|

News Analytics

In trading strategy, news analysis refers to the measurement of the various qualitative and quantitative attributes of textual (unstructured data) news stories. Some of these attributes are: sentiment, relevance, and novelty. Expressing news stories as numbers and metadata permits the manipulation of everyday information in a mathematical and statistical way. This data is often used in financial markets as part of a trading strategy or by businesses to judge market sentiment and make better business decisions. News analytics are usually derived through automated text analysis and applied to digital texts using elements from natural language processing and machine learning such as latent semantic analysis, support vector machines, "bag of words" among other techniques. Applications and strategies The application of sophisticated linguistic analysis to news and social media has grown from an area of research to mature product solutions since 2007. News analytics and news sentiment ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trading Strategy

In finance, a trading strategy is a fixed plan that is designed to achieve a profitable return by going long or short in markets. The main reasons that a properly researched trading strategy helps are its verifiability, quantifiability, consistency, and objectivity. For every trading strategy one needs to define assets to trade, entry/exit points and money management rules. Bad money management can make a potentially profitable strategy unprofitable.Nekrasov, V. Knowledge rather than Hope: A Book for Retail Investors and Mathematical Finance Students''. 2014pages 24-26 Trading strategies are based on fundamental or technical analysis, or both. They are usually verified by backtesting, where the process should follow the scientific method, and by forward testing (a.k.a. 'paper trading') where they are tested in a simulated trading environment. Types of trading strategies The term trading strategy can in brief be used by any fixed plan of trading a financial instrument, but the gen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Passive Management

Passive management (also called passive investing) is an investing strategy that tracks a market-weighted index or portfolio. Passive management is most common on the equity market, where index funds track a stock market index, but it is becoming more common in other investment types, including bonds, commodities and hedge funds.Burton G. Malkiel, A Random Walk Down Wall Street, W. W. Norton, 1996, The most popular method is to mimic the performance of an externally specified index by buying an index fund. By tracking an index, an investment portfolio typically gets good diversification, low turnover (good for keeping down internal transaction costs), and low management fees. With low fees, an investor in such a fund would have higher returns than a similar fund with similar investments but higher management fees and/or turnover/transaction costs.William F. SharpeIndexed Investing: A Prosaic Way to Beat the Average Investor May 1, 2002. Retrieved May 20, 2010. The bulk of money ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

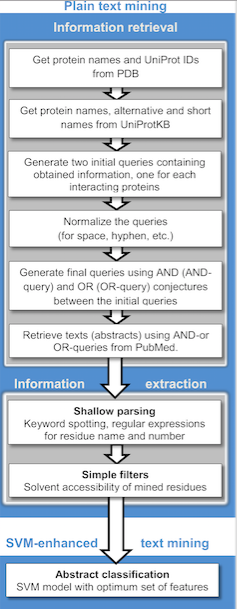

Text Mining

Text mining, also referred to as ''text data mining'', similar to text analytics, is the process of deriving high-quality information from text. It involves "the discovery by computer of new, previously unknown information, by automatically extracting information from different written resources." Written resources may include websites, books, emails, reviews, and articles. High-quality information is typically obtained by devising patterns and trends by means such as statistical pattern learning. According to Hotho et al. (2005) we can distinguish between three different perspectives of text mining: information extraction, data mining, and a KDD (Knowledge Discovery in Databases) process. Text mining usually involves the process of structuring the input text (usually parsing, along with the addition of some derived linguistic features and the removal of others, and subsequent insertion into a database), deriving patterns within the structured data, and finally evaluation and inte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sentiment Analysis

Sentiment analysis (also known as opinion mining or emotion AI) is the use of natural language processing, text analysis, computational linguistics, and biometrics to systematically identify, extract, quantify, and study affective states and subjective information. Sentiment analysis is widely applied to voice of the customer materials such as reviews and survey responses, online and social media, and healthcare materials for applications that range from marketing to customer service to clinical medicine. With the rise of deep language models, such as RoBERTa, also more difficult data domains can be analyzed, e.g., news texts where authors typically express their opinion/sentiment less explicitly.Hamborg, Felix; Donnay, Karsten (2021)"NewsMTSC: A Dataset for (Multi-)Target-dependent Sentiment Classification in Political News Articles" "Proceedings of the 16th Conference of the European Chapter of the Association for Computational Linguistics: Main Volume" Examples The objective an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Computational Linguistics

Computational linguistics is an Interdisciplinarity, interdisciplinary field concerned with the computational modelling of natural language, as well as the study of appropriate computational approaches to linguistic questions. In general, computational linguistics draws upon linguistics, computer science, artificial intelligence, mathematics, logic, philosophy, cognitive science, cognitive psychology, psycholinguistics, anthropology and neuroscience, among others. Sub-fields and related areas Traditionally, computational linguistics emerged as an area of artificial intelligence performed by computer scientists who had specialized in the application of computers to the processing of a natural language. With the formation of the Association for Computational Linguistics (ACL) and the establishment of independent conference series, the field consolidated during the 1970s and 1980s. The Association for Computational Linguistics defines computational linguistics as: The term "comp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Opportunity Cost

In microeconomic theory, the opportunity cost of a particular activity is the value or benefit given up by engaging in that activity, relative to engaging in an alternative activity. More effective it means if you chose one activity (for example, an investment) you are giving up the opportunity to do a different option. The optimal activity is the one that, net of its opportunity cost, provides the greater return compared to any other activities, net of their opportunity costs. For example, if you buy a car and use it exclusively to transport yourself, you cannot rent it out, whereas if you rent it out you cannot use it to transport yourself. If your cost of transporting yourself without the car is more than what you get for renting out the car, the optimal choice is to use the car yourself. In basic equation form, opportunity cost can be defined as: "Opportunity Cost = (returns on best Forgone Option) - (returns on Chosen Option)." The opportunity cost of mowing one’s own la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Algorithmic Trading

Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. This type of trading attempts to leverage the speed and computational resources of computers relative to human traders. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. It is widely used by investment banks, pension funds, mutual funds, and hedge funds that may need to spread out the execution of a larger order or perform trades too fast for human traders to react to. A study in 2019 showed that around 92% of trading in the Forex market was performed by trading algorithms rather than humans. The term algorithmic trading is often used synonymously with automated trading system. These encompass a variety of trading strategies, some of which are based on formulas and results from mathematical finance, and often rely on specialized software. Examples o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Covariance Matrix

In probability theory and statistics, a covariance matrix (also known as auto-covariance matrix, dispersion matrix, variance matrix, or variance–covariance matrix) is a square matrix giving the covariance between each pair of elements of a given random vector. Any covariance matrix is symmetric and positive semi-definite and its main diagonal contains variances (i.e., the covariance of each element with itself). Intuitively, the covariance matrix generalizes the notion of variance to multiple dimensions. As an example, the variation in a collection of random points in two-dimensional space cannot be characterized fully by a single number, nor would the variances in the x and y directions contain all of the necessary information; a 2 \times 2 matrix would be necessary to fully characterize the two-dimensional variation. The covariance matrix of a random vector \mathbf is typically denoted by \operatorname_ or \Sigma. Definition Throughout this article, boldfaced unsubsc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value At Risk

Value at risk (VaR) is a measure of the risk of loss for investments. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. VaR is typically used by firms and regulators in the financial industry to gauge the amount of assets needed to cover possible losses. For a given portfolio, time horizon, and probability ''p'', the ''p'' VaR can be defined informally as the maximum possible loss during that time after excluding all worse outcomes whose combined probability is at most ''p''. This assumes mark-to-market pricing, and no trading in the portfolio. For example, if a portfolio of stocks has a one-day 95% VaR of $1 million, that means that there is a 0.05 probability that the portfolio will fall in value by more than $1 million over a one-day period if there is no trading. Informally, a loss of $1 million or more on this portfolio is expected on 1 day out of 20 days (because of 5% proba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge

A hedge or hedgerow is a line of closely spaced shrubs and sometimes trees, planted and trained to form a barrier or to mark the boundary of an area, such as between neighbouring properties. Hedges that are used to separate a road from adjoining fields or one field from another, and are of sufficient age to incorporate larger trees, are known as hedgerows. Often they serve as windbreaks to improve conditions for the adjacent crops, as in bocage country. When clipped and maintained, hedges are also a simple form of topiary. A hedge often operates as, and sometimes is called, a "live fence". This may either consist of individual fence posts connected with wire or other fencing material, or it may be in the form of densely planted hedges without interconnecting wire. This is common in tropical areas where low-income farmers can demarcate properties and reduce maintenance of fence posts that otherwise deteriorate rapidly. Many other benefits can be obtained depending on the specie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Risk

Market risk is the risk of losses in positions arising from movements in market variables like prices and volatility. There is no unique classification as each classification may refer to different aspects of market risk. Nevertheless, the most commonly used types of market risk are: * ''Equity risk'', the risk that stock or stock indices (e.g. Euro Stoxx 50, etc.) prices or their implied volatility will change. * ''Interest rate risk'', the risk that interest rates (e.g. Libor, Euribor, etc.) or their implied volatility will change. * ''Currency risk'', the risk that foreign exchange rates (e.g. EUR/USD, EUR/GBP, etc.) or their implied volatility will change. * ''Commodity risk'', the risk that commodity prices (e.g. corn, crude oil) or their implied volatility will change. * '' Margining risk'' results from uncertain future cash outflows due to margin calls covering adverse value changes of a given position. * ''Shape risk'' * '' Holding period risk'' * ''Basis risk'' The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Risk

A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments. In the first resort, the risk is that of the lender and includes lost principal and interest, disruption to cash flows, and increased collection costs. The loss may be complete or partial. In an efficient market, higher levels of credit risk will be associated with higher borrowing costs. Because of this, measures of borrowing costs such as yield spreads can be used to infer credit risk levels based on assessments by market participants. Losses can arise in a number of circumstances, for example: * A consumer may fail to make a payment due on a mortgage loan, credit card, line of credit, or other loan. * A company is unable to repay asset-secured fixed or floating charge debt. * A business or consumer does not pay a trade invoice when due. * A business does not pay an employee's earned wages when due. * A business or government bond issuer does not make a payment on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |