|

Outline Of Accounting

The following outline is provided as an overview of and topical guide to accounting: Accounting – measurement, statement or provision of assurance about financial information primarily used by managers, investors, tax authorities and other decision makers to make resource allocation decisions within companies, organizations, and public agencies. The terms derive from the use of financial accounts. Nature of accounting What type of thing is accounting? Accounting can be described as all of the following: * Vocation – occupation to which a person is specially drawn or for which they are suited, trained, or qualified. Though now often used in non-religious contexts, the meanings of the term originated in Christianity. ** Profession – * Academic discipline – Essence of accounting * Bookkeeping ** Single-entry bookkeeping system ** Double-entry bookkeeping system * Financial statements * Financial audit Fields of accounting * Auditing * Cost accounting – help ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fund Accounting

Fund accounting is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law.Leon E. Hay (1980). ''Accounting for Governmental and Nonprofit Entities, Sixth edition'', page 5. Richard D. Irwin, Inc., Homewood, IL. It emphasizes accountability rather than profitability, and is used by Nonprofit organizations and by governments. In this method, a ''fund'' consists of a self-balancing set of accounts and each are reported as either unrestricted, temporarily restricted or permanently restricted based on the provider-imposed restrictions. The label ''fund accounting'' has also been applied to investment accounting, portfolio accounting or securities accounting – all synonyms describing the process of accounting for a portfolio of investments such as securities, commodities and/or real estate held in an investment fund such as a mutual fund or hedge fund. Investment acc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Method Of Accounting

The cash method of accounting, also known as cash-basis accounting, cash receipts and disbursements method of accounting or cash accounting (the EU VAT directive vocabulary Article 226) records revenue when cash is received, and expenses when they are paid in cash. As a basis of accounting, this is in contrast to the alternative accrual method which records income items when they are ''earned'' and records deductions when expenses are ''incurred'' regardless of the flow of cash. Cash method of accounting in the United States (GAAP) Use in contract accounting The cash method of accounting has historically been one of the four methods of recognizing revenues and profits on contracts, the other ones being the accrual method, the completed-contract method and the percentage-of-completion methods. Since the approval by Congress of the Tax Reform Act of 1986, the cash method could not longer be used for C corporations, partnerships in which one or more partners are C Corporations, t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Comparison Of Cash And Accrual Methods Of Accounting

Comparison or comparing is the act of evaluating two or more things by determining the relevant, comparable characteristics of each thing, and then determining which characteristics of each are similar to the other, which are different, and to what degree. Where characteristics are different, the differences may then be evaluated to determine which thing is best suited for a particular purpose. The description of similarities and differences found between the two things is also called a comparison. Comparison can take many distinct forms, varying by field: To compare things, they must have characteristics that are similar enough in relevant ways to merit comparison. If two things are too different to compare in a useful way, an attempt to compare them is colloquially referred to in English as "comparing apples and oranges." Comparison is widely used in society, in science and in the arts. General usage Comparison is a natural activity, which even animals engage in when deci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accrual

Accrual (''accumulation'') of something is, in finance, the adding together of interest or different investments over a period of time. Accruals in accounting For example, a company delivers a product to a customer who will pay for it 30 days later in the next fiscal year, which starts a week after the delivery. The company recognizes the proceeds as a revenue in its current income statement still for the fiscal year of the delivery, even though it will not get paid until the following accounting period. The proceeds are also an accrued income (asset) on the balance sheet for the delivery fiscal year, but not for the next fiscal year when cash is received. Similarly, the salesperson who sold the product earned a commission at the moment of sale (or delivery). The company will recognize the commission as an expense in its current income statement, even though the salesperson will actually get paid at the end of the following week in the next accounting period. The commission is a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting Period

An accounting period, in bookkeeping, is the period with reference to which management accounts and financial statements are prepared. In management accounting the accounting period varies widely and is determined by management. Monthly accounting periods are common. In financial accounting the accounting period is determined by regulation and is usually 12 months. The beginning of the accounting period differs according to jurisdiction. For example, one entity may follow the calendar year, January to December, while another may follow April to March as the accounting period. The International Financial Reporting Standards allow a period of 52 weeks as an accounting period instead of 12 months. This method is known as the 4-4-5 calendar in British and Commonwealth usage and the 52–53-week fiscal year in the United States. In the United States the method is permitted by generally accepted accounting principles, as well as by US Internal Revenue Code Regulation 1.441-2 (IRS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

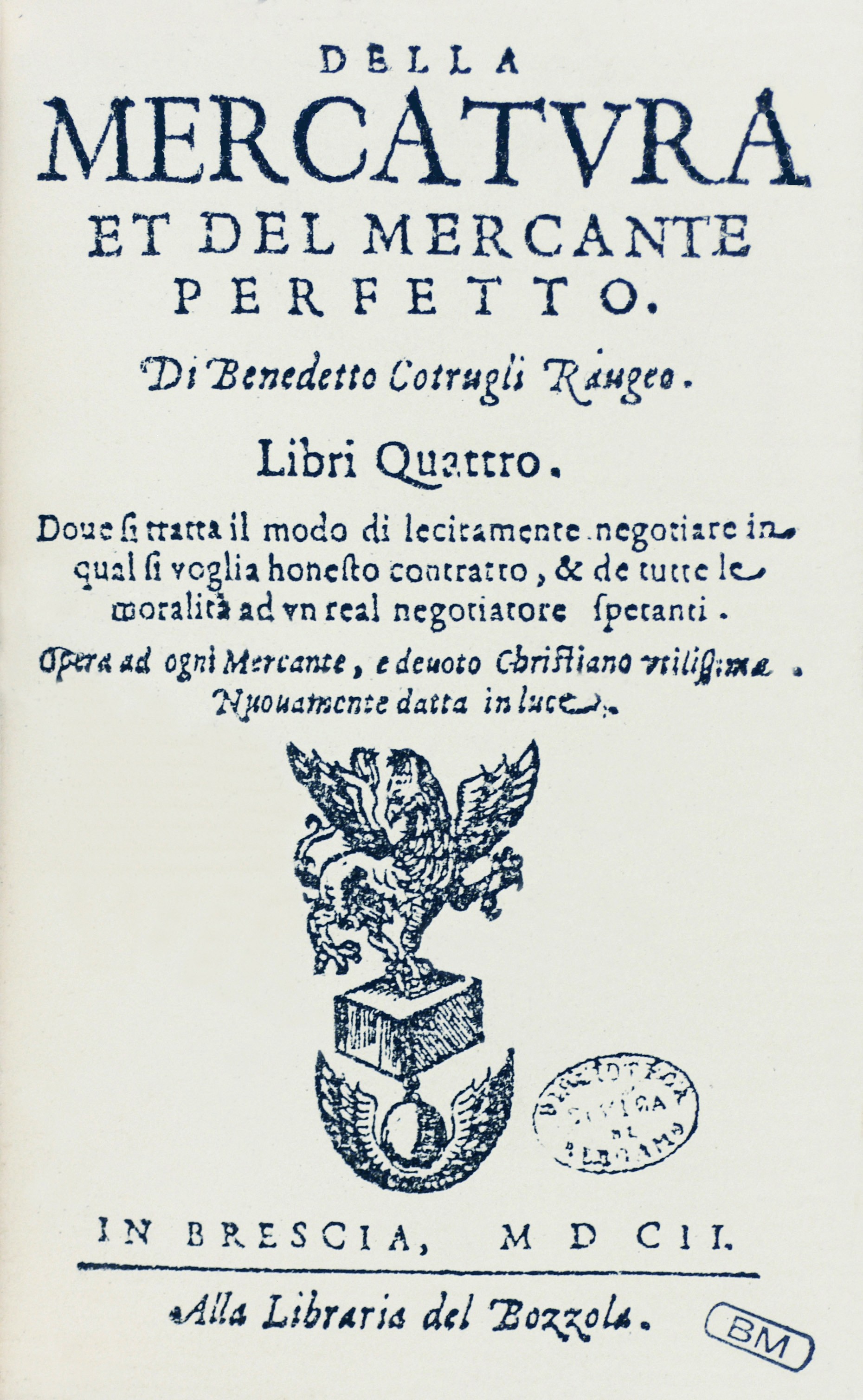

History Of Double-entry Bookkeeping Systems

Double-entry bookkeeping, also known as double-entry accounting, is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information. Every entry to an account requires a corresponding and opposite entry to a different account. The double-entry system has two equal and corresponding sides known as debit and credit. A transaction in double-entry bookkeeping always affects at least two accounts, always includes at least one debit and one credit, and always has total debits and total credits that are equal. The purpose of double-entry bookkeeping is to allow the detection of financial errors and fraud. For example, if a business takes out a bank loan for $10,000, recording the transaction would require a debit of $10,000 to an asset account called "Cash", as well as a credit of $10,000 to a liability account called "Notes Payable". The basic entry to record this transaction in a general ledger will look like this: Double-entry bookkeeping is b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

History Of Money

The history of money concerns the development throughout time of systems that provide the functions of money. Such systems can be understood as means of trading wealth indirectly; not directly as with bartering. Money is a mechanism that facilitates this process. Money may take a physical form as in coins and notes, or may exist as a written or electronic account. It may have intrinsic value (commodity money), be legally exchangeable for something with intrinsic value (representative money), or only have nominal value (fiat money). Overview The invention of money took place before the beginning of written history.Denise Schmandt-Besserat [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

History Of Writing

The history of writing traces the development of expressing language by systems of markings and how these markings were used for various purposes in different societies, thereby transforming social organization. Writing systems are the foundation of literacy and literacy learning, with all the social and psychological consequences associated with literacy activities. In the history of how writing systems have evolved in human civilizations, more complete writing systems were preceded by ''proto-writing'', systems of ideographic or early mnemonic symbols (symbols or letters that make remembering them easier). ''True writing'', in which the content of a linguistic utterance is encoded so that another reader can reconstruct, with a fair degree of accuracy, the exact utterance written down, is a later development. It is distinguished from proto-writing, which typically avoids encoding grammatical words and affixes, making it more difficult or even impossible to reconstruct the exac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

History Of Mathematics

The history of mathematics deals with the origin of discoveries in mathematics and the mathematical methods and notation of the past. Before the modern age and the worldwide spread of knowledge, written examples of new mathematical developments have come to light only in a few locales. From 3000 BC the Mesopotamian states of Sumer, Akkad and Assyria, followed closely by Ancient Egypt and the Levantine state of Ebla began using arithmetic, algebra and geometry for purposes of taxation, commerce, trade and also in the patterns in nature, the field of astronomy and to record time and formulate calendars. The earliest mathematical texts available are from Mesopotamia and Egypt – '' Plimpton 322'' ( Babylonian c. 2000 – 1900 BC), the ''Rhind Mathematical Papyrus'' ( Egyptian c. 1800 BC) and the '' Moscow Mathematical Papyrus'' (Egyptian c. 1890 BC). All of these texts mention the so-called Pythagorean triples, so, by inference, the Pythagorean theorem seems to be the most anci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

History Of Accounting

The history of accounting or accountancy can be traced to ancient civilizations.Keith, Robson. 1992. “Accounting Numbers as ‘inscription’: Action at a Distance and the Development of Accounting.” ''Accounting, Organizations and Society'' 17 (7): 685–708. The early development of accounting dates to ancient Mesopotamia, and is closely related to developments in writing, counting and money and early auditing systems by the ancient Egyptians and Babylonians. By the time of the Roman Empire, the government had access to detailed financial information. In India, Chanakya wrote a manuscript similar to a financial management book, during the period of the Mauryan Empire. His book '' Arthashastra'' contains few detailed aspects of maintaining books of accounts for a sovereign state. The Italian Luca Pacioli, recognized as ''The Father of accounting and bookkeeping'' was the first person to publish a work on double-entry bookkeeping, and introduced the field in Italy. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Accounting In The United States

U.S. tax accounting refers to accounting for tax purposes in the United States. Unlike most countries, the United States has a comprehensive set of accounting principles for tax purposes, prescribed by tax law, which are separate and distinct from Generally Accepted Accounting Principles. Basic rules The Internal Revenue Code governs the application of tax accounting.Section 446sets the basic rules for tax accounting. Tax accounting undeemphasizes consistency for a tax accounting method with references to the applied financial accounting to determine the proper method. The taxpayer must choose a tax accounting method using the taxpayer's financial accounting method as a reference point. Types of tax accounting methods Proper accounting methods are described iwhich permits cash, accrual, and other methods approved by the Internal Revenue Service (IRS) including combinations. After choosing a tax accounting method, undesection 446(b)the IRS has wide discretion to re-compute th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |