|

Modified Gross National Income

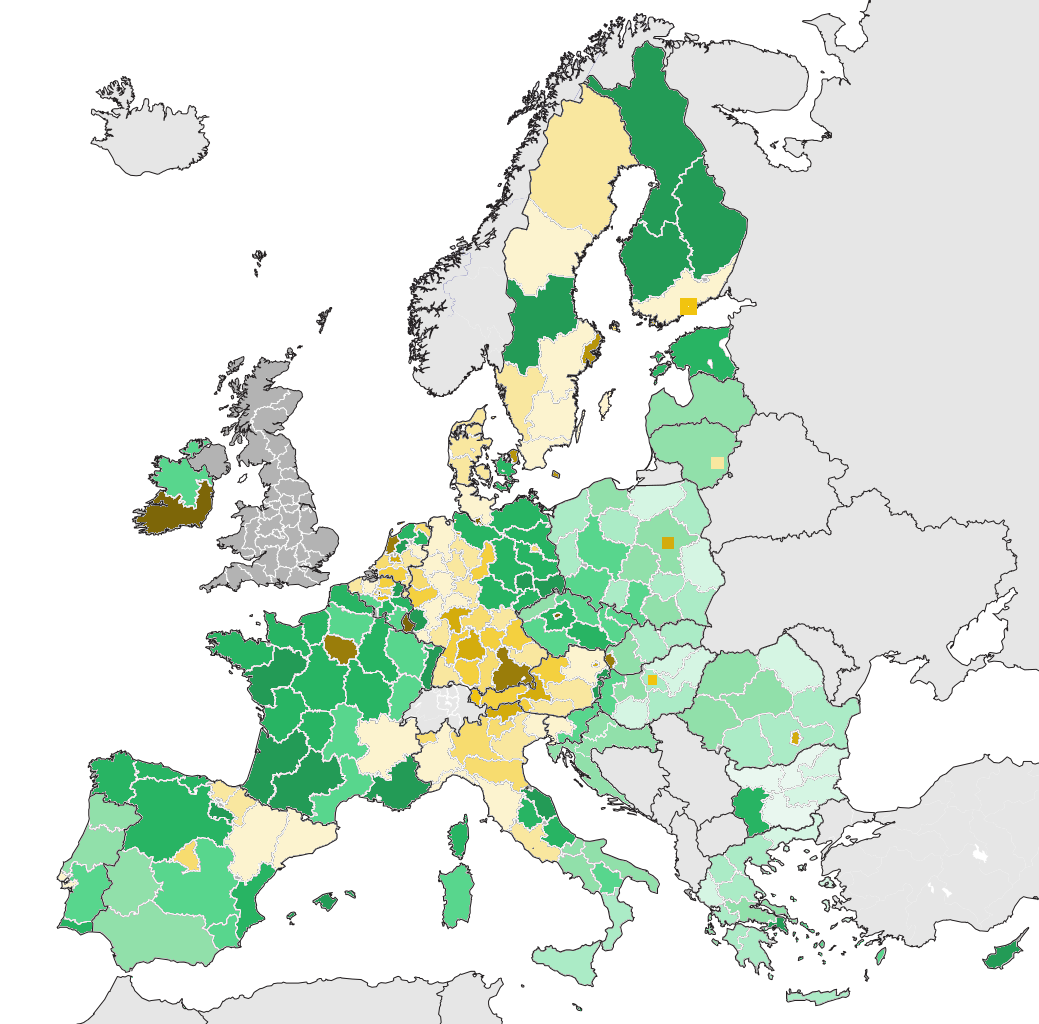

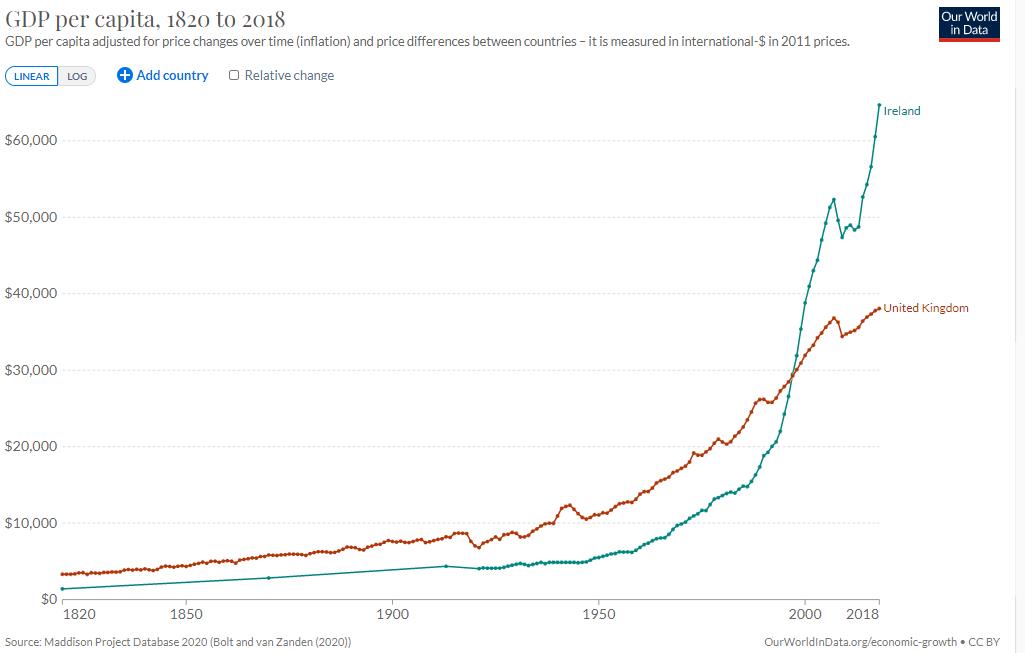

Modified gross national income, Modified GNI or GNI* was created by the Central Bank of Ireland in February 2017 as a new way to measure the Irish economy, and Irish indebtedness, due to the increasing distortion that the base erosion and profit shifting ("BEPS") tools of US Corporation tax in the Republic of Ireland#Multinational tax schemes, multinational tax schemes were having on Irish Gross national product, GNP and Irish Gross domestic product, GDP; the climax being the July 2016 leprechaun economics affair with Apple Inc. While "Tax haven#Inflated GDP-per-capita, Inflated GDP-per-capita" due to BEPS tools is a feature of tax havens, Ireland was the first to adjust its GDP metrics. Economists, including Eurostat, noted Irish Modified GNI (GNI*) is still distorted by Irish BEPS tools and US multinational tax planning activities in Ireland (e.g. contract manufacturing); and that Irish BEPS tools distort ''aggregate'' EU-28 data, and the EU-US trade deficit. In August 2018, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

THE CENTRAL BANK OF IRELAND (NEW HEADQUARTER BUILDING ON NORTH WALL QUAY)- ALONG BOTANIC AVENUE (JANUARY 2018)-135339 (27856990779)

''The'' () is a grammatical Article (grammar), article in English language, English, denoting persons or things already mentioned, under discussion, implied or otherwise presumed familiar to listeners, readers, or speakers. It is the definite article in English. ''The'' is the Most common words in English, most frequently used word in the English language; studies and analyses of texts have found it to account for seven percent of all printed English-language words. It is derived from gendered articles in Old English which combined in Middle English and now has a single form used with pronouns of any gender. The word can be used with both singular and plural nouns, and with a noun that starts with any letter. This is different from many other languages, which have different forms of the definite article for different genders or numbers. Pronunciation In most dialects, "the" is pronounced as (with the voiced dental fricative followed by a schwa) when followed by a consonant s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EUROSTAT Ireland Gross Operating Surplus By Controlling Country, €million 2015

Eurostat ('European Statistical Office'; DG ESTAT) is a Directorate-General of the European Commission located in the Kirchberg quarter of Luxembourg City, Luxembourg. Eurostat's main responsibilities are to provide statistical information to the institutions of the European Union (EU) and to promote the harmonisation of statistical methods across its Member state of the European Union, member states and Enlargement of the European Union, candidates for accession as well as European Free Trade Association, EFTA countries. The organisations in the different countries that cooperate with Eurostat are summarised under the concept of the European Statistical System. Organisation Eurostat operates pursuant tRegulation (EC) No 223/2009 Since the swearing in of the von der Leyen Commission in December 2019, Eurostat is allocated to the portfolio of the European Commissioner for Economic and Financial Affairs, Taxation and Customs, European Commissioner for the Economy, Paolo Gentiloni. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Post-2008 Irish Economic Downturn

The post-2008 Irish economic downturn in the Republic of Ireland, coincided with a series of banking scandals, followed the 1990s and 2000s Celtic Tiger period of rapid real economic growth fuelled by foreign direct investment, a subsequent property bubble which rendered the real economy uncompetitive, and an expansion in bank lending in the early 2000s. An initial slowdown in economic growth amid the international financial crisis of 2007–2008 greatly intensified in late 2008 and the country fell into recession for the first time since the 1980s. Emigration, as did unemployment (particularly in the construction sector), escalated to levels not seen since that decade. The Irish Stock Exchange (ISEQ) general index, which reached a peak of 10,000 points briefly in April 2007, fell to 1,987 points—a 14-year low—on 24 February 2009 (the last time it was under 2,000 being mid-1995). In September 2008, the Irish government—a Fianna Fáil–Green coalition—officially acknowl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Celtic Tiger

The "Celtic Tiger" ( ga, An Tíogar Ceilteach) is a term referring to the economy of the Republic of Ireland, economy of Ireland from the mid-1990s to the late 2000s, a period of rapid real economic growth fuelled by foreign direct investment. The boom was dampened by a subsequent property bubble which resulted in a severe economic downturn. At the start of the 1990s, Ireland was a relatively poor country by Western European standards, with high poverty, high unemployment, inflation, and low economic growth. The Irish economy expanded at an average rate of 9.4% between 1995 and 2000, and continued to grow at an average rate of 5.9% during the following decade until 2008, when it Post-2008 Irish economic downturn, fell into recession. Ireland's rapid economic growth has been described as a rare example of a Western country matching the growth of East Asian nations, i.e. the 'Four Asian Tigers'. The economy underwent a dramatic reversal from 2008, hit hard by the Financial crisi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

McKinsey & Company

McKinsey & Company is a global management consulting firm founded in 1926 by University of Chicago professor James O. McKinsey, that offers professional services to corporations, governments, and other organizations. McKinsey is the oldest and largest of the " Big Three" management consultancies (MBB), the world's three largest strategy consulting firms by revenue. The firm mainly focuses on the finances and operations of their clients. Under the leadership of Marvin Bower, McKinsey expanded into Europe during the 1940s and 1950s. In the 1960s, McKinsey's Fred Gluck—along with Boston Consulting Group's Bruce Henderson, Bill Bain at Bain & Company, and Harvard Business School's Michael Porter—transformed corporate culture. A 1975 publication by McKinsey's John L. Neuman introduced the business practice of "overhead value analysis" that contributed to a downsizing trend that eliminated many jobs in middle management. McKinsey has a notoriously competitive hiring process, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Feargal O'Rourke

Feargal “Sake” O'Rourke (born 3 August 1964) is an Irish accountant and corporate tax expert, who is the managing partner of PwC in Ireland. He is considered the architect of the ''Double Irish'' tax scheme used by U.S. firms such as Apple, Google and Facebook in Ireland, and a leader in the development of corporate tax planning tools, and tax legislation, for U.S. multinationals in Ireland. Personal O'Rourke comes from an established Fianna Fáil political dynasty. He is the son of former Irish Minister Mary O'Rourke, nephew of former Irish Tánaiste Brian Lenihan Snr, and cousin of former Irish Finance Minister Brian Lenihan Jnr, and former Irish Minister of State Conor Lenihan. He chaired the college branch of Fianna Fáil at UCD and joined the national executive on graduation. Double Irish O'Rourke was once labeled the "great architect" of the ''Double Irish'' base erosion and profit shifting ("BEPS") tool, as used by U.S. multinationals in Ireland such as Google, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Justice Network

The Tax Justice Network (or TJN) is an advocacy group consisting of a coalition of researchers and activists with a shared concern about tax avoidance, tax competition, and tax havens. Empirical results The TJN has reported on the OECD Base erosion and profit shifting (BEPS) projects and conducted their own research that the scale of corporate taxes being avoided by multinationals is an estimated $660bn in 2012 (a quarter of US multinationals’ gross profits), which is equivalent to 0.9% of World GDP. In July 2012, following a study into wealthy individuals with offshore accounts, the Tax Justice Network published claims regarding deposits worth at least $21 trillion (£13 trillion), potentially even $32 trillion, in secretive tax havens. As a result, governments suffer a lack of income taxes of up to $280 billion. In November 2020, the TJN published "The State of Tax Justice 2020" report. It claims $427 billion is lost every year to tax abuse. Focus Financial Secrecy Index ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published six days a week by Dow Jones & Company, a division of News Corp. The newspaper is published in the broadsheet format and online. The ''Journal'' has been printed continuously since its inception on July 8, 1889, by Charles Dow, Edward Jones, and Charles Bergstresser. The ''Journal'' is regarded as a newspaper of record, particularly in terms of business and financial news. The newspaper has won 38 Pulitzer Prizes, the most recent in 2019. ''The Wall Street Journal'' is one of the largest newspapers in the United States by circulation, with a circulation of about 2.834million copies (including nearly 1,829,000 digital sales) compared with ''USA Today''s 1.7million. The ''Journal'' publishes the luxury news and lifestyle magazine ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Double Irish

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest tax avoidance tool in history and by 2010 was shielding US$100 billion annually in US multinational foreign profits from taxation, and was the main tool by which US multinationals built up untaxed offshore reserves of US$1 trillion from 2004 to 2018. Traditionally, it was also used with the Dutch Sandwich BEPS tool; however, 2010 changes to tax laws in Ireland dispensed with this requirement. Despite US knowledge of the Double Irish for a decade, it was the European Commission that in October 2014 forced Ireland to close the scheme, starting in January 2015. However, users of existing schemes, such as Apple, Google, Facebook and Pfizer, were given until January 2020 to close them. At the announcement of the closure it was known that multin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dhammika Dharmapala

Dhammika Dharmapala (born 1969/1970) is an economist who is the Paul H. and Theo Leffman Professor of Law at the University of Chicago Law School. He is known for his research into corporate tax avoidance, corporate use of tax havens, and the corporate use of ''base erosion and profit shifting'' ("BEPS") techniques. Biography Dharmapala was born in Sri Lanka, educated in Australia, and settled in the U.S. (he is a naturalized U.S. citizen), to pursue a career as an academic economist. He taught economics at the University of Connecticut and law at the University of Illinois, Urbana-Champaign before joining the Chicago faculty in 2014. Dharmapala's research on tax havens, often with James R. Hines Jr., is cited as important. In addition to his role as professor at the University of Chicago Law School, Dharmapala is an International Research Fellow at the Oxford University Centre for Business Taxation, and has served on the board of directors of the American Law and Economics As ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

University Of Chicago

The University of Chicago (UChicago, Chicago, U of C, or UChi) is a private research university in Chicago, Illinois. Its main campus is located in Chicago's Hyde Park neighborhood. The University of Chicago is consistently ranked among the best universities in the world and it is among the most selective in the United States. The university is composed of an undergraduate college and five graduate research divisions, which contain all of the university's graduate programs and interdisciplinary committees. Chicago has eight professional schools: the Law School, the Booth School of Business, the Pritzker School of Medicine, the Crown Family School of Social Work, Policy, and Practice, the Harris School of Public Policy, the Divinity School, the Graham School of Continuing Liberal and Professional Studies, and the Pritzker School of Molecular Engineering. The university has additional campuses and centers in London, Paris, Beijing, Delhi, and Hong Kong, as well as in downtown ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)