|

Negative Income Tax

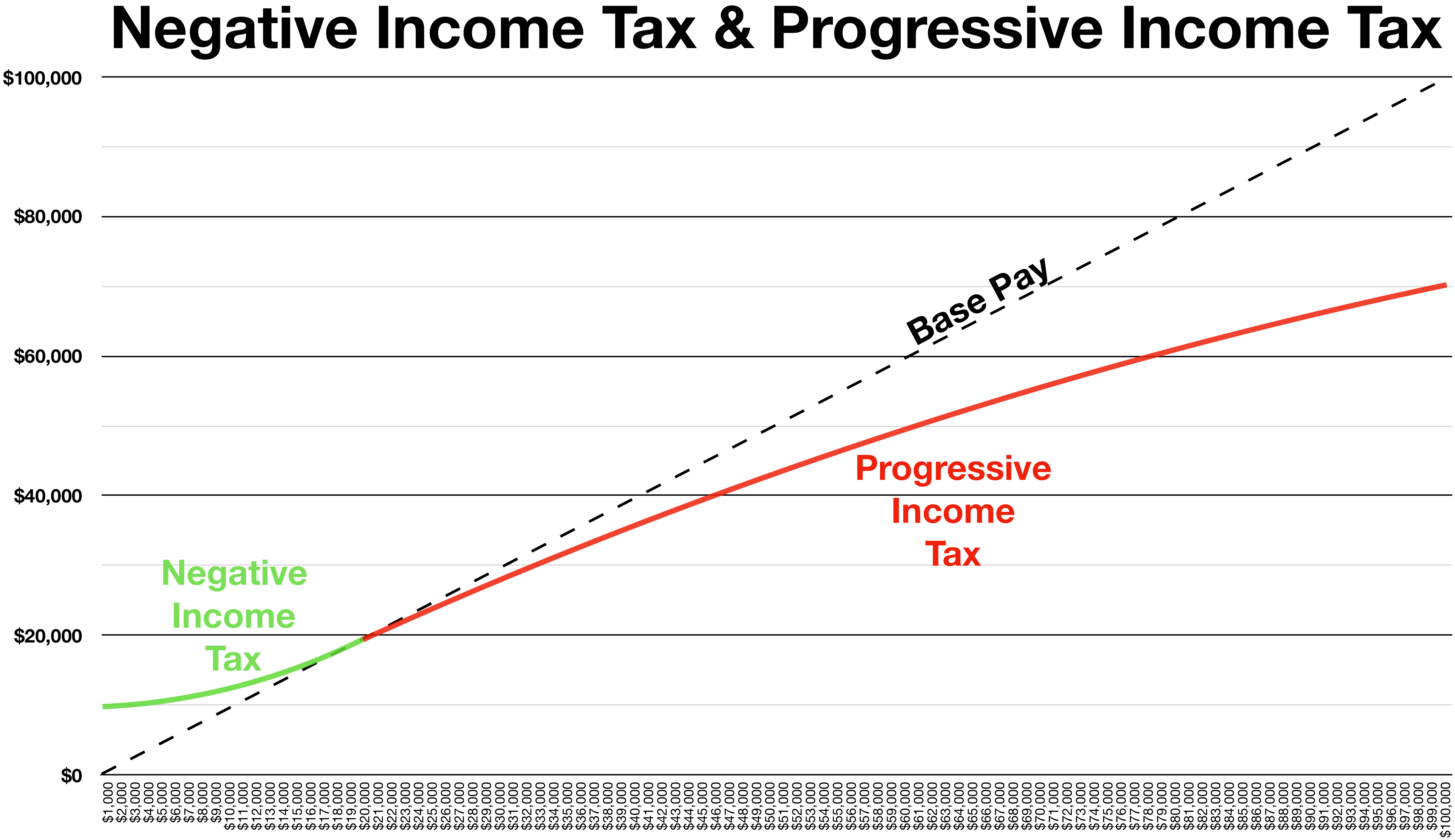

In economics, a negative income tax (NIT) is a system which reverses the direction in which tax is paid for incomes below a certain level; in other words, earners above that level pay money to the state while earners below it receive money, as shown by the blue arrows in the diagram. NIT was proposed by Juliet Rhys-Williams while working on the Beveridge Report in the early 1940s and popularized by Milton Friedman in the 1960s as a system in which the state makes payments to the poor when their income falls below a threshold, while taxing them on income above that threshold. Together with Friedman, supporters of NIT also included James Tobin, Joseph A. Pechman, and Peter M. Mieszkowski, and even then-President Richard Nixon, who suggested implementation of modified NIT in his Family Assistance Plan. After the increase in popularity of NIT, an experiment sponsored by the US government was conducted between 1968 and 1982 on effects of NIT on labour supply, income, and substitutio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Negative Income Tax

In economics, a negative income tax (NIT) is a system which reverses the direction in which tax is paid for incomes below a certain level; in other words, earners above that level pay money to the state while earners below it receive money, as shown by the blue arrows in the diagram. NIT was proposed by Juliet Rhys-Williams while working on the Beveridge Report in the early 1940s and popularized by Milton Friedman in the 1960s as a system in which the state makes payments to the poor when their income falls below a threshold, while taxing them on income above that threshold. Together with Friedman, supporters of NIT also included James Tobin, Joseph A. Pechman, and Peter M. Mieszkowski, and even then-President Richard Nixon, who suggested implementation of modified NIT in his Family Assistance Plan. After the increase in popularity of NIT, an experiment sponsored by the US government was conducted between 1968 and 1982 on effects of NIT on labour supply, income, and substitutio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Minimum Wage

A minimum wage is the lowest remuneration that employers can legally pay their employees—the price floor below which employees may not sell their labor. Most countries had introduced minimum wage legislation by the end of the 20th century. Because minimum wages increase the cost of labor, companies often try to avoid minimum wage laws by using gig workers, by moving labor to locations with lower or nonexistent minimum wages, or by automating job functions. The movement for minimum wages was first motivated as a way to stop the exploitation of workers in sweatshops, by employers who were thought to have unfair bargaining power over them. Over time, minimum wages came to be seen as a way to help lower-income families. Modern national laws enforcing compulsory union membership which prescribed minimum wages for their members were first passed in New Zealand in 1894. Although minimum wage laws are now in effect in many jurisdictions, differences of opinion exist about the benefit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Guaranteed Minimum Income

Guaranteed minimum income (GMI), also called minimum income (or mincome for short), is a social-welfare system that guarantees all citizens or families an income sufficient to live on, provided that certain eligibility conditions are met, typically: citizenship; a means test; and either availability to participate in the labor market, or willingness to perform community services. The primary goal of a guaranteed minimum income is reduction of poverty. In circumstances when citizenship is the sole qualification, the program becomes a universal basic income system. Elements A system of guaranteed minimum income can consist of several elements, most notably: * Calculation of the social minimum, usually below the minimum wage * Social safety net that helps those without sufficient financial means survive at the social minimum through payments or a loan, generally conditional on availability for work, performance of community services, some kind of social contract, or commitment t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Effective Marginal Tax Rate

The effective marginal tax rate (EMTR) is the combined effect on a person's earnings of income tax and the withdrawal of means testing of state welfare benefits. The EMTR is the percentage of an extra unit of income (extra dollar, euro, yen etc.) that the recipient loses due to income taxes, payroll taxes, and any decline in tax credits and welfare entitlements. Calculating the EMTR is typically very dependent on individual circumstances and involves a consideration of welfare withdrawal rules, income tax laws, low income tax offsets, tax rebates and the individuals tax and welfare status. As such tables showing EMTRs are rarely published. The net effect however is generally a higher effective marginal rate of tax than that suggested by income tax tables. See also *Welfare trap The welfare trap (or unemployment trap or poverty trap in British English) theory asserts that taxation and welfare systems can jointly contribute to keep people on social insurance because the withdrawa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capitalism And Freedom

''Capitalism and Freedom'' is a book by Milton Friedman originally published in 1962 by the University of Chicago Press which discusses the role of economic capitalism in liberal society. It has sold more than half a million copies since 1962 and has been translated into eighteen languages. Friedman argues for economic freedom as a precondition for political freedom. He defines "liberal" in European Enlightenment terms, contrasting with an American usage that he believes has been corrupted since the Great Depression. The book identifies several places in which a free market can be promoted for both philosophical and practical reasons. Among other concepts, Friedman advocates ending the mandatory licensing of physicians and introducing a system of vouchers for school education. Context ''Capitalism and Freedom'' was published nearly two decades after World War II, a time when the Great Depression was still in collective memory. Under the Kennedy and preceding Eisenhower admin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rose Friedman

Rose Director Friedman (; born Rose Director (December 1910 – 18 August 2009), was a free-market economist and co-founder of the Milton and Rose D. Friedman Foundation. Biography Rose Friedman attended Reed College and then transferred to the University of Chicago, where she received a Bachelor of Philosophy degree. After this she began to study for a doctorate in economics at the University of Chicago and completed all work necessary for the Ph.D. except for writing the dissertation. In her youth, she wrote articles with Dorothy Brady on consumption. She received an honorary LL.D. in December 1986 from Pepperdine University. She is believed to have been born the last week of December, 1910; however, the birth records have been lost. She was born in Staryi Chortoryisk, in Ukraine, to the Director family, prominent Jewish residents. She was married to her frequent collaborator, Milton Friedman (1912–2006), who won the 1976 Nobel Prize in Economics. Her brother, Aaron Directo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

James Mirrlees

Sir James Alexander Mirrlees (5 July 1936 – 29 August 2018) was a British economist and winner of the 1996 Nobel Memorial Prize in Economic Sciences. He was knighted in the 1997 Birthday Honours. Early life and education Born in Minnigaff, Kirkcudbrightshire, Mirrlees was educated at Douglas Ewart High School, then at the University of Edinburgh ( MA in Mathematics and Natural Philosophy in 1957) and Trinity College, Cambridge (Mathematical Tripos and PhD in 1963 with thesis title ''Optimum Planning for a Dynamic Economy'', supervised by Richard Stone). He was a very active student debater. A contemporary, Quentin Skinner, has suggested that Mirrlees was a member of the Cambridge Apostles along with fellow Nobel Laureate Amartya Sen during the period. Economics Between 1968 and 1976, Mirrlees was a visiting professor at the Massachusetts Institute of Technology three times. He was also a visiting professor at the University of California, Berkeley (1986) and Yale Univers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

David Hume

David Hume (; born David Home; 7 May 1711 NS (26 April 1711 OS) – 25 August 1776) Cranston, Maurice, and Thomas Edmund Jessop. 2020 999br>David Hume" ''Encyclopædia Britannica''. Retrieved 18 May 2020. was a Scottish Enlightenment philosopher, historian, economist, librarian, and essayist, who is best known today for his highly influential system of philosophical empiricism, scepticism, and naturalism. Beginning with '' A Treatise of Human Nature'' (1739–40), Hume strove to create a naturalistic science of man that examined the psychological basis of human nature. Hume argued against the existence of innate ideas, positing that all human knowledge derives solely from experience. This places him with Francis Bacon, Thomas Hobbes, John Locke, and George Berkeley as an Empiricist. Hume argued that inductive reasoning and belief in causality cannot be justified rationally; instead, they result from custom and mental habit. We never actually perceive that one event caus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Utilitarianism

In ethical philosophy, utilitarianism is a family of normative ethical theories that prescribe actions that maximize happiness and well-being for all affected individuals. Although different varieties of utilitarianism admit different characterizations, the basic idea behind all of them is, in some sense, to maximize utility, which is often defined in terms of well-being or related concepts. For instance, Jeremy Bentham, the founder of utilitarianism, described ''utility'' as: That property in any object, whereby it tends to produce benefit, advantage, pleasure, good, or happiness ... rto prevent the happening of mischief, pain, evil, or unhappiness to the party whose interest is considered. Utilitarianism is a version of consequentialism, which states that the consequences of any action are the only standard of right and wrong. Unlike other forms of consequentialism, such as egoism and altruism, utilitarianism considers the interests of all sentient beings equally. Pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Welfare Function

In welfare economics, a social welfare function is a function that ranks social states (alternative complete descriptions of the society) as less desirable, more desirable, or indifferent for every possible pair of social states. Inputs of the function include any variables considered to affect the economic welfare of a society. In using welfare measures of persons in the society as inputs, the social welfare function is individualistic in form. One use of a social welfare function is to represent prospective patterns of collective choice as to alternative social states. The social welfare function provides the government with a simple guideline for achieving the optimal distribution of income. The social welfare function is analogous to the consumer theory of indifference-curve– budget constraint tangency for an individual, except that the social welfare function is a mapping of individual preferences or judgments of everyone in the society as to collective choices, which ap ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |