|

Mutual Credit

"Mutual credit" (sometimes called "multilateral barter" or "credit clearing") is a term mostly used in the field of complementary currencies to describe a common, usually small-scale, endogenous money system. The term implies that creditors and debtors are the same people lending to each other, but there are several nuances. Some think of mutual credit as a type of currency but this can be problematic because no currency or money is 'issued' in the sense that most people would understand it. Cash is very rarely 'issued', accounting normally taking place on a ledger, therefore it could also be called 'ledger money', a money ''system'', accounting for exchange or credit clearing system. The accounting is explained under multilateral exchange. Economics The practice of multilateral exchange can be a mere convenience, but once a common unit of account is agreed, the extent to which members can draw credit limited, a mutual credit system quickly resembles a money system. However, mut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multilateral Barter

A multilateral exchange is a transaction, or forum for transactions, which involve more than two parties. For example, Alice gives Bob an apple in exchange for an orange, that is a bilateral exchange. A multilateral exchange would involve a third party, for example: Alice gives an apple to Bob who gives an orange to Charles, who gives a pear to Alice. In the real world, such transactions are spread over time, and involved items of different values, and involve many more parties. A special type of accounting is used for this, called mutual credit, or credit clearing. Accounting Although any accounting framework can be used, there is one approach that fits naturally for multilateral exchange. It is the simplest possible database/spreadsheet design, single-entry bookkeeping rather than double-entry bookkeeping. All accounts begin with a balance of zero, meaning they owe nothing and are owed nothing. An account may only close at zero, meaning it has given as much as it has received, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Poverty Trap

In economics, a cycle of poverty or poverty trap is caused by self-reinforcing mechanisms that cause poverty, once it exists, to persist unless there is outside intervention. It can persist across generations, and when applied to developing countries, is also known as a development trap. Families trapped in the cycle of poverty have few to no resources. There are many self-reinforcing disadvantages that make it virtually impossible for individuals to break the cycle. This occurs when poor people do not have the resources necessary to escape poverty, such as financial capital, education, or connections. Impoverished individuals do not have access to economic and social resources as a result of their poverty. This lack may increase their poverty. This could mean that the poor remain poor throughout their lives.Hutchinson Encycloped ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Rating

A credit rating is an evaluation of the credit risk of a prospective debtor (an individual, a business, company or a government), predicting their ability to pay back the debt, and an implicit forecast of the likelihood of the debtor defaulting. The credit rating represents an evaluation of a credit rating agency of the qualitative and quantitative information for the prospective debtor, including information provided by the prospective debtor and other non-public information obtained by the credit rating agency's analysts. Credit reporting (or credit score) – is a subset of credit rating – it is a numeric evaluation of an ''individual's'' credit worthiness, which is done by a credit bureau or consumer credit reporting agency. Sovereign credit ratings A sovereign credit rating is the credit rating of a sovereign entity, such as a national government. The sovereign credit rating indicates the risk level of the investing environment of a country and is used by investors whe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Bubble

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be caused by overly optimistic projections about the scale and sustainability of growth (e.g. dot-com bubble), and/or by the belief that intrinsic valuation is no longer relevant when making an investment (e.g. Tulip mania). They have appeared in most asset classes, including equities (e.g. Roaring Twenties), commodities (e.g. Uranium bubble), real estate (e.g. 2000s US housing bubble), and even esoteric assets (e.g. Cryptocurrency bubble). Bubbles usually form as a result of either excess liquidity in markets, and/or changed investor psychology. Large multi-asset bubbles (e.g. 1980s Japanese asset bubble and the 2020–21 Everything bubble), are attributed to central banking liquidity (e.g. overuse of the Fed put). In the early stages of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moral Equivalence

Moral equivalence is a term used in political debate, usually to deny that a moral comparison can be made of two sides in a conflict, or in the actions or tactics of two sides. The term had some currency in polemic debates about the Cold War, and currently the Arab–Israeli conflict. "Moral equivalence" began to be used as a polemic ''term-of-retort'' to "moral relativism", which had been gaining use as an indictment against political foreign policy that appeared to use only a situation-based application of widely held ethical standards. International conflicts are sometimes viewed similarly, and interested parties periodically urge both sides to conduct a ceasefire and negotiate their differences. However these negotiations may prove difficult in that both parties in a conflict believe that they are morally superior to the other, and are unwilling to negotiate on basis of moral equivalence. Cold War In the Cold War context, the term was and is most commonly used by anticommun ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

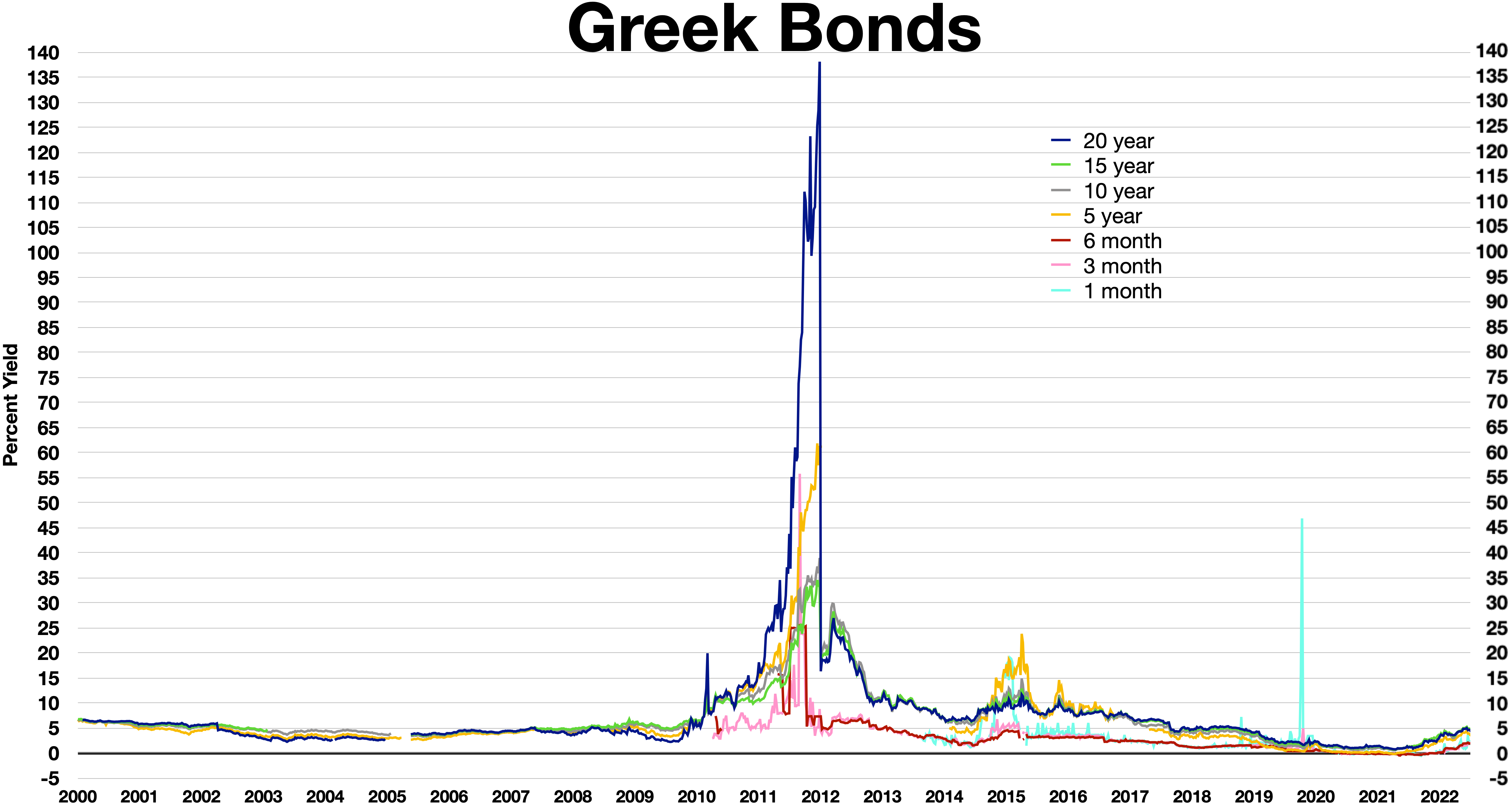

Greek Government-debt Crisis

Greece faced a sovereign debt crisis in the aftermath of the financial crisis of 2007–2008. Widely known in the country as The Crisis ( Greek: Η Κρίση), it reached the populace as a series of sudden reforms and austerity measures that led to impoverishment and loss of income and property, as well as a small-scale humanitarian crisis. In all, the Greek economy suffered the longest recession of any advanced mixed economy to date. As a result, the Greek political system has been upended, social exclusion increased, and hundreds of thousands of well-educated Greeks have left the country. The Greek crisis started in late 2009, triggered by the turmoil of the world-wide Great Recession, structural weaknesses in the Greek economy, and lack of monetary policy flexibility as a member of the Eurozone. The crisis included revelations that previous data on government debt levels and deficits had been underreported by the Greek government: the official forecast for the 2009 budg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Troika

The troika is a term used to refer to the single decision group created by three entities, the European Commission (EC), the European Central Bank (ECB) and the International Monetary Fund (IMF). It was formed in the aftermath of the European debt crisis as an ''ad hoc'' authority with a mandate to manage the "bailouts" of Cyprus, Greece, Ireland and Portugal, in the aftermath of their prospective insolvency caused by the world financial crisis of 2007–2008. Earlier, "troika" had been used as the designation of a triumvirate that represented the European Union in its foreign relations, in particular concerning its common foreign and security policy (CFSP), until the Treaty of Lisbon was ratified in 2009. Background of the financial crisis bailout troika The role of the Troika The term ''troika'' has been widely used in Greece, Cyprus ( el, τρόικα), Ireland, Portugal, and Spain to refer to the consortium of the European Commission, the European Central Bank an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debtors' Prison

A debtors' prison is a prison for people who are unable to pay debt. Until the mid-19th century, debtors' prisons (usually similar in form to locked workhouses) were a common way to deal with unpaid debt in Western Europe.Cory, Lucinda"A Historical Perspective on Bankruptcy" , ''On the Docket'', Volume 2, Issue 2, U.S. Bankruptcy Court, District of Rhode Island, April/May/June 2000, retrieved December 20, 2007. Destitute people who were unable to pay a court-ordered judgment would be incarcerated in these prisons until they had worked off their debt via labour or secured outside funds to pay the balance. The product of their labour went towards both the costs of their incarceration and their accrued debt. Increasing access and lenience throughout the history of bankruptcy law have made prison terms for unaggravated indigence obsolete over most of the world. Since the late 20th century, the term ''debtors' prison'' has also sometimes been applied by critics to criminal justice syst ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Usury

Usury () is the practice of making unethical or immoral monetary loans that unfairly enrich the lender. The term may be used in a moral sense—condemning taking advantage of others' misfortunes—or in a legal sense, where an interest rate is charged in excess of the maximum rate that is allowed by law. A loan may be considered usurious because of excessive or abusive interest rates or other factors defined by the laws of a state. Someone who practices usury can be called a ''usurer'', but in modern colloquial English may be called a ''loan shark''. In many historical societies including ancient Christian, Jewish, and Islamic societies, usury meant the charging of interest of any kind, and was considered wrong, or was made illegal. During the Sutra period in India (7th to 2nd centuries BC) there were laws prohibiting the highest castes from practicing usury. Similar condemnations are found in religious texts from Buddhism, Judaism (''Loans and interest in Judaism, ribbit'' in He ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be attri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Elasticity (economics)

In economics, elasticity measures the percentage change of one economic variable in response to a percentage change in another. If the price elasticity of the demand of something is -2, a 10% increase in price causes the demand quantity to fall by 20%. Introduction Elasticity is an important concept in neoclassical economic theory, and enables in the understanding of various economic concepts, such as the incidence of indirect taxation, marginal concepts relating to the theory of the firm, distribution of wealth, and different types of goods relating to the theory of consumer choice. An understanding of elasticity is also important when discussing welfare distribution, in particular consumer surplus, producer surplus, or government surplus. Elasticity is present throughout many economic theories, with the concept of elasticity appearing in several main indicators. These include price elasticity of demand, price elasticity of supply, income elasticity of demand, elastici ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (currency), currency in circulation (i.e. physical cash) and demand deposits (depositors' easily accessed assets on the books of financial institutions). The central bank of a country may use a definition of what constitutes legal tender for its purposes. Money supply data is recorded and published, usually by a government agency or the central bank of the country. Public sector, Public and private sector analysts monitor changes in the money supply because of the belief that such changes affect the price levels of Security (finance), securities, inflation, the exchange rates, and the business cycle. The relationship between money and prices has historically been associated with the quantity theory of money. There is some empirical evidence of a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |