|

Office Of Tax Policy

The Office of Tax Policy is an agency of the United States Department of the Treasury headed by the Assistant Secretary of the Treasury for Tax Policy. The Office assists the Secretary in developing and implementing tax policies and programs; provides the official estimates of all Government receipts for the President's budget, fiscal policy decisions, and Treasury cash management decisions; establishes policy criteria reflected in regulations and rulings and guides preparation of them with the Internal Revenue Service to implement and administer the Internal Revenue Code; negotiates tax treaties for the United States and represents the United States in meetings and work of multilateral organizations dealing with tax policy matters; and provides economic and legal policy analysis for domestic and international tax policy decisions. SourcesOffice of Tax ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

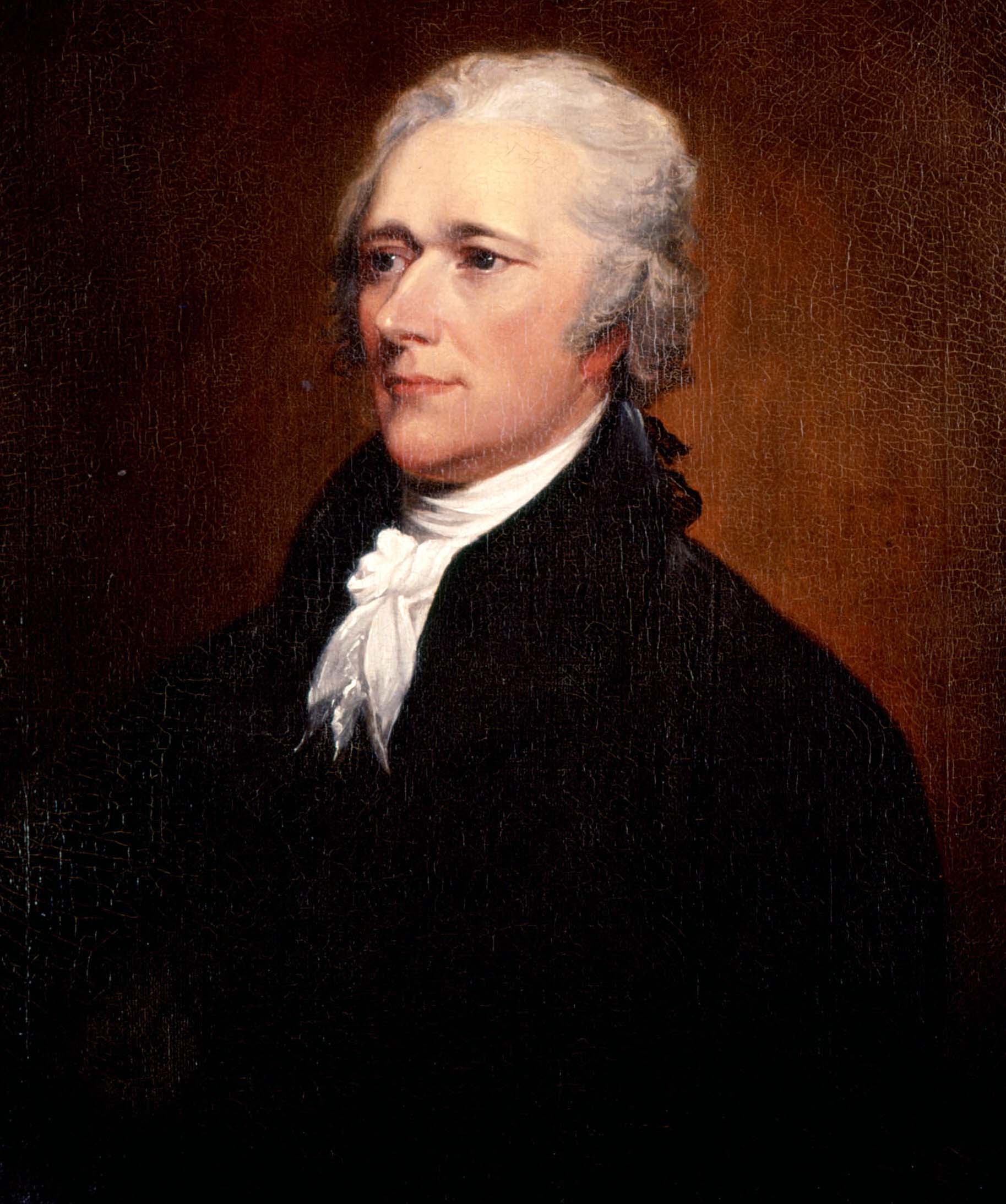

United States Department Of The Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and the U.S. Mint. These two agencies are responsible for printing all paper currency and coins, while the treasury executes its circulation in the domestic fiscal system. The USDT collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy. The department is administered by the secretary of the treasury, who is a member of the Cabinet. The treasurer of the United States has limited statutory duties, but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes. The depart ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Secretary Of The Treasury

The United States secretary of the treasury is the head of the United States Department of the Treasury, and is the chief financial officer of the federal government of the United States. The secretary of the treasury serves as the principal advisor to the president of the United States on all matters pertaining to economic and fiscal policy. The secretary is a statutory member of the Cabinet of the United States, and is fifth in the United States presidential line of succession, presidential line of succession. Under the Appointments Clause of the United States Constitution, the officeholder is nominated by the president of the United States, and, following a confirmation hearing before the United States Senate Committee on Finance, Senate Committee on Finance, is confirmed by the United States Senate. The United States Secretary of State, secretary of state, the secretary of the treasury, the United States Secretary of Defense, secretary of defense, and the United States Att ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Policy

Tax policy includes the guidelines developed by a government regarding how taxes are imposed, in what amounts, and on whom. It has both microeconomic and macroeconomic aspects. The macroeconomic aspect concerns the overall quantity of taxes to collect, which can inversely affect the level of economic activity; this is one component of fiscal policy. The microeconomic aspects concern issues of fairness (whom to tax) and allocative efficiency (i.e., which taxes will have how much of a distorting effect on the amounts of various types of economic activity). A country’s tax framework is a key policy instrument that is intended to positively influence the country's economy. Tax policies have significant economic consequences for both a national economy and particular groups within the economy (e.g., households, firms and banks). Tax policies are often designed with the intention of stimulating economic growth—although economists' opinions differ significantly about which polici ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure provided over a fifth of the Union's war expenses before being allowed to expire a decade later. In 1913, the Sixteenth Amendment to the U.S. Constitutio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |