|

National Investment Corporation Of National Bank Of Kazakhstan

National Investment Corporation of the National Bank of Kazakhstan (NIC) was established in October 2012 to preserve and enhance the long-term purchasing power of Kazakhstan’s foreign exchange reserves and of the National Fund through investments in less liquid high yielding asset classes. NIC manages assets entrusted by the National Bank of Kazakhstan. NIC invests in private equity, hedge funds, real estate and infrastructure through external managers and has signed up to the Santiago Principles on best practice in managing sovereign wealth funds. In order to achieve its goals the NIC will invest in alternative asset classes in the international financial markets with investment horizon of 10–20 years, and other types of activities involving trust asset management. History NIC was established under the initiative of the Governor of National Bank of Kazakhstan and under the agreement of the President of the Republic of Kazakhstan. It is a 100% subsidiary of the National B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institutional Investor

An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked companies, insurers, pension funds, sovereign wealth funds, charities, hedge funds, REITs, investment advisors, endowments, and mutual funds. Operating companies which invest excess capital in these types of assets may also be included in the term. Activist institutional investors may also influence corporate governance by exercising voting rights in their investments. In 2019, the world's top 500 asset managers collectively managed $104.4 trillion in Assets under Management (AuM). Although institutional investors appear to be more sophisticated than retail investors, it remains unclear if professional active investment managers can reliably enhance risk-adjusted returns by an amount that exceeds fees and expenses of investment managemen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nur-Sultan

Astana, previously known as Akmolinsk, Tselinograd, Akmola, and most recently Nur-Sultan, is the capital city of Kazakhstan. The city lies on the banks of the Ishim (river), Ishim River in the north-central part of Kazakhstan, within the Akmola Region, though administered as a city with special status separately from the rest of the region. A 2020 official estimate reported a population of 1,136,008 within the city limits, making it the List of most populous cities in Kazakhstan, second-largest city in the country, after Almaty, which had been the capital until 1997. The city became the capital of Kazakhstan in 1997; since then it has grown and developed economically into one of the most modern cities in Central Asia. In 2021, the government selected Astana as one of the 10 priority destinations for tourist development. Modern Astana is a Planned community, planned city, following the process of List of purpose-built national capitals, other planned capitals. After it became t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Bank Of Kazakhstan

is the central bank of Kazakhstan. History The National Bank of Kazakhstan was established on the basis of the Kazakh Republican Bank of the State Bank of the USSR (since 1990 - the State Bank of the Kazakh SSR, since 1991 - the National State Bank of the Kazakh SSR). On April 13, 1993, in accordance with the Law "On the National Bank of the Republic of Kazakhstan", the National Bank of the Kazakh SSR was renamed the National Bank of the Republic of Kazakhstan. On March 30, 1995, a new Law of the Republic of Kazakhstan dated March 30, 1995 No. 2155 "On the National Bank of the Republic of Kazakhstan" was issued. On 15 November 1999, the National Bank of Kazakhstan became the founder and the sole shareholder of the Kazakhstan Deposit Insurance Fund ("KDIF"). Management Structure The National Bank is accountable to the President of the Republic of Kazakhstan, but acting independently to the extent scope of authority granted under the legislation thereto. The National Bank coordi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Santiago Principles

The Santiago Principles or formally the Sovereign Wealth Funds: Generally Accepted Principles and Practices (GAPP) are designed as a common global set of 24 voluntary guidelines that assign best practices for the operations of Sovereign Wealth Funds (SWFs). They are a consequence of the concern of investors and regulators to establish management principles addressing the inadequate transparency, independence, and governance in the industry. They are guidelines to be followed by sovereign wealth fund management to maintain a stable global financial system, proper controls around risk, regulation and a sound governance structure. As of 2016 30 funds have formally signed up to the Principles and joined the IFSWF representing collectively 80% of assets managed by sovereign funds globally or US$5.5 trillion. The principles are maintained and promoted by the International Forum of Sovereign Wealth Funds (IFSWF) and whose membership have to either have implemented or aspire to implement t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Forum Of Sovereign Wealth Funds

The International Forum of Sovereign Wealth Funds (IFSWF) is a nonprofit international group of sovereign wealth funds managers which was established in 2009. It is based in London, England. History In 2009, a group of 23 leading state-owned international investors from around the world established the IFSWF's precursor, the International Working Group of Sovereign Wealth Funds, following discussions with global groups such as the G20, International Monetary Fund, IMF, and the U.S. Department of Treasury in 2007 and 2008. The Working Group created a set of Generally Accepted Principles and Practices, better known as the "Santiago Principles", for sovereign wealth funds' institutional governance and risk-management frameworks. Following the Kuwait Declaration in 2009, the International Working Group became the IFSWF with the mandate of helping members implement the Principles. Overview As of February 2018 IFSWF had 32 members, including some of the world's largest sovereign we ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

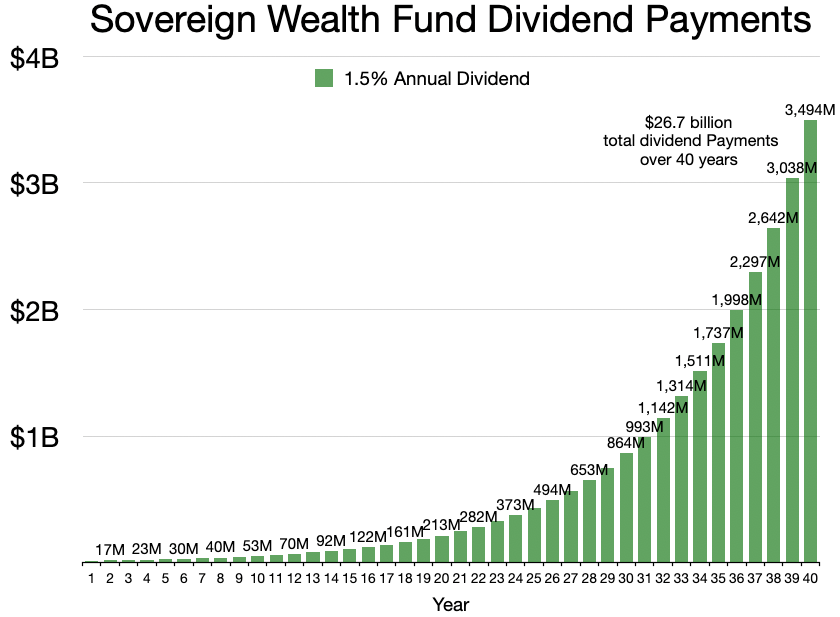

Sovereign Wealth Fund

A sovereign wealth fund (SWF), sovereign investment fund, or social wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign-exchange reserves held by the central bank. Some sovereign wealth funds may be held by a central bank, which accumulates the funds in the course of its management of a nation's banking system; this type of fund is usually of major economic and fiscal importance. Other sovereign wealth funds are simply the state savings that are invested by various entities for the purposes of investment return, and that may not have a significant role in fiscal management. The accumulated funds may have their origin in, or may represent, foreign currency deposits, gold, special drawing rights (SDRs) and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

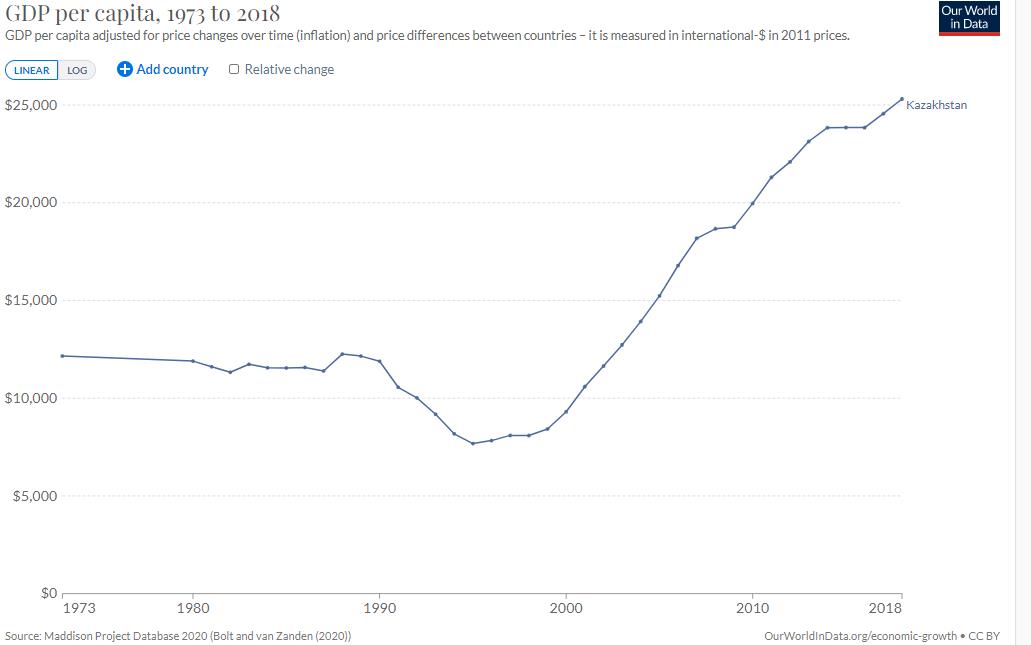

Economy Of Kazakhstan

The economy of Kazakhstan is the largest in Central Asia in both absolute and per capita terms. Kazakhstan has attracted to 2021 more than US$370 billion of foreign investments since becoming an independent republic after the collapse of the former Soviet Union. It possesses oil reserves as well as minerals and metals. It also has considerable agricultural potential, with its vast steppe lands accommodating both livestock and grain production. The mountains in the south are important for apples and walnuts; both species grow wild there. Kazakhstan's industrial sector rests on the extraction and processing of these natural resources. The Dissolution of the Soviet Union and the collapse of demand for Kazakhstan's traditional heavy industry products have resulted in a sharp decline of the economy since 1991, with the steepest annual decline occurring in 1994. In 1995–97 the pace of the government program of economic reform and privatization quickened, resulting in a substantia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sovereign Wealth Funds

A sovereign wealth fund (SWF), sovereign investment fund, or social wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign-exchange reserves held by the central bank. Some sovereign wealth funds may be held by a central bank, which accumulates the funds in the course of its management of a nation's banking system; this type of fund is usually of major economic and fiscal importance. Other sovereign wealth funds are simply the state savings that are invested by various entities for the purposes of investment return, and that may not have a significant role in fiscal management. The accumulated funds may have their origin in, or may represent, foreign currency deposits, gold, special drawing rights (SDRs) and In ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

%2C_satellite_image_2017-07-24.jpg)