|

Omnibus Clause

An omnibus clause is a clause that provides or includes all residuary not specifically mentioned. In automobile liability insurance an omnibus clause may provide coverage for the named insured, any member of the insured's household, and any person using the automobile with the insured's permission, provided the use was within the permitted scope. In a will an omnibus clause can distribute to a named beneficiary A beneficiary (also, in trust law, '' cestui que use'') in the broadest sense is a natural person or other legal entity who receives money or other benefits from a benefactor. For example, the beneficiary of a life insurance policy is the person ... all unnamed assets included in the decedent's estate. {{DEFAULTSORT:Omnibus Clause Contract clauses References ProtectioneVB Nummern (in German) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clause

In language, a clause is a constituent that comprises a semantic predicand (expressed or not) and a semantic predicate. A typical clause consists of a subject and a syntactic predicate, the latter typically a verb phrase composed of a verb with any objects and other modifiers. However, the subject is sometimes unvoiced if it is retrievable from context, especially in null-subject language but also in other languages, including English instances of the imperative mood. A complete simple sentence includes a single clause with a finite verb. Complex sentences contain multiple clauses including at least one ''independent clause'' (meaning, a clause that can stand alone as a simple sentence) coordinated either with at least one dependent clause (also called an embedded clause) or with one or more independent clauses. Two major distinctions A primary division for the discussion of clauses is the distinction between independent clauses and dependent clauses. An independent clause can s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liability Insurance

Liability insurance (also called third-party insurance) is a part of the general insurance system of risk financing to protect the purchaser (the "insured") from the risks of liabilities imposed by lawsuits and similar claims and protects the insured if the purchaser is sued for claims that come within the coverage of the insurance policy. Originally, individual companies that faced a common ''peril'' formed a group and created a self-help fund out of which to pay compensation should any member incur loss (in other words, a mutual insurance arrangement). The modern system relies on dedicated carriers, usually for-profit, to offer protection against specified perils in consideration of a premium. Liability insurance is designed to offer specific protection against third-party insurance claims, i.e., payment is not typically made to the insured, but rather to someone suffering loss who is not a party to the insurance contract. In general, damage caused intentionally as well as c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

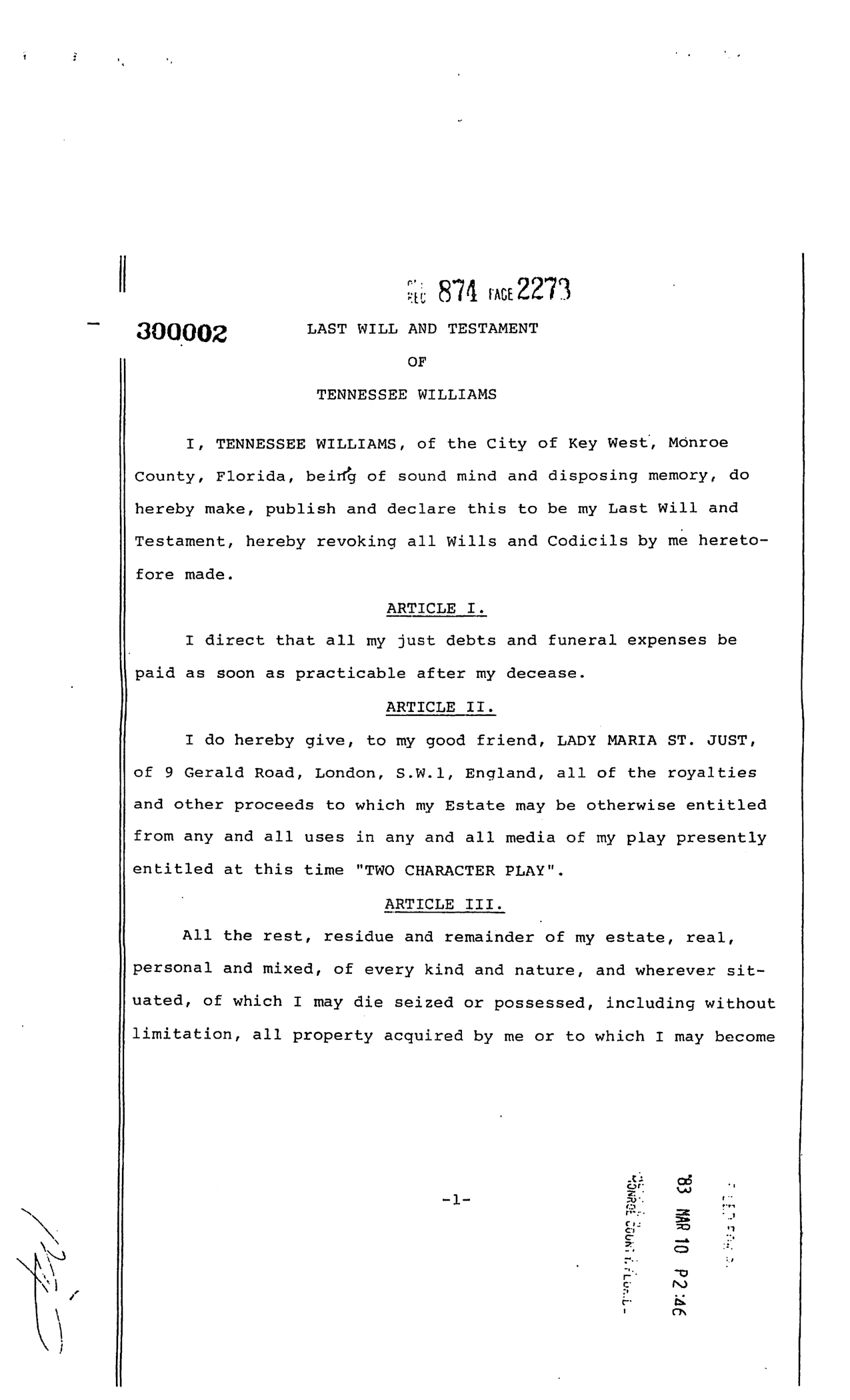

Will And Testament

A will or testament is a legal document that expresses a person's (testator) wishes as to how their property ( estate) is to be distributed after their death and as to which person ( executor) is to manage the property until its final distribution. For the distribution (devolution) of property not determined by a will, see inheritance and intestacy. Though it has at times been thought that a "will" historically applied only to real property while "testament" applied only to personal property (thus giving rise to the popular title of the document as "last will and testament"), the historical records show that the terms have been used interchangeably. Thus, the word "will" validly applies to both personal and real property. A will may also create a testamentary trust that is effective only after the death of the testator. History Throughout most of the world, the disposition of a dead person's estate has been a matter of social custom. According to Plutarch, the written will was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Beneficiary

A beneficiary (also, in trust law, '' cestui que use'') in the broadest sense is a natural person or other legal entity who receives money or other benefits from a benefactor. For example, the beneficiary of a life insurance policy is the person who receives the payment of the amount of insurance after the death of the insured. Most beneficiaries may be designed to designate where the assets will go when the owner(s) dies. However, if the primary beneficiary or beneficiaries are not alive or do not qualify under the restrictions, the assets will probably pass to the ''contingent beneficiaries''. Other restrictions such as being married or more creative ones can be used by a benefactor to attempt to control the behavior of the beneficiaries. Some situations such as retirement accounts do not allow any restrictions beyond death of the primary beneficiaries, but trusts allow any restrictions that are not illegal or for an illegal purpose. The concept of a "beneficiary" will also fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |