|

Multilevel Monte Carlo Method

Multilevel Monte Carlo (MLMC) methods in numerical analysis are algorithms for computing expectations that arise in stochastic simulations. Just as Monte Carlo methods, they rely on repeated random sampling, but these samples are taken on different levels of accuracy. MLMC methods can greatly reduce the computational cost of standard Monte Carlo methods by taking most samples with a low accuracy and corresponding low cost, and only very few samples are taken at high accuracy and corresponding high cost. Goal The goal of a multilevel Monte Carlo method is to approximate the expected value \operatorname /math> of the random variable G that is the output of a stochastic simulation. Suppose this random variable cannot be simulated exactly, but there is a sequence of approximations G_0, G_1, \ldots, G_L with increasing accuracy, but also increasing cost, that converges to G as L\rightarrow\infty. The basis of the multilevel method is the telescoping sum identity, that is trivially s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Numerical Analysis

Numerical analysis is the study of algorithms that use numerical approximation (as opposed to symbolic computation, symbolic manipulations) for the problems of mathematical analysis (as distinguished from discrete mathematics). It is the study of numerical methods that attempt to find approximate solutions of problems rather than the exact ones. Numerical analysis finds application in all fields of engineering and the physical sciences, and in the 21st century also the life and social sciences like economics, medicine, business and even the arts. Current growth in computing power has enabled the use of more complex numerical analysis, providing detailed and realistic mathematical models in science and engineering. Examples of numerical analysis include: ordinary differential equations as found in celestial mechanics (predicting the motions of planets, stars and galaxies), numerical linear algebra in data analysis, and stochastic differential equations and Markov chains for simulati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Uncertainty Quantification

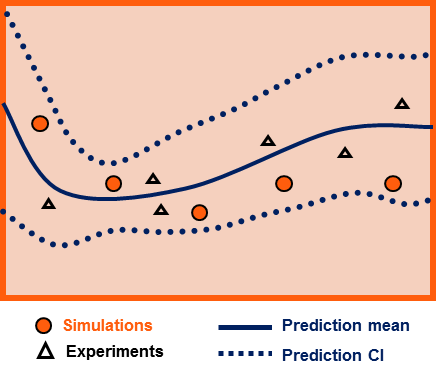

Uncertainty quantification (UQ) is the science of quantitative characterization and estimation of uncertainties in both computational and real world applications. It tries to determine how likely certain outcomes are if some aspects of the system are not exactly known. An example would be to predict the acceleration of a human body in a head-on crash with another car: even if the speed was exactly known, small differences in the manufacturing of individual cars, how tightly every bolt has been tightened, etc., will lead to different results that can only be predicted in a statistical sense. Many problems in the natural sciences and engineering are also rife with sources of uncertainty. Computer experiments on computer simulations are the most common approach to study problems in uncertainty quantification. Sources Uncertainty can enter mathematical models and experimental measurements in various contexts. One way to categorize the sources of uncertainty is to consider: ; Parame ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Stochastic Simulation

A stochastic simulation is a simulation of a system that has variables that can change stochastically (randomly) with individual probabilities.DLOUHÝ, M.; FÁBRY, J.; KUNCOVÁ, M.. Simulace pro ekonomy. Praha : VŠE, 2005. Realizations of these random variables are generated and inserted into a model of the system. Outputs of the model are recorded, and then the process is repeated with a new set of random values. These steps are repeated until a sufficient amount of data is gathered. In the end, the distribution of the outputs shows the most probable estimates as well as a frame of expectations regarding what ranges of values the variables are more or less likely to fall in. Often random variables inserted into the model are created on a computer with a random number generator (RNG). The U(0,1) uniform distribution outputs of the random number generator are then transformed into random variables with probability distributions that are used in the system model. Etymology ''St ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Sampling Techniques

Sampling may refer to: *Sampling (signal processing), converting a continuous signal into a discrete signal * Sampling (graphics), converting continuous colors into discrete color components *Sampling (music), the reuse of a sound recording in another recording **Sampler (musical instrument), an electronic musical instrument used to record and play back samples *Sampling (statistics), selection of observations to acquire some knowledge of a statistical population * Sampling (case studies), selection of cases for single or multiple case studies * Sampling (audit), application of audit procedures to less than 100% of population to be audited * Sampling (medicine), gathering of matter from the body to aid in the process of a medical diagnosis and/or evaluation of an indication for treatment, further medical tests or other procedures. * Sampling (occupational hygiene), detection of hazardous materials in the workplace *Sampling (for testing or analysis), taking a representative portion ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Numerical Analysis

Numerical analysis is the study of algorithms that use numerical approximation (as opposed to symbolic computation, symbolic manipulations) for the problems of mathematical analysis (as distinguished from discrete mathematics). It is the study of numerical methods that attempt to find approximate solutions of problems rather than the exact ones. Numerical analysis finds application in all fields of engineering and the physical sciences, and in the 21st century also the life and social sciences like economics, medicine, business and even the arts. Current growth in computing power has enabled the use of more complex numerical analysis, providing detailed and realistic mathematical models in science and engineering. Examples of numerical analysis include: ordinary differential equations as found in celestial mechanics (predicting the motions of planets, stars and galaxies), numerical linear algebra in data analysis, and stochastic differential equations and Markov chains for simulati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Monte Carlo Methods

Monte Carlo methods, or Monte Carlo experiments, are a broad class of computational algorithms that rely on Resampling (statistics), repeated random sampling to obtain numerical results. The underlying concept is to use randomness to solve problems that might be deterministic system, deterministic in principle. The name comes from the Monte Carlo Casino in Monaco, where the primary developer of the method, mathematician Stanisław Ulam, was inspired by his uncle's gambling habits. Monte Carlo methods are mainly used in three distinct problem classes: optimization, numerical integration, and generating draws from a probability distribution. They can also be used to model phenomena with significant uncertainty in inputs, such as calculating the risk of a nuclear power plant failure. Monte Carlo methods are often implemented using computer simulations, and they can provide approximate solutions to problems that are otherwise intractable or too complex to analyze mathematically. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Uncertainty Quantification

Uncertainty quantification (UQ) is the science of quantitative characterization and estimation of uncertainties in both computational and real world applications. It tries to determine how likely certain outcomes are if some aspects of the system are not exactly known. An example would be to predict the acceleration of a human body in a head-on crash with another car: even if the speed was exactly known, small differences in the manufacturing of individual cars, how tightly every bolt has been tightened, etc., will lead to different results that can only be predicted in a statistical sense. Many problems in the natural sciences and engineering are also rife with sources of uncertainty. Computer experiments on computer simulations are the most common approach to study problems in uncertainty quantification. Sources Uncertainty can enter mathematical models and experimental measurements in various contexts. One way to categorize the sources of uncertainty is to consider: ; Parame ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Quasi-Monte Carlo Methods In Finance

High-dimensional integrals in hundreds or thousands of variables occur commonly in finance. These integrals have to be computed numerically to within a threshold \epsilon. If the integral is of dimension d then in the worst case, where one has a guarantee of error at most \epsilon, the computational complexity is typically of order \epsilon^. That is, the problem suffers the curse of dimensionality. In 1977 P. Boyle, University of Waterloo, proposed using Monte Carlo Method, Monte Carlo (MC) to evaluate options.Boyle, P. (1977), Options: a Monte Carlo approach, J. Financial Economics, 4, 323-338. Starting in early 1992, Joseph Traub, J. F. Traub, Columbia University, and a graduate student at the time, S. Paskov, used Quasi-Monte Carlo method, quasi-Monte Carlo (QMC) to price a Collateralized mortgage obligation with parameters specified by Goldman Sachs. Even though it was believed by the world's leading experts that QMC should not be used for high-dimensional integration, Paskov and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Monte Carlo Methods In Finance

Monte Carlo methods are used in corporate finance and mathematical finance to value and analyze (complex) instruments, portfolios and investments by simulating the various sources of uncertainty affecting their value, and then determining the distribution of their value over the range of resultant outcomes. This is usually done by help of stochastic asset models. The advantage of Monte Carlo methods over other techniques increases as the dimensions (sources of uncertainty) of the problem increase. Monte Carlo methods were first introduced to finance in 1964 by David B. Hertz through his ''Harvard Business Review'' article, discussing their application in Corporate Finance. In 1977, Phelim Boyle pioneered the use of simulation in derivative valuation in his seminal ''Journal of Financial Economics'' paper. This article discusses typical financial problems in which Monte Carlo methods are used. It also touches on the use of so-called "quasi-random" methods such as the use of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Quasi-Monte Carlo Method

In numerical analysis, the quasi-Monte Carlo method is a method for numerical integration and solving some other problems using low-discrepancy sequences (also called quasi-random sequences or sub-random sequences) to achieve variance reduction. This is in contrast to the regular Monte Carlo method or Monte Carlo integration, which are based on sequences of pseudorandom numbers. Monte Carlo and quasi-Monte Carlo methods are stated in a similar way. The problem is to approximate the integral of a function ''f'' as the average of the function evaluated at a set of points ''x''1, ..., ''x''''N'': : \int_ f(u)\,u \approx \frac\,\sum_^N f(x_i). Since we are integrating over the ''s''-dimensional unit cube, each ''x''''i'' is a vector of ''s'' elements. The difference between quasi-Monte Carlo and Monte Carlo is the way the ''x''''i'' are chosen. Quasi-Monte Carlo uses a low-discrepancy sequence such as the Halton sequence, the Sobol sequence, or the Faure sequence, whereas Mont ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Discretization

In applied mathematics, discretization is the process of transferring continuous functions, models, variables, and equations into discrete counterparts. This process is usually carried out as a first step toward making them suitable for numerical evaluation and implementation on digital computers. Dichotomization is the special case of discretization in which the number of discrete classes is 2, which can approximate a continuous variable as a binary variable (creating a dichotomy for modeling purposes, as in binary classification). Discretization is also related to discrete mathematics, and is an important component of granular computing. In this context, ''discretization'' may also refer to modification of variable or category ''granularity'', as when multiple discrete variables are aggregated or multiple discrete categories fused. Whenever continuous data is discretized, there is always some amount of discretization error. The goal is to reduce the amount to a level ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Stochastic Partial Differential Equation

Stochastic partial differential equations (SPDEs) generalize partial differential equations via random force terms and coefficients, in the same way ordinary stochastic differential equations generalize ordinary differential equations. They have relevance to quantum field theory, statistical mechanics, and spatial modeling. Examples One of the most studied SPDEs is the stochastic heat equation, which may formally be written as : \partial_t u = \Delta u + \xi\;, where \Delta is the Laplacian and \xi denotes space-time white noise. Other examples also include stochastic versions of famous linear equations, such as the wave equation and the Schrödinger equation. Discussion One difficulty is their lack of regularity. In one dimensional space, solutions to the stochastic heat equation are only almost 1/2-Hölder continuous in space and 1/4-Hölder continuous in time. For dimensions two and higher, solutions are not even function-valued, but can be made sense of as random d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |