Euronext Growth and Euronext Access, providing access to listing for small and medium-sized enterprises. Euronext's commodity market includes the electric power exchange Nord Pool, as well as Fish Pool. Post-trade services include clearing performed by Euronext's multi-asset clearing house, Euronext Clearing, as well as custody and settlement performed by Euronext's central secur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by ''σ'') is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn calculated using the sum of s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company is divided, or these shares considered together" "When a company issues shares or stocks ''especially AmE'', it makes them available for people to buy for the first time." (Especially in American English, the word "stocks" is also used to refer to shares.) A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain clas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Liquidity

In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset's price. Liquidity involves the trade-off between the price at which an asset can be sold, and how quickly it can be sold. In a liquid market, the trade-off is mild: one can sell quickly without having to accept a significantly lower price. In a relatively illiquid market, an asset must be discounted in order to sell quickly. Money, or cash, is the most liquid asset because it can be exchanged for goods and services instantly at face value. Overview A liquid asset has some or all of the following features: It can be sold rapidly, with minimal loss of value, anytime within market hours. The essential characteristic of a liquid market is that there are always ready and willing buyers and sellers. It is similar to, but distinct from, market depth, which relates to the trade-off between quantit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Float (finance)

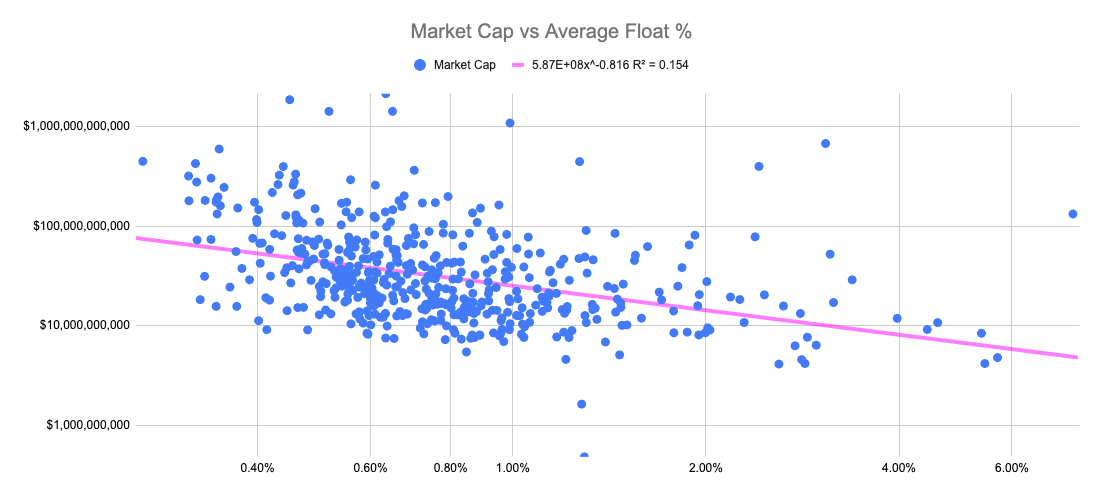

In the context of stock markets, the public float or free float represents the portion of shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments. This number is sometimes seen as a better way of calculating market capitalization, because it provides a more accurate reflection (than entire market capitalization) of what public investors consider the company to be worth. In this context, the ''float'' may refer to all the shares outstanding that can be publicly traded. Calculating public float The float is calculated by subtracting the locked-in shares from outstanding shares. For example, a company may have 10 million outstanding shares, with 3 million of them in a locked-in position; this company's float would be 7 million (multiplied by the share price). Stocks with smaller floats tend to be more volatile than those with larger floats. In general, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statistical Significance

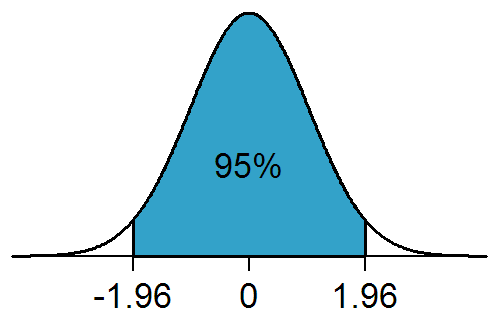

In statistical hypothesis testing, a result has statistical significance when it is very unlikely to have occurred given the null hypothesis (simply by chance alone). More precisely, a study's defined significance level, denoted by \alpha, is the probability of the study rejecting the null hypothesis, given that the null hypothesis is true; and the ''p''-value of a result, ''p'', is the probability of obtaining a result at least as extreme, given that the null hypothesis is true. The result is statistically significant, by the standards of the study, when p \le \alpha. The significance level for a study is chosen before data collection, and is typically set to 5% or much lower—depending on the field of study. In any experiment or observation that involves drawing a sample from a population, there is always the possibility that an observed effect would have occurred due to sampling error alone. But if the ''p''-value of an observed effect is less than (or equal to) the significa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sample Size Determination

Sample size determination is the act of choosing the number of observations or replicates to include in a statistical sample. The sample size is an important feature of any empirical study in which the goal is to make inferences about a population from a sample. In practice, the sample size used in a study is usually determined based on the cost, time, or convenience of collecting the data, and the need for it to offer sufficient statistical power. In complicated studies there may be several different sample sizes: for example, in a stratified survey there would be different sizes for each stratum. In a census, data is sought for an entire population, hence the intended sample size is equal to the population. In experimental design, where a study may be divided into different treatment groups, there may be different sample sizes for each group. Sample sizes may be chosen in several ways: *using experience – small samples, though sometimes unavoidable, can result in wide conf ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yahoo! Finance

Yahoo! Finance is a media property that is part of the Yahoo! network. It provides financial news, data and commentary including stock quotes, press releases, financial reports, and original content. It also offers some online tools for personal finance management. In addition to posting partner content from other web sites, it posts original stories by its team of staff journalists. It is ranked 20th by SimilarWeb on the list of largest news and media websites. In 2017 Yahoo! Finance added the feature to look at news surrounding cryptocurrency. It lists over 9,000 unique coins including Bitcoin and Ethereum. See also * Google Finance * MSN Money References * https://finance.yahoo.com/portfolios External links Yahoo! Finance Economics websites Finance Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dot-com Bubble

The dot-com bubble (dot-com boom, tech bubble, or the Internet bubble) was a stock market bubble in the late 1990s, a period of massive growth in the use and adoption of the Internet. Between 1995 and its peak in March 2000, the Nasdaq Composite stock market index rose 400%, only to fall 78% from its peak by October 2002, giving up all its gains during the bubble. During the dot-com crash, many online shopping companies, such as Pets.com, Webvan, and Boo.com, as well as several communication companies, such as Worldcom, NorthPoint Communications, and Global Crossing, failed and shut down. Some companies that survived, such as Amazon, lost large portions of their market capitalization, with Cisco Systems alone losing 80% of its stock value. Background Historically, the dot-com boom can be seen as similar to a number of other technology-inspired booms of the past including railroads in the 1840s, automobiles in the early 20th century, radio in the 1920s, television in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Western World

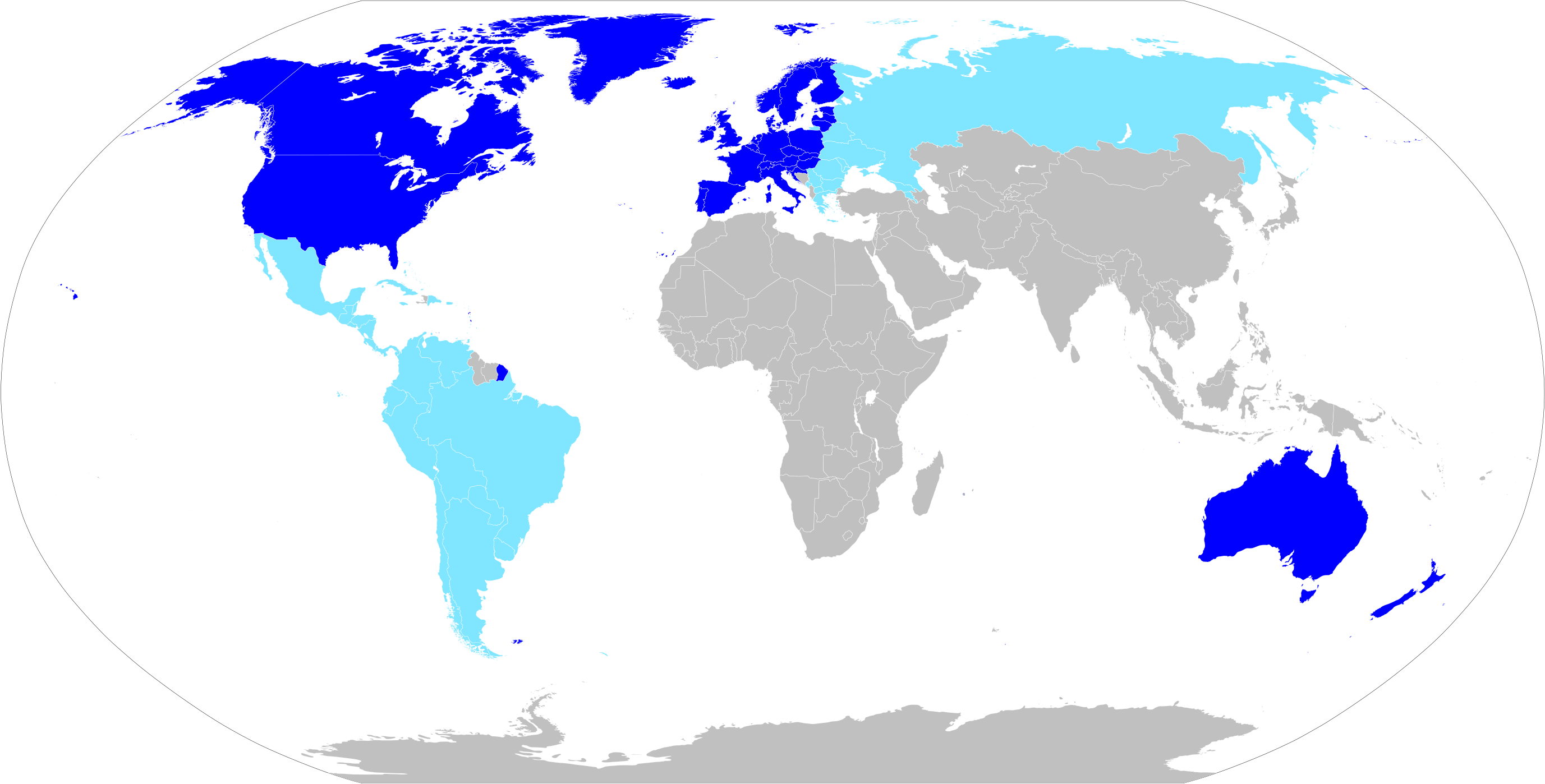

The Western world, also known as the West, primarily refers to the various nations and states in the regions of Europe, North America, and Oceania.Western Civilization Our Tradition; James Kurth; accessed 30 August 2011 The Western world is also known as the (from the word ''occidēns'' "setting down, sunset, west") in contrast to the known as the [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Blue Chip (stock Market)

A blue chip is stock in a ''stock corporation'' (contrasted with non-stock one) with a national reputation for quality, reliability, and the ability to operate profitably in good and bad times. Origin As befits the sometimes high-risk nature of stock picking, the term "blue chip" derives from the card game poker. The simplest sets of poker chips include white, red, and blue chips, with American tradition dictating that the blues are highest in value. In the United States, blue chips were traditionally used for higher values such that "blue chip" used in noun and adjectival senses are attested since 1873 and 1894, respectively. This established connotation was first extended to the sense of a blue-chip stock in the 1920s. According to Dow Jones company folklore, this sense extension was coined by Oliver Gingold (an early employee of the company that would become Dow Jones) sometime in the 1920s, when Gingold was standing by the stock ticker at the brokerage firm that later ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jornal De Negócios

''Jornal de Negócios'' (meaning ''Business Newspaper'' in English) is a Portuguese language business newspaper published in Lisbon, Portugal. History and profile ''Jornal de Negócios'' was started in 1997 as a finance website, being the first in the country. In 1998 it became a business newspaper and on 8 May 2003 it began to be published daily. ''Jornal de Negócios'' is owned by Cofina and is based in Lisbon. Its sister newspaper is ''Correio da Manhã ''Correio da Manhã'' () is a Portuguese daily newspaper from Portugal. Published in Lisbon, it is the most circulated daily newspaper in Portugal. History and profile ''Correio da Manhã'' was established in 1979. The paper is based in Lisbon ...'', also owned by Cofina. Both papers are published in tabloid format. The publisher of ''Jornal de Negócios'' is Mediafin-Sociedade Editora. Circulation In 2003 ''Jornal de Negócios'' had a circulation of 10,000 copies. Its 2004 circulation was 8,000 copies. In 2007 the pape ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |