|

Matchbook FX

Matchbook FX was an internet-based electronic communication network ("ECN" or Electronic Trading Network) for trading currency online in the Spot-FX or foreign exchange market. It operated between 1999 and 2002. History Founded in 1999, Matchbook FX (sometimes referenced as "MatchbookFX", "MatchBook FX" or "Match-Book FX") was the world's first open and inclusive internet ECN for Foreign Exchange trading, available to all willing FX trading participants including hedge funds, CTAs, banks, corporations and, uniquely at the time, retail FX traders as well. Matchbook FX was initially conceived by Daniel Uslander, Ron Comerchero (commodity futures and equities traders) and Josh Levy (former Goldman Sachs FX trader) of the New York-based proprietary FX trading firm Valhalla Forex Inc, as well as Mark S Smith of the Florida-based equities-trading technology firm NexTrade ECN. Several months later, GlobalNetFinancial.com, a NASDAQ-traded financial news and technology firm, bought in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brokerage

A broker is a person or firm who arranges transactions between a buyer and a seller for a commission when the deal is executed. A broker who also acts as a seller or as a buyer becomes a principal party to the deal. Neither role should be confused with that of an agent—one who acts on behalf of a principal party in a deal. Definition A broker is an independent party whose services are used extensively in some industries. A broker's prime responsibility is to bring sellers and buyers together and thus a broker is the third-person facilitator between a buyer and a seller. An example would be a real estate or stock broker who facilitates the sale of a property. Brokers can furnish market research and market data. Brokers may represent either the seller or the buyer but generally not both at the same time. Brokers are expected to have the tools and resources to reach the largest possible base of buyers and sellers. They then screen these potential buyers or sellers for the perfe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

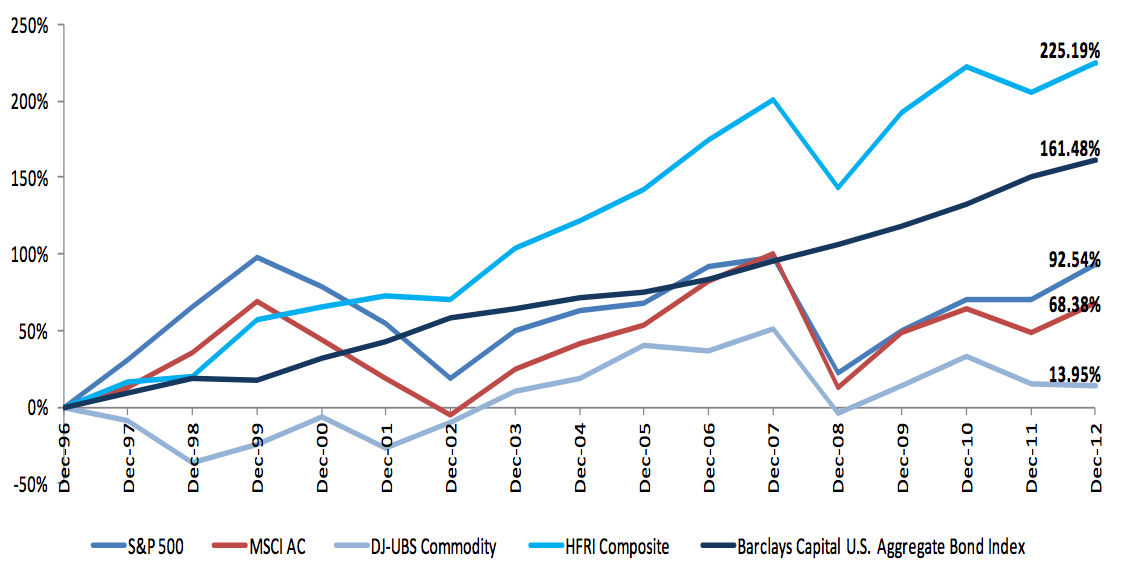

Hedge Funds

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as short selling, leverage, and derivatives. Financial regulators generally restrict hedge fund marketing to institutional investors, high net worth individuals, and accredited investors. Hedge funds are considered alternative investments. Their ability to use leverage and more complex investment techniques distinguishes them from regulated investment funds available to the retail market, commonly known as mutual funds and ETFs. They are also considered distinct from private equity funds and other similar closed-end funds as hedge funds generally invest in relatively liquid assets and are usually open-ended. This means they typically allow investors to invest and withdraw capital periodically based on the fund's net asset value, whereas privat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Futures Modernization Act Of 2000

The Commodity Futures Modernization Act of 2000 (CFMA) is United States federal legislation that ensured financial products known as over-the-counter (OTC) derivatives remained unregulated. It was signed into law on December 21, 2000 by President Bill Clinton. It clarified the law so most OTC derivative transactions between "sophisticated parties" would not be regulated as "futures" under the Commodity Exchange Act of 1936 (CEA) or as "securities" under the federal securities laws. Instead, the major dealers of those products (banks and securities firms) would continue to have their dealings in OTC derivatives supervised by their federal regulators under general "safety and soundness" standards. The Commodity Futures Trading Commission's (CFTC) desire to have "functional regulation" of the market was also rejected. Instead, the CFTC would continue to do "entity-based supervision of OTC derivatives dealers". The CFMA's treatment of OTC derivatives such as credit default swaps has b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Futures Association

The National Futures Association (NFA) is the self-regulatory organization (SRO) for the U.S. derivatives industry, including on-exchange traded futures, retail off-exchange foreign currency (forex) and OTC derivatives ( swaps). NFA is headquartered in Chicago and maintains an office in New York City. NFA is a non-profit A nonprofit organization (NPO) or non-profit organisation, also known as a non-business entity, not-for-profit organization, or nonprofit institution, is a legal entity organized and operated for a collective, public or social benefit, in co ..., independent regulatory organization. NFA does not operate any markets and is not a trade association. NFA is financed from membership dues and assessment fees, and membership is mandatory for many market participants. History The National Futures Association (NFA) was created by the Commodity Futures Trading Commission (CFTC) in September 1981 and began regulatory operations in 1982. Responsibilities NFA chie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bucket Shop (stock Market)

A bucket shop is a business that allows gambling based on the prices of stocks or commodities. A 1906 U.S. Supreme Court ruling defined a ''bucket shop'' as "an establishment, nominally for the transaction of a stock exchange business, or business of similar character, but really for the registration of bets, or wagers, usually for small amounts, on the rise or fall of the prices of stocks, grain, oil, etc., there being no transfer or delivery of the stock or commodities nominally dealt in". A person who engages in the practice is referred to as a bucketeer and the practice is sometimes referred to as bucketeering. Bucket shops were found in many large American cities from the mid-1800s but the practice was eventually ruled illegal and largely disappeared by the 1920s. Overview Definition and term origin According to ''The New York Times'' in 1958, a bucket shop is "an office with facilities for making bets in the form of orders or options based on current exchange prices of s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Request For Quotation

A request for quotation (RfQ) is a business process in which a company or public entity requests a quote from a supplier for the purchase of specific products or services. RfQ generally means the same thing as Call for bids (CfB) and Invitation for bid (IfB). An RfQ typically involves more than the price per item. Information like payment terms, quality level per item or contract length may be requested during the bidding process. To receive correct quotes, RfQs often include the specifications of the items/services to make sure all the suppliers are bidding on the same item/service. Logically, the more detailed the specifications, the more accurate the quote will be and comparable to the other suppliers. Another reason for being detailed in sending out an RfQ is that the specifications could be used as legal binding documentation for the suppliers. The ubiquitous availability of the Internet has made many government agencies turn either to state-run or vendor operated websit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bid–ask Spread

The bid–ask spread (also bid–offer or bid/ask and buy/sell in the case of a market maker) is the difference between the prices quoted (either by a single market maker or in a limit order book) for an immediate sale (ask) and an immediate purchase ( bid) for stocks, futures contracts, options, or currency pairs in some auction scenario. The size of the bid–ask spread in a security is one measure of the liquidity of the market and of the size of the transaction cost. If the spread is 0 then it is a frictionless asset. Liquidity The trader initiating the transaction is said to demand liquidity, and the other party (counterparty) to the transaction supplies liquidity. Liquidity demanders place market orders and liquidity suppliers place limit orders. For a round trip (a purchase and sale together) the liquidity demander pays the spread and the liquidity supplier earns the spread. All limit orders outstanding at a given time (i.e. limit orders that have not been executed) are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Maker

A market maker or liquidity provider is a company or an individual that quotes both a buy and a sell price in a tradable asset held in inventory, hoping to make a profit on the ''bid–ask spread'', or ''turn.'' The benefit to the firm is that it makes money from doing so; the benefit to the market is that this helps limit price variation ( volatility) by setting a limited trading price range for the assets being traded. In U.S. markets, the U.S. Securities and Exchange Commission defines a "market maker" as a firm that stands ready to buy and sell stock on a regular and continuous basis at a publicly quoted price. A Designated Primary Market Maker (DPM) is a specialized market maker approved by an exchange to guarantee that they will take a position in a particular assigned security, option, or option index. In currency exchange Most foreign exchange trading firms are market makers, as are many banks. The foreign exchange market maker both buys foreign currency from clients and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Limit Order Book

Central is an adjective usually referring to being in the center of some place or (mathematical) object. Central may also refer to: Directions and generalised locations * Central Africa, a region in the centre of Africa continent, also known as Middle Africa * Central America, a region in the centre of America continent * Central Asia, a region in the centre of Eurasian continent * Central Australia, a region of the Australian continent * Central Belt, an area in the centre of Scotland * Central Europe, a region of the European continent * Central London, the centre of London * Central Region (other) * Central United States, a region of the United States of America Specific locations Countries * Central African Republic, a country in Africa States and provinces * Blue Nile (state) or Central, a state in Sudan * Central Department, Paraguay * Central Province (Kenya) * Central Province (Papua New Guinea) * Central Province (Solomon Islands) * Central Province, Sri L ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Power

In economics, market power refers to the ability of a firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market power occurs if a firm does not face a perfectly elastic demand curve and can set its price (P) above marginal cost (MC) without losing revenue.Syverson, C. (2019). Macroeconomics and Market Power. The Journal of Economic Perspectives, 33(3), 23-43. https://doi.org/10.1257/jep.33.3.23 This indicates that the magnitude of market power is associated with the gap between P and MC at a firm's profit maximising level of output. Such propensities contradict perfectly competitive markets, where market participants have no market power, P = MC and firms earn zero economic profit. Market participants in perfectly competitive markets are consequently referred to as 'price takers', whereas market participants that exhibit market power are referred to as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Maker

A market maker or liquidity provider is a company or an individual that quotes both a buy and a sell price in a tradable asset held in inventory, hoping to make a profit on the ''bid–ask spread'', or ''turn.'' The benefit to the firm is that it makes money from doing so; the benefit to the market is that this helps limit price variation ( volatility) by setting a limited trading price range for the assets being traded. In U.S. markets, the U.S. Securities and Exchange Commission defines a "market maker" as a firm that stands ready to buy and sell stock on a regular and continuous basis at a publicly quoted price. A Designated Primary Market Maker (DPM) is a specialized market maker approved by an exchange to guarantee that they will take a position in a particular assigned security, option, or option index. In currency exchange Most foreign exchange trading firms are market makers, as are many banks. The foreign exchange market maker both buys foreign currency from clients and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Buy Side

Buy-side is a term used in investment firms to refer to advising institutions concerned with buying investment services. Private equity funds, mutual funds, life insurance companies, unit trusts, hedge funds, and pension funds are the most common types of buy side entities. In sales and trading, the split between the buy side and sell side should be viewed from the perspective of securities exchange services. The investing community must use those services to trade securities. The "Buy Side" are the buyers of those services; the "Sell Side", also called "prime brokers", are the sellers of those services. Sell side brokerages are registered members of a stock exchange, and are required to be market makers in a given security. Buy side firms usually take speculative positions or make relative value trades. Buy side firms participate in a smaller number of overall transactions, and aim to profit from market movements and accruals rather than through risk management and the bid– ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |