|

Net Operating Loss

Under U.S. Federal income tax law, a net operating loss (NOL) occurs when certain tax-deductible expenses exceed taxable revenues for a taxable year. If a taxpayer is taxed during profitable periods without receiving any tax relief (e.g., a refund) during periods of NOLs, an unbalanced tax burden results. Consequently, in some situations, Congress allows taxpayers to use the losses in one year to offset the profits of other years. Calculating the NOL amount The NOL amount is the amount of the loss from the current year that can be carried forward to future years or, in certain instances, carried back to prior years. Individuals For individuals, the NOL amount is generally the excess of deductions over income from the operation of a business. The following items are excluded when calculating the NOL amount: * net capital losses, i.e., capital losses in excess of capital gains; (net capital gains are included) * nonbusiness deductions in excess of nonbusiness income; (net nonbusine ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax In The United States

Income taxes in the United States are imposed by the federal government, and most states. The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed (with some exceptions in the case of Federal income taxation), but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the federal and some state levels. In the United States, the term "payroll tax" usually refers to FICA taxes that are paid to fund Social Security and Medicare, while "income tax" re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

COVID-19 Recession

The COVID-19 recession, also referred to as the Great Lockdown, is a global recession, global economic recession caused by the COVID-19 pandemic. The recession began in most countries in February 2020. After a year of global economic slowdown that saw stagnation of economic growth and consumer activity, the COVID-19 lockdowns and other precautions taken in early 2020 drove the global economy into crisis. Within seven months, every advanced economy had fallen to recession. The first major sign of recession was the 2020 stock market crash, which saw major indices drop 20 to 30% in late February and March. Recovery began in early April 2020; by April 2022, the GDP for most major economies had either returned to or exceeded pre-pandemic levels and many market indices recovered or even set new records by late 2020. The recession saw unusually high and rapid increases in unemployment in many countries. By October 2020, more than 10 million unemployment cases had been filed in the U ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Barbados

Barbados is an island country in the Lesser Antilles of the West Indies, in the Caribbean region of the Americas, and the most easterly of the Caribbean Islands. It occupies an area of and has a population of about 287,000 (2019 estimate). Its capital and largest city is Bridgetown. Inhabited by Island Caribs, Kalinago people since the 13th century, and prior to that by other Indigenous peoples of the Americas, Amerindians, Spanish navigators took possession of Barbados in the late 15th century, claiming it for the Crown of Castile. It first appeared on a Spanish map in 1511. The Portuguese Empire claimed the island between 1532 and 1536, but abandoned it in 1620 with their only remnants being an introduction of wild boars for a good supply of meat whenever the island was visited. An Kingdom of England, English ship, the ''Olive Blossom'', arrived in Barbados on 14 May 1625; its men took possession of the island in the name of James VI and I, King James I. In 1627, the first ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kinross Gold

Kinross Gold Corporation is a Canadian-based gold mining, gold and silver mining company founded in 1993 and headquartered in Toronto, Ontario, Canada. Kinross currently operates six active gold mines, and was ranked fifth of the "10 Top Gold-mining Companies" of 2019 by ''InvestingNews''. The company's mines are located in Brazil, Mauritania, and the United States. It trades under the KGC ticker in the New York Stock Exchange, and under K in the Toronto Stock Exchange. Operations Kinross Gold operates mines in North and South America, and West Africa. In 2022, 58% of Kinross gold production is expected to come from the Americas. Fort Knox This property includes a mill, tailings storage, Heap leaching, heap leach facility, the Gil project, and the True North open pit mine, which is closed and under monitoring. Expected to run out of ore in 2021, the mine's life has been extended to 2030 following a $100 million expansion investment announced in 2018, increasing life-of-mine produ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US GAAP

Generally Accepted Accounting Principles (GAAP or U.S. GAAP, pronounced like "gap") is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC) and is the default accounting standard used by companies based in the United States. The Financial Accounting Standards Board (FASB) publishes and maintains the Accounting Standards Codification (ASC), which is the single source of authoritative nongovernmental U.S. GAAP. The FASB published U.S. GAAP in Extensible Business Reporting Language (XBRL) beginning in 2008. Sources of GAAP The FASB Accounting Standards Codification is the source of authoritative GAAP recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC under authority of federal securities laws are also sources of authoritative GAAP for SEC registrants. In addition to the SEC's rules and interpretive releases, the SEC staff issues Staff Accounting Bulletins that represent practices followed by t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Recovery And Reinvestment Act Of 2009

The American Recovery and Reinvestment Act of 2009 (ARRA) (), nicknamed the Recovery Act, was a stimulus package enacted by the 111th U.S. Congress and signed into law by President Barack Obama in February 2009. Developed in response to the Great Recession, the primary objective of this federal statute was to save existing jobs and create new ones as soon as possible. Other objectives were to provide temporary relief programs for those most affected by the recession and invest in infrastructure, education, health, and renewable energy. The approximate cost of the economic stimulus package was estimated to be $787 billion at the time of passage, later revised to $831 billion between 2009 and 2019. The ARRA's rationale was based on the Keynesian economic theory that, during recessions, the government should offset the decrease in private spending with an increase in public spending in order to save jobs and stop further economic deterioration. The politics around the stimulus w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

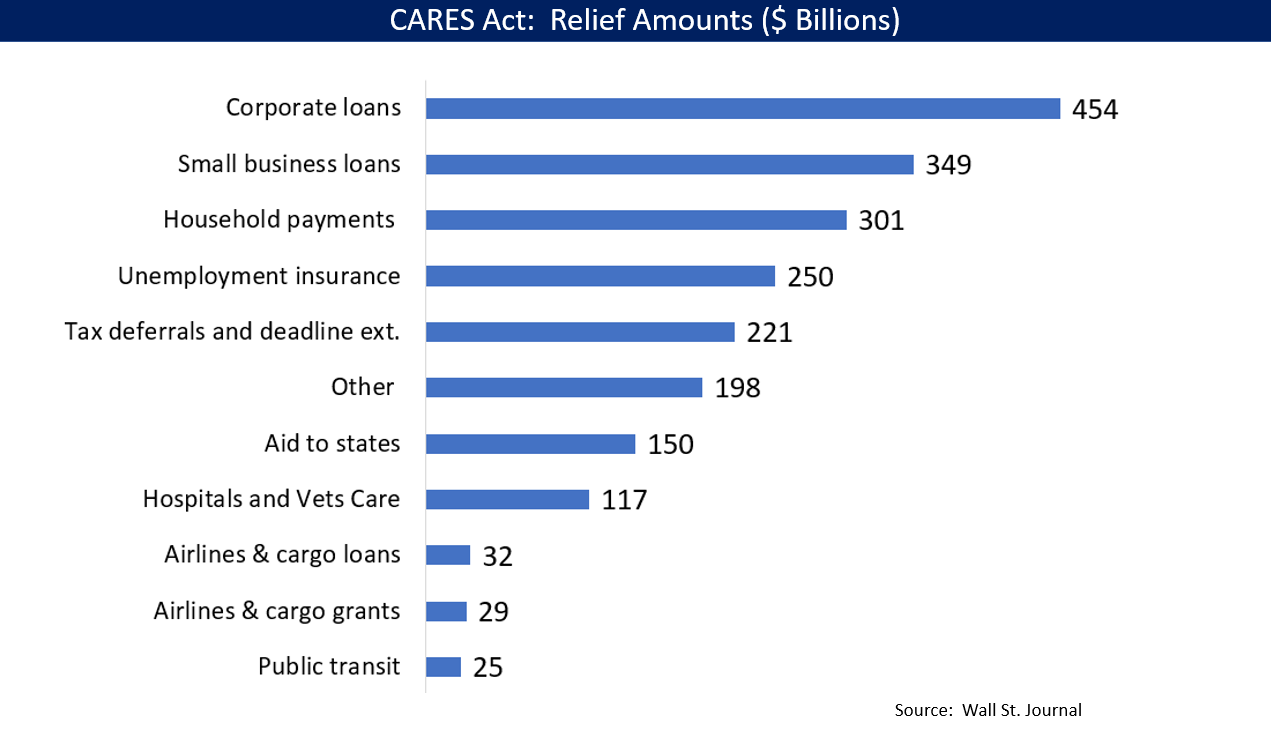

CARES Act

The Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act, is a $2.2trillion Stimulus (economics), economic stimulus bill passed by the 116th U.S. Congress and signed into law by President Donald Trump on March 27, 2020, in response to the economic fallout of the COVID-19 pandemic in the United States. The spending primarily includes $300billion in one-time cash payments to individual people who submit a tax return in America (with most single adults receiving $1,200 and families with children receiving more), $260billion in increased unemployment benefits, the creation of the Paycheck Protection Program that provides forgivable loans to small businesses with an initial $350billion in funding (later increased to $669billion by subsequent legislation), $500billion in loans for corporations, and $339.8 billion to state and local governments. The original CARES Act proposal included $500billion in direct payments to Americans, $208billion in loans ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

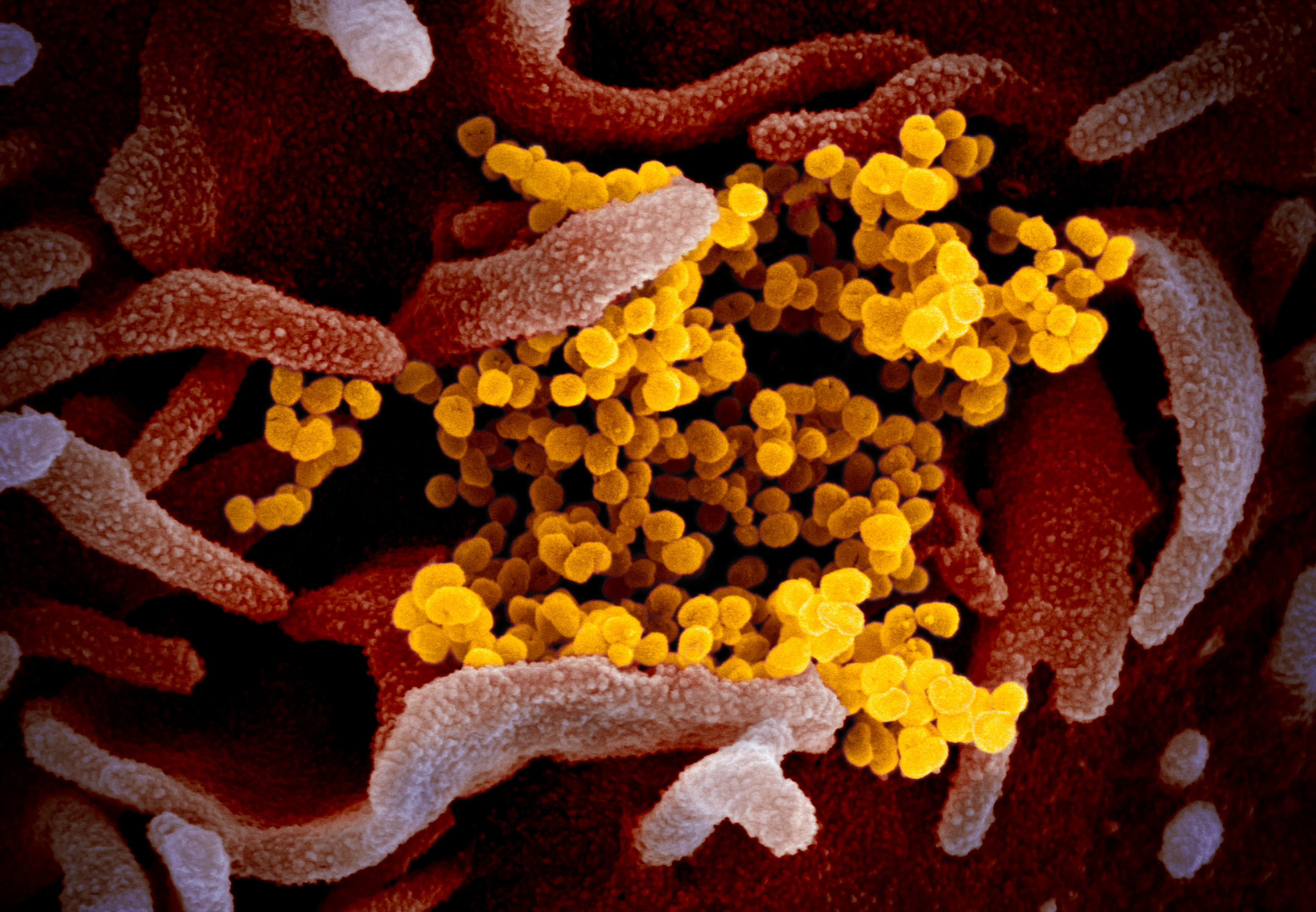

COVID-19 Pandemic In The United States

The COVID-19 pandemic in the United States is a part of the COVID-19 pandemic, worldwide pandemic of COVID-19, coronavirus disease 2019 (COVID-19) caused by SARS-CoV-2, severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). In the United States, it has resulted in confirmed cases with all-time deaths, the most of any country, and COVID-19 pandemic death rates by country, the twentieth-highest per capita worldwide. The COVID-19 pandemic ranks first on the list of disasters in the United States by death toll; it was the third-leading cause of death in the U.S. in 2020, behind heart disease and cancer. From 2019 to 2020, U.S. life expectancy dropped by 3years for Hispanic and Latino Americans, 2.9years for African Americans, and 1.2years for white Americans. These effects persisted as U.S. deaths due to COVID-19 in 2021 exceeded those in 2020, and life expectancy continued to fall from 2020 to 2021. On December 31, 2019, China announced the discovery of a cluster of pne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Cuts And Jobs Act Of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act (TCJA), that amended the Internal Revenue Code of 1986. Major elements of the changes include reducing tax rates for businesses and individuals, increasing the standard deduction and family tax credits, eliminating personal exemptions and making it less beneficial to itemize deductions, limiting deductions for state and local income taxes and property taxes, further limiting the mortgage interest deduction, reducing the alternative minimum tax for individuals and eliminating it for corporations, doubling the estate tax exemption, and cancelling the penalty enforcing individual mandate of the Affordable Care Act (ACA). The Act is based on tax reform advocated by congressional Republicans and the Trump administration. The nonpartisan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Deduction

Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while credits reduce tax. Above and below the line Above and below the line refers to items above or below adjusted gross income, which is item 37 on the tax year 2017 1040 tax form. Tax deductions above the line lessen adjusted gross income, while deductions below the line can only lessen taxable income if the aggregate of those deductions exceeds the standard deduction, which in tax year 2018 in the U.S., for example, was $12,000 for a single taxpayer and $24,000 for married couple. Limitations Often, deductions are subject to conditions, such as being allowed only for expenses incurred that produce current benefits. C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Qualified Production Activities Income

Qualified Production Activities Income is a class of income which is entitled to favored tax treatment under Section 199 of the United States Internal Revenue Code. History Former section 114 of the United States Internal Revenue Code excluded "extraterritorial income" which constituted "qualifying foreign trade income" under former section 941 from income. The effect of these provisions was a reduced tax burden in exchange for increased exports, creating an incentive for individuals and businesses within the United States to export. In August 2001, a panel of the World Trade Organization ruled that former section 114 of the United States Internal Revenue Code constituted a violation of the Agreement on Subsidies and Countervailing Measures as a prohibited export subsidy, and a WTO Appellate Body affirmed the finding in January 2002. The finding was based on the fact the provision resulted in the United States government forgoing revenue to which it was otherwise entitled and the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Congress

The United States Congress is the legislature of the federal government of the United States. It is bicameral, composed of a lower body, the House of Representatives, and an upper body, the Senate. It meets in the U.S. Capitol in Washington, D.C. Senators and representatives are chosen through direct election, though vacancies in the Senate may be filled by a governor's appointment. Congress has 535 voting members: 100 senators and 435 representatives. The U.S. vice president has a vote in the Senate only when senators are evenly divided. The House of Representatives has six non-voting members. The sitting of a Congress is for a two-year term, at present, beginning every other January. Elections are held every even-numbered year on Election Day. The members of the House of Representatives are elected for the two-year term of a Congress. The Reapportionment Act of 1929 establishes that there be 435 representatives and the Uniform Congressional Redistricting Act requires ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)