|

Optimal Labor Income Taxation

Optimal labour income tax is a sub-area of optimal tax theory which refers to the study of designing a tax on individual labour income such that a given economic criterion like social welfare is optimized. Efficiency-Equity tradeoff The modern literature on optimal labour income taxation largely follows from James Mirrlees' "Exploration in the Theory of Optimum Income Taxation". The approach is based on asymmetric information, as the government is assumed to be unable to observe the number of hours people work or how productive they are, but can observe individuals' incomes. This imposes incentive compatibility constraints that limit the taxes which the government is able to levy, and prevents it from taxing high-productivity people at higher rates than low-productivity people. The government seeks to maximise a utilitarian social welfare function subject to these constraints. It faces a tradeoff between efficiency and equity: * Higher levels of taxation on the rich create re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Optimal Tax

Optimal tax theory or the theory of optimal taxation is the study of designing and implementing a tax that maximises a social welfare function subject to economic constraints. The social welfare function used is typically a function of individuals' utilities, most commonly some form of utilitarian function, so the tax system is chosen to maximise the aggregate of individual utilities. Tax revenue is required to fund the provision of public goods and other government services, as well as for redistribution from rich to poor individuals. However, most taxes distort individual behavior, because the activity that is taxed becomes relatively less desirable; for instance, taxes on labour income reduce the incentive to work. The optimization problem involves minimizing the distortions caused by taxation, while achieving desired levels of redistribution and revenue. Some taxes are thought to be less distorting, such as lump-sum taxes (where individuals cannot change their behaviour to redu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arthur Laffer

Arthur Betz Laffer (; born August 14, 1940) is an American economist and author who first gained prominence during the Reagan administration as a member of Reagan's Economic Policy Advisory Board (1981–1989). Laffer is best known for the Laffer curve, an illustration of the theory that there exists some tax rate between 0% and 100% that will result in maximum tax revenue for government. In certain circumstances, this would allow governments to cut taxes, and simultaneously increase revenue and economic growth. Laffer was an economic advisor to Donald Trump's 2016 presidential campaign. On June 19, 2019, President Trump awarded Laffer with the Presidential Medal of Freedom for his contributions in the field of economics. Early life and education Laffer was born in Youngstown, Ohio, the son of Marian Amelia "Molly" (née Betz), a homemaker and politician, and William Gillespie Laffer, president of the Clevite Corporation. He was raised in the Cleveland, Ohio area. He is a P ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

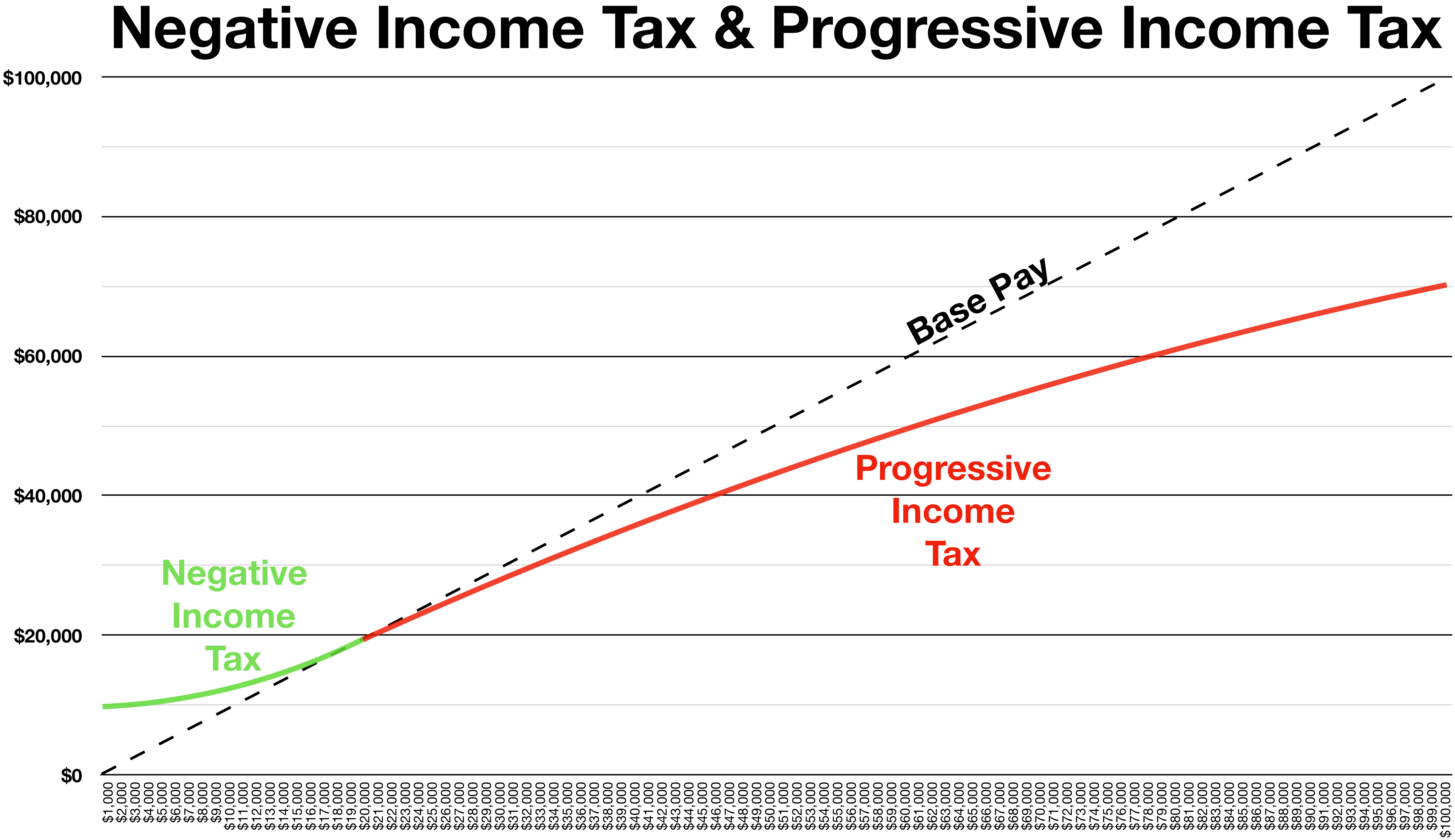

Negative Income Tax

In economics, a negative income tax (NIT) is a system which reverses the direction in which tax is paid for incomes below a certain level; in other words, earners above that level pay money to the state while earners below it receive money, as shown by the blue arrows in the diagram. NIT was proposed by Juliet Rhys-Williams while working on the Beveridge Report in the early 1940s and popularized by Milton Friedman in the 1960s as a system in which the state makes payments to the poor when their income falls below a threshold, while taxing them on income above that threshold. Together with Friedman, supporters of NIT also included James Tobin, Joseph A. Pechman, and Peter M. Mieszkowski, and even then-President Richard Nixon, who suggested implementation of modified NIT in his Family Assistance Plan. After the increase in popularity of NIT, an experiment sponsored by the US government was conducted between 1968 and 1982 on effects of NIT on labour supply, income, and substitutio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Science Direct

ScienceDirect is a website which provides access to a large bibliographic database of scientific and medical publications of the Dutch publisher Elsevier. It hosts over 18 million pieces of content from more than 4,000 academic journals and 30,000 e-books of this publisher. The access to the full-text requires subscription, while the bibliographic metadata is free to read. ScienceDirect is operated by Elsevier. It was launched in March 1997. Usage The journals are grouped into four main sections: ''Physical Sciences and Engineering'', ''Life Sciences'', ''Health Sciences'', and ''Social Sciences and Humanities''. Article abstracts are freely available, and access to their full texts (in PDF and, for newer publications, also HTML) generally requires a subscription or pay-per-view purchase unless the content is freely available in open access. Subscriptions to the overall offering hosted on ScienceDirect, rather than to specific titles it carries, are usually acquired through a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rent-seeking

Rent-seeking is the act of growing one's existing wealth without creating new wealth by manipulating the social or political environment. Rent-seeking activities have negative effects on the rest of society. They result in reduced economic efficiency through misallocation of resources, reduced wealth creation, lost government revenue, heightened income inequality, and potential national decline. Attempts at capture of regulatory agencies to gain a coercive monopoly can result in advantages for rent-seekers in a market while imposing disadvantages on their uncorrupt competitors. This is one of many possible forms of rent-seeking behavior. Description The term rent, in the narrow sense of economic rent, was coined by the British 19th-century economist David Ricardo, but rent-seeking only became the subject of durable interest among economists and political scientists more than a century later after the publication of two influential papers on the topic by Gordon Tullock in 19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Negative Income Tax

In economics, a negative income tax (NIT) is a system which reverses the direction in which tax is paid for incomes below a certain level; in other words, earners above that level pay money to the state while earners below it receive money, as shown by the blue arrows in the diagram. NIT was proposed by Juliet Rhys-Williams while working on the Beveridge Report in the early 1940s and popularized by Milton Friedman in the 1960s as a system in which the state makes payments to the poor when their income falls below a threshold, while taxing them on income above that threshold. Together with Friedman, supporters of NIT also included James Tobin, Joseph A. Pechman, and Peter M. Mieszkowski, and even then-President Richard Nixon, who suggested implementation of modified NIT in his Family Assistance Plan. After the increase in popularity of NIT, an experiment sponsored by the US government was conducted between 1968 and 1982 on effects of NIT on labour supply, income, and substitutio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lump Sum

A lump sum is a single payment of money, as opposed to a series of payments made over time (such as an annuity). The United States Department of Housing and Urban Development distinguishes between "price analysis" and "cost analysis" by whether the decision maker compares lump sum amounts, or subjects contract prices to an itemized cost breakdown. In 1911, American union leaders including Samuel Gompers of the American Federation of Labor expressed opposition to lump sums being awarded to their members pursuant to a new workers compensation law, saying that when they received lump sums rather than periodic payments the risk of them squandering the money was greater. ''The Financial Times'' reported in July 2011 that research by Prudential had found that 79% of polled pensioners in the UK collecting a company or private pension that year took a tax-free lump sum as part of their retirement benefits, as compared to 76% in 2008. Prudential was of the view that for many retirees, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eytan Sheshinski

Ethan is a male given name of Hebrew origin () that means "firm, enduring, strong and long-lived". The name Ethan appears eight times in the Hebrew Bible (1 Kings. 4:31, Ps. 89 title, 1 Chr. 2:6 and 2:8, 1 Chr. 6:42 and 6:44, and 1 Chr. 15:17 and 15:19). See Ethan (biblical figure). It may also be spelled or pronounced as Etan, Eitan or Eytan. Popularity In 2013, it was the fourth most popular name for boys in Australia. Ethan is also popular in the United States and was the 10th most popular boy's name in 2016. According to the US data, 97% of all American boys named Ethan were born after 1989. Notable people with the given name "Ethan" include A *Ethan Alagich (born 2003), Australian footballer * Ethan Albright (born 1971), American football player *Ethan Allen (other), multiple people *Ethan Ampadu (born 2000), British footballer * Ethan Allen Andrews (other), multiple people *Ethan Anthony (born 1950), American architect * Ethan Ash, English singer-s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax In The United States

Income taxes in the United States are imposed by the federal government, and most states. The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed (with some exceptions in the case of Federal income taxation), but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the federal and some state levels. In the United States, the term "payroll tax" usually refers to FICA taxes that are paid to fund Social Security and Medicare, while "income tax" re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Homemaking

Homemaking is mainly an American and Canadian term for the management of a home, otherwise known as housework, housekeeping, housewifery or household management. It is the act of overseeing the organizational, day-to-day operations of a house or estate, and the managing of other domestic concerns. A person in charge of the homemaking, who is not employed outside the home, in the US and Canada, is called a homemaker, a term for a housewife or a househusband. Historically the role of homemaker was often assumed by women. The term "homemaker", however, may also refer to a social worker who manages a household during the incapacity of the housewife or househusband. Home health workers assume the role of homemakers when caring for elderly individuals. This includes preparing meals, giving baths, and any duties the person in need cannot perform for themselves. Homemaking can be the full-time responsibility of one parent, shared with children or extended family, or shared or traded be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Heritage Foundation

The Heritage Foundation (abbreviated to Heritage) is an American conservative think tank based in Washington, D.C. that is primarily geared toward public policy. The foundation took a leading role in the conservative movement during the presidency of Ronald Reagan, whose policies were taken from Heritage's policy study '' Mandate for Leadership''. The Heritage Foundation has had significant influence in U.S. public policy making. It is among the most influential public policy organizations in the United States. History and major initiatives Early years The Heritage Foundation was founded on February 16, 1973, by Paul Weyrich, Edwin Feulner, and Joseph Coors. Growing out of the new business activist movement inspired by the Powell Memorandum, discontent with Richard Nixon's embrace of the " liberal consensus" and the nonpolemical, cautious nature of existing think tanks, Weyrich and Feulner sought to create a version of the Brookings Institution that advanced conservative acti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Laffer Curve

In economics, the Laffer curve illustrates a theoretical relationship between rates of taxation and the resulting levels of the government's tax revenue. The Laffer curve assumes that no tax revenue is raised at the extreme tax rates of 0% and 100%, meaning that there is a tax rate between 0% and 100% that maximizes government tax revenue. The shape of the curve is a function of taxable income elasticity – i.e., taxable income changes in response to changes in the rate of taxation. As popularized by supply-side economist Arthur Laffer, the curve is typically represented as a graph that starts at 0% tax with zero revenue, rises to a maximum rate of revenue at an intermediate rate of taxation, and then falls again to zero revenue at a 100% tax rate. However, the shape of the curve is uncertain and disputed among economists. One implication of the Laffer curve is that increasing tax rates beyond a certain point is counter-productive for raising further tax revenue. In th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)