|

Natural Borrowing Limit

A borrowing limit is the amount of money that individuals could borrow from other individuals, firms, banks or governments. There are many types of borrowing limits, and a natural borrowing limit is one specific type of borrowing limit among those. When individuals are said to face the natural borrowing limit, it implies they are allowed to borrow up to the sum of all their future incomes. A natural debt limit and a natural borrowing constraint are other ways to refer to the natural borrowing limit. Although the concept is widely discussed in the economic literatures, it is less likely to observe lenders willing to lend up to the natural borrowing limit. In the real economic activities, borrowing limits are usually much tighter than the natural borrowing limit due to the immature financial systems of the economy or the gap between the amount of information that the borrowers and lenders have(The latter is usually referred to as an asymmetric information problem). Illustrative exa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Borrowing Limit

Borrow or borrowing can mean: to receive (something) from somebody temporarily, expecting to return it. *In finance, monetary debt *In language, the use of loanwords * In arithmetic, when a digit becomes less than zero and the deficiency is taken from the next digit to the left *You cannot borrow an item that will be replaced. This is commonly referred to as loaning or replacing. Borrowing is retuning the same item that was used. *In music, the use of borrowed chords *In construction, borrow pit *In golf, the tendency of a putted ball to deviate from the straight line; see Glossary of golf#B People * David Borrow (born 1952), British politician * George Borrow (1803–1881), English author * Nik Borrow, bird artist and ornithologist See also * Borough * Borro (other) * Borrowes, a surname * Borrows, a surname * Bureau (other) * Burrow An Eastern chipmunk at the entrance of its burrow A burrow is a hole or tunnel excavated into the ground by an animal to constr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Collateral (finance)

In lending agreements, collateral is a borrower's pledge of specific property to a lender, to secure repayment of a loan. The collateral serves as a lender's protection against a borrower's default and so can be used to offset the loan if the borrower fails to pay the principal and interest satisfactorily under the terms of the lending agreement. The protection that collateral provides generally allows lenders to offer a lower interest rate on loans that have collateral. The reduction in interest rate can be up to several percentage points, depending on the type and value of the collateral. For example, the Annual Percentage Rate (APR) on an unsecured loan is often much higher than on a secured loan or logbook loan. If a borrower defaults on a loan (due to insolvency or another event), that borrower loses the property pledged as collateral, with the lender then becoming the owner of the property. In a typical mortgage loan transaction, for instance, the real estate being acq ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Cycle Model

A macroeconomic model is an analytical tool designed to describe the operation of the problems of economy of a country or a region. These models are usually designed to examine the comparative statics and dynamics of aggregate quantities such as the total amount of goods and services produced, total income earned, the level of employment of productive resources, and the level of prices. Macroeconomic models may be logical, mathematical, and/or computational; the different types of macroeconomic models serve different purposes and have different advantages and disadvantages. Macroeconomic models may be used to clarify and illustrate basic theoretical principles; they may be used to test, compare, and quantify different macroeconomic theories; they may be used to produce "what if" scenarios (usually to predict the effects of changes in monetary, fiscal, or other macroeconomic policies); and they may be used to generate economic forecasts. Thus, macroeconomic models are widely use ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity (finance)

In finance, equity is ownership of assets that may have debts or other liabilities attached to them. Equity is measured for accounting purposes by subtracting liabilities from the value of the assets. For example, if someone owns a car worth $24,000 and owes $10,000 on the loan used to buy the car, the difference of $14,000 is equity. Equity can apply to a single asset, such as a car or house, or to an entire business. A business that needs to start up or expand its operations can sell its equity in order to raise cash that does not have to be repaid on a set schedule. In government finance or other non-profit settings, equity is known as "net position" or "net assets". Origins The term "equity" describes this type of ownership in English because it was regulated through the system of equity law that developed in England during the Late Middle Ages to meet the growing demands of commercial activity. While the older common law courts dealt with questions of property title, equi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Rationing Problem

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt), but promises either to repay or return those resources (or other materials of equal value) at a later date. In other words, credit is a method of making reciprocity formal, legally enforceable, and extensible to a large group of unrelated people. The resources provided may be financial (e.g. granting a loan), or they may consist of goods or services (e.g. consumer credit). Credit encompasses any form of deferred payment. Credit is extended by a creditor, also known as a lender, to a debtor, also known as a borrower. Etymology The term "credit" was first used in English in the 1520s. The term came "from Middle French crédit (15c.) "belief, trust," from Italian credito, from Latin creditum "a loan, thing entrusted to another," from past ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Market Imperfections

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability assessmen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zero Borrowing Constraint

0 (zero) is a number representing an empty quantity. In place-value notation such as the Hindu–Arabic numeral system, 0 also serves as a placeholder numerical digit, which works by multiplying digits to the left of 0 by the radix, usually by 10. As a number, 0 fulfills a central role in mathematics as the additive identity of the integers, real numbers, and other algebraic structures. Common names for the number 0 in English are ''zero'', ''nought'', ''naught'' (), ''nil''. In contexts where at least one adjacent digit distinguishes it from the letter O, the number is sometimes pronounced as ''oh'' or ''o'' (). Informal or slang terms for 0 include ''zilch'' and ''zip''. Historically, ''ought'', ''aught'' (), and ''cipher'', have also been used. Etymology The word ''zero'' came into the English language via French from the Italian , a contraction of the Venetian form of Italian via ''ṣafira'' or ''ṣifr''. In pre-Islamic time the word (Arabic ) had the meaning ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inada Condition

Inada is a Japanese surname. Notable people with the surname include: * Etsuko Inada (1924–2003), Japanese figure skater * Ken-Ichi Inada (1925–2002), Japanese economist * Koji Inada (other), multiple people *Lawson Fusao Inada (born 1938), American poet, fifth poet laureate of the Oregon *Masaru Inada (born 1978), Japanese skeleton racer * Masazumi Inada (1896–1986), lieutenant general in the Japanese Imperial Army during World War II *Nada Inada (1929–2013), the pen-name of a Japanese psychiatrist, writer and literary critic * Noriko Inada (born 1978), Japanese former swimmer who competed in the Olympic games *Ryukichi Inada (1874–1950), Japanese physician, a prominent academic, and bacteriologist researcher *Tetsu Inada (born 1972), Japanese voice actor who works for Aoni Production *Tomomi Inada (born 1959), Japanese politician of the Liberal Democratic Party See also *Family Inada (Inada) is a Japanese manufacturer of robotic massage chairs *Inada conditions ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk-free Interest Rate

The risk-free rate of return, usually shortened to the risk-free rate, is the rate of return of a hypothetical investment with scheduled payments over a fixed period of time that is assumed to meet all payment obligations. Since the risk-free rate can be obtained with no risk, any other investment having some risk will have to have a higher rate of return in order to induce any investors to hold it. In practice, to infer the risk-free interest rate in a particular currency, market participants often choose the yield to maturity on a risk-free bond issued by a government of the same currency whose risks of default are so low as to be negligible. For example, the rate of return on T-bills is sometimes seen as the risk-free rate of return in US dollars. Theoretical measurement As stated by Malcolm Kemp in chapter five of his book ''Market Consistency: Model Calibration in Imperfect Markets'', the risk-free rate means different things to different people and there is no consensus on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk-free Bond

A risk-free bond is a theoretical bond that repays interest and principal with absolute certainty. The rate of return would be the risk-free interest rate. It is primary security, which pays off 1 unit no matter state of economy is realized at time t+1 . So its payoff is the same regardless of what state occurs. Thus, an investor experiences no risk by investing in such an asset. In practice, government bonds of financially stable countries are treated as risk-free bonds, as governments can raise taxes or indeed print money to repay their domestic currency debt. For instance, United States Treasury notes and United States Treasury bonds are often assumed to be risk-free bonds. Even though investors in United States Treasury securities do in fact face a small amount of credit risk, this risk is often considered to be negligible. An example of this credit risk was shown by Russia, which defaulted on its domestic debt during the 1998 Russian financial crisis. Modelling the price b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption Smoothing

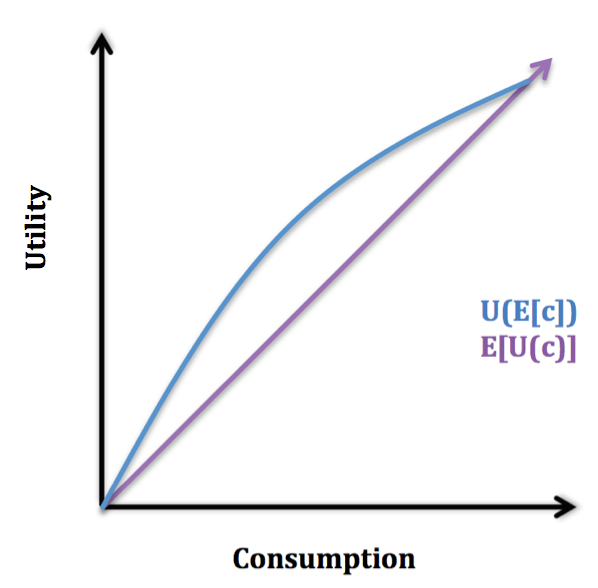

Consumption smoothing is an economic concept for the practice of optimizing a person's standard of living through an appropriate balance between savings and consumption over time. An optimal consumption rate should be relatively similar at each stage of a person's life rather than fluctuate wildly. Luxurious consumption at an old age does not compensate for an impoverished existence at other stages in one's life. Since income tends to be hump-shaped across an individual's life, economic theory suggests that individuals should on average have low or negative savings rate at early stages in their life, high in middle age, and negative during retirement. Although many popular books on personal finance advocate that individuals should at all stages of their life set aside money in savings, economist James Choi states that this deviates from the advice of economists. Expected utility model The graph below illustrates the expected utility model, in which U(c) is increasing in and con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |