|

OrbiMed Advisors

OrbiMed (also known as OrbiMed Advisors) is an American investment firm based in New York City, United States. It is focused on making public and private investments in the Healthcare and Biotechnology industries. OrbiMed is considered to be the largest dedicated healthcare investment firm in the world. History In 1989, S.G Warburg pharmaceutical analysts, Viren Mehta and Samuel Isaly founded Mehta & Isaly, a money-management and research firm. This was the predecessor firm to OrbiMed. In 1993, the firm made its first private equity investment. In 1998, Mehta & Isaly split up where Mehta would form Mehta Partners and Isaly would form OrbiMed. In 2007, OrbiMed expanded into Asia opening offices in Shanghai and Mumbai and in 2010, expanded into the Middle East opening a office in Herzliya, Israel. In 2011, OrbiMed launched its first health care royalties and credit opportunities fund. In December 2017, Isaly stepped down from his role as managing partner of OrbiMed due to all ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Privately Held Company

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is offered, owned, traded, exchanged privately, or Over-the-counter (finance), over-the-counter. In the case of a closed corporation, there are a relatively small number of shareholders or company members. Related terms are closely-held corporation, unquoted company, and unlisted company. Though less visible than their public company, publicly traded counterparts, private companies have major importance in the world's economy. In 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for ($1.8 trillion) in revenues and employed 6.2 million people, according to ''Forbes''. In 2005, using a substantially smaller pool size (22.7%) for comparison, the 339 companies on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hong Kong

Hong Kong ( (US) or (UK); , ), officially the Hong Kong Special Administrative Region of the People's Republic of China ( abbr. Hong Kong SAR or HKSAR), is a city and special administrative region of China on the eastern Pearl River Delta in South China. With 7.5 million residents of various nationalities in a territory, Hong Kong is one of the most densely populated places in the world. Hong Kong is also a major global financial centre and one of the most developed cities in the world. Hong Kong was established as a colony of the British Empire after the Qing Empire ceded Hong Kong Island from Xin'an County at the end of the First Opium War in 1841 then again in 1842.. The colony expanded to the Kowloon Peninsula in 1860 after the Second Opium War and was further extended when Britain obtained a 99-year lease of the New Territories in 1898... British Hong Kong was occupied by Imperial Japan from 1941 to 1945 during World War II; British administration resume ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

California Institute For Quantitative Biosciences

The California Institute for Quantitative Biosciences (QB3) is a nonprofit research and technology commercialization institute affiliated with three University of California campuses in the San Francisco Bay Area: Berkeley, San Francisco, and Santa Cruz. QB3's domain is the quantitative biosciences: areas of biology in which advances are chiefly made by scientists applying techniques from physics, chemistry, engineering, and computer science. History QB3 was founded in 2000 as one of four Governor Gray Davis Institutes for Science and Innovation (originally, California Institutes for Science and Innovation, or Cal ISIs). From a 2005 article written for the University of California Academic Senate: The Institutes were launched in 2000 as an ambitious statewide initiative to support research in fields that were recognized as critical to the economic growth of the state—biomedicine, bioengineering, nanosystems, telecommunications and information technology. Moreover, the Cal ISI ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ambit Biosciences

Ambit was an American pharmaceutical company focused on development of kinase inhibitor therapeutics to treat a variety of human diseases.The SEC 10K submission for 2013 indicates that the company is a "biopharmaceutical" company, which implies that they are primarily developing biopharmaceuticals; however, their lead product is a small molecule therapeutic, calling into question the term used in the SEC submission. , the company was based in San Diego, California, and consisted of a single facility. Ambit made an initial public offering in May 2013, and was listed on the NASDAQ exchange under the symbol "AMBI". Ambit was acquired by Daiichi Sankyo in 2014 and is no longer traded on the NASDAQ exchange. Products , three products were under development, of which quizartinib was their lead drug candidate. Business model In June 2010, Ambit completed a Series D-2 round of equity financing, raising $30 million in new capital. The investor syndicate was led by Apposite Capital LLP and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Acceleron Pharma

Acceleron Pharma, Inc. is an American clinical stage biopharmaceutical company based in Cambridge, Massachusetts with a broad focus on developing medicines that regulate the transforming growth factor beta (TGF-β) superfamily of proteins, which play fundamental roles in the growth and repair of cells and tissues such as red blood cells, muscle, bone, and blood vessels. Pipeline Acceleron has four drugs in clinical trials, and one in preclinical development. * Luspatercept (ACE-536) for anemia * Sotatercept (ACE-011) for kidney disease * Dalantercept (ACE-041) for kidney cancer * ACE-083 for muscular disorders History The company was formed in June 2003 in Cambridge, Massachusetts as a Delaware corporation; the original name was Phoenix Pharma. The founders were scientists Jasbir Seehra, Tom Maniatis, Mark Ptashne, Wylie Vale, and scientific advisor Joan Massague, and business people and investors John Knopf and Christoph Westphal of Polaris Venture Partners, who served as f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

AbCellera

AbCellera Biologics Inc. is a Vancouver, British Columbia-based biotechnology firm that researches and develops human antibodies. The company is best known for its leading role in the Pandemic Prevention Platform, a project of DARPA's Biological Technologies Office. AbCellera utilizes a proprietary technology platform, which they claim can develop "medical countermeasures within 60 days." Its platform for single-cell screening was initially developed at the University of British Columbia. History AbCellera was founded in 2012 by biomedical researchers Carl Hansen, Véronique Lecault, Kevin Heyries, Daniel Da Costa and Oleh Petriv. In November 2016, the company received a 645K grant from the Bill & Melinda Gates Foundation to develop a test for tuberculosis. In September 2018, a $10M series A round of funding was closed. In May 2020, a $105M series B round of funding was closed. In January 2017, AbCellera announced that it would be collaborating with Pfizer to discover and de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity. The term can also be used metaphorically to cover moral obligations and other interactions not based on a monetary value. For example, in Western cultures, a person who has been helped by a second person is sometimes said to owe a "debt of gratitude" to the second person. Etymology The English term "debt" was first used in the late 13th century. The term "debt" comes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Growth Equity

Growth capital (also called expansion capital and growth equity) is a type of private equity investment, usually a Minority interest, minority investment, in relatively mature companies that are looking for capital to expand or restructure operations, enter new markets or finance a significant acquisition without a change of control of the business. Companies that seek growth capital will often do so to finance a transformational event in their lifecycle. These companies are likely to be more mature than venture capital funded companies, able to generate revenue and profit but unable to generate sufficient cash to fund major expansions, acquisitions or other investments. Because of this lack of scale, these companies generally can find few alternative finance, alternative conduits to secure capital for growth, so access to growth equity can be critical to pursue necessary facility expansion, sales and marketing initiatives, equipment purchases, and new product development. Growth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Startup Companies

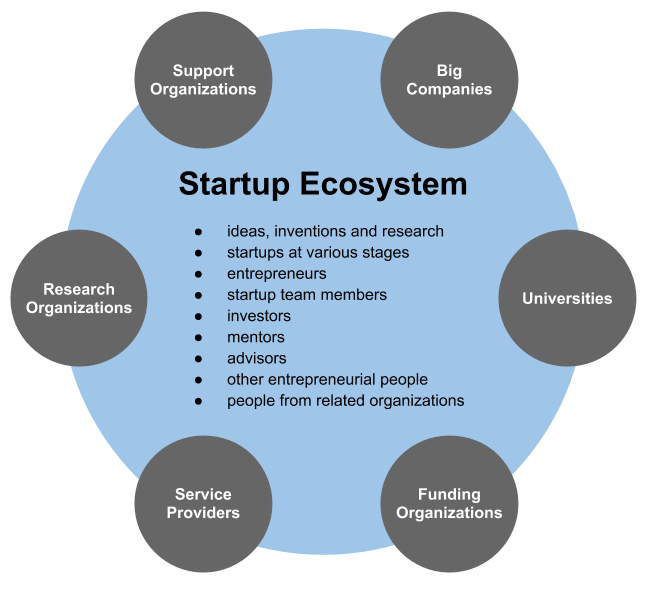

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship refers to all new businesses, including self-employment and businesses that never intend to become registered, startups refer to new businesses that intend to grow large beyond the solo founder. At the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to be successful and influential.Erin Griffith (2014)Why startups fail, according to their founders Fortune.com, 25 September 2014; accessed 27 October 2017 Actions Startups typically begin by a founder (solo-founder) or co-founders who have a way to solve a problem. The founder of a startup will begin market validation by problem interview, solution interview, and building a minimum viable product (MVP), i.e. a prototype, to develop and validate their business models. The startup process can take a long period of time (by so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Trust

An investment trust is a form of investment fund found mostly in the United Kingdom and Japan. Investment trusts are constituted as public limited companies and are therefore closed ended since the fund managers cannot redeem or create shares. The first investment trust was the Foreign & Colonial Investment Trust, started in 1868 "to give the investor of moderate means the same advantages as the large capitalists in diminishing the risk by spreading the investment over a number of stocks". In many respects, the investment trust was the progenitor of the investment company in the U.S. The name is somewhat misleading, given that (according to law) an investment "trust" is not in fact a "trust" in the legal sense at all, but a separate legal person or a company. This matters for the fiduciary duties owed by the board of directors and the equitable ownership of the fund's assets. In the United Kingdom, the term "investment trust" has a strict meaning under tax law. However, the t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Closed-end Fund

A closed-end fund (CEF) is a fund that raises capital by issuing a fixed number of shares which are not redeemable, and then invest that capital in financial assets such as stocks and bonds. Unlike open-end funds, new shares in a closed-end fund are not created by managers to meet demand from investors. Instead, the shares can be purchased and sold only in the market, which is the original design of the mutual fund, which predates open-end mutual funds but offers the same actively-managed pooled investments. In the United States, closed-end funds sold publicly must be registered under both the Securities Act of 1933 and the Investment Company Act of 1940. Closed-end funds are usually listed on a recognized stock exchange and can be bought and sold on that exchange. The price per share is determined by the market and is usually different from the underlying value or net asset value (NAV) per share of the investments held by the fund. The price is said to be at a discount or pre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Event-driven Investing

Event-driven investing or Event-driven trading is a hedge fund investment strategy that seeks to exploit pricing inefficiencies that may occur before or after a corporate event, such as an earnings call, bankruptcy, merger, acquisition, or spinoff. In more recent times market practitioners have expanded this definition to include additional events such as natural disasters and actions initiated by shareholder activists. However, merger arbitrage remains the best-known investment strategy within this group. Event-driven investing strategies are typically used only by sophisticated investors, such as hedge funds and private-equity firms. That’s because traditional equity investors, including managers of equity mutual funds, do not have the expertise or access to information necessary to properly analyze the risks associated with many of these corporate events. This strategy was successfully utilized by Cornwall Capital and profiled in "The Big Short" by Michael Lewis. His ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |