|

Miami International Holdings

Miami International Holdings, Inc. (MIH) is an American company formed in 2007 that operates global financial exchanges and execution services. The company owns several U.S. exchanges for equities, equity options, and commodities. These include the MIAX Exchange Group — which is composed of MIAX, MIAX Pearl, MIAX Pearl Equities, and MIAX Emerald — and the Minneapolis Grain Exchange (MGEX). It also owns the Bermuda Stock Exchange and Dorman Trading, a Futures Commission Merchant. MIH also has a subsidiary, Miami International Technologies, which is focused on the sale and licensing of trading technology developed by MIAX Exchange Group. History MIH launched the Miami International Securities Exchange (MIAX) in 2012, after receiving approval from the U.S. Securities and Exchange Commission (SEC). In 2019, MIH acquired a majority stake in the Bermuda Stock Exchange. The company received approval from the SEC and launched MIAX Pearl Equities, MIH's first equities exchange, i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Princeton, New Jersey

Princeton is a municipality with a borough form of government in Mercer County, in the U.S. state of New Jersey. It was established on January 1, 2013, through the consolidation of the Borough of Princeton and Princeton Township, both of which are now defunct. Centrally located within the Raritan Valley region, Princeton is a regional commercial hub for the Central New Jersey region and a commuter town in the New York metropolitan area.New York-Newark, NY-NJ-CT-PA Combined Statistical Area . Accessed December 5, 2020. As of the |

IMC Financial Markets

IMC Financial Markets, sometimes referred to as IMC Trading, is a proprietary trading firm and market maker for various financial instruments listed on exchanges throughout the world. Founded in 1989 as International Market makers Combination, the company employs over 1100 people and has offices in Amsterdam, Chicago, Sydney, Hong Kong and Mumbai. Trading IMC is a technology-driven trading firm active in over 100 trading venues throughout the world and offering liquidity to over 200,000 securities. IMC makes markets in the major exchange-traded instruments – equities, bonds, commodities, and currencies – on 100 exchanges worldwide and is a significant liquidity provider on the NYSE Arca, NASDAQ, CBOE, BATS Bats are mammals of the order Chiroptera.''cheir'', "hand" and πτερόν''pteron'', "wing". With their forelimbs adapted as wings, they are the only mammals capable of true and sustained flight. Bats are more agile in flight than most bi ..., and CME exchang ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronic Trading Platforms

Electronic may refer to: *Electronics, the science of how to control electric energy in semiconductor * ''Electronics'' (magazine), a defunct American trade journal * Electronic storage, the storage of data using an electronic device * Electronic commerce or e-commerce, the trading in products or services using computer networks, such as the Internet * Electronic publishing or e-publishing, the digital publication of books and magazines using computer networks, such as the Internet *Electronic engineering, an electrical engineering discipline Entertainment * Electronic (band), an English alternative dance band ** ''Electronic'' (album), the self-titled debut album by British band Electronic *Electronic music, a music genre * Electronic musical instrument * Electronic game, a game that employs electronics See also * Electronica, an electronic music genre *Consumer electronics Consumer electronics or home electronics are electronic ( analog or digital) equipment intended for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

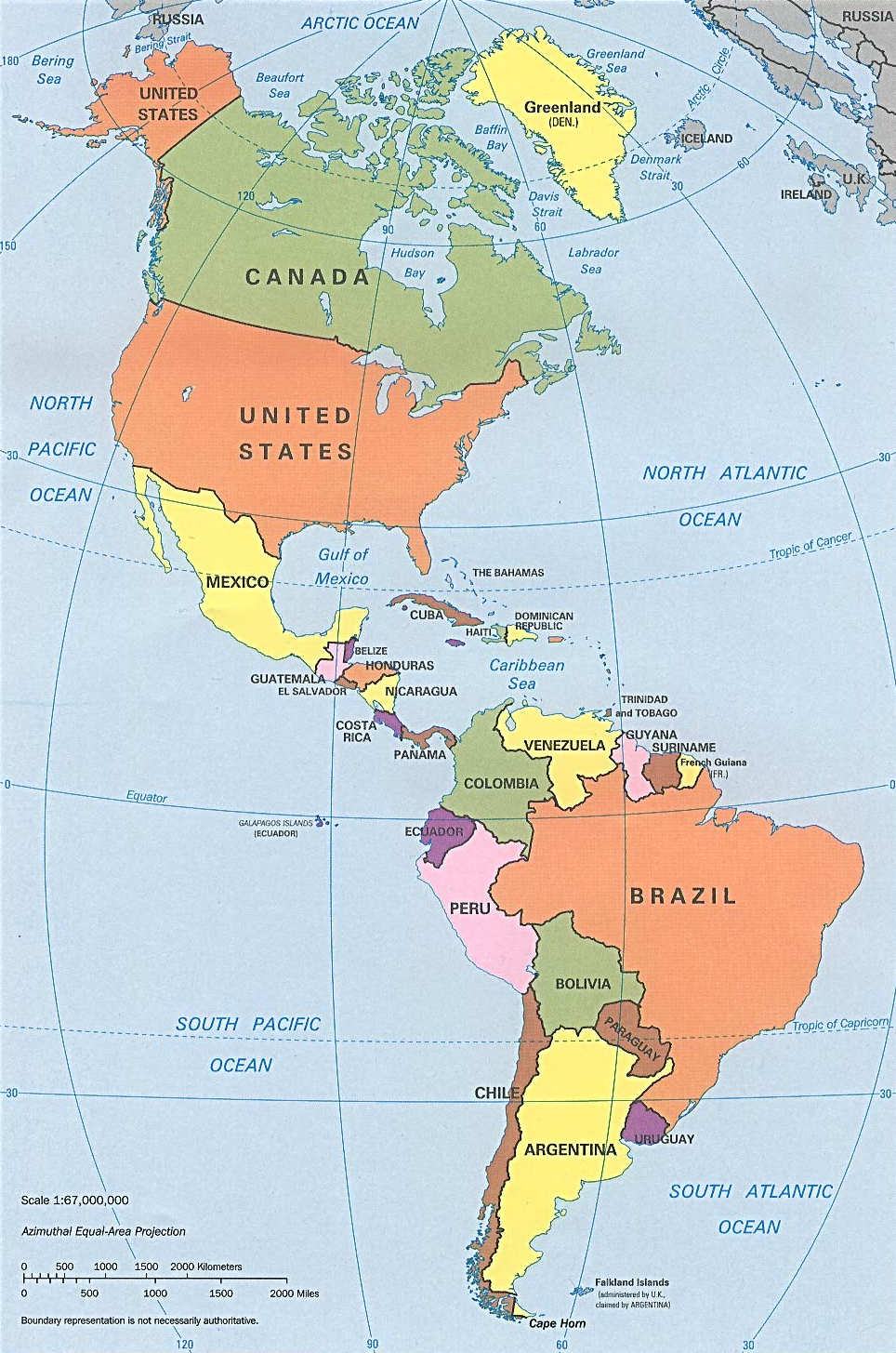

List Of Stock Exchanges In The Americas

This is a list of active stock exchanges in the Americas. Stock exchanges in Latin America (where Spanish and Portuguese prevail) use the term ''Bolsa de Valores'', meaning "bag" or "purse" of "values". (compare Börse in German or bourse in French). The Caribbean has one major regional stock exchange: the Eastern Caribbean Securities Exchange (ECSE), which serves Anguilla, Antigua and Barbuda, Dominica, Grenada, Montserrat, Saint Kitts and Nevis, Saint Lucia, and Saint Vincent and the Grenadines. The service area of the ECSE corresponds to the service area of the Eastern Caribbean Central Bank, with which it is associated. Stock exchanges in the Americas Former exchanges Major exchange mergers See also * List of futures exchanges * List of stock exchanges External linksWorld-Stock-Exchange.net list of Stock Markets in South America References {{DEFAULTSORT:Stock Exchanges In The Americas, List Of * * * * Americas-related lists Americas The Americas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Options Price Reporting Authority

The Options Price Reporting Authority (OPRA) provides, through market data vendors, last sale information and current options quotations from a committee of participant exchanges designated as the Options Price Reporting Authority. OPRA is a national market system plan that governs the process by which options market data are collected from participant exchanges, consolidated, and disseminated. Participant Exchanges Current OPRA participants include: * NYSE Amex Equities (AMEX) * Boston Options Exchange (BOX) * Chicago Board Options Exchange (CBOE) * Miami International Holdings (EMERALD) * Nasdaq, Inc.(GEMX) * Nasdaq, Inc.(ISE) * Nasdaq, Inc.(MRX) * Miami International Holdings (MIAX) * NYSE (ARCA) * Miami International Holdings (PEARL) * Nasdaq, Inc.(NASD) * Nasdaq, Inc.(BX) * Chicago Board Options Exchange (C2) * Nasdaq Philadelphia Stock Exchange (PHLX) * Chicago Board Options Exchange (BATS) Acquisition and Distribution of Market Data The Securities Industry Aut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ethereum

Ethereum is a decentralized, open-source blockchain with smart contract functionality. Ether (Abbreviation: ETH; sign: Ξ) is the native cryptocurrency of the platform. Among cryptocurrencies, ether is second only to bitcoin in market capitalization. Ethereum was conceived in 2013 by programmer Vitalik Buterin. Additional founders of Ethereum included Gavin Wood, Charles Hoskinson, Anthony Di Iorio and Joseph Lubin. In 2014, development work began and was crowdfunded, and the network went live on 30 July 2015. Ethereum allows anyone to deploy permanent and immutable decentralized applications onto it, with which users can interact. Decentralized finance (DeFi) applications provide a broad array of financial services without the need for typical financial intermediaries like brokerages, exchanges, or banks, such as allowing cryptocurrency users to borrow against their holdings or lend them out for interest. Ethereum also allows users to create and exchange NFTs, which are un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bitcoin

Bitcoin ( abbreviation: BTC; sign: ₿) is a decentralized digital currency that can be transferred on the peer-to-peer bitcoin network. Bitcoin transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain. The cryptocurrency was invented in 2008 by an unknown person or group of people using the name Satoshi Nakamoto. The currency began use in 2009, when its implementation was released as open-source software. The word "''bitcoin''" was defined in a white paper published on October 31, 2008. It is a compound of the words ''bit'' and ''coin''. The legality of bitcoin varies by region. Nine countries have fully banned bitcoin use, while a further fifteen have implicitly banned it. A few governments have used bitcoin in some capacity. El Salvador has adopted Bitcoin as legal tender, although use by merchants remains low. Ukraine has accepted cryptocurrency donations to fund the resistance to the 2022 Russ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Futures Trading Commission

The Commodity Futures Trading Commission (CFTC) is an independent agency of the US government created in 1974 that regulates the U.S. derivatives markets, which includes futures, swaps, and certain kinds of options. The Commodity Exchange Act (CEA), ''et seq.'', prohibits fraudulent conduct in the trading of futures, swaps, and other derivatives. The stated mission of the CFTC is to promote the integrity, resilience, and vibrancy of the U.S. derivatives markets through sound regulation. After the financial crisis of 2007–08 and since 2010 with the Dodd–Frank Wall Street Reform and Consumer Protection Act, the CFTC has been transitioning to bring more transparency and sound regulation to the multitrillion dollar swaps market. History Futures contracts for agricultural commodities have been traded in the U.S. for more than 150 years and have been under federal regulation since the 1920s. The Grain Futures Act of 1922 set the basic authority and was changed by the Commo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unlisted Trading Privileges

Unlisted Trading Privileges (UTP) oversees the Securities Information Processor for securities listed on Nasdaq and other securities that do not meet the requirements for listing on an exchange. Acquisition and distribution of market data Nasdaq established the UTP Plan to outline the consolidation and distribution of data through one centralized resource called the Securities Information Processor (SIP). The securities listed on Nasdaq can be quoted and traded from any US exchange. Trades and quotes on these securities are distributed on two separate feeds, the UTP Quotation Data Feed (UQDF) and the UTP Trade Data Feed (UTDF). UQDF provides traders a direct view of an NBBO. These feeds are considered level 1 or the top-of-book. National Market System (NMS) plan The NMS Plan regulates the UTP and Consolidated Tape Association (CTA) networks. The particulars for executing the regulation requires real-time reporting of transactions and their volumes, prices, and auditing det ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chicago Trading Company

(''City in a Garden''); I Will , image_map = , map_caption = Interactive Map of Chicago , coordinates = , coordinates_footnotes = , subdivision_type = Country , subdivision_name = United States , subdivision_type1 = State , subdivision_type2 = Counties , subdivision_name1 = Illinois , subdivision_name2 = Cook and DuPage , established_title = Settled , established_date = , established_title2 = Incorporated (city) , established_date2 = , founder = Jean Baptiste Point du Sable , government_type = Mayor–council , governing_body = Chicago City Council , leader_title = Mayor , leader_name = Lori Lightfoot ( D) , leader_title1 = City Clerk , leader_name1 = Anna Valencia ( D) , unit_pref = Imperial , area_footnotes = , area_tot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hudson River Trading

Hudson River Trading (HRT) is a quantitative trading firm headquartered in New York City and founded in 2002. In 2014, it accounted for about 5% of all trading in the United States. Trading Although HRT is often classified as engaging in high-frequency trading (HFT), it claims to differ from stereotypical HFT firms in several important ways: it holds about 25% of its trading capital overnight (unlike most HFT firms that hold almost nothing overnight), its average holding time is about five minutes as opposed to the sub-second times observed for some HFT firms, and it does less than 1% of its trading in dark pools, the lightly regulated private trading venues under scrutiny from regulators. People The firm hires programmers, software engineers, and mathematicians to develop and improve its proprietary trading strategies. HRT head of business development Adam Nunes has been cited in a ''Wall Street Journal'' article on financial firms' efforts to recruit programming talent away f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Two Sigma Investments

Two Sigma Investments is a New York City-based hedge fund that uses a variety of technological methods, including artificial intelligence, machine learning, and distributed computing, for its trading strategies. The firm is run by John Overdeck and David Siegel.The World's 100 richest Hedge Funds '''' History Two Sigma Investments was founded in 2001 by ,[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)