|

Office Of The Exchange Fund

The Hong Kong Monetary Authority (HKMA) is Hong Kong's central banking institution. It is a government authority founded on 1 April 1993 when the Office of the Exchange Fund and the Office of the Commissioner of Banking merged. The organisation reports directly to the Financial Secretary. Responsibilities The exchange fund was established and managed originally by the Currency Ordinance in 1935, now named the Exchange Fund Ordinance. Under the Ordinance, the HKMA's primary objective is to ensure the stability of the Hong Kong currency, and the banking system. It is also responsible for promoting the efficiency, integrity and development of the financial system.Noel FungGovernment power over Exchange Fund's stability role under review, The Standard, 18 November 1997 The HKMA issues banknotes only in the denomination of ten Hong Kong dollars. The role of issuing other banknotes is delegated to the note-issuing banks in the territory, namely The Hongkong and Shanghai Banking ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Finance Centre (Hong Kong)

The International Finance Centre, abbreviated as ifc) is a skyscraper and an integrated commercial development on the Victoria Harbour, waterfront of Hong Kong's Central and Western District, Central District. A prominent landmark on Hong Kong Island, IFC consists of two skyscrapers, the ifc mall, and the 55-storey Four Seasons Hotel Hong Kong. Twe 02 is the second tallest building in Hong Kong at a height of 415 m, behind the International Commerce Centre in West Kowloon, and the List of tallest buildings, 31st-tallest building in the world. It is the fourth-tallest building in the Greater China, Greater China region and the eighth-tallest office building in the world, based on structural heights; It is of similar height to the former World Trade Center (1973–2001), World Trade Center. The Airport Express (MTR), Airport Express Hong Kong station is directly beneath it, with subway lines to Hong Kong International Airport. ifc was constructed and is owned by IFC Developmen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-DVP

Non-DVP trading is defined as securities trading where a client's custodian will have to release payment or deliver securities on behalf of the client before there is certainty that it will receive the counter-value in cash or securities, thus incurring settlement risk. DVP stands for delivery versus payment Delivery versus payment or DvP is a common form of settlement for securities. The process involves the simultaneous delivery of all documents necessary to give effect to a transfer of securities in exchange for the receipt of the stipulated payment .... A party to a transaction pays for something when it is delivered. When there is a delivery from A to B, delivery is made by A, receipt is had by B. B, the party that receives, is obliged to make a payment. The issue revolves around: # the timing of the transaction # the value of the transaction, and # the trustworthiness of A and B. The ideal situation is timing is matched for delivery/receipt and payment without any lag or def ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard & Poor's

S&P Global Ratings (previously Standard & Poor's and informally known as S&P) is an American credit rating agency (CRA) and a division of S&P Global that publishes financial research and analysis on stocks, bonds, and commodities. S&P is considered the largest of the Big Three credit-rating agencies, which also include Moody's Investors Service and Fitch Ratings. Its head office is located on 55 Water Street in Lower Manhattan, New York City. History The company traces its history back to 1860, with the publication by Henry Varnum Poor of ''History of Railroads and Canals in the United States''. This book compiled comprehensive information about the financial and operational state of U.S. railroad companies. In 1868, Henry Varnum Poor established H.V. and H.W. Poor Co. with his son, Henry William Poor, and published two annually updated hardback guidebooks, ''Poor's Manual of the Railroads of the United States'' and ''Poor's Directory of Railway Officials''. In 1906, Lu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moody's Investors Service

Moody's Investors Service, often referred to as Moody's, is the bond credit rating business of Moody's Corporation, representing the company's traditional line of business and its historical name. Moody's Investors Service provides international financial research on bonds issued by commercial and government entities. Moody's, along with Standard & Poor's and Fitch Group, is considered one of the Big Three credit rating agencies. It is also included in the Fortune 500 list of 2021. The company ranks the creditworthiness of borrowers using a standardized ratings scale which measures expected investor loss in the event of default. Moody's Investors Service rates debt securities in several bond market segments. These include government, municipal and corporate bonds; managed investments such as money market funds and fixed-income funds; financial institutions including banks and non-bank finance companies; and asset classes in structured finance. In Moody's Investors Service' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange Fund (Hong Kong)

The Exchange Fund of Hong Kong is the primary investment arm and de facto sovereign wealth fund of the Hong Kong Monetary Authority. First established in 1935 in order to provide backing to the issuance of Hong Kong dollar banknotes, over the years the role of the Fund has continually expanded to now include management of fiscal reserves, foreign currency reserves, real estate investments, and private equity. Portfolio of Funds The Exchange Fund, which oversees over HKD 4 trillion of assets as of 31 December 2019, consists of a number of different portfolios. The Exchange Fund runs three main portfolios with the Government's fiscal reserves, investing in a number of different assets (for varying risk and return levels), while separate funds set up (with funding coming from other sources) may also choose to invest in these core portfolios. In other words, portfolios indicate assets being held by the Exchange Fund, while funds indicate other funding sources. Core Portfolios * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

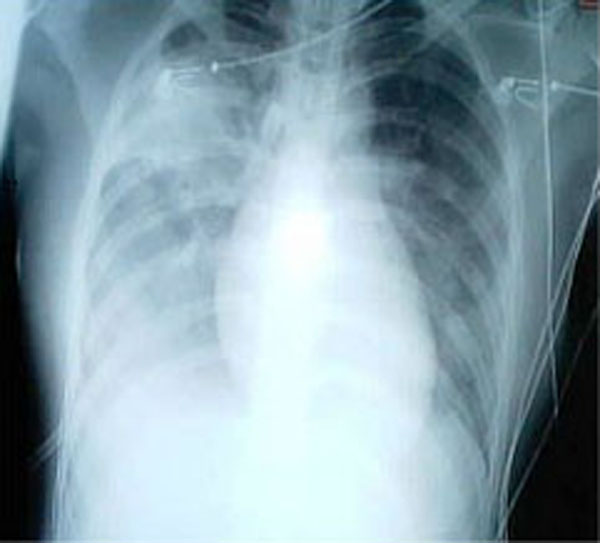

SARS

Severe acute respiratory syndrome (SARS) is a viral respiratory disease of zoonotic origin caused by the severe acute respiratory syndrome coronavirus (SARS-CoV or SARS-CoV-1), the first identified strain of the SARS coronavirus species, ''severe acute respiratory syndrome–related coronavirus'' (SARSr-CoV). The first known cases occurred in November 2002, and the syndrome caused the 2002–2004 SARS outbreak. In the 2010s, Chinese scientists traced the virus through the intermediary of Asian palm civets to cave-dwelling horseshoe bats in Xiyang Yi Ethnic Township, Yunnan.The locality was referred to be "a cave in Kunming" in earlier sources because the Xiyang Yi Ethnic Township is administratively part of Kunming, though 70 km apart. Xiyang was identified on * For an earlier interview of the researchers about the locality of the caves, see: SARS was a relatively rare disease; at the end of the epidemic in June 2003, the incidence was 8,469 cases with a case fatality rate (CFR ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1997 Asian Financial Crisis

The Asian financial crisis was a period of financial crisis that gripped much of East Asia and Southeast Asia beginning in July 1997 and raised fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1999 was rapid and worries of a meltdown subsided. The crisis started in Thailand (known in Thailand as the ''Tom Yam Kung crisis''; th, วิกฤตต้มยำกุ้ง) on 2 July, with the financial collapse of the Thai baht after the Thai government was forced to float the baht due to lack of foreign currency to support its currency peg to the U.S. dollar. Capital flight ensued almost immediately, beginning an international chain reaction. At the time, Thailand had acquired a burden of foreign debt. As the crisis spread, most of Southeast Asia and later South Korea and Japan saw slumping currencies, devalued stock markets and other asset prices, and a precipitous rise in private debt. South Korea, Indonesia and Thailand were ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity Trap

A liquidity trap is a situation, described in Keynesian economics, in which, "after the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers holding cash rather than holding a debt ( financial instrument) which yields so low a rate of interest." Keynes, John Maynard (1936) ''The General Theory of Employment, Interest and Money'', United Kingdom: Palgrave Macmillan, 2007 edition, A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Among the characteristics of a liquidity trap are interest rates that are close to zero and changes in the money supply that fail to translate into changes in the price level. Krugman, Paul R. (1998)"It's baack: Japan's Slump and the Return of the Liquidity Trap," Brookings Papers on Economic Activity Origin and definition of the term John Maynard Keynes, in his 1936 ''Gener ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Cycle

Business cycles are intervals of Economic expansion, expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production. Business cycle fluctuations are usually characterized by general upswings and downturns in a span of macroeconomic variables. The individual episodes of expansion/recession occur with changing duration and intensity over time. Typically their periodicity has a wide range from around 2 to 10 years (the technical phrase "stochastic cycle" is often used in statistics to describe this kind of process.) As in [Harvey, Trimbur, and van Dijk, 2007, ''Journal of Econometrics''], such flexible knowledge about the frequency of business cycles can actually be included in their mathematical study, using a Bayesian statistical paradigm. There are numer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gold Standard

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves. Historically, the silver standard and bimetallism have been more common than the gold standard. The shift to an international monetary system based on a gold standard reflected accident, network externalities, and path dependence. Great Britain accidentally adopted a ''de facto'' gold standard in 1717 when Sir Isaac Newton, then-master of the Royal Mint, set the exchange rate of silver to gold too low, thus causing silver coins to go out of circulation. As Great Britain became the world's leading financ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiat Currency

Fiat money (from la, fiat, "let it be done") is a type of currency that is not backed by any commodity such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was sometimes issued by local banks and other institutions. In modern times, fiat money is generally authorized by government regulation. Fiat money generally does not have intrinsic value and does not have use value. It has value only because the individuals who use it as a unit of account or, in the case of currency, a medium of exchange agree on its value. They trust that it will be accepted by merchants and other people. Fiat money is an alternative to commodity money, which is a currency that has intrinsic value because it contains, for example, a precious metal such as gold or silver which is embedded in the coin. Fiat also differs from representative money, which is money that has intrinsic value because it is backed by and can be converted in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transfer Of The Sovereignty Of Hong Kong

Sovereignty of Hong Kong was transferred from the United Kingdom to the People's Republic of China (PRC) at midnight on 1 July 1997. This event ended 156 years of British rule in the former colony. Hong Kong was established as a special administrative region of China (SAR) for 50 years, maintaining its own economic and governing systems from those of mainland China during this time, although influence from the central government in Beijing increased after the passing of the Hong Kong national security law in 2020. Hong Kong had been a colony of the British Empire since 1841, except for four years of Japanese occupation from 1941 to 1945. After the First Opium War, its territory was expanded on two occasions; in 1860 with the addition of Kowloon Peninsula and Stonecutters Island, and again in 1898, when Britain obtained a 99-year lease for the New Territories. The date of the handover in 1997 marked the end of this lease. The 1984 Sino-British Joint Declaration had set the con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)