|

Mauritius Leaks

The Mauritius Leaks were the report of a data journalism, datajournalistic investigation by the International Consortium of Investigative Journalists (ICIJ) in 2019 about how the former British Empire, British colony Mauritius has transformed itself into a thriving financial centre and tax haven. A whistleblower leaked documents from a law firm in Mauritius to the investigative journalists, providing insight in how multinational companies avoid paying taxes when they do business in Africa, the Middle East, and Asia. Leak contents The report was considered as evidence that laws in the country of Mauritius help corporations to avoid taxes globally, including on the continent of Africa, resulting in a loss of billions of dollars a year because of a complex, yet legal web of tax treaties and shell corporations. At the heart of the ICIJ investigation was the law firm of Conyers Dill and Pearman with offices in Bermuda, Hong Kong, the Cayman Islands and Mauritius. More than 200,000 leake ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Data Journalism

Data journalism or data-driven journalism (DDJ) is a journalistic process based on analyzing and filtering large data sets for the purpose of creating or elevating a news story. Data journalism is a type of journalism reflecting the increased role that numerical data is used in the production and distribution of information in the digital era. It reflects the increased interaction between content producers (journalist) and several other fields such as design, computer science and statistics. From the point of view of journalists, it represents "an overlapping set of competencies drawn from disparate fields". Data journalism has been widely used to unite several concepts and link them to journalism. Some see these as levels or stages leading from the simpler to the more complex uses of new technologies in the journalistic process. Many data-driven stories begin with newly available resources such as open source software, open access publishing and open data, while others are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aircastle

Aircastle Limited is an aircraft leasing company that acquires, leases and sells commercial jet aircraft to airlines around the world. It has its headquarters in Stamford, Connecticut, with offices in Dublin and Singapore. Aircastle was incorporated on October 29, 2004. , Aircastle owns and managed 277 aircraft leased to 87 lessees located in 48 countries. From August 2006 to March 2020, Aircastle traded on the New York Stock Exchange under the ticker symbol AYR. On November 6, 2019, Aircastle reached a merger agreement with Marubeni (, OSE: 8002, NSE: 8002) is a ''sōgō shōsha'' (general trading company) headquartered in Nihonbashi, Chuo, Tokyo, Japan. It is one of the largest ''sogo shosha'' and has leading market shares in cereal and paper pulp trading as well as a st ... and Mizuho Leasing at a price of per share, for a company valuation of billion; Marubeni was previously Aircastle's largest shareholder. The acquisition was completed on March 27, 2020. Referen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swiss Leaks

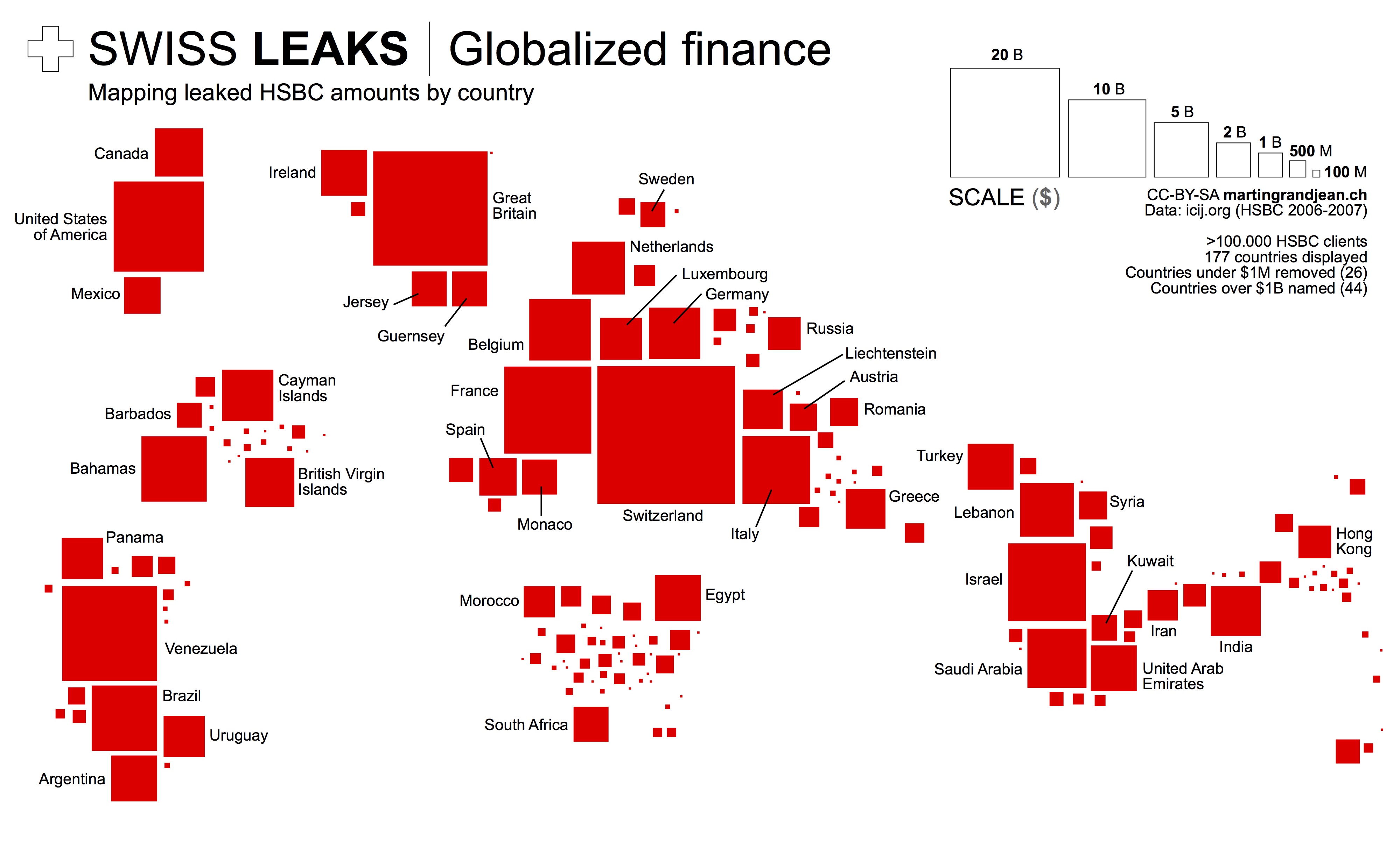

Swiss Leaks (or SwissLeaks) is the name of a journalistic investigation, released in February 2015, of a giant tax evasion scheme allegedly operated with the knowledge and encouragement of the British multinational bank HSBC via its Swiss subsidiary, HSBC Private Bank (Suisse). Triggered by leaked information from French computer analyst Hervé Falciani on accounts held by over 100,000 clients and 20,000 offshore companies with HSBC in Geneva, the disclosed information was then called "the biggest leak in Swiss banking history". Investigation Investigators allege that 180.6 billion euros passed through HSBC accounts held in Geneva by over 100,000 clients and 20,000 offshore companies between November 2006 and March 2007. The data for this period comes from files removed from HSBC Private Bank by a former staffer, software engineer Hervé Falciani, who fled to Lebanon with the attempt to sell it. Later he handed it to French authorities in late 2008. Investigation in Fra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bahamas Leaks

The Bahama Leaks are 1.3 million internal files from the company register of the Bahamas. After the release of the Panama Papers in 2016, an unknown source handed over internal data from the national corporate registry of the Bahamas to Frederik Obermaier and Bastian Obermayer, who analyzed them with the help of the International Consortium of Investigative Journalists (ICIJ). At the same time, ICIJ, Süddeutsche Zeitung and other media partners published detailed reporting before they published an online database of offshore entities. The files provided data on 175,888 shell companies and trusts that were established in the Bahamas between 1990 and 2016. The 38 gigabytes of data showed that "several current and former heads of state and government and high-ranking politicians, including former EU Commissioner Neelie Kroes; Colombia’s former mining minister Carlos Caballero Argáez; Hamad bin Jassim bin Jaber Al Thani, the former prime minister of Qatar; and Angola’s vice-pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pandora Papers

The Pandora Papers are 11.9 million leaked documents with 2.9 terabytes of data that the International Consortium of Investigative Journalists (ICIJ) published beginning on 3 October 2021. The leak exposed the secret offshore accounts of 35 world leaders, including current and former presidents, prime ministers, and heads of state as well as more than 100 billionaires, celebrities, and business leaders. The news organizations of the ICIJ described the document leak as their most expansive exposé of financial secrecy yet, containing documents, images, emails and spreadsheets from 14 financial service companies, in nations including Panama, Switzerland and the United Arab Emirates, surpassing their previous release of the Panama Papers in 2016, which had 11.5 million confidential documents (2.6 terabytes). At the time of the release of the papers, the ICIJ said it is not identifying its source for the documents. Estimates by the ICIJ of money held offshore (outside the coun ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paradise Papers

The Paradise Papers are a set of over 13.4 million confidential electronic documents relating to offshore investments that were leaked to the German reporters Frederik Obermaier and Bastian Obermayer, from the newspaper'' Süddeutsche Zeitung''. The newspaper shared them with the International Consortium of Investigative Journalists, and a network of more than 380 journalists. Some of the details were made public on 5 November 2017 and stories are still being released. The documents originate from the legal firm Appleby, the corporate services providers Estera and Asiaciti Trust, and business registries in 19 tax jurisdictions. They contain the names of more than 120,000 people and companies. Among those whose financial affairs are mentioned are, separately, AIG, Prince Charles and Queen Elizabeth II, President of Colombia Juan Manuel Santos, and U.S. Secretary of Commerce Wilbur Ross. The released information resulted in scandal, litigation, and loss of positio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panama Papers

The Panama Papers ( es, Papeles de Panamá) are 11.5 million leaked documents (or 2.6 terabytes of data) that were published beginning on April 3, 2016. The papers detail financial and attorney–client information for more than 214,488 offshore entities. The documents, some dating back to the 1970s, were created by, and taken from, former Panamanian offshore law firm and corporate service provider Mossack Fonseca. The documents contain personal financial information about wealthy individuals and public officials that had previously been kept private. The publication of these documents made it possible to establish the prosecution of Jan Marsalek, who is still a person of interest to a number of European governments due to his revealed links with Russian intelligence, and international financial fraudsters David and Josh Baazov. While offshore business entities are legal (see Offshore Magic Circle), reporters found that some of the Mossack Fonseca shell corporations we ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax Haven

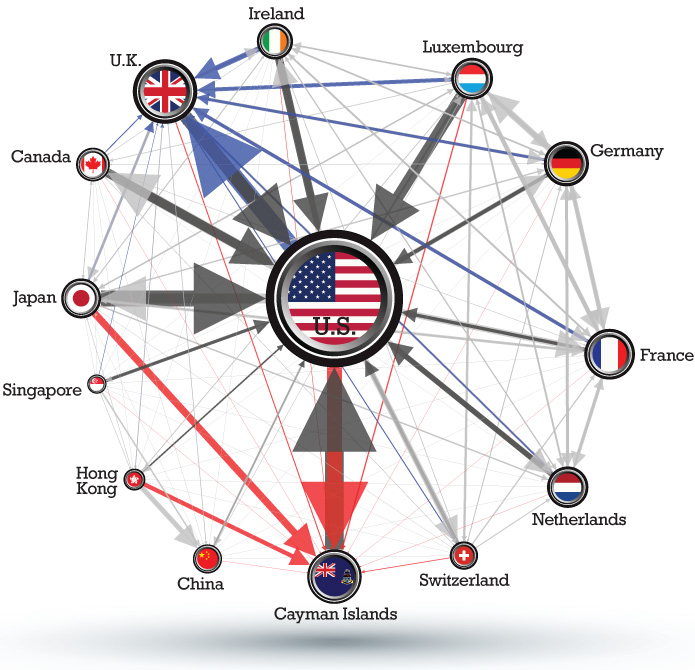

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties which accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the dutch sandwich, and single malt). Corporate tax h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Offshore Financial Centre

An offshore financial centre (OFC) is defined as a "country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the size and the financing of its domestic economy." "Offshore" does not refer to the location of the OFC, since many Financial Stability Forum– IMF OFCs, such as Delaware, South Dakota, Singapore, Luxembourg and Hong Kong, are located "onshore", but to the fact that the largest users of the OFC are non-resident, i.e. "offshore". The IMF lists OFCs as a third class of financial centre, with international financial centres (IFCs), and regional financial centres (RFCs); there is overlap (e.g. Singapore is an RFC and an OFC). The Caribbean, including the Cayman Islands, the British Virgin Islands and Bermuda, has several major OFCs, facilitating many billions of dollars worth of trade and investment globally. During April–June 2000, the Financial Stability Forum–International Monetary Fund produced the first l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many corporations and businesses that take part in the practice experience a backlash from their active customers or online. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multinational Corporation

A multinational company (MNC), also referred to as a multinational enterprise (MNE), a transnational enterprise (TNE), a transnational corporation (TNC), an international corporation or a stateless corporation with subtle but contrasting senses, is a corporate organization that owns and controls the production of goods or services in at least one country other than its home country. Control is considered an important aspect of an MNC, to distinguish it from international portfolio investment organizations, such as some international mutual funds that invest in corporations abroad simply to diversify financial risks. Black's Law Dictionary suggests that a company or group should be considered a multinational corporation "if it derives 25% or more of its revenue from out-of-home-country operations". Most of the largest and most influential companies of the modern age are publicly traded multinational corporations, including '' Forbes Global 2000'' companies. History Colonialism Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Irish Times

''The Irish Times'' is an Irish daily broadsheet newspaper and online digital publication. It launched on 29 March 1859. The editor is Ruadhán Mac Cormaic. It is published every day except Sundays. ''The Irish Times'' is considered a newspaper of record for Ireland. Though formed as a Protestant nationalist paper, within two decades and under new owners it had become the voice of British unionism in Ireland. It is no longer a pro unionist paper; it presents itself politically as "liberal and progressive", as well as being centre-right on economic issues. The editorship of the newspaper from 1859 until 1986 was controlled by the Anglo-Irish Protestant minority, only gaining its first nominal Irish Catholic editor 127 years into its existence. The paper's most prominent columnists include writer and arts commentator Fintan O'Toole and satirist Miriam Lord. The late Taoiseach Garret FitzGerald was once a columnist. Senior international figures, including Tony Blair and Bill Cl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |