|

Prospect Theory

Prospect theory is a theory of behavioral economics, judgment and decision making that was developed by Daniel Kahneman and Amos Tversky in 1979. The theory was cited in the decision to award Kahneman the 2002 Nobel Memorial Prize in Economics. Based on results from controlled studies, it describes how individuals assess their loss and gain perspectives in an asymmetric manner (see loss aversion). For example, for some individuals, the pain from losing $1,000 could only be compensated by the pleasure of earning $2,000. Thus, contrary to the expected utility theory (which models the decision that perfectly rational agents would make), prospect theory aims to describe the actual behavior of people. In the original formulation of the theory, the term ''prospect'' referred to the predictable results of a lottery. However, prospect theory can also be applied to the prediction of other forms of behaviors and decisions. Prospect theory challenges the expected utility theory deve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Daniel Kahneman (3283955327) (cropped)

Daniel Kahneman (; ; March 5, 1934 – March 27, 2024) was an Israeli-American psychologist best known for his work on the psychology of judgment and decision-making as well as behavioral economics, for which he was awarded the 2002 Nobel Memorial Prize in Economic Sciences together with Vernon L. Smith. Kahneman's published empirical findings challenge the assumption of human rationality prevailing in modern economic theory. Kahneman became known as the "grandfather of behavioral economics." With Amos Tversky and others, Kahneman established a cognitive basis for common human errors that arise from heuristics and biases, and developed prospect theory. In 2011, Kahneman was named by ''Foreign Policy'' magazine in its list of top global thinkers. In the same year, his book '' Thinking, Fast and Slow'', which summarizes much of his research, was published and became a best seller. In 2015, ''The Economist'' listed him as the seventh most influential economist in the world. Kahne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loss Aversion

In cognitive science and behavioral economics, loss aversion refers to a cognitive bias in which the same situation is perceived as worse if it is framed as a loss, rather than a gain. It should not be confused with risk aversion, which describes the rational behavior of valuing an uncertain outcome at less than its expected value. When defined in terms of the pseudo-utility function as in cumulative prospect theory (CPT), the left-hand of the function increases much more steeply than gains, thus being more "painful" than the satisfaction from a comparable gain. Empirically, losses tend to be treated as if they were twice as large as an equivalent gain. Loss aversion was first proposed by Amos Tversky and Daniel Kahneman as an important component of prospect theory. History In 1979, Daniel Kahneman and his associate Amos Tversky originally coined the term "loss aversion" in their initial proposal of prospect theory as an alternative descriptive model of decision makin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Disposition Effect

The disposition effect is an anomaly discovered in behavioral finance. It relates to the tendency of investors to sell assets that have increased in value, while keeping assets that have dropped in value. Hersh Shefrin and Meir Statman identified and named the effect in their 1985 paper, which found that people dislike losing significantly more than they enjoy winning. The disposition effect has been described as one of the foremost vigorous actualities around individual investors because investors will hold stocks that have lost value yet sell stocks that have gained value." In 1979, Daniel Kahneman and Amos Tversky traced the cause of the disposition effect to the so-called "prospect theory". The prospect theory proposes that when an individual is presented with two equal choices, one having possible gains and the other with possible losses, the individual is more likely to opt for the former choice even though both would yield the same economic result. The disposition effect ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dominating Decision Rule

In decision theory, a decision rule is said to dominate another if the performance of the former is sometimes better, and never worse, than that of the latter. Formally, let \delta_1 and \delta_2 be two decision rules, and let R(\theta, \delta) be the risk In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environ ... of rule \delta for parameter \theta. The decision rule \delta_1 is said to dominate the rule \delta_2 if R(\theta,\delta_1)\le R(\theta,\delta_2) for all \theta, and the inequality is strict for some \theta.. This defines a partial order on decision rules; the maximal elements with respect to this order are called '' admissible decision rules.'' References {{statistics-stub Decision theory ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Linear

In mathematics, the term ''linear'' is used in two distinct senses for two different properties: * linearity of a '' function'' (or '' mapping''); * linearity of a '' polynomial''. An example of a linear function is the function defined by f(x)=(ax,bx) that maps the real line to a line in the Euclidean plane R2 that passes through the origin. An example of a linear polynomial in the variables X, Y and Z is aX+bY+cZ+d. Linearity of a mapping is closely related to '' proportionality''. Examples in physics include the linear relationship of voltage and current in an electrical conductor ( Ohm's law), and the relationship of mass and weight. By contrast, more complicated relationships, such as between velocity and kinetic energy, are '' nonlinear''. Generalized for functions in more than one dimension, linearity means the property of a function of being compatible with addition and scaling, also known as the superposition principle. Linearity of a polynomial means that its de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Utility

In economics, utility is a measure of a certain person's satisfaction from a certain state of the world. Over time, the term has been used with at least two meanings. * In a normative context, utility refers to a goal or objective that we wish to maximize, i.e., an objective function. This kind of utility bears a closer resemblance to the original utilitarian concept, developed by moral philosophers such as Jeremy Bentham and John Stuart Mill. * In a descriptive context, the term refers to an ''apparent'' objective function; such a function is revealed by a person's behavior, and specifically by their preferences over lotteries, which can be any quantified choice. The relationship between these two kinds of utility functions has been a source of controversy among both economists and ethicists, with most maintaining that the two are distinct but generally related. Utility function Consider a set of alternatives among which a person has a preference ordering. A utility fu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Framing Effect (psychology)

Framing may refer to: * Framing (construction), common carpentry work * Framing (law), providing false evidence or testimony to prove someone guilty of a crime * Framing (social sciences) * Framing (visual arts), a technique used to bring the focus to the subject * Framing (World Wide Web), a technique using multiple panes within a web page * Pitch framing, a baseball concept * Timber framing, a traditional method of building with heavy timbers See also * Frame synchronization, in telecommunications * Frame of reference, a coordinate system * Frame (other) * Framed (other) * Framing device, a narrative tool * Framework (other) * Inertial frame of reference In classical physics and special relativity, an inertial frame of reference (also called an inertial space or a Galilean reference frame) is a frame of reference in which objects exhibit inertia: they remain at rest or in uniform motion relative ..., describes time and space homogeneousl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

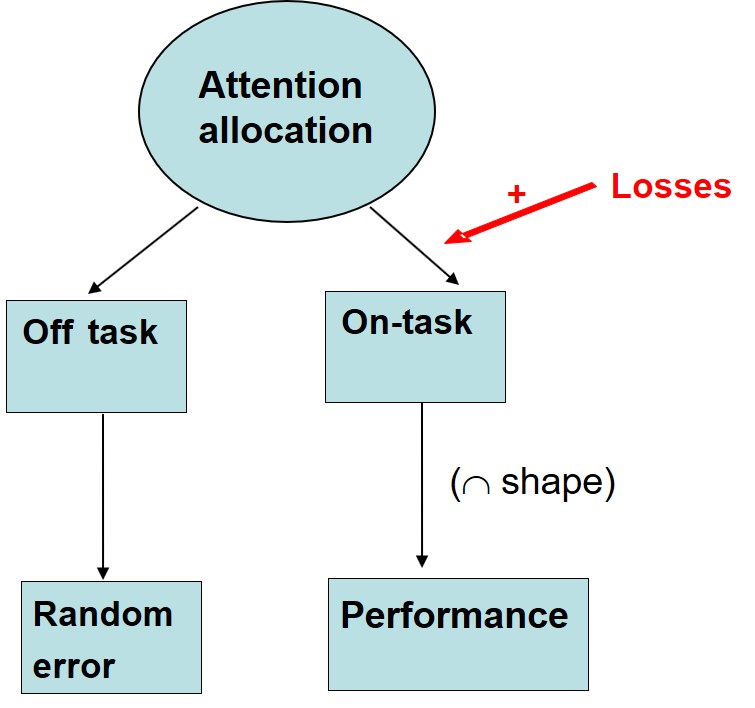

Heuristics In Judgment And Decision Making

Heuristics (from Ancient Greek εὑρίσκω, ''heurískō'', "I find, discover") is the process by which humans use mental shortcuts to arrive at decisions. Heuristics are simple strategies that humans, animals, organizations, and even machines use to quickly form judgments, make decisions, and find solutions to complex problems. Often this involves focusing on the most relevant aspects of a problem or situation to formulate a solution. While heuristic processes are used to find the answers and solutions that are ''most'' likely to work or be correct, they are not always right or the most accurate. Judgments and decisions based on heuristics are simply good enough to satisfy a pressing need in situations of uncertainty, where information is incomplete. In that sense they can differ from answers given by logic and probability. The economist and cognitive psychologist Herbert A. Simon introduced the concept of heuristics in the 1950s, suggesting there were limitations to ratio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overconfidence Effect

The overconfidence effect is a well-established bias in which a person's subjective ''confidence'' in their judgments is reliably greater than the objective ''accuracy'' of those judgments, especially when confidence is relatively high. Overconfidence is one example of a miscalibration of subjective probabilities. Throughout the research literature, overconfidence has been defined in three distinct ways: (1) ''overestimation'' of one's actual performance; (2) ''overplacement'' of one's performance relative to others; and (3) ''overprecision'' in expressing unwarranted certainty in the accuracy of one's beliefs. The most common way in which overconfidence has been studied is by asking people how confident they are of specific beliefs they hold or answers they provide. The data show that confidence systematically exceeds accuracy, implying people are more sure that they are correct than they deserve to be. If human confidence had perfect calibration, judgments with 100% confidence w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cognitive Bias

A cognitive bias is a systematic pattern of deviation from norm (philosophy), norm or rationality in judgment. Individuals create their own "subjective reality" from their perception of the input. An individual's construction of reality, not the Objectivity (philosophy), objective input, may dictate their behavior in the world. Thus, cognitive biases may sometimes lead to perceptual distortion, inaccurate judgment, illogical interpretation, and irrationality. While cognitive biases may initially appear to be negative, some are adaptive. They may lead to more effective actions in a given context. Furthermore, allowing cognitive biases enables faster decisions which can be desirable when timeliness is more valuable than accuracy, as illustrated in Heuristic (psychology), heuristics. Other cognitive biases are a "by-product" of human processing limitations, resulting from a lack of appropriate mental mechanisms (bounded rationality), the impact of an individual's constitution and bi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Utility

Marginal utility, in mainstream economics, describes the change in ''utility'' (pleasure or satisfaction resulting from the consumption) of one unit of a good or service. Marginal utility can be positive, negative, or zero. Negative marginal utility implies that every consumed additional unit of a commodity causes more harm than good, leading to a decrease in overall utility. In contrast, positive marginal utility indicates that every additional unit consumed increases overall utility. In the context of cardinal utility, liberal economists postulate a law of diminishing marginal utility. This law states that the first unit of consumption of a good or service yields more satisfaction or utility than the subsequent units, and there is a continuing reduction in satisfaction or utility for greater amounts. As consumption increases, the additional satisfaction or utility gained from each additional unit consumed falls, a concept known as ''diminishing marginal utility.'' This idea is us ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

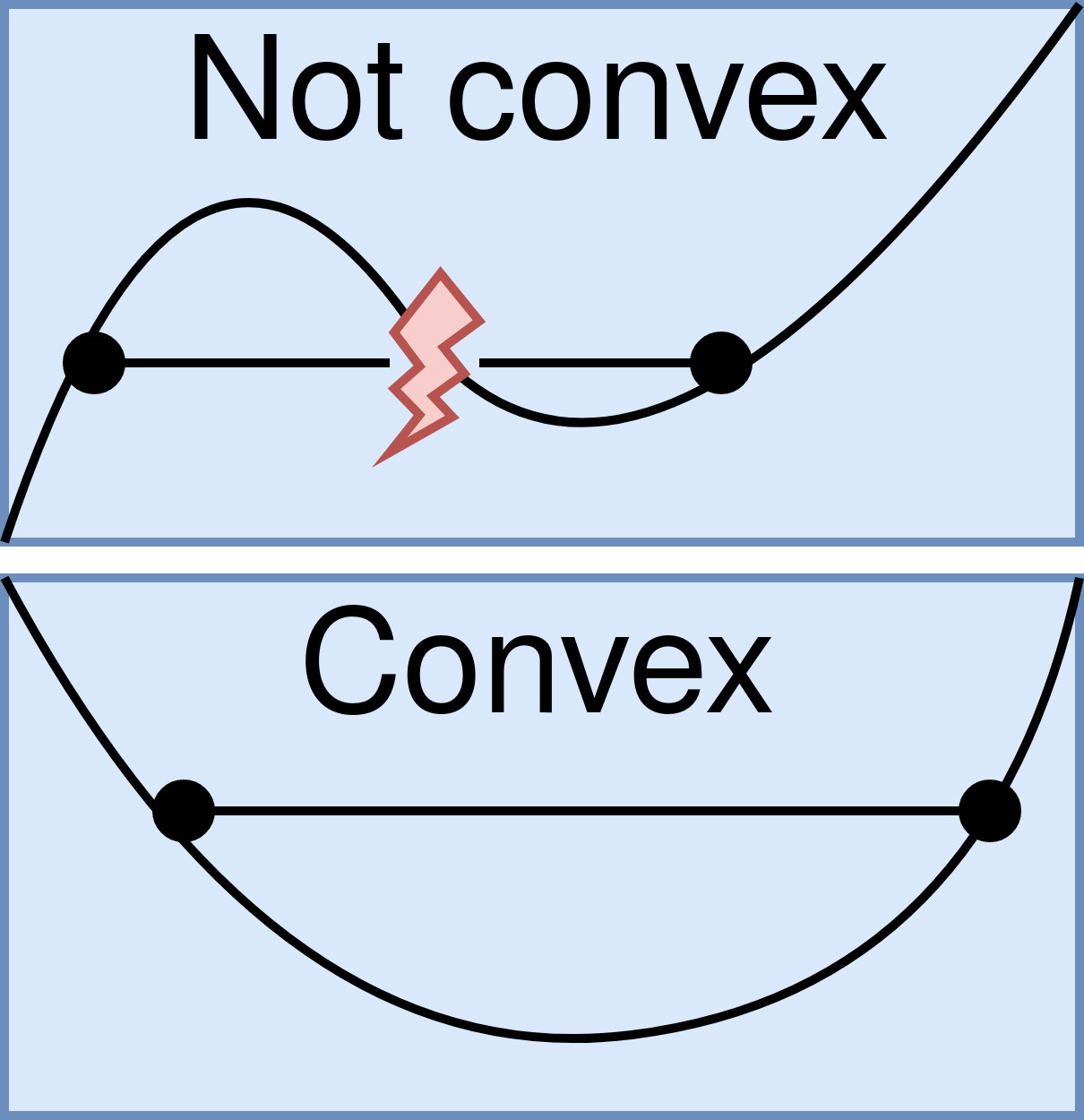

Convex Function

In mathematics, a real-valued function is called convex if the line segment between any two distinct points on the graph of a function, graph of the function lies above or on the graph between the two points. Equivalently, a function is convex if its epigraph (mathematics), ''epigraph'' (the set of points on or above the graph of the function) is a convex set. In simple terms, a convex function graph is shaped like a cup \cup (or a straight line like a linear function), while a concave function's graph is shaped like a cap \cap. A twice-differentiable function, differentiable function of a single variable is convex if and only if its second derivative is nonnegative on its entire domain of a function, domain. Well-known examples of convex functions of a single variable include a linear function f(x) = cx (where c is a real number), a quadratic function cx^2 (c as a nonnegative real number) and an exponential function ce^x (c as a nonnegative real number). Convex functions pl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |