|

Park Test

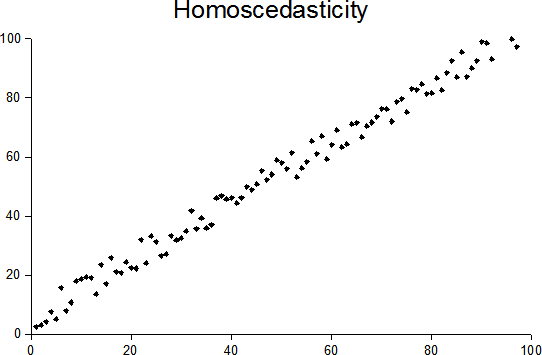

In econometrics, the Park test is a test for heteroscedasticity. The test is based on the method proposed by Rolla Edward Park for estimating linear regression parameters in the presence of heteroscedastic error terms. Background In regression analysis, heteroscedasticity refers to unequal variances of the random error terms \epsilon_i, such that :\operatorname(\epsilon_i)=E(\epsilon_i^2)-E(\epsilon_i)^2=E(\epsilon_i^2)=\sigma_i^2. It is assumed that \operatorname(\epsilon_i)=0. The above variance varies with i, or the i^ trial in an experiment or the i^case or observation in a dataset. Equivalently, heteroscedasticity refers to unequal conditional variances in the response variables Y_i, such that :\operatorname(Y_i, X_i)=\sigma_i^2, again a value that depends on i – or, more specifically, a value that is conditional on the values of one or more of the regressors X. Homoscedasticity, one of the basic Gauss–Markov assumptions of ordinary least squares linear regression ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Econometrics

Econometrics is the application of statistical methods to economic data in order to give empirical content to economic relationships.M. Hashem Pesaran (1987). "Econometrics," '' The New Palgrave: A Dictionary of Economics'', v. 2, p. 8 p. 8–22 Reprinted in J. Eatwell ''et al.'', eds. (1990). ''Econometrics: The New Palgrave''p. 1p. 1–34Abstract (2008 revision by J. Geweke, J. Horowitz, and H. P. Pesaran). More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference". An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships". Jan Tinbergen is one of the two founding fathers of econometrics. The other, Ragnar Frisch, also coined the term in the sense in which it is used today. A basic tool for econometrics is the multiple linear regression model. ''Econometric the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ordinary Least Squares

In statistics, ordinary least squares (OLS) is a type of linear least squares method for choosing the unknown parameters in a linear regression model (with fixed level-one effects of a linear function of a set of explanatory variables) by the principle of least squares: minimizing the sum of the squares of the differences between the observed dependent variable (values of the variable being observed) in the input dataset and the output of the (linear) function of the independent variable. Geometrically, this is seen as the sum of the squared distances, parallel to the axis of the dependent variable, between each data point in the set and the corresponding point on the regression surface—the smaller the differences, the better the model fits the data. The resulting estimator can be expressed by a simple formula, especially in the case of a simple linear regression, in which there is a single regressor on the right side of the regression equation. The OLS estimator is con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

White Test

In statistics, the White test is a statistical test that establishes whether the variance of the errors in a regression model is constant: that is for homoskedasticity. This test, and an estimator for heteroscedasticity-consistent standard errors, were proposed by Halbert White in 1980. These methods have become extremely widely used, making this paper one of the most cited articles in economics. In cases where the White test statistic is statistically significant, heteroskedasticity may not necessarily be the cause; instead the problem could be a specification error. In other words, the White test can be a test of heteroskedasticity or specification error or both. If no cross product terms are introduced in the White test procedure, then this is a test of pure heteroskedasticity. If cross products are introduced in the model, then it is a test of both heteroskedasticity and specification bias. Testing constant variance To test for constant variance one undertakes an auxi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Goldfeld–Quandt Test

In statistics, the Goldfeld–Quandt test checks for homoscedasticity in regression analyses. It does this by dividing a dataset into two parts or groups, and hence the test is sometimes called a two-group test. The Goldfeld–Quandt test is one of two tests proposed in a 1965 paper by Stephen Goldfeld and Richard Quandt. Both a parametric and nonparametric test are described in the paper, but the term "Goldfeld–Quandt test" is usually associated only with the former. Test In the context of multiple regression (or univariate regression), the hypothesis to be tested is that the variances of the errors of the regression model are not constant, but instead are monotonically related to a pre-identified explanatory variable. For example, data on income and consumption may be gathered and consumption regressed against income. If the variance increases as levels of income increase, then income may be used as an explanatory variable. Otherwise some third variable (e.g. wealth or l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Glejser Test

In statistics, the Glejser test for heteroscedasticity, developed in 1969 by Herbert Glejser, regresses the residuals on the explanatory variable that is thought to be related to the heteroscedastic variance. After it was found not to be asymptotically valid under asymmetric disturbances, similar improvements have been independently suggested by Im, and Machado and Santos Silva. Steps for using the Glejser method Step 1: Estimate original regression with ordinary least squares and find the sample residuals ''e''''i''. Step 2: Regress the absolute value , ''e''''i'', on the explanatory variable that is associated with the heteroscedasticity. : \begin , e_i, & = \gamma_0 + \gamma_1 X_i + v_i \\ pt, e_i, & = \gamma_0 + \gamma_1 \sqrt + v_i \\ pt, e_i, & = \gamma_0 + \gamma_1 \frac 1 + v_i \end Step 3: Select the equation with the highest ''R''2 and lowest standard errors to represent heteroscedasticity. Step 4: Perform a t-test on the equation selected from step ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Breusch–Pagan Test

In statistics, the Breusch–Pagan test, developed in 1979 by Trevor Breusch and Adrian Pagan, is used to test for heteroskedasticity in a linear regression model. It was independently suggested with some extension by R. Dennis Cook and Sanford Weisberg in 1983 (Cook–Weisberg test). Derived from the Lagrange multiplier test principle, it tests whether the variance of the errors from a regression is dependent on the values of the independent variables. In that case, heteroskedasticity is present. Suppose that we estimate the regression model : y = \beta_0 + \beta_1 x + u, \, and obtain from this fitted model a set of values for \widehat, the residuals. Ordinary least squares constrains these so that their mean is 0 and so, given the assumption that their variance does not depend on the independent variables, an estimate of this variance can be obtained from the average of the squared values of the residuals. If the assumption is not held to be true, a simple model might be t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Richard E

Richard is a male given name. It originates, via Old French, from Old Frankish and is a compound of the words descending from Proto-Germanic ''*rīk-'' 'ruler, leader, king' and ''*hardu-'' 'strong, brave, hardy', and it therefore means 'strong in rule'. Nicknames include " Richie", "Dick", " Dickon", " Dickie", "Rich", " Rick", " Rico", " Ricky", and more. Richard is a common English, German and French male name. It's also used in many more languages, particularly Germanic, such as Norwegian, Danish, Swedish, Icelandic, and Dutch, as well as other languages including Irish, Scottish, Welsh and Finnish. Richard is cognate with variants of the name in other European languages, such as the Swedish "Rickard", the Catalan "Ricard" and the Italian "Riccardo", among others (see comprehensive variant list below). People named Richard Multiple people with the same name * Richard Andersen (other) * Richard Anderson (other) * Richard Cartwright (disambiguati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stephen Goldfeld

Stephen Michael Goldfeld (August 9, 1940 – August 25, 1995) was a Princeton University economics professor and provost who served on the Council of Economic Advisers during the Carter administration. Goldfeld received a bachelor's degree from Harvard University in 1960 at the age of twenty and a doctorate in economics from the Massachusetts Institute of Technology in 1963 at the age of twenty three, when he joined the Princeton faculty. As an academic he specialized in financial institutions and in econometrics. He was an associate editor of the ''American Economic Review The ''American Economic Review'' is a monthly peer-reviewed academic journal published by the American Economic Association. First published in 1911, it is considered one of the most prestigious and highly distinguished journals in the field of ec ...'' and other major economic journals. He died in 1995 at the age of 55 of lung cancer. Noted publications * * * References Econometricians 1995 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gauss–Markov Theorem

In statistics, the Gauss–Markov theorem (or simply Gauss theorem for some authors) states that the ordinary least squares (OLS) estimator has the lowest sampling variance within the class of linear unbiased estimators, if the errors in the linear regression model are uncorrelated, have equal variances and expectation value of zero. The errors do not need to be normal, nor do they need to be independent and identically distributed (only uncorrelated with mean zero and homoscedastic with finite variance). The requirement that the estimator be unbiased cannot be dropped, since biased estimators exist with lower variance. See, for example, the James–Stein estimator (which also drops linearity), ridge regression, or simply any degenerate estimator. The theorem was named after Carl Friedrich Gauss and Andrey Markov, although Gauss' work significantly predates Markov's. But while Gauss derived the result under the assumption of independence and normality, Markov reduced ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Heteroscedasticity

In statistics, a sequence (or a vector) of random variables is homoscedastic () if all its random variables have the same finite variance. This is also known as homogeneity of variance. The complementary notion is called heteroscedasticity. The spellings ''homoskedasticity'' and ''heteroskedasticity'' are also frequently used. Assuming a variable is homoscedastic when in reality it is heteroscedastic () results in unbiased but inefficient point estimates and in biased estimates of standard errors, and may result in overestimating the goodness of fit as measured by the Pearson coefficient. The existence of heteroscedasticity is a major concern in regression analysis and the analysis of variance, as it invalidates statistical tests of significance that assume that the modelling errors all have the same variance. While the ordinary least squares estimator is still unbiased in the presence of heteroscedasticity, it is inefficient and generalized least squares should be used i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Variance

In probability theory and statistics, variance is the expectation of the squared deviation of a random variable from its population mean or sample mean. Variance is a measure of dispersion, meaning it is a measure of how far a set of numbers is spread out from their average value. Variance has a central role in statistics, where some ideas that use it include descriptive statistics, statistical inference, hypothesis testing, goodness of fit, and Monte Carlo sampling. Variance is an important tool in the sciences, where statistical analysis of data is common. The variance is the square of the standard deviation, the second central moment of a distribution, and the covariance of the random variable with itself, and it is often represented by \sigma^2, s^2, \operatorname(X), V(X), or \mathbb(X). An advantage of variance as a measure of dispersion is that it is more amenable to algebraic manipulation than other measures of dispersion such as the expected absolute deviatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |